Turkey Blocks Foreign Banks in Attempt to Stem Currency Slide

07 Mai 2020 - 8:41PM

Dow Jones News

By Avantika Chilkoti and Caitlin Ostroff

Turkey blocked three international banks from trading its

currency Thursday, an effort to stymie investors who are betting

that the country's weak financial standing will continue to

deteriorate.

Turkey's banking regulator said units of Citigroup Inc., BNP

Paribas SA and UBS Group AG can no longer process transactions

involving Turkish lira. It determined that the lenders had failed

to fulfill their liabilities in Turkish lira transactions with

Turkish banks. The watchdog didn't say how long the ban would

remain in force.

All three banks are international players in foreign-exchange

markets, helping investors and companies trade into and out of the

currencies, including the lira. The ban was issued hours after a

new regulation that gave the banking regulator, known as the BDDK,

increased powers to prosecute alleged market manipulation and the

publication of misleading information.

Representatives at UBS and BNP Paribas didn't immediately

respond to requests for comment. Citigroup declined to comment.

The Turkish currency hit a record low against the dollar earlier

Thursday before bouncing back slightly after the trading ban was

imposed. One U.S. dollar bought 7.1 lira, leaving the Turkish

currency up 1% for the day, but 20% weaker than at the start of the

year.

The slide in the lira reflects a troubling backdrop for the

Turkish economy. Heavily indebted and struggling for years to

contain high inflation, Turkey is now dealing with the impact of

the coronavirus both at home and in its biggest trading partner,

the European Union.

Banning foreign banks from trading the lira "sends a signal of

desperation," said Brad Setser, a senior fellow at the Council on

Foreign Relations. "The central bank has on one hand been unwilling

to adjust interest rates -- the classic defense of the lira -- and

on another hand has a reduced capacity to intervene directly in the

foreign-exchange market."

The country's central bank has all but run out of

foreign-currency reserves and recently sounded out the U.S. about

setting up a swap line to borrow dollars, similar to ones offered

to countries such as Brazil and Norway. Analysts say such an offer

is unlikely to materialize, given Turkey has no reserves, limited

trade with the U.S. and a fraught political relationship with

Washington.

President Recep Tayyip Erdogan in the past has refused to go to

the International Monetary Fund, which would require the country to

institute reforms in exchange for aid. Members of his

administration have explained that it would be a sign of weakness,

which would risk undermining the 66-year-old president's political

standing at home.

Seeking to revive growth after a 2018 currency crisis, the

Turkish central bank has slashed its lending rate to 8.75% from 24%

over the past 10 months. The lowering of the rate, meant to boost

domestic lending, reduced the attractiveness of holding the

currency. Foreign investors have raised a red flag around

central-bank independence since Mr. Erdogan ousted the previous

central-bank governor last year.

As the lira falls, it becomes harder for the country's banks to

pay back substantial foreign-currency debts. Turkey's banks have

$79 billion of short-term foreign-currency debt due by February

2021, according to data from Turkey's central bank.

"If they go at the pace they're going, the endgame is that they

head into a balance-of-payments crisis," said Nafez Zouk at Oxford

Economics.

The ban on the three banks may not be effective at leveling out

the lira, since it removes players from the market, said Filippo

Alloatti, senior credit analyst, international at Federated

Hermes.

"The cost of liquidity increases because you have less

counterparties you can deal with, so it is not a very efficient way

to shore up the currency in the short term," he said.

Turkey has long had a love-hate relationship with foreign

investors. In 2019, during a sharp slide in the lira, it directed

state banks to raise borrowing costs and limit the ability of

foreigners to bet against the currency.

Because it runs a current-account deficit, importing far more

than it exports, Turkey relies on foreign money to keep the economy

afloat. Foreign banks have played that role, lining up investors to

buy Turkish bonds, lend to its banks or make currency trades that

take advantage of Turkey's relatively high interest rates.

In an ironic turn, a day before being banned, Citigroup helped

organize a conference call for investors with Turkey's finance

minister, Berat Albayrak. Mr. Albayrak, who is who is also Mr.

Erdogan's son-in-law, used the call to reassure investors about

Turkey's financial position, according to people familiar with the

call.

--David Gauthier-Villars contributed to this article.

(END) Dow Jones Newswires

May 07, 2020 14:26 ET (18:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

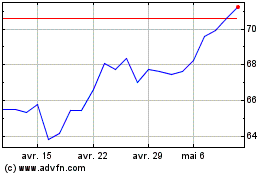

BNP Paribas (EU:BNP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

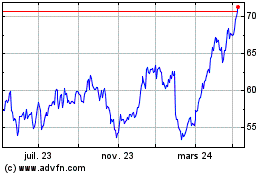

BNP Paribas (EU:BNP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024