U.S. Dollar Rises Ahead Of Powell's Senate Confirmation Hearing

28 Novembre 2017 - 9:35AM

RTTF2

The U.S. dollar advanced against its major counterparts in the

European session on Tuesday, as investors awaited the Fed chair

nominee Jerome Powell's Senate confirmation hearing in Washington

for indications on his plans to lead the U.S. central bank.

"Our aim is to sustain a strong jobs market with inflation

moving gradually up toward our target," Powell said in prepared

testimony. "We expect interest rates to rise somewhat further and

the size of our balance sheet to gradually shrink."

"I will do everything in my power to achieve those goals

(maximum employment and price stability) while preserving the

Federal Reserve's independent and nonpartisan status that is so

vital to their pursuit," he added.

Also in focus is the tax bill overhaul in the Senate, where a

vote on their version is due on Thursday. The plan should get

support from at least 50 members of the Senate GOP caucus to get it

passed.

"I think the tax bill is doing very well, and I think the

Republicans are going to be very proud of it," Trump told reporters

Monday at the White House. Economic reports on advance goods trade

balance, home prices and consumer confidence index are also likely

to garner attention.

The currency showed mixed performance in the Asian session. It

held steady against its major rivals, excepting the yen.

The greenback strengthened to a 6-day high of 1.3274 against the

pound, from a low of 1.3357 hit at 1:00 am ET. If the greenback

rises further, 1.30 is likely seen as its next resistance

level.

The greenback advanced to a 4-day high of 1.1875 against the

euro, after having fallen to 1.1920 at 3:15 am ET. The greenback is

seen finding resistance around the 1.17 region.

Data from Destatis showed that Germany's import price inflation

eased at a slower-than-expected pace in October.

Import prices climbed 2.6 percent year-over-year in October,

slower than the 3.0 percent increase in September. Economists had

expected the inflation to moderate to 2.5 percent.

The greenback held steady against the franc, after having risen

to a 6-day high of 0.9837 at 2:45 am ET. The pair closed Monday's

deals at 0.9813.

The greenback was trading in a positive territory against the

yen with the pair worth 111.26. At yesterday's close, the pair was

valued at 111.08. The next possible resistance for the

greenback-yen pair is seen around the 112.5 level.

Bank of Japan Governor Haruhiko Kuroda highlighted the

importance of diversifying the sources of corporate funding.

In a speech at Asia Securities Forum in Tokyo, Kuroda said bond

financing is often not the first choice for domestic firms when

financing their business.

After hitting a weekly high of 1.2807 against the loonie at 5:30

am ET, the greenback held steady. The greenback was worth 1.2769

against the loonie when it ended deals on Monday.

Looking ahead, Canada industrial product and raw materials price

indices for October, U.S. wholesale inventories for October,

S&P Case/Shiller home price index and FHFA's house price index

for September and consumer confidence index for November are set

for release in the New York session.

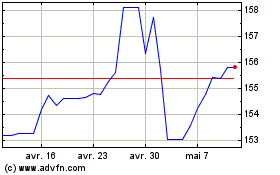

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024