- The Group's three main businesses

delivered very solid performances

- Evolution of Universal Music Group’s

share capital: bank selection process launched

- Editis: share purchase agreement

signed

Regulatory News:

Vivendi (Paris:VIV):

This press release contains unaudited consolidated revenues

established under IFRS, which were approved by Vivendi’s Management

Board on November 12, 2018, reviewed by the Audit Committee on

November 13, 2018, and by the Supervisory Board on November 15,

2018.

1 At constant currency and perimeter compared to the same period

of 2017. Constant perimeter reflects the impacts of the acquisition

of Havas (July 3, 2017) as well as the acquisition of Paylogic

(April 16, 2018) and the sale of Radionomy (August 17, 2017) by

Vivendi Village.

Vivendi’s Supervisory Board met today under the chairmanship of

Mr. Yannick Bolloré and reviewed the Group’s consolidated revenue

figures as of September 30, 2018, which were approved by the

Management Board on November 12, 2018.

REVENUES AS OF SEPTEMBER 30, 2018

For the third quarter of 2018, Vivendi’s revenues amounted to

€3,384 million, compared to €3,207 million for the same

period of 2017, an increase of 5.6% at constant currency and

perimeter1.

For the first nine months of 2018, Vivendi’s revenues amounted

to €9,847 million, compared to €8,669 million for the

same period of 2017, an increase of 13.6%, mainly as the result of

the consolidation of Havas since July 3, 2017

(+€1,048 million). At constant currency and perimeter1,

revenues increased by 4.6% compared to the first nine months of

2017, primarily driven by the growth of Universal Music Group

(+9.1%) and Canal+ Group (+0.8%).

Revenue evolution by business

segment

Organic growth1 (in %)

Q3 2018 9M 2018 Universal Music Group +13.5%

+9.1% Canal+ Group -0.2% +0.8%

Havas - Net Revenues2 (excluding

Arnold)

+2.5% -0.1% Other businesses and intercompany elimination +8.7%

+2.4%

Total Vivendi +5.6% +4.6%

OPENING OF UNIVERSAL MUSIC GROUP’S SHARE CAPITAL

Following the preliminary work carried out by the Management

Board, about fifteen banks were chosen for the bank selection

process. The banks could help Vivendi identify one or more

strategic partners for its subsidiary Universal Music Group.

Vivendi will hold working sessions with these banks before the

end of fall to determine their qualifications and discuss the

potential terms of engagement and fees.

2 Net revenues correspond to revenues less pass-through costs

rebilled to customers.

The end goal of these working sessions is to select and retain

five to seven banks that will be charged with finding the best

partners for UMG.

Universal Music Group’s 2018 financial results, which will be

published on February 14, 2019, will serve as a basis for the

discussions with potential partners.

The cash from this sale may be used for a significant share

repurchase program through a tender offer and for potential

acquisitions.

EDITIS: ACQUISITION PROCESS

On November 15, 2018, Vivendi entered into a share purchase

agreement with Grupo Planeta for 100% of the share capital of

Editis, the second largest French publishing group, following the

exclusive negotiations that began on July 30. The enterprise value

retained is €900 million.

Editis encompasses around fifty publishing houses (e.g., Nathan,

Bordas, Robert Laffont, Presses de la Cité, Julliard, XO, Plon,

Perrin, Pocket, Belfond or Le Cherche Midi) and many successful

authors (e.g., Marc Levy, Michel Bussi or Raphaëlle Giordano).

In 2017, Editis recorded revenues of approximately €750 million

and a recurring EBIT of approximately €60 million.

In France, the book industry is the leading cultural market in

terms of revenues (€6 billion in 2017), ahead of cinema and music.

The acquisition of Editis will increase Vivendi's creative

capabilities to develop new editorial projects and types of content

(e.g., audiobooks, which are growing by 40% per year) and to

develop international franchises (like the Paddington model).

Both groups have a recognized know-how in the management of

intellectual property rights and a shared passion for creativity.

Their businesses have similar structures. The functioning of

publishing houses is similar to that of UMG’s music labels, which

should help facilitate the integration of Editis within

Vivendi.

The acquisition of Editis will be another major step in

Vivendi’s building of an integrated media, content and

communications group.

The favorable opinions of Vivendi's and Editis's works councils

were obtained on September 13, 2018 and November 8, 2018,

respectively.

The transaction must now be authorized by the French Competition

Authority. The closing of the transaction is expected in late 2018

or early 2019.

COMMENTS ON REVENUE EVOLUTION BY BUSINESS

SEGMENT

Universal Music Group

For the third quarter of 2018, Universal Music Group’s (UMG)

revenues amounted to €1,495 million, up 13.5% at constant

currency and perimeter compared to the third quarter of 2017

(+13.3% on an actual basis).

For the first nine months of 2018, UMG’s revenues amounted to

€4,123 million, up 9.1% at constant currency and perimeter

compared to the same period of 2017 (+3.5% on an actual basis).

Recorded music revenues grew by 10.2% at constant currency and

perimeter as growth in subscription and streaming revenues (+35.8%)

more than offset the continued decline in both download (-24.6%)

and physical (-16.3%) sales.

Recorded music best sellers for the first nine months of 2018

included new releases from Drake, Post Malone, XXXTentacion and

Migos, as well as the soundtrack release from Black Panther

(Kendrick Lamar).

Music publishing revenues grew by 10.6% at constant currency and

perimeter, also driven by increased subscription and streaming

revenues, as well as higher revenues generated from performance

rights and synchronization.

Merchandising and other revenues were down 13.4% at constant

currency and perimeter, due to lower touring and retail

activity.

UMG songs occupied the No. 1 spot on the Spotify Global Chart

for 37 out of the first 39 weeks of 2018. In addition, for the last

week of September 2018, UMG had nine out of the Top 10 Albums on

the Billboard 200 chart in the United States. This marks the first

time in nearly five years that a label group has achieved this

performance, with UMG also being the group that did it back in

October 2013.

In addition, on November 5, 2018, Universal Music Group

announced that it has entered into an agreement with Boomplay, the

most popular music streaming service in Africa. UMG is the first

music major to license its music to this service. Launched in 2015,

Boomplay is used by more than 36 million people, attracting nearly

two million new users each month.

Canal+ Group

For the third quarter of 2018, Canal+ Group’s revenues amounted

to €1,247 million, almost stable compared to the same period

of 2017 (-0.2% at constant currency and perimeter).

For the first nine months of 2018, Canal+ Group's revenues

amounted to €3,822 million, up 0.4% compared to the same

period of 2017 (+0.8% at constant currency and perimeter). This

change was driven by the increase in the group's global subscriber

base, which reached 15.4 million compared to 14.8 million

at the end of September 2017.

Revenues from television operations in mainland France decreased

slightly due to the decline in the total individual subscriber base

(7.9 million compared to 8.0 million at the end of

September 2017), despite a positive change in the churn rate

(decrease of 4 points over the past year to 13.4%, a record low

since the third quarter of 2012). This decrease was notably due to

the continued decline in Canalplay subscriptions and the

termination of the Canalsat offer in favor of the new Canal offers

and the subscriptions via wholesale partnerships. The Canal+

channel’s individual subscriber base recorded a year-on-year

increase of 227,000 subscribers.

International pay-TV operations posted a very strong increase in

revenues of +7.8% at constant currency and perimeter driven by the

very strong growth in the individual subscriber base (+726,000

year-on-year) notably as a result of the positive, yet temporary,

impact of the 2018 FIFA World Cup.

Studiocanal’s revenues increased by 10.3% at constant currency

and perimeter, driven by more theatrical releases and very good

video sales, particularly of Paddington 2. For the third quarter of

2018, the business was impacted (-4.6% at constant currency and

perimeter) by the seasonality of movie releases. This seasonality

is also expected to be unfavorable in the fourth quarter, which, in

2017, benefited from the release of Paddington 2.

The movie Sink or Swim (Le Grand Bain), released on October 24,

2018 in France, is already performing very well, attracting more

than three million viewers three weeks after its release. Season 4

of the TV series The Bureau (Le Bureau des Légendes), a Creation

Originale Canal+, broadcast on the channel and on myCanal since

October 2018, is also a major success with both viewers and critics

alike.

On November 8, 2018, Canal+ Group announced the renewal of its

agreement with French cinema, extending until 2023 an historical

partnership of more than 30 years. This agreement was a

precondition for Canal+'s signing of the new media release

chronology, whose upcoming entry into force will enable the Group

to offer movies to its subscribers as early as 6 months after their

theatrical release. This agreement and the new media release

chronology protect and strengthen Canal+'s unique position in the

financing and broadcasting of French cinema, of which it remains by

far and more than ever the primary supporter.

On September 18, 2018, Canal+ Group and SFR announced a

commercial agreement for the distribution of the RMC Sport bouquet.

This agreement allows Canal+ Group satellite subscribers to watch

all of the UEFA Champions League, UEFA Europa League, English

Premier League, Portuguese Football Championship, as well as horse

riding, athletics, extreme sports, and more.

On October 31, 2018, Canal+ Group won the exclusive rights to

broadcast in France and Poland the English Premier League, the

world’s most watched football championship. From August 2019,

Canal+ will offer on its antennas and on myCanal the 2019/2020,

2020/2021 and 2021/2022 seasons of the Premier League. During the

upcoming seasons, Canal+ subscribers will be able to watch France’s

finest football (with the top three Ligue 1 matches every

matchday), the best of European championships including the entire

Premier League, a full-length evening show covering Ligue 2

matchdays, the entire Coupe de la Ligue, the French women’s

football championship, the FIFA Women’s World Cup, the Top 14, the

Pro D2, southern hemisphere rugby, the Formula 1, MotoGP and Rally

world championships, golf tournaments and the 2020 Olympics.

Canal+ Group is delighted to be able to offer a large number of

its subscribers all the major sports competitions via its premium

channels Canal+ and Canal+ Sport, as well as the best sports

channels including BeIn Sport, Eurosport and RMC Sports.

In addition, on November 14, 2018, Canal+ Group and TF1 Group

entered into a new global distribution agreement enabling the

integration into the Canal offers of all TF1 Group channels and

related non-linear services. The agreement is accompanied by a new

expanded partnership between TF1 and Dailymotion. The group had

entered into a similar agreement with M6 Group in early 2018.

For the full year 2018, Canal+ Group is close to achieving the

objectives set. Television activities will achieve their goals;

Studiocanal may end the year slightly behind despite the success of

Le Grand Bain.

Havas

For the third quarter of 2018, Havas's revenues amounted to

€535 million and net revenues2 were €525 million. Organic

growth of net revenues2 excluding the impact of Arnold - which is

in the process of reorganizing- stood at +2.5% compared to the

third quarter of 2017, a significant improvement compared to the

level recorded in the first half of 2018 (-1.4%).

All businesses, creative, healthcare communications and media,

contributed to this upturn. Exchange rate fluctuations had an

effect of -1.2% (primarily the US dollar, South American currencies

and the Australian dollar) and acquisitions contributed +1.0%. At

constant currency and perimeter, Havas’s net revenues increased by

0.3% compared to the third quarter of 2017.

By geographic region, the North American agencies maintained

their growth dynamic over the third quarter, thanks to continuing

strong performances from Havas Health & You, BETC, Havas Edge,

Havas Chicago and Abernathy/AMO, as well as from the media business

(contribution of the Sanofi account’s win in 2017).

Business in Europe significantly improved compared to the first

half of 2018 and reported positive organic growth in the third

quarter thanks to better performances, particularly in France and

in the United Kingdom. The main contributors in France were BETC,

Havas Paris and Ekino/Fullsix, for the creative operations, UX

(User eXperience) and CRM (Customer Relationship Management).

The agencies in the United Kingdom confirmed the local recovery

thanks to the dynamism of the healthcare communications (Havas

Lynx), creative (Havas London) and media businesses. Italy and

Germany also reported double-digit growth, offsetting the

underperformance of Spain (mainly in the media business).

2. Net revenues correspond to revenues less pass-through costs

rebilled to customers.

At the end of September, the Asia-Pacific region continued to

report positive growth, thanks to China. Latin America saw negative

growth over the quarter due to an unfavorable comparative basis,

but the region is set to maintain sharp growth over the full year

2018.

For the first nine months of 2018, Havas’s revenues amounted to

€1,587 million and net revenues2 were €1,545 million.

Organic growth excluding the impact of Arnold was stable at -0.1%

compared to the first nine months of 2017; the exchange rate effect

was negative at -4.8% and acquisitions contributed +1.2%. At

constant currency and perimeter, Havas’s net revenues2 changed by

-1.8% compared to the first nine months of 2017.

Havas pursued its policy of targeted acquisitions and continued

to strengthen in certain areas of strategic expertise or in certain

geographical regions. During the third quarter of 2018, Havas made

two acquisitions: Republica, a leading independent multicultural

marketing agency in the United States, in early September 2018, and

Catchi, the leading Conversion Rate Optimization (CRO) specialist

across Australia and New Zealand, in early July 2018.

After carrying off 3 “Grand Prix” and 47 “Lions” awards at the

Cannes Lions, some Havas Group agencies, including Havas Host in

Australia, BETC, Havas Germany, Rosapark and Havas New York, earned

recognition for their creativity at major international festivals

during the third quarter of 2018 (please refer to Appendix III for

the list of the most significant awards and wins).

New business remained vibrant over the third quarter of 2018,

with a number of new wins in creative and media businesses, as well

as healthcare communications, both on a local and global level

(please refer to Appendix III for the list of the most significant

awards and wins). These new wins will more than offset media

account losses in the third quarter. On October 29, 2018, Havas

Media also won the global Puma media planning and buying

assignment.

As previously announced, Havas expects better organic net

revenues growth for the second half of 2018, thanks to major

accounts wins in the first half of the year.

Gameloft

For the first nine months of 2018, Gameloft's revenues amounted

to €224 million, down 4.7% at constant currency and perimeter

compared to the same period of 2017 (-3.3% at constant currency and

perimeter for the third quarter of 2018), due to the slowdown of

the telco carriers’ operations and the decline in advertising

revenues. OTT operations (sales of games on platforms such as

Apple, Google, Microsoft and Amazon) represented 72% of Gameloft’s

total revenues, up 4% at constant currency.

With almost 2 million downloads per day across all

platforms during the first nine months of 2018, Gameloft is one of

the leading mobile game publishers in the world. Gameloft has

benefited from the strong performance of its catalogue, notably its

bestselling games such as War Planet Online, Dragon Mania Legends,

Disney Magic Kingdoms, March of Empires, and Asphalt 8:

Airborne.

62% of Gameloft’s revenues were generated by internally

developed franchises.

On July 26, 2018, Gameloft launched Asphalt 9: Legends. The

latest opus of the #No 1 mobile racing franchise has recorded more

than 4 million downloads in a week and more than 24 million in

three months.

In October 2018, Gameloft celebrated, in partnership with

Illumination Entertainment and Universal Games, the fifth

anniversary of Minion Rush, offering players new game modes and

unreleased content available in an updated version. With close to a

billion downloads, Minion Rush is among the top 10 most downloaded

games in the world on iOS and Google Play.

Vivendi Village

For the first nine months of 2018, Vivendi Village’s revenues

amounted to €88 million, an increase of 9.9% at constant

currency and perimeter compared to the same period of 2017. For the

third quarter of 2018, revenues were up 39.5% at constant currency

and perimeter.

Vivendi Ticketing’s revenues amounted to €41 million, a

5.5% increase compared to the first nine months of 2017, driven by

the acquisition of Paylogic in April 2018. See Tickets experienced

a record level of commercial activity in September in the United

Kingdom.

Live performance revenues almost doubled (+91.8%) compared to

the first nine months of 2017, mainly due to the development of

Olympia Production.

Olympia Production now counts a portfolio of 33 artists (e.g.,

the singers Eddy de Pretto and Dadju, and the comedian Guillermo

Guiz), which is five times more than when it launched its

activities in 2016. It will produce a thousand concerts and shows

in 2018 (excluding festivals). With the acquisition of Garorock

(announced in October 2018), one of the five major music festivals

in France, Olympia Production holds four regional festivals hosting

a total of more than 250,000 people.

L’Olympia recorded an excellent performance in the month of

September driven by the hosting of many private events; the last

quarter of 2018 will be active with 103 scheduled dates (79 were

held in the same period of 2017).

At the end of September, CanalOlympia inaugurated its tenth

cinema and live performance venue in Africa in Lomé, Togo. Theses

venues draw two times the attendance of the venues in other

countries such as France.

New Initiatives

New Initiatives, which groups together projects being launched

or under development, recorded revenues amounting to

€47 million for the first nine months of 2018, an increase of

37.6% compared to the same period of 2017.

For the third quarter of 2018, the audience of Dailymotion was

5.3 billion views worldwide, up 14% compared to the third quarter

of 2017. Its audience for premium content almost doubled in one

year reaching 2.2 billion views in the third quarter of 2018,

compared to 1.2 billion in the third quarter of 2017. During the

third quarter of 2018, Dailymotion had approximately 270 million

monthly unique visitors worldwide.

To continue the enrichment of its premium offer, Dailymotion

recently signed many content agreements. Dailymotion became the

platform for AC Milan, the EuroLeague (first European professional

basketball competition), El Espanol and Axel Springer in Spain,

Hindustan Times (third most read newspaper in India) and SBS

(second television group in South Korea).

The third quarter of 2018 was marked by the delivery of the

internally-developed SSP (sell-side platform), to automate and

optimize the selling of media space. It was gradually rolled out on

Dailymotion’s video inventory and was completed on September 15.

Since then, most of Dailymotion's revenues have been processed via

this platform.

GVA, the telecoms operator in Africa, launched the CANALBOX's

Very High-Speed Internet offer in Libreville (Gabon) and Lomé

(Togo), respectively in October 2017 and March 2018, allowing its

subscribers to benefit from the technological quality of fiber

optics.

In addition, GVA has just strengthened its network by acquiring

a development company in Pointe-Noire (Republic of the Congo).

EXTENSION OF THE UBISOFT FORWARD SHARE SALE DEADLINE

As previously announced on March 20, 2018, Vivendi has sold

forward its remaining interest in Ubisoft (i.e. 7,590,909 shares)

for approximately €500 million, corresponding to a price of

€66 per share.

Vivendi sold these 7,590,909 shares to two financial

institutions as follows: 1,040,909 shares were sold on October 1,

2018 as planned, and the sale of 6,550,000 shares was deferred to

March 5, 2019.

Vivendi has given an undertaking to Ubisoft to sell all the

shares it owns by March 7, 2019, the settlement date. In addition,

Vivendi maintains its March 2018 commitment to refrain from

purchasing Ubisoft shares for a period of five years.

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group with European roots. The

clear and ambitious strategy that was set in motion three years ago

has been successfully executed by the Management Board. First, in

content creation, the Group owns powerful, complementary assets in

music (UMG), mobile games (Gameloft) and movies/series (Canal+

Group), which are the three most popular forms of entertainment

content in the world today. Second, in the distribution market,

Vivendi has acquired the Dailymotion platform and repositioned it

to create a new digital showcase for our content. The Group has

also joined forces with several telecom operators and platforms to

maximize the reach of its distribution networks. In 2017, a third

building block – communications – was added to this structure, via

Havas. Havas possesses unique creative expertise in promoting free

content and producing short formats, which are increasingly viewed

on mobile devices. In addition, through Vivendi Village, the Group

explores new forms of business in live entertainment, franchises,

ticketing and digital technology that are complementary to its core

activities. Vivendi’s various businesses cohesively work together

as an integrated industrial group to create greater value.

www.vivendi.com, www.cultureswithvivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to the

financial condition, results of operations, business, strategy,

plans and outlook of Vivendi, including the impact of certain

transactions. Although Vivendi believes that such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance. Actual results may differ

materially from the forward-looking statements as a result of a

number of risks and uncertainties, many of which are outside our

control, including, but not limited to, the risks related to

antitrust and other regulatory approvals as well as any other

approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des marchés financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des marchés financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor any American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:Arnaud de PuyfontaineChief Executive

OfficerHervé PhilippeMember of the Management Board and

Chief Financial Officer

Date: November 15, 20186:00 pm Paris time – 5:00 pm

London time – 12:00 pm New York timeMedia invited on a

listen-only basis.The conference call will be held in

English.

Internet: The conference call can be followed on the

Internet at: www.vivendi.com (audiocast)

Numbers to dial:France: +33 (0)1 76 77 22 57United

Kingdom: +44(0) 330 336 94 11USA: +1 323 994 20

93Confirmation code: 892 51 59

On our website www.vivendi.com will be available an audio

webcast and the slides of the presentation.

APPENDIX IVIVENDIREVENUES

BY BUSINESS SEGMENT(IFRS, unaudited)

Third quarter

Three months ended September 30, (in millions of

euros) 2018 2017 % Change % Change at constant

currency % Change at constant currency and perimeter1

Revenues Universal Music Group 1,495 1,319 +13.3% +13.5%

+13.5% Canal+ Group 1,247 1,252 -0.5% -0.2% -0.2% Havas 535 539

-0.6% na na Gameloft 75 77 -3.7% -3.3% -3.3% Vivendi Village 36 25

+45.9% +45.9% +39.5% New Initiatives 15 11 +39.6% +39.6% +39.6%

Elimination of intersegment transactions (19) (16)

Total Vivendi 3,384 3,207 +5.5%

+5.9% +5.6%

First nine months

Nine months ended September 30, (in millions of

euros) 2018 2017 % Change % Change at constant

currency % Change at constant currency and perimeter1

Revenues Universal Music Group 4,123 3,985 +3.5% +9.1% +9.1%

Canal+ Group 3,822 3,807 +0.4% +0.8% +0.8% Havas 1,587 539 na na na

Gameloft 224 245 -8.7% -4.7% -4.7% Vivendi Village 88 81 +8.3%

+8.9% +9.9% New Initiatives 47 34 +37.6% +37.6% +37.6% Elimination

of intersegment transactions (44) (22)

Total Vivendi 9,847 8,669 +13.6%

+17.4% +4.6%

na: not applicable.

Nota: As from January 1, 2018, Vivendi has applied the

new accounting standard IFRS 15 – Revenues from Contracts with

Customers (please refer to Appendix II).

APPENDIX I

(Cont’d)VIVENDIREVENUES BY BUSINESS SEGMENT(IFRS,

unaudited)

Quarterly revenues

2018 (in millions of euros) Three months ended

March 31,

Three months ended

June 30,

Three months ended

September 30,

Revenues Universal Music Group 1,222 1,406 1,495 Canal+

Group 1,298 1,277 1,247 Havas 482 570 535 Gameloft 79 70 75 Vivendi

Village 23 29 36 New Initiatives 16 16 15 Elimination of

intersegment transactions (11) (14) (19)

Total Vivendi

3,109 3,354 3,384

2017

(in millions of euros) Three months

ended

March 31,

Three months ended

June 30,

Three months ended

September 30,

Three months ended

December 31,

Revenues Universal Music Group 1,284 1,382 1,319 1,688

Canal+ Group 1,272 1,283 1,252 1,391 Havas - - 539 648 Gameloft 91

77 77 82 Vivendi Village 26 30 25 28 New Initiatives 10 13 11 17

Elimination of intersegment transactions (3) (3) (16) (22)

Total

Vivendi 2,680 2,782 3,207 3,832

Nota: As from January 1, 2018, Vivendi has applied the

new accounting standard IFRS 15 – Revenues from Contracts with

Customers (please refer to Appendix II).

APPENDIX II

VIVENDI

RESTATEMENT OF COMPARATIVE

INFORMATION(IFRS, unaudited)

As from January 1, 2018, Vivendi has applied the new accounting

standard on revenues: IFRS 15 – Revenues from Contracts with

Customers. In accordance with IFRS 15, Vivendi applied this change

of accounting standard to 2017 revenues; thereby ensuring

comparability of the data relative to each period of 2018 and

2017.

Impacts related to the application of IFRS 15 on

revenues by business segment

2017 (in millions of euros) Three months

ended March 31,

Three months

ended June 30,

Three months ended

September 30,

Nine months ended September 30, Three months

ended

December 31,

Year ended

December 31,

Revenues (as previously published) (A) Universal

Music Group 1,284 1,382 1,319 3,985 1,688 5,673 Canal+ Group 1,278

1,290 1,257 3,825 1,421 5,246 Havas (a) - - 525 525 626 1,151

Gameloft 68 62 63 193 65 258 Vivendi Village 26 30 25 81 28 109 New

Initiatives 10 13 11 34 17 51 Elimination of intersegment

transactions (3) (3) (16) (22) (22) (44)

Total Vivendi

2,663 2,774 3,184 8,621 3,823

12,444 IFRS 15 restatements (B) Universal

Music Group - - - - - - Canal+ Group (6) (7) (5) (18) (30) (48)

Havas (a) - - 14 14 22 36 Gameloft 23 15 14 52 17 69 Vivendi

Village - - - - - - New Initiatives - - - - - - Elimination of

intersegment transactions - - - - - -

Total Vivendi

17 8 23 48 9 57

Restated revenues (A+B) Universal Music Group 1,284 1,382

1,319 3,985 1,688 5,673 Canal+ Group 1,272 1,283 1,252 3,807 1,391

5,198 Havas (a) - - 539 539 648 1,187 Gameloft 91 77 77 245 82 327

Vivendi Village 26 30 25 81 28 109 New Initiatives 10 13 11 34 17

51 Elimination of intersegment transactions (3) (3) (16) (22) (22)

(44)

Total Vivendi 2,680 2,782 3,207

8,669 3,832 12,501

a. As a reminder, Vivendi has fully consolidated Havas since

July 3, 2017.

APPENDIX III

VIVENDI

HAVAS: SIGNIFICANT AWARDS AND WINS

Major awards won by Havas

After carrying off 3 Grand Prix awards at the Cannes Lions, the

Palau Pledge campaign continued to triumph at a series of

worldwide creative festivals, including the Clio Awards, the Spikes

Awards, where the campaign won 5 Grand Prix, and a second

Black Pencil at the DA&D Impact Awards, culminating in the

honor of receiving "Champion for Humanity" award from the We

Are All Human Foundation at the kick-off to the United Nation's

Global Goals Week. Following this resounding success, Host/Havas

was ranked top agency in Asia-Pacific and now stands 7th in the

world, according to the Cannes Lions International Festival of

Creativity's annual Global Creativity Report.

Major account wins over the third quarter of 2018

- Creative: Barnes and Noble, Rite

Aid and National Association of Realtors (USA), La Banque Postale

and Leclerc (France), Ferrero (Germany), Affinity Petcare (Spain),

Lamborghini (Italy), X5 Retail (Russia), National Heart Foundation

(Australia), Healthy Options (Hong Kong), Molson Coors (UK);

- Media: Blizzard Entertainment

and De Beers (Global), Carrefour (6 markets in Europe), Pizza Papa

Johns (USA), China Telecom and JDE (China), Giffgaff (UK), Pernod

Ricard (Mexico), Lindt (Italy), FOX Sports (Australia), Burger

Brands (Belgium); and

- Healthcare communications: Roche

Genentech (Global), Gilead (Local), Novartis (Local), Pfizer

(Local), Transmedics (Global).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20181115005817/en/

MediaParisJean-Louis Erneux+33 (0)1 71 71 15

84Solange Maulini+33 (0) 1 71 71 11 73LondonPaul Durman+44

20 7186 8890

Investor RelationsParisXavier Le Roy+33 (0) 1 71

71 18 77Nathalie Pellet+33(0)1 71 71 11 24Delphine Maillet+33 (0)1

71 71 17 20

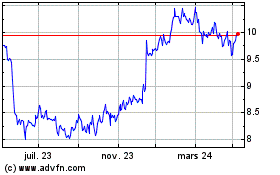

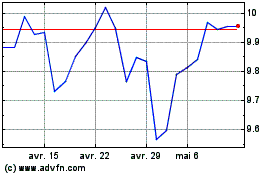

Vivendi (EU:VIV)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Vivendi (EU:VIV)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024