U.S. Dollar Higher Ahead Of Fed Announcement

13 Juin 2018 - 6:21AM

RTTF2

The U.S. dollar gained ground against its major counterparts on

Wednesday, ahead of the Federal Reserve's interest rate

announcement, which is widely expected to unveil a rate hike for

the second time this year.

The Federal Reserve is expected to raise its benchmark rate by

25 basis points when it ends a two-day policy meeting later in the

day.

With the hike, the federal funds rate is expected to be in a

range of 1.75 percent to 2 percent.

The language in the policy statement along with an updated set

of economic forecasts from Fed officials, covering GDP, inflation

and unemployment may shed light on how many additional rate hikes

might come out of the U.S. this year.

Apart from the Fed decision, U.S. producer price index for May

will be released at 8:30 am ET. The producer price index is

forecast to rise 0.3 percent on month in May, up from the previous

month's 0.1 percent rate.

On Thursday, the European Central Bank may signal that it is

getting closer to winding down its QE program.

The Bank of Japan is expected to make no changes to its monetary

policy settings when it ends a two-day review on Friday.

The greenback advanced to a 3-week high of 110.69 against the

yen and held steady thereafter. At yesterday's close, the pair was

worth 110.36.

The greenback climbed to 5-day highs of 1.1730 against the euro

and 1.3037 versus the loonie, from its early lows of 1.1753 and

1.3011, respectively. On the upside, 1.16 and 1.32 are possibly

seen as the next resistance levels for the greenback against the

euro and the loonie, respectively.

Reversing from its early lows of 1.3375 against the pound and

0.9866 against the franc, the greenback advanced to 1.3353 and

0.9882, respectively. If the greenback rises further, it may find

resistance around 1.32 against the pound and 1.01 against the

franc.

Looking ahead, U.K. house price index for April, CPI and PPI for

May and Eurozone industrial production for April and employment for

the first quarter are due in the European session.

In the New York session, U.S. PPI for May is scheduled for

release.

At 2:00 pm ET, the Fed announces its decision on interest rates.

The Fed is widely expected to raise the federal funds rate by a

quarter point to a range of 1.75 percent to 2 percent.

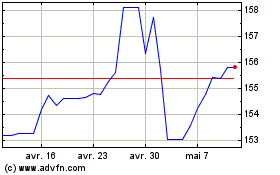

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024