Veolia to Repay Its Hybrid Debt

15 Mars 2018 - 8:00AM

Business Wire

Regulatory News:

Veolia (Paris:VIE) plans to notify investors of its intention to

redeem its deeply subordinated perpetual hybrid debt in Euros and

in Sterling issued in January 2013, for respective nominal amounts

of €1 billion and £400 million.

These instruments were issued to support the Group's

transformation, and were aimed at strengthening its financial

structure, being considered as 100 % equity in the IFRS

consolidated accounts and 50 % equity by the rating agencies1.

Thanks to the success of the Group’s transformation and the

improvement of its financial health, Veolia no longer needs these

instruments and can save the associated coupon of €68 million per

year, while maintaining an Investment Grade rating and significant

financial flexibility.

In 2017, Veolia took advantage of extremely favorable market

conditions to anticipate this repayment, which is expected to occur

on April 16, 2018.

.....

The distribution of this press release in certain jurisdictions

may be subject to specific regulations or may be restricted by

regulations or laws. In particular, this press release shall not be

released, published or distributed in the United States, its

territories and possessions, in Australia, in Canada or in

Japan.

This announcement does not constitute an offer or solicitation

in the United States, its territories and possessions, or in any

other jurisdiction.

.....

Veolia group is the global leader in optimized resource

management. With over 163 000 employees worldwide, the Group

designs and provides water, waste and energy management solutions

that contribute to the sustainable development of communities and

industries. Through its three complementary business activities,

Veolia helps to develop access to resources, preserve available

resources, and to replenish them.

In 2017, the Veolia group supplied 100 million people with

drinking water and 61 million people with wastewater service,

produced 44 million megawatt hours of energy and converted 45

million metric tons of waste into new materials and energy. Veolia

Environnement (listed on Paris Euronext: VIE) recorded consolidated

revenue of €25.13 billion in 2017. www.veolia.com

1 Moody’s and S&P. The latter removed the Equity Content in

May 2016, thanks to Veolia’s improved financial position, and

considered that Veolia did not need it anymore to maintain its

credit rating.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180315005104/en/

VEOLIA ENVIRONNEMENTGroup Press RelationsLaurent

Obadia - Sandrine GuendoulStéphane Galfré – Marie BouvetTel.+ 33 1

85 57 42 16sandrine.guendoul@veolia.comorInvestors & Analyst

RelationsRonald Wasylec - Ariane de LamazeTel. + 33 1 85 57 84

76 / 84 80orTerri Anne Powers (USA)Tel. +1 630 218 1627

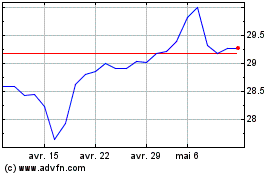

Veolia Environnement (EU:VIE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

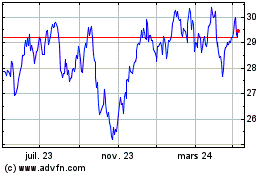

Veolia Environnement (EU:VIE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024