U.S. Stocks Pulled Down by Semiconductor Shares

06 Septembre 2018 - 6:04PM

Dow Jones News

By Ben St. Clair and Amrith Ramkumar

Weakness in technology shares hurt U.S. stocks for the second

straight session Thursday, with worries about regulation and trade

continuing to hang over the market's best-performing sector.

The tech-heavy Nasdaq Composite fell 0.9%, while the S&P 500

shed 0.5%. The Dow Jones Industrial Average declined 29 points, or

0.1%, to 25947. Major indexes had fallen in three of the previous

four sessions entering Thursday, though they remain near record

levels.

Semiconductor stocks dragged the sector lower Thursday, with

Micron Technology shares slumping 10% after Baird analysts lowered

their price target on the stock. Lam Research and Applied Materials

were also among the S&P 500's worst performers.

Chip makers have been buffeted by trade developments throughout

the year because of their reliance on global commerce, particularly

through China. While their shares recovered last month, some

analysts expect swings to continue as trade discussions roll

on.

More broadly, some investors predict that the volatility that

has engulfed stocks around the world will spread to the U.S. if the

trade fight with China continues to escalate.

The possibility of additional tariffs "doesn't seem particularly

priced into U.S. markets," said Clark Fenton, managing partner and

chief investment officer at Agilis Investment Management.

Investors are waiting to see if the Trump administration will

move ahead with tariffs on an additional $200 billion of Chinese

goods.

Weakness in internet stocks also continued Thursday, after

Facebook and Twitter executives testified before Congress a day

earlier about election interference on their platforms. Twitter,

Facebook and Google parent Alphabet were all down at least 2.5%,

while Amazon.com dropped 1.5%.

Despite recent volatility, some analysts expect consistent

revenue growth to keep technology stocks as the market's leader.

Dell Technologies boosted its full-year sales guidance after

reporting a nearly 20% increase in total net revenue for the most

recent quarter. Shares were little changed.

Broadcom is slated to report earnings after the market closes

Thursday.

Moves in most other sectors were muted, with analysts looking

ahead to Friday's jobs report for the latest reading on the U.S.

economy.

Data on Thursday showed the number of Americans filing

applications for new unemployment benefits fell at the end of

August to a nearly five-decade low, while U.S. worker productivity

rose this spring at the best pace in more than three years.

Consistent U.S. economic figures have supported major indexes

this year in the face of continuing trade disputes with China and

Canada. At the same time, investors have said growth hasn't

accelerated so quickly that the Federal Reserve will have to

quicken its pace of interest-rate increases, keeping the backdrop

favorable for U.S. stocks.

While assets more tied to global growth including commodities

and emerging markets have wobbled, some analysts expect the U.S. to

remain a favored region.

"In the short term, [trade is] not necessarily a huge story for

the U.S.," said Jonas Goltermann, an economist at ING. "It's much

worse for the Chinese."

The yield on the 10-year U.S. Treasury note fell to 2.880%,

according to Tradeweb, from 2.902%. Yields fall as prices rise.

The dollar weakened for the second straight session, lifting

beaten-down commodities by making them cheaper for overseas buyers.

The WSJ Dollar Index, which tracks the dollar against a basket of

16 other currencies, dropped 0.2%.

Elsewhere, the Stoxx Europe 600 was down 0.4% after closing

Wednesday at its lowest mark since April.

Stocks in Asia continued to fall, with Hong Kong's Hang Seng

shedding 1% and the Shanghai Composite down 0.5%. Japan's Nikkei

Stock Average declined for the fifth straight session, closing down

0.4%.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

September 06, 2018 11:49 ET (15:49 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

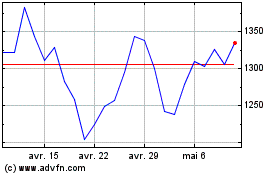

Broadcom (NASDAQ:AVGO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

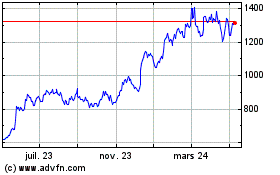

Broadcom (NASDAQ:AVGO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024