Walgreens Cuts Earnings Guidance After a Challenging Second Quarter -- Update

02 Avril 2019 - 3:04PM

Dow Jones News

By Aisha Al-Muslim

Walgreens Boots Alliance Inc. cut its earnings expectations for

the fiscal year after the drugstore chain said it faced its most

difficult quarter since the merger of Alliance Boots and

Walgreens.

In the most recent quarter, the Deerfield, Ill.-based company

said its profit fell to $1.16 billion, or $1.24 a share, from $1.35

billion, or $1.36 a share, a year earlier. Adjusted earnings came

in at $1.64 a share, lower than the $1.72 a share that analysts

polled by Refinitiv expected.

"The market challenges and macro trends we have been discussing

for some time accelerated," Walgreens Chief Executive Stefano

Pessina said Tuesday. "During the quarter, we saw significant

reimbursement pressure, compounded by lower generic deflation, as

well as continued consumer market challenges in the U.S. and

U.K.."

Walgreens shares fell about 8% to $58.40 in premarket trading.

Shares are up about 0.6% over the past year.

For fiscal 2019, Walgreens now expects adjusted earnings per

share at constant currency rates to be roughly flat, lower than its

previous guidance for 7% to 12% growth.

For the second quarter, Walgreens said sales rose 4.6% to $34.53

billion as the company continues integrating Rite Aid stores.

Analysts, according to Refinitiv, expected Walgreens to report

sales of $34.56 billion.

In the quarter, U.S. retail pharmacy sales rose 7.3% to $26.3

billion, due in large part to higher prescription volumes from the

acquisition of Rite Aid stores.

Same-store pharmacy sales increased 1.9%, while comparable

retail sales were down 3.8%. Comparable retail sales were down

primarily due to a weak cough, cold and flu season, the company

said. Also playing a role in the decline were a drop in seasonable

merchandise sales and a shift away from sales of products like

tobacco.

"We are going to be more aggressive in our response to these

rapidly shifting trends," Mr. Pessina said.

The company has been testing tobacco-free stores in the U.S. due

to pressure from federal regulators, activists and some

investors.

In early March, Walgreens shares fell for several days after the

Food and Drug Administration in February called the company out for

being a top violator among pharmacies illegally selling tobacco

products to minors.

In response, Walgreens said it has a zero-tolerance policy on

selling tobacco to minors and any employee found to be in violation

is subject to termination.

In December, Walgreens said it was taking steps over three years

to eliminate more than $1 billion in annual costs through a new

plan.

After the disappointing quarter, Walgreens increased its annual

cost-savings target to more than $1.5 billion by fiscal 2022.

The company expects to improve its performance in fiscal 2020,

resulting in mid-to-high single-digit growth in adjusted earnings

per share in the following years, it said.

The company's initiatives will result in significant

restructuring and other special charges as they are implemented,

the company said. The company recognized pretax charges of $179

million for the six months ended Feb. 28, related primarily to the

pharmaceutical wholesale and retail pharmacy international

divisions.

The drugstore chain has been shrinking its retail footprint as

it searches for other avenues of growth to ward off competition

from CVS Health Corp. and Amazon.com Inc.

Walgreens has struck about a dozen partnership deals in the past

couple of years in a bid to increase revenue by increasing pharmacy

orders and getting customers to make other in-store purchases.

Write to Aisha Al-Muslim at aisha.al-muslim@wsj.com

(END) Dow Jones Newswires

April 02, 2019 08:49 ET (12:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

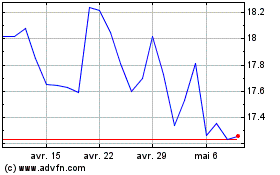

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024