Trade Truce Prompts Relief Rally for Stocks, Oil, Yuan -- Update

01 Juillet 2019 - 12:36PM

Dow Jones News

By Shen Hong in Shanghai and Steven Russolillo in Hong Kong

Global stocks and oil rallied while U.S. Treasury yields rose

Monday after Beijing and Washington agreed to get trade talks back

on track, lifting investor confidence.

Traders and analysts called the moves a relief rally, and

cautioned that frictions around commerce between the world's two

largest economies were likely to be long-lasting. A better economic

outlook with less trade-driven uncertainty could also mean

hoped-for interest-rate cuts won't be realized.

Technology stocks drove the rise in European markets, with

STMicroelectronics NV up 5.9%. That helped lift the Stoxx Europe

600 by 0.8%, while Germany's DAX index was up 1.2%.

U.S. chip makers also benefited in premarket trading after

specific concessions were given to U.S. companies that trade with

Huawei Technologies Co., the Chinese telecommunications company at

the center of the dispute over technology and security between the

two countries. Qualcomm Inc. and Broadcom Inc. were both up about

5% before U.S. markets opened.

That helped U.S. futures broadly, with the S&P 500 and the

Dow Jones Industrial Average both up by more than 1%. Changes in

equity futures don't necessarily predict moves after the opening

bell.

In China, the benchmark Shanghai Composite Index gained 2.2% on

the diminished tensions between the U.S. and China, despite a set

of disappointing readings for Chinese economic activity. Weekend

data showed factory activity in China contracted for the second

straight month in June.

Michael Kelly, global head of multiasset at PineBridge

Investments, said the outcome of the weekend's meeting of global

leaders was "a modest favorable surprise for markets." However,

issues about intellectual property were very unlikely to be solved

in the coming talks, he added.

Others were similarly cautious. "We appear to have arrived at

almost exactly the minimum positive outcome to justify financial

markets' positive sentiment," said Andrew Jackson, head of fixed

income at Hermes Investment Management.

Japan's Nikkei 225 Index rose 2.1%. Shares in London were also

higher, with the FTSE 100 rising 1.1%.

It wasn't just the trade talks that advanced in the meeting of

global leaders in Japan this weekend. Russia and Saudi Arabia

brokered a deal on cuts to oil production, helping to send Brent

crude futures up 2.8% Monday. The U.S. and Turkey also began to

smooth over their differences regarding the latter's move to

purchase a Russian missile defense system: That helped the Turkish

lira rise 1.5% against the dollar.

Haven assets, which tend to rally in times of stress, retreated.

Gold fell 1.4%, the Japanese yen weakened slightly against the

dollar and 10-year U.S. Treasurys fell in price. That lifted

yields, which move inversely to prices, to 2.017% from 1.998%.

The mood wasn't strictly bullish however, as the U.S. dollar,

which often weakens when investors get more positive on the global

economy, was stronger against a host of currencies. The WSJ dollar

index was 0.3% higher.

Yields on major European sovereign bonds slipped slightly after

government heads failed to reach an agreement on top jobs in the

European Union, including new presidents for the European

Commission and the European Central Bank. The 10-year German bund

was at minus 0.334%, a fraction below Friday's close.

Joe Wallace in London contributed to this article.

Write to Shen Hong at hong.shen@wsj.com and Steven Russolillo at

steven.russolillo@wsj.com

(END) Dow Jones Newswires

July 01, 2019 06:21 ET (10:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

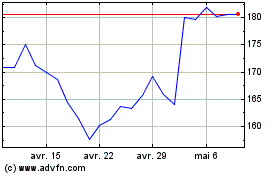

QUALCOMM (NASDAQ:QCOM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

QUALCOMM (NASDAQ:QCOM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024