Volatility for Retailers Isn't Over, Options Indicate

20 Août 2019 - 6:54PM

Dow Jones News

By Gunjan Banerji

It has been a wild earnings season for retailers, and options

traders are bracing for bigger stock swings for some shops.

Shares of big retailers such as Home Depot, Inc., Kohl's Corp.

and TJX Companies Inc. recorded large moves in trading early

Tuesday and were some of the biggest winners and losers in the

S&P 500.

Home Depot climbed 4.3% after the home-improvement retailer

reported second-quarter earnings, putting it on pace for its

largest single-day jump this year. Meanwhile, Kohl's lost 4.4% and

TJX shed 3.2% after they released quarterly results, making them

two of the biggest losers in the S&P 500 on Tuesday.

Some investors expect this type of volatility in the sector to

continue, forecasting big moves up or down for retail companies

reporting earnings in coming days. Investors have had to parse the

impact of escalating tariffs with China as well as evolving

consumer tastes in recent reports.

Home Depot warned Tuesday that tariffs could weigh on growth but

its quarterly profit still topped analyst expectations.

Options traders are forecasting a 9.9% move in Nordstrom Inc.

shares after the retailer reports the latest financials Wednesday,

above the average 6.7% over the past eight earnings releases,

according to data provider Trade Alert. The stock has already been

volatile over the past month, falling roughly 23% in August.

That projection is based on a trade known as a straddle, which

measures the size of the swing in either direction rather than the

direction of the move itself. The trade involves buying both

bullish and bearish options contracts that allow investors to buy

or sell stock at a specific price.

Similarly, options traders are also betting on up to a 13% move

in BJ's Wholesale Club Holdings, Inc. shares after the company

reports results on Thursday. Historically, the stock has swung an

average of 4.7%, Trade Alert data showed. Traders are wagering on

bigger moves than historically recorded for Ross Stores, Inc., too,

according to Trade Alert.

The wagers come as retailers are undergoing a volatile earnings

season that has separated some strong winners from losers. The

latest earnings reports have been punishing to companies that

investors weren't pleased with -- such as Tapestry, Inc. Meanwhile,

investors have cheered companies like Walmart Inc. after their

earnings, driving their share prices higher.

It looks like these divergences could continue.

Write to Gunjan Banerji at Gunjan.Banerji@wsj.com

(END) Dow Jones Newswires

August 20, 2019 12:39 ET (16:39 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

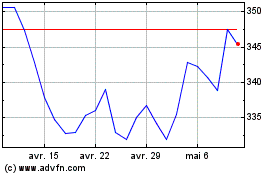

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Home Depot (NYSE:HD)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024