SpringWorks Raises IPO to 9 Million Shares at $16-$18 Each

12 Septembre 2019 - 2:21PM

Dow Jones News

By Colin Kellaher

Biopharmaceutical company SpringWorks Therapeutics Inc. on

Thursday raised its planned initial public offering to 9 million

shares at an expected price of $16 to $18 apiece.

The Stamford, Conn., company had previously planned to offer

about 7.35 million shares.

At the $17 midpoint of the expected price range, SpringWorks

said it expects net proceeds of about $139 million, or roughly

$160.3 million if the underwriters exercise their option to buy an

additional 1.35 million shares.

The company said it will use the proceeds to fund studies of

nirogacestat, its most advanced product candidate, which is

initially in development for the treatment of desmoid tumors, and

of mirdametinib, its second product candidate, which is initially

in development to treat a rare tumor of the peripheral nerve

sheath.

SpringWorks said it will have about 43.2 million shares

outstanding after the IPO, assuming the underwriters exercise their

overallotment option, for a valuation of about $735 million at the

$17 midpoint.

Bain Capital and OrbiMed Advisors will each own about 17% of

SpringWorks after the IPO, while Pfizer Inc. (PFE) will hold about

10.9%, according to a filing with the Securities and Exchange

Commission.

SpringWorks said its shares have been approved for listing on

the Nasdaq Global Select Market under the symbol SWTX.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

September 12, 2019 08:06 ET (12:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

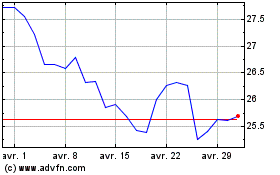

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Pfizer (NYSE:PFE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024