Solvay successfully places a perpetual hybrid bond of €500 million

25 Août 2020 - 6:00PM

Solvay successfully places a perpetual hybrid bond of €500

million

Solvay successfully places a perpetual

hybrid bond of €500 million

Brussels, August 25, 2020, 18:00

--- Solvay has successfully issued a new perpetual hybrid

bond for an aggregate principal amount of €500 million, to be used

for general corporate purposes, including the possible repayment of

other indebtedness. The new €500 million hybrid bond has a

perpetual maturity with a first call date on 2 December 2025 and

will pay a fixed coupon of 2.5% (with corresponding yield of

2.625%) until 2 March 2026 (first reset date). The coupon will

reset on this date and every 5 years thereafter. The notes will

rank junior to all senior debt and will be recorded as equity (and

coupons will be recorded as dividends) in accordance with IFRS

requirements. The hybrid bond will benefit from 50% rating agency

equity treatment by both Moody’s (“basket C”) and S&P

(“intermediate equity content”).

Solvay has concurrently launched a tender offer

to repurchase any-and-all of its €500 million perpetual hybrid bond

with a first call date in June 2021, which bears interest at a rate

of 5.118%. The offer will expire on the 1st of September 2020 at

17:00 CET.

Karim Hajjar, Solvay’s Chief Financial Officer,

commented: "Over the past years Solvay optimised its capital

structure and reduced leverage and interest burden as the focus on

cash generation was stepped up. Today’s transactions take matters

to the next level and will create further value whilst reinforcing

our investment grade credit rating. We appreciate investors’

continued trust in Solvay’s credit, manifested by more than €3

billion of demand for our €500 million issuance at a 2.5% coupon, a

historic low for Solvay.”

* * * * *

This press release does not constitute an offer

to sell, or a solicitation of offers to purchase or subscribe for,

securities in the United States or any other jurisdiction. The

securities referred to herein have not been, and will not be,

registered under the Securities Act of 1933, as amended, and may

not be offered, exercised or sold in the United States or to U.S.

persons absent registration or an applicable exemption from

registration requirements. There is no intention to register any

portion of the offering in the United States or to conduct a public

offering of securities in the United States.

The issue, exercise or sale of securities in the

offering are subject to specific legal or regulatory restrictions

in certain jurisdictions. Solvay assumes no responsibility in the

event there is a violation by any person of such restrictions.

The information contained herein shall not

constitute or form part of an offer to sell or the solicitation of

an offer to buy, nor shall there be any sale of the securities

referred to herein, in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

Solvay has not authorised any offer to the

public of securities in any Member State of the European Economic

Area (“EEA”) nor in the United Kingdom (the “UK”).

The securities referred to herein are not

intended to be offered, sold or otherwise made available to, and

should not be offered, sold or otherwise made available to, any

retail investor in the EEA or in the UK. For these purposes, the

expression “retail investor” means a person who is one (or both)

of: (a) a retail client, as defined in point (11) of Article 4(1)

of the Market and Financial Instruments Directive 2014/65/EU, as

amended (“MiFID II”) or (b) a customer, within the meaning of the

Directive (EU) 2016/97 (as amended) where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of MiFID II.

This communication may only be communicated to

persons in the United Kingdom in circumstances where the provisions

of section 21(1) of the FSMA do not apply to the Issuer and is

directed solely at persons in the United Kingdom who (i) have

professional experience in matters relating to investments, such

persons falling within the definition of “investment professionals”

in Article 19(5) of the FSMA (Financial Promotion) Order 2005, as

amended (the “Financial Promotion Order”) or (ii) are persons

falling within article 49(2)(a) to (d) of the Financial Promotion

Order or other persons to whom it may lawfully be communicated,

(all such persons together being referred to as “relevant

persons”). This communication is directed only to relevant persons

and must not be acted on or relied on by persons who are not

relevant persons.

The securities referred to herein may be held

only by, and transferred only to, eligible investors referred to in

Article 4 of the Belgian Royal Decree of 26 May 1994, holding their

securities in an exempt securities account that has been opened

with a financial institution that is a direct or indirect

participant in the Securities Settlement System operated by the

National Bank of Belgium. The securities are not intended to be

offered, sold or otherwise made available to, and should not be

offered, sold or otherwise made available to, any consumer

(consumenten / consommateurs) within the meaning of the Belgian

Code of Economic Law (Wetboek van economisch recht / Code de droit

économique).

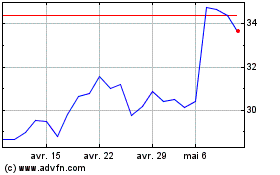

Solvay (EU:SOLB)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Solvay (EU:SOLB)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024