Strong Jobs Data Buoys Dollar

01 Juin 2018 - 11:51AM

RTTF2

The U.S. dollar strengthened against its major counterparts in

the European session on Friday, as U.S. job growth beat forecasts

in May and jobless rate remained at a 17-year low.

Data from the Labor Department showed that non-farm payroll

employment surged up by 223,000 jobs in May after climbing by a

downwardly revised 159,000 jobs in April.

Economists had expected employment to increase by 188,000 jobs

compared to the addition of 164,000 jobs originally reported for

the previous month.

With the jump in employment, the unemployment rate edged down to

3.8 percent in May from 3.9 percent in April. The unemployment rate

had been expected to come in unchanged.

The currency rose against its major rivals in the Asian

session.

The greenback strengthened to 109.67 against the yen, a 3-day

high. The next possible resistance for the greenback is seen around

the 111.00 area.

The latest survey from Nikkei showed that Japan manufacturing

sector continued to expand in May, albeit at a slower rate, with a

manufacturing PMI score of 52.8.

That's down from 53.8 in April, although it remains well above

the boom-or-bust line of 50 that separates expansion from

contraction.

The greenback appreciated to a 2-day high of 0.9897 against the

Swiss franc, from a low of 0.9841 seen at 6:45 pm ET. The greenback

is likely to find resistance around the 1.00 area.

The greenback bounced off to 1.1648 against the euro, from a low

of 1.1718 hit at 6:00 am ET. Next key resistance for the greenback

is likely seen around the 1.15 level.

Final data from IHS Markit showed that the upturn in the

Eurozone manufacturing sector showed further signs of cooling in

May, as initially estimated.

The factory Purchasing Managers' Index fell to a 15-month low of

55.5 from 56.2 in April. The score matched the flash estimate of

55.5.

The greenback strengthened to 2-day highs of 0.6961 against the

kiwi, 1.3008 against the loonie and 0.7514 against the aussie, from

its early lows of 0.7020, 0.7573 and 1.2932, respectively. The

greenback is poised to challenge resistance around 0.68 against the

kiwi, 1.31 against the loonie and 0.74 against the aussie.

On the flip side, the greenback dropped to 1.3338 against the

pound, reversing from a 2-day high of 1.3254 set at 1:00 am ET. If

the greenback continues its fall, 1.35 is possibly seen as its next

support level.

Survey data from IHS Markit and Chartered Institute of

Procurement & Supply showed that the UK manufacturing sector

expanded at a faster pace in May.

The manufacturing Purchasing Managers' Index rose unexpectedly

to 54.4 in May from a 17-month low of 53.9 in April. The score was

expected to drop to 53.5.

The U.S. construction spending for April and ISM manufacturing

index for May are due shortly.

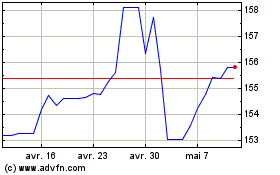

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024