U.S. Dollar Higher As Hopes For Aggressive Fed Rate Cuts Wane

26 Juin 2019 - 12:18PM

RTTF2

The U.S. dollar spiked higher against its key counterparts in

the European session on Wednesday, as hopes for a rate cut in July

receded after Fed Chairman Jerome Powell remarked that the central

bank is "insulated from short-term political pressures."

Speaking in New York on Tuesday, Powell remarked that the Fed is

independent, insulated from short-term political pressures.

Powell resisted President Donald Trump's call to cut interest

rates, saying that monetary policy should not overreact to any

individual data point or short-term swing in sentiment.

Separately, St. Louis Fed President Jim Bullard, a well-known

policy dove, said that a 50 basis point rate cut in July would be

too much.

"I don't think we have to take huge action," Bullard told in an

interview on Bloomberg.

Data from the Commerce Department showed that new orders for

U.S. manufactured durable goods unexpectedly fell sharply in

May.

The durable goods orders tumbled by 1.3 percent in May after

plunging by a revised 2.8 percent in April.

The currency has been trading higher against its most major

rivals in the Asian session following Fed comments.

The greenback strengthened to a 5-day high of 0.9785 against the

franc, from Tuesday's closing value of 0.9755. The currency is seen

finding resistance around the 1.00 level.

The greenback that finished Tuesday's New York session close at

107.16 against the yen firmed to a 6-day high of 107.76. If the

currency rises further, 111.00 is possibly seen as its next

resistance level.

The U.S. currency ticked higher to 1.1351 against the euro and

held steady thereafter. At yesterday's close, the pair was worth

1.1366.

Survey data from market research group GfK showed that Germany's

consumer sentiment is set to weaken in July as income expectations

suffer significant setbacks amid fears of job losses among

shoppers.

The forward-looking consumer sentiment index dropped

more-than-expected to 9.8 in July from 10.1 in June. The score was

forecast to fall marginally to 10.0.

The greenback rose back to 1.2664 against the pound, a pip short

of a 6-day high of 1.2663 seen at 3:00 am ET. The next possible

resistance for the greenback is seen around the 1.24 area.

The JobsOutlook survey by the Recruitment & Employment

Confederation showed that UK employers' confidence on the economy

and their hiring and investment intentions improved since the

extension of the Brexit deadline.

Employers' confidence in making hiring and investment decisions

improved with the index rising 4 percentage points to positive

1.

On the flip side, the greenback weakened to near a 4-month low

of 1.3142 versus the loonie and more than 2-week low of 0.6995

against the aussie from yesterday's closing values of 1.3169 and

0.6960, respectively. On the downside, 1.30 and 0.72 are likely

seen as the next support levels for the greenback against the

loonie and the aussie, respectively.

The greenback also fell to more than a 2-month low of 0.6686

against the kiwi, from an early 2-day high of 0.6593. Further

downtrend may take the greenback to a support around the 0.68

region.

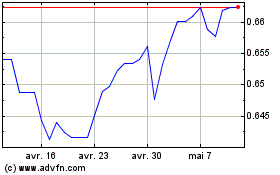

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

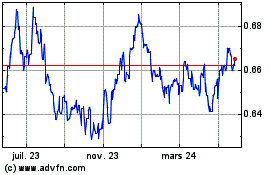

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024