VGP NV: Broad-based Strength in New Leases Driving Record Development Pipeline

14 Novembre 2019 - 7:00AM

VGP NV: Broad-based Strength in New Leases Driving Record

Development Pipeline

PRESS RELEASE Regulated Information

14 November 2019, 7:00am, Antwerp

(Berchem), Belgium: VGP NV (‘VGP’ or ‘the Group’), a

leading European provider of high-quality logistics and

semi-industrial real estate, today published a trading update for

the first ten months of 2019:

- Robust operating performance driven by record new leases

- Strong leasing growth across the portfolio resulting in record

€39.3 million net increase signed and renewed lease agreements,

bringing total annualized rental income to €143.6 million (+37.9%

year-to-date) and increasing the average lease term of the

portfolio to 8.8 years (vs. 7.8 at Dec-18)

- A record of 34 projects under construction, representing

705,000 m2 or €37.3 million in additional annual rent once fully

built and let. The portfolio under construction, including projects

to be started up in the next six months is 75% pre-let

- 16 projects delivered in 2019 year-to-date representing 255,000

m2 (100% occupancy)

- Replenished land bank to secure future growth

- Maintained pipeline through 2.50 million m2 of new land bought

and a further 2.13 million m2 committed subject to permits

- Total land bank acquired and secured of 6.18 million m2 which

supports 2.76 million m2 of future lettable area

- Continued cash recycling and strengthening of funding base

- Successful first closing with VGP European Logistics 2 joint

venture on 31 July allowed recycling of €96 million of gross cash

proceeds

- Expect sixth closing for VGP European Logistics joint venture

at the end of November 2019, with anticipated gross cash proceeds

of circa € 130 million

- Enhanced sustainability targets set for 2020 onwards with 100%

of new developments to be BREEAM certified ‘Very Good’ or

equivalent and emphasis on increasing renewable energy generation

across the group

VGP’s Chief Executive Officer, Jan van

Geet, said: “Across Europe competition for industrial

space close to major population centres continues to thrive, mainly

driven by e-commerce as their push for a wide delivery network with

faster delivery is being rolled-out. This has resulted in

continued strong demand for our parks whilst fueling our mostly

pre-let construction pipeline. The investments made during

the last few years – both in terms of land bank and organizational

structure – have created this expanding opportunity to serve our

clients and build shareholder value for the long run.”

Jan van Geet concluded: " At the same time,

through our enhanced sustainability targets we are taking a new

path towards sustainable construction and resource-conserving

operations, as I believe business must play a leadership role in

creating solutions that protect the environment and grow the

economy together with the communities in which they operate."

OPERATING HIGHLIGHTS

Record new leases

- Record signed and renewed rental income of € 42.5 million

driven by €41.2 million of new leases (€3.3 million on behalf of

the Joint Ventures1) and €1.3 million of renewals (€1.2 million on

behalf of the Joint Ventures). During the year lease contracts for

a total amount of € 1.6 million (€0.7 million on behalf of the

Joint Ventures) were terminated

- Annualized committed leases at the end of October 2019

(including joint ventures at 100%) increased to €143.6 million (vs

€104.1 million at Dec-18) of which € 90.5 million related

to the Joint Ventures

- The signed new leases have a weighted average lease term of

10.8 years which has increased the average term of the combined own

and Joint Ventures’ portfolio to 8.8 years2 (7.8 years at

Dec-18)

Momentum in development activity with strong largely

pre-let construction pipeline

- Development of 34 projects under construction totaling 705,000

m2 of future lettable area and expected to generate € 37.3 million

of new rent when fully built and leased

- Of the construction activities, 41% is located in Germany –

including over 100,000 m2 at VGP Park Munich, 47,000 m2 at VGP Park

Berlin, 46,000 m2 at VGP Park Gottingen, 30,000 m2 at VGP Park

Wustermark and 21,000 m2 at VGP Park Halle, 16% is located in Spain

– including 45,000 m2 at VGP Park Llica d’Amunt, 39,000 m2 at VGP

Park Valencia and 18,000 m2 at VGP Park Zaragoza, 15% is located in

the Netherlands of which 64,000 m2 at VGP Park Nijmegen and 41,000

m2 at VGP Park Roosendaal, and 11% in the Czech Republic of which

56,000 m² in VGP Park Olomouc and 15,000 m² in VGP Park

Prostejov.

- The pre-let ratio of the portfolio under construction,

including construction projects which are expected to be started up

in the next six month, is currently 75% (the portfolio under

construction today is 57% pre-let)3

- Delivery of 16 projects during the first ten months of in total

255,000 m2 of lettable area – of which 40% in Germany and 30% in

Spain – representing € 12.7 million of annualized committed leases;

these buildings are 100% let

Land bank maintained

- 2.50 million m2 of land acquired YTD (of which 50% in Germany)

bringing the total owned and secured land bank to 6.18 million m2

supporting 2.76 million m2 of future lettable area

- A further 830,000 m2 of new land plots identified which are

under exclusive negotiation and have a development potential of

397,000 m2 of future lettable area

Continued cash recycling and strengthening of funding

base

- On 31 July 2019, the initial transaction closing with Second

Joint Venture i.e. VGP European Logistics 2, the second 50:50 joint

venture between VGP and Allianz Real Estate, for an initial

transaction value of € 175 million generated gross cash proceeds of

circa € 96 million

- At the end of November 2019, a sixth closing for First Joint

Venture i.e. VGP European Logistics is expected to occur, with

anticipated gross cash proceeds of circa € 130 million

- Since 30 June 2019, VGP completed bilateral unsecured financing

lines for a total of €58.5 million with several financial

institutions and before the end of the year additional credit

facilities are expected to be put in place

Enhanced

sustainability targets set for 2020 onwards

- As part of a comprehensive strategy to advance environmentally

sustainable solutions for our tenants and our own operations, VGP

has committed to obtain BREEAM ‘Very Good’ certificates for all our

construction projects by 2020 onwards and to source renewable power

from as many of our parks’ available resources as possible –

starting with increasing investments into roof-fixed solar

panels

- This commitment builds on VGP’s efforts to advance

sustainability in our business and operations in an effort to

support our tenants and the communities in which we operate

CONTACT

DETAILS FOR INVESTORS AND MEDIA ENQUIRIES

|

Martijn Vlutters (VP – Business Development & Investor

Relations) |

Tel: +32 (0)3 289 1433 |

|

Petra Vanclova (External Communications) |

Tel: +42 0 602 262 107 |

|

Anette NachbarBrunswick Group |

Tel: +49 152 288 10363 |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. Such statements reflect the current views of management

regarding future events, and involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. VGP is providing the information in this press release

as of this date and does not undertake any obligation to update any

forward-looking statements contained in this press release in light

of new information, future events or otherwise. The information in

this announcement does not constitute an offer to sell or an

invitation to buy securities in VGP or an invitation or inducement

to engage in any other investment activities. VGP disclaims

any liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by VGP.

ABOUT VGP

VGP is a leading pan-European developer, manager

and owner of high-quality logistics and semi-industrial real

estate. VGP operates a fully integrated business model with

capabilities and longstanding expertise across the value chain. The

company has a well-advanced development land bank of 7.0 million m²

and the strategic focus is on the development of business parks.

Founded in 1998 as a family-owned real estate developer in the

Czech Republic, VGP with a staff of over 200 employees today owns

and operates assets in 12 European countries directly and through

VGP European Logistics, a joint venture with Allianz Real Estate.

As of June 2019, the Gross Asset Value of VGP, including the joint

venture at 100%, amounted to €2.2 billion and the company had a Net

Asset Value (EPRA NAV) of €604 million. VGP is listed on Euronext

Brussels and on the Prague Stock Exchange (ISIN: BE0003878957).

For more information, please

visit: http://www.vgpparks.eu

1 Joint Ventures means either and each of (i)

the First Joint Venture i.e. VGP European Logistics S.à r.l.,

the 50:50 joint venture between VGP and Allianz and (ii) the Second

Joint Venture i.e. VGP European Logistics 2 S.à r.l., the

50:50 joint venture between VGP and Allianz

2 The weighted average lease term until first break is 8.3

years. The weighted average lease term of our own portfolio stands

at 12.1 years (11.7 years until first break) and for the Joint

Ventures’ portfolio at 7.0 years (6.4 years until first break)

3 The completed portfolio (incl Joint Ventures at 100%) has an

occupancy ratio of 99.7%

- VGP - Trading update - 14 November 2019 (EN)

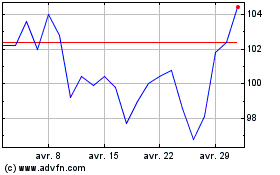

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024