By William Boston

BERLIN -- Volkswagen AG on Wednesday took the wraps off its ID.4

all-electric sport-utility vehicle in a bid by the world's largest

car maker to challenge Tesla Inc. and re-energize a problem-ridden

electric vehicle strategy.

Volkswagen remains years behind its U.S. rival in developing and

selling a mass market electric car. Even as it slowly catches up,

Tesla has stayed one step ahead, launching better-performing

vehicles and even building a new factory near the German capital,

in Volkswagen's backyard.

The ID.4's predecessor, the ID.3, has been plagued by software

glitches, forcing Volkswagen to sell tens of thousands of the first

models in a stripped down version pending a full software update

later this year or early next year.

The problems were so alarming to the company's owners that

directors stripped CEO Herbert Diess of his job managing the

Volkswagen brand earlier this year. Volkswagen has since undergone

a sweeping restructuring of management in charge of the electric

vehicle development.

Ralf Brandstätter, CEO of the Volkswagen brand, said last week

that the ID.4 would have the full software package when it is

available next year.

Tesla, meanwhile, has long left its own production problems

behind. The company has now gone from Silicon Valley startup to a

global manufacturer with one factory in China already operating and

its European plant near Berlin set to start production next

summer.

Some 80% of the 245,000 electric vehicles sold in the U.S. last

year were Teslas. Worldwide, the company sold 367,500 cars in 2019,

a 50% increase from the previous year, giving the Silicon Valley

manufacturer 17.5% of all electric car sales last year.

Technologically, Volkswagen's ID.4 is full of gadgets and

electronics -- advanced driver assistance, over-the-air software

updates, a digital assistant that responds to the command "Hello

ID" -- but the battery gets just 250 miles of range on a single

charge, compared with Tesla's Model Y's 316 miles. And Tesla has

long had remote software update capabilities and near autonomous

driving features.

"Do we have the exact range of Tesla? No, but we have a better

price point," said Scott Keogh, CEO of Volkswagen Group of

America.

At a starting price of $39,995 before subsidies and federal tax

credits, the ID.4 is nearly $7,000 cheaper than the Model Y, Mr.

Keogh said. And the price of the ID.4 is expected to fall to around

$35,000 when the vehicle is produced in the U.S. after 2022. Until

then, it will be imported from Europe.

Volkswagen is well-known to American consumers, but despite a

brief period of popular success in the 1960s and 1970s the company

has fallen behind its Asian rivals Toyota Motor Co., Nissan Motor

Co. and Hyundai Motor Co. Ltd.

Last year, Volkswagen sold 363,322 vehicles in the U.S. -- a 2%

market share and a steep drop from the 1970s, when the company was

selling more than 500,000 cars a year in a smaller market.

Volkswagen is a more dominant player outside the U.S. It is the

biggest foreign auto maker in China, where it builds and sells more

than four million vehicles a year. In Europe, Volkswagen and its

stable of brands that include Audi, Porsche, Skoda, and Seat have

26% market share.

Volkswagen has made several attempts at a U.S. comeback before,

including its ill-fated "clean diesel" campaign which the company

admitted in 2015 was built on illegal software that allowed its

diesel-powered cars to cheat emissions tests. The company's

reputation tanked as the details of dieselgate, as the scandal was

known, emerged.

But in 2016, the company launched the Atlas 7-seater SUV, built

in the Chattanooga, Tenn., plant for the U.S. market. It has since

become one of the most popular medium-size SUVs in the U.S. Last

year, the company sold 81,508 Atlas models, nearly a quarter of its

U.S. sales overall.

The Atlas was the result of years of trial and mostly error for

Volkswagen in responding to American tastes. It also informed

Volkswagen's decision to make its first electric vehicle built for

the U.S. an SUV.

"The way you catch on in culture is you launch a great product

and it catches fire," said Mr. Keogh.

He said the "sweet spot" in the U.S. market is compact SUVs,

which is now dominated by conventional brands such as Toyota's

RAV4, and is the largest part of the U.S. passenger car market.

The closest Tesla comes to that segment is its Model Y, which

went on sale this year. But the Model Y is built on the same

framework as the Model 3 four-door fastback sedan and is more a

crossover between a sedan and an SUV.

Industry analysts expect the share of electric vehicles to

outpace traditional cars in the coming years and account for up to

70% of the market by 2040.

Volkswagen is targeting annual sales of 1.5 million electric

vehicles a year by 2025, about a third of which it says will be

ID.4 models.

Write to William Boston at william.boston@wsj.com

(END) Dow Jones Newswires

September 23, 2020 12:28 ET (16:28 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

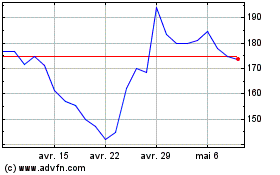

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Tesla (NASDAQ:TSLA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024