This press release is not intended for

publication, dissemination, transmission, or distribution directly

or indirectly to or within the United States of America, Canada,

Australia, Japan or any other country in which the publication,

dissemination, transmission or distribution of this press release

is unlawful.

Regulatory News:

Tikehau Capital (Paris:TKO), the global alternative asset

management group, today announces that it has successfully launched

and priced an inaugural sustainable bond issue for a total amount

of €500 million maturing in March 2029. This issue of senior

unsecured sustainable bond is associated with a fixed annual coupon

of 1.625%, the lowest ever achieved by the Group.

- This is the first ever public sustainable benchmark bond issued

by an alternative asset manager in Euro

- Tikehau Capital’s first sustainable bond is a key step to

accelerate the Group’s impact strategy around its four pillars:

climate change, social inclusion, healthcare, and innovation

- This sustainable bond is the first to rely on an innovative

Sustainable Bond Framework that allows the Group to invest the

proceeds into sustainable assets (green and social activities) and

ESG funds aligned with the Group’s priority SDGs

- Through this operation, Tikehau Capital extends its average

debt’s maturity to 5.5 years

- This issuance reinforces the Group’s impact investment strategy

alongside its private equity energy transition platform and its

impact lending fund as well as its by-design global ESG investment

approach

Mathieu Chabran, co-founder of

Tikehau Capital, said:

"Tikehau Capital has placed ESG at the very heart of its

operations and impact is the new frontier. We are developing

strategies which address societal challenges while generating

competitive financial returns for investors. The success of this

first-ever sustainable bond is a new step forward that will allow

the Group to reflect its voluntary ESG policy into its financing

structure. With this sustainable bond, we want to focus our

investments on sustainable companies and projects, but also on

funds that can have a significant social or environmental impact.

We would like to thank our bondholders and investors who have

participated to this transaction and so help us institutionalize

impact investing.”

Laure Villepelet, head of CSR/ESG of

Tikehau Capital added:

“The issuance of this first sustainable bond is also a strong

message to our teams: Tikehau Capital aims to strengthen its

investments in its own funds and invites its investment teams to

develop funds with sustainable themes.”

The issuance of this first sustainable bond is part of Tikehau

Capital’s impact strategy. It encourages the launch of new

initiatives and sustainable funds, with underlying investments that

will comply with the specific ESG and impact criteria set for the

bond itself.

Tikehau Capital is successfully building an impact investing

platform, with three dedicated funds launched across the Group’s

strategies in the recent years:

- In 2018, Tikehau Capital launched T2 Energy Transition fund, a

private equity fund dedicated to energy transition. On 23 February

2021, Tikehau Capital announced it has finished fundraising for

this strategy for a total exceeding €1bn.

- In 2020, Tikehau Capital launched Tikehau Impact Lending (TIL),

aiming at providing financing solutions with terms and conditions

depending on the underlying companies’ ESG performance. The first

closing of this impact lending fund has been achieved for c. €100

million at end-December 2020 with the support from the European

Union.

- In 2021, Tikehau Capital intends to launch a new high yield

impact fund within its capital markets strategies.

This first issue of sustainable bond has reached a strong

appetite from investors which confirms their confidence in the

credit quality of Tikehau Capital.

It has been placed with a diversified base of more than one

hundred investors and has been subscribed by more than 75% of

international investors.

Tikehau Capital’s long-term issuer credit rating has been

confirmed by Fitch Ratings at the beginning of 2021 at BBB- with a

stable outlook. Tikehau Capital’s ESG performance has also been

recognized in particular in 2020, and positions the Group among the

best players in its industry:

- Tikehau Capital has been awarded an A+ overall score by the UN

PRI (United Nations Principles for Responsible Investment) and for

the second year in a row, received an A+ score in the Strategy and

Governance module covering the firm’s overall responsible investing

and ESG approach.

- In September 2020, Tikehau Capital has been assigned a 66/100

inaugural ESG rating by Vigeo, placing the Group among the best

European companies in its field.

- Tikehau Capital is ranked 4th by Sustainalytics, out of a

universe of more than 250 asset managers and custodians, reflecting

a low level of exposure to ESG risks as well as a highly effective

ESG risk management policy.

The sustainability aspects of this bond issue have been

structured in collaboration with Crédit Agricole Corporate and

Investment Bank as sole sustainable bond structurer. The net

proceeds of this issue will be used to finance and/or re-finance in

whole or in part, new and/or existing Eligible Sustainable

Investments as set out in Tikehau Capital’s sustainable bond

framework available on the Group’s website

(https://www.tikehaucapital.com).

Application has been made to Euronext Paris for the bonds to be

admitted to trading on Euronext Paris.

Once the Autorité des marchés financiers has approved the

prospectus, the final version of the prospectus, which includes

risk factors in relation to Tikehau Capital which are more up to

date than those in the 2019 Universal Registration Document of

Tikehau Capital will be published on the Issuer's website. The

settlement is scheduled for 31 March 2021.

Characteristics of the bond issue:

Total amount issued

€500m

Maturity

31 March 2029

Annual interest rate

1.625%

Listing

Euronext Paris

The bond placement has been arranged by Crédit Agricole

Corporate and Investment Bank, Goldman Sachs Bank Europe SE and

Société Générale as Global Coordinators and Joint Lead Managers, as

well as by BNP Paribas, Intesa Sanpaolo S.p.A., RBC Capital Markets

(Europe) GmbH and UniCredit Bank AG as Joint Lead Managers.

ABOUT TIKEHAU

CAPITAL

Tikehau Capital is a global alternative asset management group

with €28.5 billion of assets under management (at 31 December

2020).

Tikehau Capital has developed a wide range of expertise across

four asset classes (private debt, real assets, private equity and

capital markets strategies) as well as multi-asset and special

opportunities strategies.

Tikehau Capital is a founder-led team with a differentiated

business model, a strong balance sheet, proprietary global deal

flow and a track record of backing high quality companies and

executives.

Deeply rooted in the real economy, Tikehau Capital provides

bespoke and innovative alternative financing solutions to companies

it invests in and seeks to create long-term value for its

investors. Leveraging its strong equity base (€2.8 billion of

shareholders’ equity at 31 December 2020), the firm invests its own

capital alongside its investor-clients within each of its

strategies.

Controlled by its managers alongside leading institutional

partners, Tikehau Capital is guided by a strong entrepreneurial

spirit and DNA, shared by its 594 employees (at 31 December 2020)

across its 12 offices in Europe, Asia and North America.

Tikehau Capital is listed in compartment A of the regulated

Euronext Paris market (ISIN code: FR0013230612; Ticker:

TKO.FP).

For more information, please visit: www.tikehaucapital.com

DISCLAIMER:

This press release is for information purposes only and is not

an offer to sell or subscribe securities or a solicitation of an

order to purchase or subscribe securities in any jurisdiction. The

securities mentioned in this press release were not and will not be

offered through a public offering and no related documents will be

distributed to the public in any jurisdiction.

This press release does not constitute an offer for sale of

securities in the United States of America or any other

jurisdiction. These securities may not be offered or sold in the

United States of America unless they are registered or exempt from

registration under the US Securities Act of 1933 (the “US

Securities Act”), as amended. Tikehau Capital does not intend to

register any of the securities mentioned in this announcement in

the United States or to conduct a public offering of securities in

the United States.

This press release is not a prospectus as required under

Regulation (UE) 2017/1129 (the “EU Prospectus

Regulation”).

No action has been undertaken or will be undertaken to make

available any Bonds to any retail investor in the European Economic

Area. For the purposes of this provision:

a) The expression “retail investor” means a person who is one

(or more) of the following:

(i) a retail client as defined in point (11)

of Article 4(1) of Directive 2014/65/EU (as amended, “EU MiFID

II”); or

(ii) a customer within the meaning of

Directive 2016/97/EU, as amended, where that customer would not

qualify as a professional client as defined in point (10) of

Article 4(1) of EU MiFID II.

b) The expression “offer” includes the communication in any form

and by any means of sufficient information on the terms of the

offer and the Bonds to be offered so as to enable an investor to

decide to purchase or subscribe the Bonds.

Consequently, no key information document required by Regulation

(EU) No 1286/2014 (as amended, the “EU PRIIPs Regulation”)

for offering or selling the Bonds or otherwise making them

available to retail investors in the EEA has been prepared and

therefore offering or selling the Bonds or otherwise making them

available to any retail investor in the EEA may be unlawful under

the EU PRIIPS Regulation.

This press release does not constitute an offer of securities in

France or in any other country. The bonds have been and will only

be offered and distributed to qualified investors, as defined in

article 2(e) of the EU Prospectus Regulation, and in accordance

with, Article L.411-2 of the French Monetary and Financial Code, as

amended.

[No action has been undertaken or will be undertaken to make

available any Bonds to any retail investor in the United Kingdom.

For the purposes of this provision:

a) The expression “retail investor” means a person who is one

(or more) of the following:

(i) a retail client, as defined in point (8)

of Article 2 of Regulation (EU) No 2017/565 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

("EUWA"); or

(ii) a customer within the meaning of the

provisions of the Financial Services and Markets Act 2000 (the

"FSMA") and any rules or regulations made under the FSMA to

implement Directive (EU) 2016/97, where that customer would not

qualify as a professional client, as defined in point (8) of

Article 2(1) of Regulation (EU) No 600/2014 as it forms part of UK

domestic law by virtue of the EUWA.

b) The expression “offer” includes the communication in any form

and by any means of sufficient information on the terms of the

offer and the Bonds to be offered so as to enable an investor to

decide to purchase or subscribe the Bonds.

This press release may be sent to persons located in the United

Kingdom only under circumstances where section 21(1) of the

Financial Services and Markets Act 2000 does not apply.

The subscription or purchase of securities of Tikehau Capital

may be subject to specific legal or regulatory restrictions in

certain countries. Tikehau Capital assumes no responsibility for

any violation by any person of these restrictions. The distribution

of this press release in certain jurisdictions may be restricted by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210324006013/en/

PRESS CONTACTS: Tikehau Capital: Valérie Sueur – +33 1 40 06 39

30 UK – Prosek Partners: Henrietta Dehn – +44 7717 281 665 USA –

Prosek Partners: Trevor Gibbons – +1 646 818 9238

press@tikehaucapital.com

SHAREHOLDER AND INVESTOR CONTACT: Louis Igonet – +33 1 40 06 11

11 shareholders@tikehaucapital.com

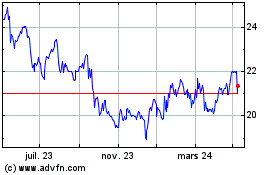

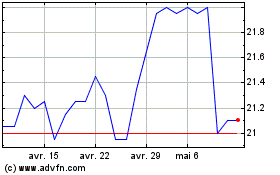

Tikehau Capital (EU:TKO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tikehau Capital (EU:TKO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024