Transamerica's Entities to Pay $97.6 Million to Misled Retail Investors--Update

27 Août 2018 - 8:56PM

Dow Jones News

By Kimberly Chin

Transamerica Corp. has agreed to pay $97.6 million following a

settlement with the U.S. Securities and Exchange Commission over

charges that four of its entities misled retail investors.

The SEC said Monday that Aegon USA Investment Management LLC,

along with Transamerica Asset Management Inc.,Transamerica

Financial Advisors Inc. and Transamerica Capital Inc., claimed that

investment decisions would be based on Aegon's quantitative

models.

The models, however, were developed solely by an inexperienced

junior analyst, contained numerous errors, and didn't work as

promised, the SEC said. When the entities found out about the

errors, they stopped using the models without telling their

investors, who had put billions of dollars into mutual funds and

other strategies using the models.

The four Transamerica entities didn't admit or deny the SEC's

charges. They agreed to pay about $53.3 million in disgorgement, $8

million in interest and a $36.3 million penalty. The entities also

agreed to create and administer a fund to distribute the entire

$97.6 million to affected investors.

In an email, a spokesman for Aegon NV, the Dutch parent company

of Transamerica, said the company cooperated fully with SEC

throughout the investigation and is "pleased to put the matter

behind us."

"While the models at issue are no longer in use, we recognize we

must do better, and we have taken steps to enhance our policies,

procedures and disclosure processes," the spokesman said. "We

remain confident in our investment process and are committed to

continuously improving our business."

In two separate orders, the SEC also found that Bradley Beman,

Aegon's former global chief investment officer, and Kevin Giles,

its former director of new initiatives, each "were a cause" for the

violations at the investment firm.

The agency said Mr. Beman "did not take reasonable steps to make

sure the mutual funds' models worked as intended," and that both

contributed to Aegon's "compliance failings related to the

development and use of models."

Mr. Beman and Mr. Giles didn't admit wrongdoing. They agreed to

settle with the agency to return, as a penalty, $65,000 and $25,000

respectively to investors.

A counsel for Mr. Beman wasn't immediately available for

comment. Mr. Giles's counsel said he had no further comment.

A spokesman from the law firm representing Mr. Beman noted in an

email that the faulty models were used in a small subset of U.S.

strategies at a time when Mr. Beman was responsible for multiple

strategies and portfolio teams globally. The analyst who created

them didn't report to Mr. Beman.

"There was no intent and no personal benefit to Mr. Beman," the

spokesman added.

Write to Kimberly Chin at kimberly.chin@wsj.com

(END) Dow Jones Newswires

August 27, 2018 14:41 ET (18:41 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

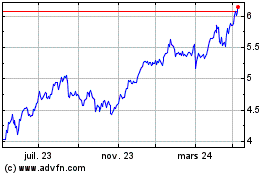

Aegon (EU:AGN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Aegon (EU:AGN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024