Tech Firms Say China Tariffs Will Set Back U.S.'s 5G Goals

07 Septembre 2018 - 8:18PM

Dow Jones News

By Jay Greene

A handful of tech giants are invoking one of the White House's

priorities -- leadership in an emerging wireless technology known

as 5G -- to argue against adding tariffs on $200 billion in goods

coming from China.

Intel Corp., Cisco Systems Inc., Dell Technologies Inc. and

other tech companies are seeking to convince the U.S. Trade

Representative to nix plans to place tariffs on products they say

are vital to rolling out fifth-generation wireless services in the

U.S.

By raising costs for the goods required to build 5G networks,

the proposed tariffs "will slow down the pace of technology

adoption across the U.S. economy, causing American firms and

institutions to fall behind foreign competitors outside of China

that aren't subject to the same tariffs," Intel wrote in comments

filed with the agency late Thursday.

The tariffs appear to run counter to the White House's stated

goal of leadership in 5G technology. In March, the Trump

administration scuttled Broadcom Ltd.'s $117 billion hostile bid

for Qualcomm Inc. after a U.S. panel that vets foreign deals raised

concerns the acquisition could stymie the San Diego chip maker's 5G

development. At the time, the White House held up U.S. leadership

in 5G development as an issue of national security.

The U.S. Trade Representative is reviewing comments before

making a final determination on specific products to tariff. The

Trump administration wants to make sure China competes fairly in

the emerging 5G market, White House deputy press secretary Lindsay

Walters said.

"No final decisions on specifics have been made," she said.

The White House is preparing to increase pressure on China by

putting up to 25% tariffs on as much as $200 billion in Chinese

goods. That would be on top the $50 billion of Chinese exports the

administration already hit with 25% duties. The public comment

period on the new tariffs ended Thursday, the last step before a

decision.

President Trump on Friday threatened another $267 billion in

tariffs on Chinese goods, saying they could be rolled out on short

notice.

It isn't clear how significant the impact of tariffs will be on

American 5G competitiveness, said Chetan Sharma, a mobile-industry

consultant. The market is still nascent, and the supplies of

infrastructure for the new technology are only beginning to move

out of China.

"But if this situation lasts too long into 2019, then there

could be measurable impact," Mr. Sharma said.

The tech companies argued tariffs would stall next-generation

technology that promises higher-speed connections needed for

self-driving cars, wireless virtual reality and other

innovations.

The tariffs would raise costs on goods such as routers and

switches used to roll out 5G, said Cisco, Dell, Hewlett Packard

Enterprise Co. and Juniper Networks Inc. in a joint filing.

Wireless-service providers would pass those increases to consumers,

raising prices for mobile plans, they said. And higher costs would

reduce incentives to improve networking infrastructure, the

companies asserted.

Like Intel, the companies wrote "the proposed duties would have

a detrimental impact on broader U.S. economic and strategic

priorities."

Moreover, the companies argue, reduced profits caused by the

tariffs could lead to "hiring freezes, stagnant wages, and even job

losses, as well as harm to investors such as reduced dividends and

erosion of shareholder value," the companies wrote.

(END) Dow Jones Newswires

September 07, 2018 14:03 ET (18:03 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

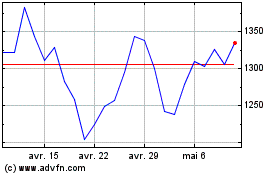

Broadcom (NASDAQ:AVGO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

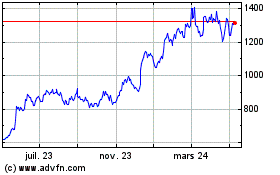

Broadcom (NASDAQ:AVGO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024