Vertiv To Become Publicly Traded Through Merger With GS Acquisition

10 Décembre 2019 - 1:55PM

Dow Jones News

By Michael Dabaie

Vertiv Holdings LLC said it will become a publicly traded

company through a merger with GS Acquisition Holdings Corp

(GSAH).

GS Acquisition is a special purpose acquisition company

co-sponsored by an affiliate of Goldman Sachs Group Inc. (GS) and

David M. Cote. Vertiv provides digital infrastructure and

continuity solutions and is a Platinum Equity portfolio

company.

Mr. Cote, chief executive of GS Acquisition and former executive

chairman and CEO of Honeywell, will be executive chairman of

Vertiv. Vertiv's existing management team will continue to be led

by CEO Rob Johnson.

Vertiv said the transaction is expected to close in the first

quarter of 2020 and at close Vertiv's stock will trade under the

ticker symbol VRT.

Upon closing, Vertiv will have an anticipated pro forma

enterprise value of about $5.3 billion, the company said.

Upon completion, Platinum Equity is expected to hold about 38%

of Vertiv Holdings Co and the sponsor, including Mr. Cote and

affiliates of Goldman Sachs, will own about 5%.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

December 10, 2019 07:40 ET (12:40 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

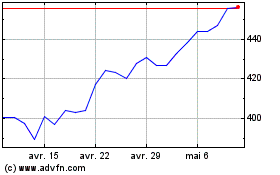

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

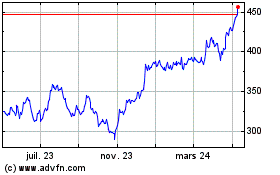

Goldman Sachs (NYSE:GS)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024