By Tim Higgins

Sales of Tesla Inc.'s high-end Model S sedan have taken a big

hit in the company's most important U.S. market, California, as the

electric auto maker is leaning more heavily on selling the

lower-priced Model 3 compact car, new data show.

Falling sales of the Model S -- and its sister sport-utility

vehicle Model X -- threatens Tesla's growth goals and profit

ambitions as it must rely more on its cheaper Model 3 to make up

the difference.

Registrations of new Model S sedans in the second quarter

plummeted 54% to 1,205 in California, according to the Dominion

Cross-Sell report that compiles data from state motor-vehicle

records. The Golden State is a strong indicator of demand as

Tesla's largest U.S. market, representing 40% of Model S

registrations in the country last year, according to auto-sales

tracker Edmunds.com Inc.

The new data from research firm Dominion Enterprises indicates

the stylish sedan that arguably changed car buyers' view of

electric cars is losing its luster. Tesla is increasingly dependent

on sales of the smaller Model 3, which starts at about $35,000,

less than half the price of the most basic Model S.

Registrations of Tesla's expensive Model X sport-utility vehicle

also fell by about 40% in California during the quarter. Model 3

registrations, by contrast, nearly doubled in the state to 16,372.

Registrations, which tend to lag sales by weeks, provide insight

into where deliveries take place.

On Wednesday, Tesla is scheduled to report second-quarter

results that could shed light into the erosion of high-end

automotive sales and how it is affecting sales and profits. Tesla

doesn't break out its sales by state.

Ahead of the earnings, Tesla shares recently traded at $257.80,

down 15% over the past year but up 44% from their low in June.

The sales decline of the older, higher-end vehicles threatens

the underpinning of Tesla's business, which Chief Executive Elon

Musk has said was built on the assumption of delivering a combined

annual total of 100,000 of the Model S and X vehicles. The company

is targeting at least 360,000 total global deliveries this year, a

more than 45% rise from last year.

Concerns about whether demand for Tesla vehicles have peaked

emerged after the first quarter when sales dropped dramatically.

Those concerns were eased by a return in the second quarter to

growth for the smaller Model 3. Still, Model S and Model X

continued to struggle six months into the year, raising questions

about whether the Model 3 was eating into Tesla's established

business. Sales of the two more expensive vehicles are down 33% for

the year so far.

Analysts surveyed by FactSet, on average, expect total

deliveries of the Model S and Model X vehicles to drop 30% this

year compared with last year. Tesla has delivered a total of more

than 158,000 of its three vehicles through the first half and would

need to increase the pace of sales in the final two quarters

compared with the record second quarter to meet its year-end

goal.

"The key is cash flow, and people will look for whether they

traded profit for volume in Q2," said David Whiston, an analyst for

Morningstar Research Services. "Also, did they get enough [Model] 3

volume to offset the 21% decline in combined S and X sales."

Mr. Musk is betting the Model 3 will transform the company from

a niche luxury car maker to one that sells affordable electric

vehicles. He envisions selling millions of vehicles a year, an

ambitious jump from selling just tens of thousands of vehicles two

years ago.

With Tesla selling cheaper vehicles, analysts are increasingly

worried about the company's ability to maintain higher margins.

Analysts on average predict second-quarter margins, excluding

revenue from the sale of credits, will fall to 20.1% compared with

24.7% in the fourth quarter. Some analysts, however, think Tesla

has made progress in reducing costs and can stave off a steep

decline.

The Model S made its debut in 2012 to rave reviews and helped

Tesla credibly challenge against luxury sedans offered by Daimler

AG's Mercedes-Benz and BMW AG. Though seven years old, Tesla has

frequently updated the car's software, improved its front end and

made other upgrades. Tesla earlier this year began offering a

version that could travel 370 miles on a single charge.

Part of the issue for Tesla may be that the cheapest Model S is

competing with the most expensive Model 3, said Shane Marcum, a

vice president of Dominion Enterprises, the research firm that

issued the registrations report. Until recently the difference in

price was about $6,000.

That gap has widened to about $16,000. The most expensive Model

3 version now sells for almost $64,000, down from a fully loaded

version going for about $69,000. Tesla last week increased the cost

of the standard Model S to $79,990. It also effectively lowered the

highest-priced version of the Model S to about $113,000 from about

$130,000 by making the previous $20,000 Ludicrous Mode upgrade part

of the performance version.

Simplifying the lineup could help Tesla reduce manufacturing

complexity at its Fremont, Calif., factory ahead of starting

production of the Model Y compact SUV planned for next year.

David Packham, 42 years old, said he is a happy Model 3 owner

since buying the car in March. The Naples, Fla., man originally

sought the most basic Model S but changed his mind after realizing

he could get similar options with the fully equipped Model 3.

"When I added up what I got for the money...it was a

no-brainer," Mr. Packham said. He said he would like to eventually

trade the Model 3 in for the larger Model S if Tesla comes out with

an updated version of the sedan with longer range and a more

luxurious interior.

Mr. Musk on Twitter in recent days has tried to extinguish talk

of a major refresh of the Model S, though the company already has

hinted at a 400-mile range car coming someday.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

July 23, 2019 14:30 ET (18:30 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

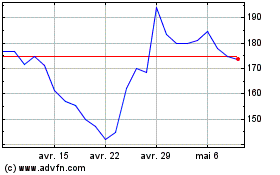

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024