By Richard Rubin

Some of the nation's largest employers -- including CVS Health

Corp., Wells Fargo & Co. and the U.S. Postal Service -- say

they won't implement President Trump's payroll-tax deferral plan,

opting to leave employee paychecks alone this fall.

The president's plan lets employers stop withholding the 6.2%

Social Security tax now for most workers and requires them to pay

it back early next year through additional paycheck withholding.

Mr. Trump wants Congress to forgive those deferred taxes, but

without any assurance of that happening, the plan continues to find

little footing in the private sector as companies make their

decisions.

"We have reviewed the guidance issued by the U.S. Treasury

Department and the IRS and have determined that participating in

this optional deferral program is not in our employees' best

interest," said Michael DeAngelis, a spokesman for CVS Health.

Other large employers, including United Parcel Service Inc.,

JPMorgan Chase & Co., and Home Depot Inc., say they aren't

participating either. Wells Fargo wanted "to avoid creating a

future financial burden for employees," said spokesman Peter

Gilchrist.

That lack of interest from companies -- some of which employ

hundreds of thousands of potentially eligible workers -- limits the

broader economic impact of the deferral. For now, the largest group

of affected workers is the one controlled by Mr. Trump -- federal

executive-branch employees and military-service members who will

see their paychecks grow this month and then shrink in January.

Mr. Trump announced the payroll-tax deferral in August, offering

it as his way of getting money to households during the

pandemic-induced economic downturn amid a stalemate in Congress

over further assistance. He used a law that lets the administration

postpone tax deadlines after a disaster.

The deferral is available through Dec. 31 for workers making

under $104,000 on an annualized basis. Someone making $80,000 a

year could push as much as $1,653 in the employee's share of

payroll taxes from this year's paychecks into next year's.

Mr. Trump's approach delayed the taxes but didn't eliminate them

because only Congress can do that. He has urged Congress to forgive

deferred taxes and to approve a transfer that would keep the Social

Security trust fund whole.

"When we win I, as your President, will totally forgive ALL

deferred payroll taxes with money from the General Fund," he said

on Twitter on Thursday.

So far, however, lawmakers have shown little appetite to approve

the forgiveness, and Democrats are trying to overturn the executive

action. And the fewer affected employees there are, the less

pressure Congress will feel.

Dozens of large employers, ranging from private-sector companies

to state governments, have yet to say whether they will participate

in the deferral program.

The Internal Revenue Service says employers who defer taxes now

must collect them with double withholding in early 2021. If

necessary, they can make other arrangements with workers to get the

money.

Employers get to decide whether to participate, and many just

aren't interested.

The change can be hard to explain to employees and the benefits

can be small because of the need to pay the money back next year.

If workers leave their jobs before the tax is recouped, the

employer can be stuck with the tax liability.

Some small businesses and Trump-aligned employers seem the most

likely to participate.

The Republican National Committee is offering the deferral to

its employees, said spokesman Michael Ahrens.

Rep. Kevin Brady (R., Texas), the top Republican on the House

Ways and Means Committee, said Thursday that he is deferring the

taxes for his campaign staff and is exploring options for his

congressional staff. But the House's chief administrative officer

said in a memo Friday that it wouldn't be implementing the

deferral.

Mr. Brady is introducing a bill to forgive the deferred

taxes.

"It would be a shame if employers, large and small, don't help

their workers with this deferral," he said.

Still, some states run by Republican governors may not implement

the deferral for their own workers. Oklahoma won't do it, said

Baylee Lakey, spokeswoman for Oklahoma Gov. Kevin Stitt. Other

states with Republican governors, including Maryland and Georgia,

haven't made decisions yet and neither has Democratic-run New

York.

Payroll providers are changing their software so employers can

implement the deferral. In some cases, employers may offer workers

an option about whether to defer the taxes.

Federal workers and military-service members aren't getting that

choice. In a Sept. 4 internal memo, IRS human-resources executives

said many employees had asked whether they could opt out.

"We have had many discussions with Treasury and they have

confirmed that no eligible IRS employees can opt out," they

wrote.

With no option available, Sergeant Major of the Army Michael

Grinston, the top enlisted official, has urged soldiers to set the

extra money aside when it starts arriving in paychecks.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

September 11, 2020 12:16 ET (16:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

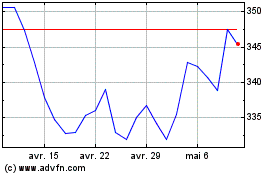

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024