- Provides over 12 months run way

- Secured and flexible financing with no associated warrants

- An asset in the context of the Chapter 11 & French

‘Sauvegarde’ plans

Regulatory News:

SpineGuard (Paris:ALSGD) (FR0011464452 – ALSGD), an

innovative company that deploys its DSG® (Dynamic Surgical

Guidance) sensing technology to secure and streamline the placement

of bone implants, announces today that it has secured a €2.4M

financing in the form of an equity line made of 120 convertible

warrants (BSAR) over a period of 12 months.

This flexible financing secures the Company’s cash runway in the

context of both the COVID-19 pandemic and the Chapter 11 and French

‘sauvegarde’ plans currently being prepared.

Pierre Jérôme, Chairman, CEO and co-founder of SpineGuard,

comments: « Whereas we were on track with our objective of

operational profitability, COVID-19 strongly impacted our revenue

beginning in mid-March. Elective surgeries are now progressively

resuming and we are about to launch our new DSG-Connect interface,

however we thought it was important to secure the company’s cash

runway beyond 12 months. We are very pleased with this financing as

it provides us with greater flexibility as we work on the plans for

the Chapter 11 and French ‘Sauvegarde’ to be presented to the US

and French Courts. I wish to thank Nice & Green for their

renewed confidence.”

MAIN TERMS AND CONDITIONS

The financing is provided by Nice & Green, a private company

that specializes in financing solutions tailored to the

requirements of listed companies.

A meeting of the Board of Directors, held on May 14, 2020,

acting upon the delegation granted by the General Shareholders

Meeting has approved the concept of the facility, without

preferential right of subscription, in favor of Nice & Green of

one hundred and twenty (120) BSAR with a nominal value of twenty

thousand (20,000) euros each and delegated to the CEO (‘Directeur

Général’) the authority to execute each of the draws contemplated

under the facility agreement.

- The BSAR will not be listed

- Conversion of the BSAR by Nice & Green is at their

hand

- The number of shares resulting from the conversion of the BSAR

will be determined by the lowest VWAP 10 days plus a discount of

8%.

The facility provides secured and scheduled monthly draws of €

200,000 each during a period of 12 months according to the

timetable below that will be subscribed by Nice & Green.

The facility does not require the establishment of a prospectus

requiring a visa by the AMF.

MAIN CHARACTERISTICS OF THE BSAR – SHARE DISPOSALS AFTER

CONVERSION OF THE BSAR

The company has entered into this BSAR facility as authorized by

the Shareholders’ Meeting of May 14, 2020 in its 11th and 12th

resolutions.

Nominal value of the BSAR: €

20,000 each at 100% of the par value.

Identification – Timetable for the

issuance of the BSAR:

The BSAR are numbered from 1 to 120 and shall be issued and

subscribed by Nice & Green in several monthly tranches of

200,000 euros each according to the following timetable:

DATE

BSAR #

1 July 2020

1 à 10

31 July 2020

11 à 20

31 Aug. 2020

21 à 30

29 Sep. 2020

31 à 40

28 Oct. 2020

41 à 50

27 Nov. 2020

51 à 60

30 Dec. 2020

61 à 70

1 Feb 2021

71 à 80

2 March 2021

81 à 90

31 March 2021

91 à 100

3 May 2021

101 à 110

3 June 2021

111 à 120

- The BSAR are non-transferable, except to companies controlled

by Nice & Green.

- Cases of default: The agreement includes standard provisions

for cases of defaults under similar contracts that allow the

solicitation of an anticipated reimbursement or a stop of the BSAR

issuances and subscriptions and/or to suspend or refuse to

subscribe the OCAPI not yet issued.

- SpineGuard has a unilateral right of revocation to repay the

outstanding BSAR at any time.

Subscription and exercise of the BSAR

The subscription price of each BSAR is of eighteen thousand

(18,000) euros and shall be paid by Nice & Green to SpineGuard

on the subscription date.

Except in the case of suspension per the terms and condition of

the agreement, each BSA shall be converted within 45 days after the

subscription date at Nice & Green discretion.

The exercise price of each BSAR is of two thousand (2,000) euros

and shall be paid by Nice & Green to SpineGuard on each

exercise date.

Conversion of the BSAR: BSAR

can be converted into SpineGuard shares upon their holder request,

at any time, according the following conversion formula:

N = (PS +PEx) /PE

« N »: the number of new ordinary shares of to be issued under

one BSAR conversion « PS »: the subscription price « PEx »: the

exercise price « PE »: the emission price Example for the 10 BSAR

to be converted Average Weighted Stock Price for the period: €0.30

x 0.92 =€0.2760 # of shares to be issued: (180,000 + 20,000) /

€0.2760 = 724,638 shares

The new shares issued upon the conversion of the BSAR shall be

immediately eligible for dividends, bear the same right of all

others existing ordinary shares and will trade on Euronext Growth

under Code ISIN FR0011464452 - ALSGD.

The number of shares issued pursuant the BSAR conversions will

be communicated by the Company on its web site under the category

of regulated information relative to the existing number of shares

and their associated voting rights. Should the case of significant

conversion of BSAR occur, thus with a potential impact on the stock

price, the Company will proceed to an ad-hoc communication in

respect.

Nice & Green policy is not to be part of the governance of

the companies in which it has invested. Therefore, it will not

require any seat at SpineGuard’s Board of Directors.

Nice & Green does not act as a financial intermediary and

invests its own equity resources. Therefore, while Nice & Green

has no constraints for a fast sell of the converted shares, it has

no intention of remaining a long term shareholder.

THEORETICAL EFFECT OF THE ISSUANCE OF THE BSAR

The theoretical effect of the issue of the BSAR for a total

nominal amount of € 2,400,000 would be as follows:

- Effect of the issue on the equity per share: base is the net

equity per the financial statements as of 31 May 2020 and of the

total issued shares on the effective date of the financing i.e.

17,707,245 shares:

Equity per share (in euros)

Base non diluted

Base diluted (1)

Number of shares

Before the issue of the BSAR

(€0.03)

(€0.03)

17,707,245

After the issue of 120 BSAR

(€0.02)

(€0.02)

26,402,897

(1) Calculations are made on the

assumption that all warrants, stock-options and free shares are

exercised prior to the issue of the OCAPI.

- Incidence of the issue on a 1% stake of a shareholder:

Equity per share (%)

Base non diluted

Base diluted (1)

Number of shares

Before the issue of the BSAR

1.00%

0.87%

17,707,245

After the issue of 120 BSAR

0.67%

0.61%

26,402,897

The calculation of the number of new issued shares and its

subsequent dilution for the shareholders has been made on the base

of an exercise price of €0.2760 per share resulting in a total of

8,695,652 newly created shares for the 120 BSAR

About SpineGuard®

Founded in 2009 in France and the USA by Pierre Jérôme and

Stéphane Bette, SpineGuard is an innovative company deploying its

proprietary radiation-free real time sensing technology DSG®

(Dynamic Surgical Guidance) to secure and streamline the placement

of implants in the skeleton. SpineGuard designs, develops and

markets medical devices that have been used in over 75,000 surgical

procedures worldwide. Fifteen studies published in peer-reviewed

scientific journals have demonstrated the multiple benefits DSG®

offers to patients, surgeons, surgical staff and hospitals.

Building on these solid fundamentals and several strategic

partnerships, SpineGuard has expanded its technology platform in a

disruptive innovation: the « smart » pedicle screw launched late

2017 and is broadening the scope of applications in dental

implantology and surgical robotics. DSG® was co-invented by Maurice

Bourlion, Ph.D., Ciaran Bolger, M.D., Ph.D., and Alain Vanquaethem,

Biomedical Engineer.

For further information, visit www.spineguard.com

Disclaimer

The SpineGuard securities may not be offered or sold in the

United States as they have not been and will not be registered

under the Securities Act or any United States state securities

laws, and SpineGuard does not intend to make a public offer of its

securities in the United States. This is an announcement and not a

prospectus, and the information contained herein does and shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of the securities referred to herein in

the United States in which such offer, solicitation or sale would

be unlawful prior to registration or exemption from

registration.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200626005140/en/

SpineGuard Pierre Jérôme CEO & Chairman Tel.: +33 1

45 18 45 19 p.jerome@spineguard.com

SpineGuard Manuel Lanfossi CFO Tel.: +33 1

45 18 45 19 m.lanfossi@spineguard.com

NewCap Investor Relations & Financial

Communication Mathilde Bohin / Pierre Laurent Tel.: +33 1 44 71 94

94 spineguard@newcap.eu

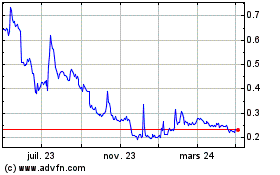

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Spineguard (EU:ALSGD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024