UK Factory Growth Loses Momentum Amid Price Pressures, Brexit Worries

01 Février 2018 - 9:43AM

RTTF2

Britain's factory sector growth eased further at the start of

2018 to a seven-month low, thanks to increased price pressures, but

sustained its robust momentum even as Brexit worries cloud the

economic outlook.

The Purchasing Managers' Index for the manufacturing sector fell

to 55.3 from 56.2 in December, survey data from IHS Markit and the

Chartered Institute of Procurement & Supply showed Thursday.

Economists had predicted a score of 56.5.

A PMI score above 50 suggests growth in the sector. The latest

reading was the lowest since June last year. Yet, the figure

remained well above its long-run average of 51.7.

The pace of growth in new orders and output slowed further,

while price pressures accelerated.

Output growth fell to a six-month low and new order intake was

the slowest in seven months. Investment goods sector led the

expansion in production and demand.

Foreign demand improved at one of the quickest rates over the

past four years, the survey report said.

"The trend in demand will need to strengthen in the near-term to

prevent further growth momentum being lost in the coming months,"

IHS Markit Director Rob Dobson said.

"Price trends will be watched closely to see if the upsurge is

simply a one-off spike or something more embedded," Dobson

added.

Input price inflation accelerated strongly as increased demand

for inputs led to improved supplier pricing power and shortages of

raw materials.

Output price inflation was the fastest in 11 months and one of

the sharpest in the survey history, IHS Markit said. This was

mainly due to an increase in prices of several raw materials and

commodities.

January also had the steepest increase in output charges since

April of last year as part of the increase in costs was passed on

to clients.

Manufacturers remained optimistic and over 55 percent forecast

production to be higher in one year's time.

ING Bank economist James Knightley point out that the latest

worries on the prospect of a Brexit transitional deal post March

2019 is not helping. "This uncertainty still has the potential to

weigh on activity very broadly and deter the BoE from hiking," he

added.

The Bank of England is set to announce its latest interest rate

decision on February 8.

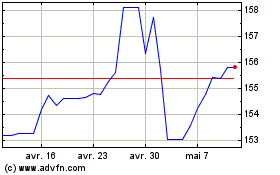

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

US Dollar vs Yen (FX:USDJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024