U.S. Dollar Advances After Fed Minutes

12 Avril 2018 - 5:22AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

Asian session on Thursday, as minutes from the recent Federal Open

Market Committee meeting showed that members were optimistic about

economic growth and inflation moving up to target, which might need

a "slightly steeper" path of rate hikes than currently

expected.

"All participants agreed that the outlook for the economy beyond

the current quarter had strengthened in recent months," the minutes

from the March 20-21 meeting showed.

The Fed also anticipated a rise in inflation that was

progressing toward its 2 percent goal.

"A number of participants indicated that the stronger outlook

for economic activity, along with their increased confidence that

inflation would return to 2 percent over the medium term, implied

that the appropriate path for the (Fed's policy rate) over the next

few years would likely be slightly steeper than they had previously

expected," the minutes said.

Some member say that "monetary policy eventually would likely

gradually move from an accommodative stance to being a neutral or

restraining factor for economic activity," it showed.

At the March meeting, the Fed raised its benchmark federal-funds

rate by a quarter percentage point to between 1.5% and 1.75%.

The greenback climbed to a 3-day high of 0.9601 against the

Swiss franc, from a low of 0.9568 hit at 5:00 pm ET. The greenback

is seen finding resistance around the 0.98 region.

The greenback reversed from an early low of 1.2380 against the

euro, rising to 1.2354. On the upside, 1.19 is likely seen as the

next resistance for the greenback.

The greenback bounced off to 1.4171 against the pound, from a

low of 1.4198 hit at 9:00 pm ET. The next possible resistance for

the greenback is seen around the 1.38 level.

Data from the Royal Institution of Chartered Surveyors showed

that UK house price balance remained at zero in March.

The balance was forecast to rise to 2 percent from zero posted

in February.

The greenback recovered to 0.7745 against the aussie and 1.2594

against the loonie, from its early lows of 0.7772 and 1.2562,

respectively. If the greenback rises further, it may find

resistance around 0.75 against the aussie and 1.28 against the

loonie.

Having fallen to 106.70 against the yen at 8:15 pm ET, the

greenback reversed direction and rose to 106.97. The greenback is

likely to find resistance around the 110.00 region.

Looking ahead, Eurozone industrial production for February and

ECB minutes of March 7-8 meeting are due in the European

session.

In the New York session, U.S. import and export prices for

March, weekly jobless claims for the week ended April 7 and Canada

new housing price index for February are scheduled for release.

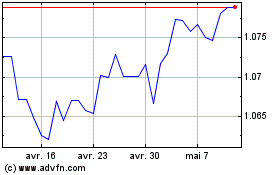

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Euro vs US Dollar (FX:EURUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024