Starboard, Elliott Management Call on eBay to Shed StubHub, Classifieds

22 Janvier 2019 - 4:41PM

Dow Jones News

By Cara Lombardo and Kimberly Chin

EBay Inc. is being circled by a pair of activist investors who

want the online marketplace to consider parting ways with its

StubHub ticketing and classified-ads businesses.

Elliott Management Corp. announced Tuesday that it has a more

than 4% stake in eBay and urged the online marketplace to consider

spinning off or selling StubHub and the classifieds business

because they could be worth more on their own.

Another hedge fund, Starboard Value LP, also has a large

position in eBay of less than 4% and has spoken to the company

about those same changes, according to a person familiar with the

matter.

Starboard took the stake at least six months ago and has been

talking to the San Jose, Calif.-based company in recent months

about improving its operations and potentially separating the two

businesses similar to the way it previously spun off payment

platform PayPal Holdings Inc., the person said.

Through Friday, eBay shares were down about 20% over the past

year. They jumped 8.6% to $33.68 in early trading Tuesday on news

of the two activists' involvement. The company has a market value

of roughly $30 billion.

In a letter sent Tuesday to eBay's board, Elliott also said eBay

should focus on revitalizing its core marketplace business, make

operational improvements to improve its margins and ensure it has

the right leadership team in place.

Elliott says in the letter that eBay created a unique forum to

match buyers and sellers, but has failed to take advantage of more

sales moving online. Elliott partner Jesse Cohn notes his own

mother has sold jewelry on the website for over a decade.

StubHub, which eBay bought in 2007 for $310 million, accounted

for about 14% of eBay's more than $2 billion of revenue in its

third quarter last year. Its classified business made up about 12%.

The company is set to report its fourth-quarter results next

week.

EBay has attracted activists in the past. Billionaire investor

Carl Icahn showed up in eBay's stock in 2014 and urged a breakup.

Following its own review, eBay spun out PayPal, giving each eBay

holder a new share in PayPal, which is now itself a company worth

more than $100 billion. Mr. Icahn sold out of his eBay position

soon after the split and last year exited his stake in PayPal, with

it having roughly doubled in value since the spinoff.

Write to Cara Lombardo at cara.lombardo@wsj.com and Kimberly

Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

January 22, 2019 10:26 ET (15:26 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

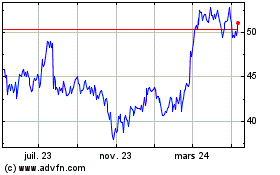

eBay (NASDAQ:EBAY)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

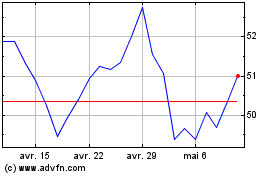

eBay (NASDAQ:EBAY)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024