By Sarah Krouse

Facebook Inc. is getting deeper into the wireless business.

The social-media giant isn't buying a cellular provider or even

licenses to use federally controlled airwaves. Instead, it has

built networking technology that equipment makers and internet

providers can license free of charge that helps provide home

internet connections through wireless service instead of running

fiber to each home.

The move is part of a growing effort by some tech giants and a

host of small, upstart internet providers to win more customers by

creating home wireless connections at speeds comparable to what

traditional fiber can deliver, at a cheaper price than the big

cable companies charge. These new services often come with fewer

restrictions on data usage than traditional providers.

Combined, these internet providers control just a small slice of

American households but aim to take more as consumers cut the cord

and seek cheaper alternatives to traditional broadband providers.

In some cases, the upstarts will compete with the faster 5G home

broadband service that carriers like Verizon Communications Inc.

are racing to roll out.

The new wave

For the most part, Facebook and the other tech companies looking

to get into the wireless game are still in the early stages of

their efforts.

Microsoft Corp., for instance, has pressed the Federal

Communications Commission to free up more unused television

broadcast airwaves for rural connectivity and created patents and

equipment for using them. Alphabet Inc.'s Google, meanwhile, has

tested laying its own fiber and is trying to commercialize its Loon

project, which delivers connectivity via stratospheric

balloons.

Meanwhile, Facebook's technology, called Terragraph, uses

unlicensed airwaves to transmit signals, which are broadcast by

small radio nodes that can sit on some consumers' homes or street

poles. The providers that use Terragraph can rent existing fiber to

help power their networks, but the fiber only has to be within

about a mile radius.

Together, the fiber, airwaves and nodes create a mesh of

wireless coverage that helps service providers avoid running

physical fiber to every house they want to reach. When one signal

in the mesh network that the nodes create gets blocked, the system

automatically reroutes it to avoid service disruptions.

That mesh network is necessary, because Terragraph -- like other

technologies for providing wireless home internet service -- relies

on ultra-high-frequency airwaves that deliver fast speeds but don't

travel long distances. In addition, these airwaves struggle to

penetrate hard materials and can suffer interference during

inclement weather, challenges that have long made them difficult to

use and that engineers and equipment makers are still working to

overcome.

Facebook says its plans for Terragraph are limited to empowering

internet providers, which brings more people online and translates

into new users for itself. "We're just trying to do that one thing,

which is to get people online," says Dan Rabinovitsj, vice

president of connectivity at Facebook. "We don't want to stand up

and operate networks."

Like many of the small providers in this niche, the companies

that are using Terragraph are largely still experimenting with the

system or deploying it in a small area. Terragraph technology has

been tested in parts of Malaysia, Hungary and San Jose, Calif.

It is currently used by Common Networks, a three-year-old

service provider, in some of its radios to provide in-home 5G

service in markets including Alameda, Calif. The technology is also

set to be deployed in service offered by Agile Networks in a

Canton, Ohio, innovation district next year.

For providers that adopt Terragraph, cost is a big factor.

Common Networks, which targets suburban areas with 500 to 5,000

homes per square mile, uses Terragraph and other radio technology

that enables wireless broadband in suburban areas where it can be

expensive to lay fiber to every home. It charges up to $49 a month

for high-speed service.

Kyle Quillen, chief executive of Agile, says bringing internet

service to a 25- to 30-home development outside Canton would likely

cost $250,000 and take nine months with traditional fiber. The

company plans to do it in three months for 30% of the cost, partly

because of the Terragraph technology, which is "a multiplier of

availability and capacity," he says.

Terragraph is part of a stable of connectivity projects at

Facebook that include helping carriers analyze how their networks

are performing or being used by customers, and Free Basics, which

involves partnering with local carriers to provide limited internet

access. Free Basics, which is available in dozens of countries, has

met political opposition in some corners of the world.

Other competitors

Meanwhile, other service providers are finding their own ways to

sell home wireless service.

Starry Inc., a four-year-old company, uses licensed

ultra-high-frequency spectrum and its own technology -- from chips

and base stations to home Wi-Fi routers -- to provide in-home 200

megabit-per-second broadband service. It charges about $50 a month

and shows the speeds customers get on the screen of a device in

each home and on its customer app, a rare practice among internet

providers.

With more than $300 million in funding from firms such as KKR

& Co. and Tiger Global Management, Starry has so far rolled out

in Boston, Los Angeles, Washington, D.C. and Denver, and plans to

expand into other urban areas.

Amish Jani, founder of venture-capital firm FirstMark Capital

and an investor in Starry, says the fact that consumers often have

little choice in their internet provider made backing an upstart in

the space appealing. Roughly 90 million Americans live in areas

served by only one high-speed broadband provider, according to an

estimate from the Institute for Local Self-Reliance, a nonprofit

organization in Washington, D.C., that advocates for sustainable

community development.

Another provider, Honest Networks Inc., has deployed an internet

service -- using ultra-high-frequency spectrum and other companies'

existing fiber -- in 100 apartment complexes in parts of New York

City and Jersey City, N.J. Honest Networks benefits from a

partnership with real-estate-investment venture fund Fifth Wall

that gives the company a foot in the door with landlords, an

obstacle for new connectivity providers.

Honest says it doesn't share or monetize customer browsing data,

a practice some traditional providers are exploring as a way to win

over privacy-conscious consumers, and it doesn't place data limits

or require contracts.

A spokesman for cable trade group NCTA says there is strong

competition in the U.S. between wired and wireless broadband

providers. "It's great that new entrants are exploring innovative

ways of delivering broadband access to consumers, and we encourage

them to dedicate their resources to reaching consumers in

communities that currently don't have access to broadband

networks," he says.

Ms. Krouse is a Wall Street Journal reporter in New York. She

can be reached at sarah.krouse@wsj.com .

(END) Dow Jones Newswires

October 23, 2019 10:42 ET (14:42 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

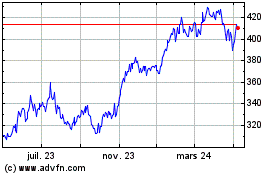

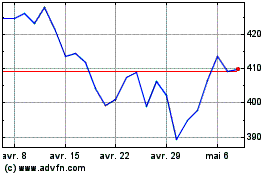

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024