Verizon Revenue Drops as Pandemic Slows Phone Shopping--Update

24 Juillet 2020 - 4:18PM

Dow Jones News

By Drew FitzGerald

Verizon Communications Inc. continued to add cellphone customers

during the pandemic, though quarterly revenue declined in its core

wireless business and its online advertising unit.

The largest U.S. cellphone carrier by subscribers reported a net

gain of 173,000 postpaid phone connections during the three months

that ended in June. That figure included past-due accounts that

were still in service under the federal Keep Americans Connected

pledge.

Verizon counted 119.9 million active wireless connections, which

include tablets, smartwatches and other cellular devices, at the

end of June.

U.S. wireless and broadband-service providers agreed earlier

this year to waive late-payment and overage fees and keep service

active for customers unable to pay their bills during a pandemic

that had already forced tens of millions of Americans to work from

home. The program ended in June, putting hundreds of thousands of

customers at risk of losing service.

Verizon's latest report only covered the second quarter, when

the pledge was still active. The carrier said it enrolled many

customers in extended repayment plans in July to keep them on its

rolls.

"We believe the vast majority of these accounts can be cured

over time," Chief Financial Officer Matt Ellis said during a

conference call with analysts, though he warned that expectation

hinges on the economic environment.

Rival AT&T Inc. on Thursday reported a net loss of 151,000

postpaid phone subscribers, a figure that counted 338,000 past-due

subscribers as disconnections, though they maintained service

during the pledge.

Verizon, which temporarily closed its retail stores as the

coronavirus pandemic spread across the U.S., said its

device-upgrade rate fell to 3.7% from 4.3% a year earlier as weak

retail traffic crimped smartphone sales. The company said more than

60% of its locations were open by the end of the second quarter and

it expects to be close to fully open by the end of July.

Overall, the company's total revenue slipped 5.1% to $30.4

billion. Wireless-service revenue fell 1.7% in the second quarter

from a year ago, but the company forecast it would be flat to down

1% in the third quarter. Revenue in the company's media business,

which includes its Yahoo and AOL properties, declined 25% in the

quarter to $1.4 billion.

Net income attributable to Verizon reached $4.7 billion, or

$1.13 a share, compared with $3.9 billion, or 95 cents a share, a

year earlier. Fewer phone sales helped boost Verizon's bottom line

because devices sold to customers offer carriers little to no

profit. Total equipment costs dropped 18%.

The Covid-19 pandemic upended companies' profit projections this

spring and forced many to set aside more cash for unexpected

expenses. Verizon earlier this year pulled its revenue guidance and

lowered its annual adjusted per-share profit projection to a range

between 2% growth and a 2% decline. The company on Friday

reiterated that prediction.

Executives have also said the essential nature of cellphone and

broadband service could benefit earnings. The company in April

agreed to buy Blue Jeans Network Inc., a videoconferencing service

that targets corporate clients, as the pandemic triggered a

work-from-home wave.

The company's consumer unit reported a net gain of 10,000 Fios

broadband subscribers despite a temporary pause in some in-home

installations. Fios pay-TV customers dropped by 81,000 as more

Americans cut the cable cord in favor of cheaper streaming video

options.

Write to Drew FitzGerald at andrew.fitzgerald@wsj.com

(END) Dow Jones Newswires

July 24, 2020 10:03 ET (14:03 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

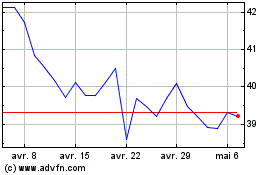

Verizon Communications (NYSE:VZ)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Verizon Communications (NYSE:VZ)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024