U.S. Dollar Slides Despite Strong GDP Data

26 Avril 2019 - 11:51AM

RTTF2

The U.S. dollar fell against its major counterparts in early New

York deals on Friday, after a sharp rise initially following the

release of strong GDP data for the first quarter.

Data from the Commerce Department report showed an unexpected

acceleration in the pace of U.S. economic growth in the first

quarter.

Preliminary data showed real gross domestic product jumped by

3.2 percent in the first quarter after climbing by 2.2 percent in

the fourth quarter of 2018.

The acceleration in the pace of growth came as a surprise to

economists, who had expected GDP to increase by 2.1 percent.

Investors await the University of Michigan's revised reading on

consumer sentiment for April, due at 10:00 am ET.

The consumer sentiment index for April is expected to be

upwardly revised to 97.0 from 96.9, which was down from 98.4 in

March.

The currency traded mixed against its major counterparts in the

Asian session. While it rose against the yen and the euro, it held

steady against the franc and the pound.

The greenback depreciated to 1.1155 against the euro, reversing

from near a 2-year high of 1.1111 touched immediately after the

data. The greenback is seen finding support around the 1.13

level.

The greenback pulled back to a 2-day low of 1.2918 against the

pound, following a high of 1.2874 hit in immediate aftermath of the

data. The next possible support for the greenback is seen around

the 1.32 level.

After touching near a 4-month high of 1.0236 against franc soon

after the data release, the greenback retreated to 1.0198. Next key

support for the greenback is likely seen around the 1.00 level.

The greenback was trading lower at 111.60 against the yen,

quickly erasing its post-data advance to 112.02. The greenback is

poised to find support around the 110.00 level.

Data from the Ministry of Economy, Trade and Industry showed

that Japan retail sales rose a seasonally adjusted 0.2 percent on

month in March.

That beat expectations for a flat reading and was down from the

0.4 percent increase in February.

Extending early slide, the greenback slid to a 2-day low of

0.7053 against the aussie and a 3-day low of 0.6671 against the

kiwi, from its previous highs of 0.7007 and 0.6619, respectively.

Further downtrend may take the greenback to support levels of

around 0.72 against the aussie and 0.68 against the kiwi.

The greenback dipped to a 2-day low of 1.3459 against the

loonie, from a high of 1.3498 seen at 5:45 am ET. The greenback is

likely to find support around the 1.31 region, should it falls

again.

The University of Michigan's final consumer sentiment index for

April will be out at 10:00 am ET.

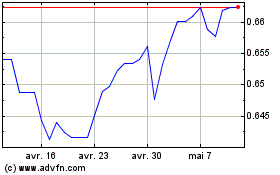

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

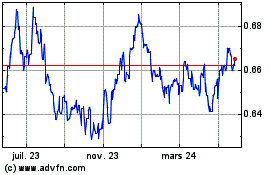

AUD vs US Dollar (FX:AUDUSD)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024