VGP NV: Trading Update

PRESS RELEASE Regulated Information

14 May 2021, 7:00am, Antwerp (Berchem),

Belgium: VGP NV (‘VGP’ or ‘the Group’), a European

provider of high-quality logistics and semi-industrial real estate,

today published a trading update for the first four months of

2021:

- Continued

strong operating performance

- €12.5 million

signed and renewed lease agreements, bringing total annualized

rental income to €196.8 million (+6% year-to-date)

- A record

1,041,000 m2 under construction representing €64.8 million in

additional annual rent once fully built and let (currently 80.1%

pre-let)

- Completed

portfolio grown with 58k m2 to 2.50 million m2 which is 99.6%

let

- Expansion of

land bank to secure future growth

- Extended

pipeline through 471,000 m2 of new land bought and a further 3.1

million m2 committed subject to permits

- Total land bank

acquired and secured has grown to 8.54 million m2 (+11.6%

year-to-date) which supports 4.0 million m2 of future lettable

area

- Joint Venture

closing anticipated for end of May with expected net cash proceeds

of €52 million

- Advanced

discussions with Allianz regarding expansion of first Joint Venture

ongoing

VGP’s Chief Executive Officer, Jan Van

Geet, said: “The year 2021 has started on a strong footing

as demand for premium locations remains at elevated levels due to

changing consumer behaviour and technological advancements in

industry. Year-to-date we have signed €12.5 million of lease

agreements and we expect this number to grow in the coming weeks as

several signed prelim agreements representing >€10 million are

expected to be finalized.”

Jan Van Geet continued: "As a result, our

predominantly pre-let construction portfolio is topping for the

first time 1 million m2, of which over half is situated in Germany

(with 215k in VGP Park München) and the other projects well spread

across the other European markets. These strong market fundamentals

and our resilient delivery put us at pace for another very strong

year.”

Jan Van Geet concluded: “Our recent inaugural

€600 million international green bond offering has allowed us to

diversify our funding mix and provides enhanced flexibility for

future capital allocation decisions. Whilst maintaining a

disciplined and fortress balance sheet, we remain committed to

using our resources to drive inclusive and sustainable solutions

for the communities we serve as we support our customers in solving

their logistics needs or manufacturing real estate requirements.

This has enabled us, despite scarcity of permittable land, to

continue to make significant investments in the future pipeline, by

replenishing and growing our secured land bank with net 900,000 m2

year to date, including several trophy locations which will drive

leasing growth in the coming years.”

OPERATING HIGHLIGHTS – 4M

2021

Lease operations

- Signed and renewed rental income of

€ 12.5 million driven by €11.8 million of new leases (€2.6 million

on behalf of the Joint Ventures1) and €0.7 million of renewals (all

on behalf of the Joint Ventures). Lease agreements in the amount of

€ 0.2 million were terminated

- Annualized committed leases at

April 2021 (including Joint Ventures at 100%) of €196.8 million (vs

€185.2 million at Dec-20) of which €145.9 million related to the

Joint Ventures

- Several leasing contracts are in

the pipeline and expected to be signed in the coming weeks

- The impact of COVID-19 on leasing

operations and customer payment behaviour has been minimal with

virtually all rent payments received on time

Development activities

- Development of 39 projects under

construction totalling 1,041,000 m2 of future lettable area and

expected to generate € 64.8 million of new rent when fully built

and leased (80.1% pre-let)

- Geographical split of parks under

construction: 53% is located in Germany, 11% Spain, 7% in each

Czech Republic and Slovakia, 5% Romania, 4% in each Italy and

Netherlands, 3% in each Hungary and Portugal and 1% in Austria

- Delivery of 4 projects during the

first four months of 2021 of in total 58,000 m2 of lettable area

representing € 1.2 million of annualized committed leases; these

buildings are 100% let

- All construction activities

currently run on schedule whilst taking into account the applicable

Health and Safety guidance and regulations for all our operations

in relation to COVID-19

Land bank

- During the first four months of

2021 in total 0.47 million m2 of land was acquired representing a

development potential of 0.20 million m2

- A further 3.09 million m2 of land

plots are committed, pending permits, and have a development

potential of 1.31 million m2 of future lettable area, bringing the

total owned and secured land bank to 8.54 million m2 supporting

3.97 million m2 of future lettable area

- In addition 3.83 million m2 of land

has been identified and is under exclusive negotiation

(representing 1.58 million m2 of future lettable area)

Renewable Energy

- A total solar power generation

capacity of 48.8MWp is currently installed or under construction

through 45 roof-projects. This is being realised through a €21

million investment to date. In addition, the pipeline identified at

the moment equates to an additional power generation capacity of 64

MWp

Capital and liquidity position

- On 31 March 2021, VGP announced the

successful issue of a first benchmark international green bond for

an aggregate nominal amount of € 600 million, paying a coupon of

1.50 per cent. p.a. and maturing on 8 April 2029. Demand exceeded

2.7 times the volume of the issue. The proceeds from this issuance

are being used to fund the majority pre-let development pipeline,

the build out of renewable energy assets and the design and

development of new green logistics and semi-industrial parks

- Before the end

of May, we anticipate the eighth closing with VGP European

Logistics, the First Joint Venture with Allianz Real Estate. The

expected transaction value is €70 million and the expected net cash

proceeds amount to €52 million. As the First Joint Venture has

reached its expanded investment target, this will be the last

closing with the First Joint Venture to include new parks.

- Advanced discussion with Allianz

Real Estate with regards to the expansion of the First Joint

Venture are progressing well and expected to be finalized in the

coming weeks

- On 14 May 2021, the Board of

Directors will propose to the Annual Shareholders Meeting to

distribute a gross dividend of €3.65 per share corresponding to a

total gross dividend amount of €75.1 million, with payment date

proposed for 25 May 2021 (to be confirmed by shareholders at the

AGM)

CONTACT DETAILS FOR INVESTORS AND MEDIA

ENQUIRIES

|

Martijn Vlutters (VP – Business Development & Investor

Relations) |

Tel: +32 (0)3 289 1433 |

|

Petra Vanclova (External Communications) |

Tel: +42 0 602 262 107 |

|

Anette NachbarBrunswick Group |

Tel: +49 152 288 10363 |

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking

statements. Such statements reflect the current views of management

regarding future events, and involve known and unknown risks,

uncertainties and other factors that may cause actual results to be

materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements. VGP is providing the information in this press release

as of this date and does not undertake any obligation to update any

forward-looking statements contained in this press release in light

of new information, future events or otherwise. The information in

this announcement does not constitute an offer to sell or an

invitation to buy securities in VGP or an invitation or inducement

to engage in any other investment activities. VGP disclaims any

liability for statements made or published by third parties and

does not undertake any obligation to correct inaccurate data,

information, conclusions or opinions published by third parties in

relation to this or any other press release issued by VGP.

ABOUT VGP

VGP is a pan-European developer, manager and

owner of high-quality logistics and semi-industrial real estate.

VGP operates a fully integrated business model with capabilities

and longstanding expertise across the value chain. The company has

a development land bank (owned or committed) of 8.54 million m² and

the strategic focus is on the development of business parks.

Founded in 1998 as a Belgian family-owned real estate developer in

the Czech Republic, VGP with a staff of c. 300 employees today owns

and operates assets in 11 European countries directly and through

several 50:50 joint ventures. As of December 2020, the Gross Asset

Value of VGP, including the joint ventures at 100%, amounted to €

3.84 billion and the company had a Net Asset Value (EPRA NAV) of €

1.35 billion. VGP is listed on Euronext Brussels and on the Prague

Stock Exchange (ISIN: BE0003878957).

For more information, please visit:

http://www.vgpparks.eu

1 Joint Ventures means either and each of (i)

the First Joint Venture i.e. VGP European Logistics S.à.r.l., the

50:50 joint venture between VGP and Allianz and (ii) the Second

Joint Venture i.e. VGP European Logistics 2 S.à.r.l., the 50:50

joint venture between VGP and Allianz, and (iii) the Third Joint

Venture i.e. VGP Park München GmbH, the 50:50 joint venture between

VGP and Allianz, and (iv) LPM Joint Venture, i.e. LPM Holding B.V.,

the 50:50 joint venture between VGP and Roozen Landgoederen

Beheer

- VGP - Trading update - 14 May 2021 (EN)

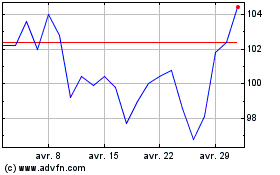

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

VGP NV (EU:VGP)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024