The Just Eat-Takeaway.com Combination Explained

10 Janvier 2020 - 4:18PM

Dow Jones News

By Adria Calatayud

Dutch food-delivery group Takeaway.com NV (TKWY.AE) will join

forces with its U.K. peer Just Eat PLC (JE.LN), after emerging as

the winner of a bidding war with Prosus NV (PRX.AE). The deal

combines two of the largest meal-delivery platforms in Europe at a

time when the industry is moving toward consolidation

worldwide.

Who's who?

Just Eat is a London-based food-delivery company with operations

in 13 countries. Founded in a Danish basement in 2001, it was one

of the pioneer online food-ordering platforms which, like GrubHub

Inc. (GRUB) in the U.S., acts as middleman between restaurants and

customers.

Takeaway.com is an Amsterdam-based food-delivery company which

operates in ten European countries and Israel. It was founded by

Chief Executive Jitse Groen in 2000, when he was a student.

Takeaway.com focuses its operations on a marketplace business

model--linking restaurants to diners--but also has its own

delivery-logistics unit, Scoober.

Prosus is a Dutch technology investor which last year was spun

out of South Africa's Naspers Ltd. (NPN.JO). Naspers, which owns a

near-third stake in Chinese internet giant Tencent Holdings Ltd.

(0700.HK), still holds a majority interest in Prosus. Online food

delivery is one of Prosus's key areas of investment. The company

holds stakes in Germany's Delivery Hero AG (DHER.FF), India's

Swiggy and Brazil's iFood--also backed by Just Eat.

Why Just Eat?

Just Eat is the leading food-delivery platform in the U.K. and

most of the markets where it operates but has been losing market

share to startups with deep-pocketed backers like London-based

Deliveroo, Uber Technologies Inc.'s (UBER) meal-delivery arm Uber

Eats and Spain's Glovo. Shares in the company, which listed on the

London Stock Exchange in 2014, peaked in February 2018, but took a

hit after Just Eat launched its own delivery services to fend off

competitors. Peter Plumb stepped down as chief executive in January

2019 following an activist campaign by U.S. investor Cat Rock

Capital Management LP, and Just Eat has been without a permanent

CEO since then.

How is the deal structured?

Takeaway.com's all-share offer will give Just Eat shareholders a

57.5% stake of the combined group while Takeaway.com investors will

hold the remaining 42.5%. Just Eat shareholders will be entitled to

receive 0.12111 new Takeaway.com shares for each Just Eat share

held. This valued Just Eat at around 6.25 billion pounds ($8.17

billion), or 916 pence a share, based on the closing share price of

the Dutch company on Dec. 18, the last day before its final bid was

made.

What took so long?

Takeaway.com and Just Eat first said they were in talks to

combine their businesses in late July. A merger agreement was

reached a few days later. Under that agreement, Just Eat

shareholders would have owned 52.12% interest in the combined group

and the U.K. company was at 731 pence a share. However, Just Eat

investors Aberdeen Standard Investments and Eminence Capital LP

publicly criticized the deal's terms, arguing that the U.K. company

deserved a higher price.

Prosus made an all-cash offer in late October, gatecrashing Just

Eat's planned merger with Takeaway.com, but its 710 pence a share

bid was promptly rejected by the U.K. company's board. Prosus and

Takeaway.com then entered into a war of words, exchanging

accusations over the other party's efforts to take over Just

Eat.

Delivery Hero--which counts Prosus as its largest

shareholder--in September started selling shares in Takeaway.com,

which hurt the Dutch company's share price and lowered the value of

its offer for Just Eat. Cat Rock--an investor in both Takeaway.com

and Just Eat--accused Delivery Hero of undermining the sale process

of the U.K. company. Delivery Hero said it categorically refuted

all allegations. Takeaway.com asked the Berlin-based company to

refrain from voting on the Just Eat deal, citing a potential

conflict of interest.

Although Prosus increased its offer to 740 pence a share on Dec.

9, Just Eat's board stuck to its recommendation of the combination

with Takeaway.com. Both suitors put in their final, sweetened

offers for Just Eat on Dec. 19--Takeaway.com gave Just Eat

shareholders a larger slice of the merged group and Prosus raised

its cash bid to 800 pence a share.

What's next?

Just Eat and Takeaway.com said their combination will create the

largest food-delivery platform outside of China, with No. 1

positions in 15 out of the 23 countries where it is present. The

companies said that combined they had 360 million orders in 2018

worth about 7.3 billion euros ($8.11 billion). The chief executive

will be Takeaway.com's CEO Mr. Groen and it will be chaired by Just

Eat Chairman Mike Evans.

Takeaway.com pledged to explore options to exit Just Eat's

investment in iFood after completion of the deal. If Just Eat's 33%

stake is sold, half of the net proceeds would be returned to

shareholders of the combined group and the other half would be

retained as the business invests to strengthen its competitive

position. Analysts at Barclays said Prosus is the most likely buyer

for Just Eat's stake, given it already has a large holding in the

Brazilian company.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

January 10, 2020 10:03 ET (15:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

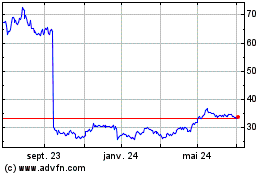

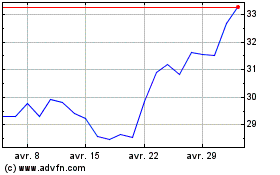

Prosus NV (EU:PRX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Prosus NV (EU:PRX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024