Total Signs Financing for Mozambique LNG Project

17 Juillet 2020 - 8:36PM

Dow Jones News

By Stephen Nakrosis

Total SA on Friday said it signed a $14.9 billion senior debt

financing deal for its Mozambique liquefied natural gas

project.

The French energy company said the project, which is

Mozambique's first onshore LNG development, will include

development of two offshore natural gas fields and the construction

of a liquefaction plant with two production lines.

Total also said the financing, which it described as the biggest

ever in Africa, includes loans from eight export credit agencies,

including the Export Import Bank of the United States, the Japan

Bank for International Corporation, UK Export Finance and the

Export Credit Insurance Corporation of South Africa. Financing was

also received from 19 commercial bank facilities and a loan from

the African Development Bank, Total said.

Total E&P Mozambique Area 1 Limitada, a wholly owned

subsidiary of Total SA, operates Mozambique LNG.

"The signing of this large-scale project financing, less than

one year after Total assumed the role of operator of Mozambique

LNG, represents a significant achievement and a major milestone for

the project," Jean-Pierre Sbraire, Total's chief financial officer,

said.

Write to Stephen Nakrosis at stephen.nakrosis@wsj.com

(END) Dow Jones Newswires

July 17, 2020 14:21 ET (18:21 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

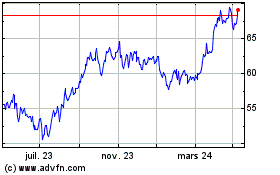

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

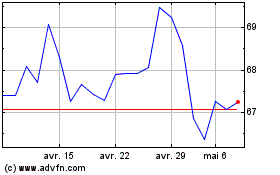

De Mar 2024 à Avr 2024

TotalEnergies (EU:TTE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024