Stocks on Track for Weekly Gains as Growth Fears Ease

11 Janvier 2019 - 2:33PM

Dow Jones News

By Riva Gold

Global stocks were little changed Friday but remained on track

for solid weekly gains thanks to fading concerns about the economy

and interest rate policy.

S&P 500 futures edged down 0.1% Friday after the index

advanced for five straight sessions and rose 2.6% so far this week.

Shares of Activision Blizzard fell 6%, leading in premarket

trading, following news it is cutting ties with a videogame

studio.

The Stoxx Europe 600 was flat Friday but was on course to end

the week 1.6% higher, while Japan's Nikkei and Hong Kong's Hang

Seng each gained Friday and climbed around 4.1% this week, their

biggest weekly gain since November.

Markets around the world have drawn support recently from

reassurance from the Federal Reserve will adjust its pace of

tightening monetary policy if needed, as well as hopes for progress

in U.S.-China trade relations, rising oil prices and signs the U.S.

economy remains healthy.

On Thursday, Federal Reserve Chairman Jerome Powell reiterated

the central bank's flexible outlook on raising rates at an

appearance in Washington, D.C., while Fed Vice Chairman Richard

Clarida separately said low inflation should allow the bank to be

patient with future interest-rate increases.

"You basically have a dovish fed and a still strong economy -- a

positive cocktail for markets," said Thomas Costerg, senior

economist at Pictet Wealth Management.

Investors now see a roughly 19% of one or more additional

interest rate rises by late June, compared with a 45% chance a

month ago, according to fed-fund futures tracked by CME Group.

That has pushed the dollar lower, helping support a rebound in

emerging markets and commodities, and assuaged investors' fears

about the global economy.

Jeroen Blokland, a portfolio manager at Dutch asset manager

Robeco, recently increased exposure to stocks in his portfolios on

the expectation that growth will continue.

He expects volatility to return, however. "Some kind of

turbulence, or phases of elevated volatility, will stay with us

because every time the economy hits a soft spot, there will be this

chatter about a potential recession coming," he said. "I don't

think we'll see the stability we've seen in 2017 and the first part

of 2018, but I do think it will become less volatile than

December."

Meanwhile, investors have become more hopeful about the trade

outlook in recent weeks. Following midlevel trade talks held in

Beijing this week, China and the U.S. are moving ahead with plans

for higher-level talks, with President Xi Jinping's economic-policy

chief scheduled to visit Washington in late January.

Uncertainty around the trade outlook led analysts in December to

rapidly downgrade their forecasts for corporate earnings.

Companies in the S&P 500 are forecast to grow their earnings

by 12% in the fourth quarter of 2018, down from a forecast of 18%

in July, according to FactSet.

"Earnings estimates were slashed in anticipation of trade war,"

said Mike Thompson, head of S&P Investment Advisory

Services.

Now, "It's easier to be optimistic at these [valuation] levels,

and there's more clarity [on the economic and policy outlook]" he

added, noting he expects U.S. earnings to exceed expectations by a

large margin as fourth-quarter results begin to pour in next

week.

The S&P 500 currently trades at 15 times forward earnings,

down from 18.6 a year ago.

Write to Riva Gold at riva.gold@wsj.com

(END) Dow Jones Newswires

January 11, 2019 08:18 ET (13:18 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

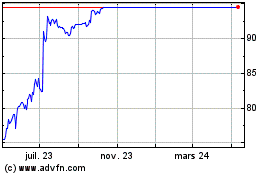

Activision Blizzard (NASDAQ:ATVI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Activision Blizzard (NASDAQ:ATVI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024