U.S. Dollar Falls Ahead Of Fed Minutes

11 Avril 2018 - 8:42AM

RTTF2

The U.S. dollar slipped against its most major counterparts in

early European deals on Wednesday, as investors awaited U.S.

inflation data and the minutes from the latest Fed meeting for more

clues about policy outlook.

The U.S. Labor Department will release consumer prices for March

at 8:30 am ET. The inflation is expected to stagnate on a monthly

basis, compared to a 0.2 percent rise in February.

At 2 pm ET, the Fed releases minutes of its March 20-21 meeting,

the first under Chairman Jerome Powell.

At the meeting, the policy makers raised interest rates by 25

basis points and signaled two more rate hikes for this year,

dampening hopes for aggressive rate hike path.

Caution prevailed following reports that U.S. President Donald

Trump is considering more aggressive strike in Syria within the

next 48 hours.

Russia has threatened to shoot down any U.S. missiles fired at

neighboring Syria if the U.S. decides to strike Syrian bases in

response to a chemical attack.

The currency has been trading in a negative territory against

its major rivals in the Asian session, with the exception of the

franc.

The greenback dropped to 106.89 against the yen, from a high of

107.25 hit at 5:30 pm ET. The next possible support for the

greenback is seen around the 104.00 level.

Data from the Bank of Japan showed that Japan's producer prices

fell 0.1 percent on month in March.

That was in line with expectations following the upwardly

revised 0.1 percent increase in February.

The greenback fell to 1.2387 against the euro, its lowest since

March 28. The greenback is seen finding support around the 1.25

area.

The greenback that ended Tuesday's trading at 1.4174 against the

pound dropped to a new 2-week low of 1.4223. If the greenback falls

further, 1.44 is possibly seen as its support level.

Data from the Office for National Statistics showed that U.K.

industrial production grew at a slower pace on weak mining and

manufacturing output in February.

Industrial output edged up 0.1 percent month-on-month in

February, compared to January's 1.3 percent increase. Production

was expected to climb 0.4 percent.

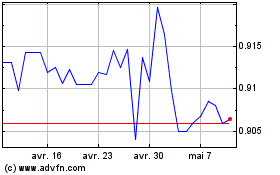

On the flip side, the greenback climbed to a 2-day high of

0.9596 against the Swiss franc, compared to 0.9568 hit late New

York Tuesday. On the upside, 0.98 is likely seen as the next

resistance for the greenback.

Looking ahead, at 7:00 am ET, the European Central Bank

President Mario Draghi speaks at the Generation €uro Students'

Award Ceremony in Frankfurt.

In the New York session, U.S. CPI for March, FOMC minutes from

March 20-21 meeting and monthly budget statement are scheduled for

release.

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs CHF (FX:USDCHF)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024