Trade Optimism Boosts Shares of Casino, Manufacturing, Semiconductor Companies

12 Décembre 2019 - 5:59PM

Dow Jones News

By Akane Otani

Shares of companies sensitive to U.S.-China trade policy are

rallying on hopes that the two countries may be nearing an

agreement.

The S&P 500 climbed 0.8% Thursday after President Trump said

a trade deal with China was close, and The Wall Street Journal

reported U.S. negotiators had offered to cancel fresh tariffs on

Chinese goods that were set to take place Sunday.

A few categories of stocks got an even bigger boost.

Wynn Resorts Ltd. and Las Vegas Sands Corp. rose 7% and 3.9%,

respectively. The casino operators both operate resorts in Macau, a

semiautonomous region of China, making them sensitive to Washington

and Beijing's trade rift.

Chemicals companies also jumped. Shares of Dow Inc., which makes

chemical products used in industries ranging from agriculture to

consumer goods, added 2%. The company had cut its full-year

spending forecast over the summer, citing the prolonged U.S.-China

trade fight.

Another group getting a boost Thursday: industrial stocks. One

of the key snags in the U.S. and China's trade negotiations over

the past few months has been disagreement over the level of farm

purchases China should make from the U.S. A trade deal that clears

the picture there stands to benefit farms and the companies that

make equipment for them. Deere & Co., which manufactures

equipment for farmers, along with construction companies, rose

1.2%. Caterpillar Inc. advanced 1.7%.

Semiconductor firms, whose profits rely in part on demand from

China, also outperformed the broader market. Shares of Nvidia Corp.

added 1.7%, while Micron Technology Inc. rose 3%.

Write to Akane Otani at akane.otani@wsj.com

(END) Dow Jones Newswires

December 12, 2019 11:44 ET (16:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

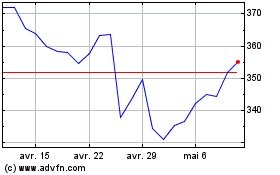

Caterpillar (NYSE:CAT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Caterpillar (NYSE:CAT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024