Walgreens Needs New Treatment Options

03 Avril 2019 - 9:03AM

Dow Jones News

By WSJ City

Pharmacy giant Walgreens Boots Alliance has a slumping business

and an ailing stock price. That much became clear Tuesday after

Walgreens announced fiscal second-quarter results, writes Charley

Grant for Heard on the Street.

KEY FACTS

-- The company said its profit fell 14% to $1.16bn in the most recent

quarter.

-- Walgreens shares fell about 13% to $55.34 on Tuesday.

-- The stock is down 12% over the past year.

-- For 2019, Walgreens expects adjusted earnings per share at constant

currency rates to be roughly flat.

-- That's lower than its previous guidance for 7% to 12% growth.

"This has been a disappointing quarter and I am equally

disappointed that we have had to reduce our guidance. We will

respond quickly to ensure we return to growth," said Walgreens

Chief Executive Stefano Pessina, in a call with analysts.

WHAT HAPPENED?

The chain said it made less money on prescription drugs, which

drive the bulk of store sales. That's because tougher economics

around generics drove prices lower. Also driving prices lower:

pressure from insurers to reduce reimbursements to pharmacies.

Comparable retail sales were down primarily due to a weak cough,

cold and flu season, the company said. Also playing a role in the

decline were a drop in seasonable merchandise sales and a shift

away from sales of products like tobacco. "We are going to be more

aggressive in our response to these rapidly shifting trends,"

Pessina said.

ANALYSIS

Identifying what went wrong is easier than fixing it. Walgreens

increased its target for annual cost savings to more than $1.5bn by

fiscal 2022, up from $1bn, but arresting the stock-price decline

will likely require a more ambitious plan, because the US payer

environment is unlikely to improve. After all, its largest

competitor, CVS Health , now owns a major health insurer and should

be better positioned to handle reimbursement pressures.

The competitive environment could worsen still. Amazon bought

online pharmacy PillPack last summer and could conceivably expand

its pharmacy presence in the years to come. On the bright side,

Walgreens's balance sheet is in decent shape, and its strategy of

pursuing partnerships means it could do a large deal if it chose.

Walgreens could even mimic CVS and try to merge with a major health

insurer.

A fuller story is available on WSJ.com

WSJ City: The news, the key facts and why it matters. Be deeply

informed in less than five minutes. You can find more concise

stories like this on the WSJ City app. Download now from the App

Store or Google Play, or sign up to newsletters here

http://www.wsj.com/newsletters?sub=356&mod=djemwsjcity

(END) Dow Jones Newswires

April 03, 2019 02:48 ET (06:48 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

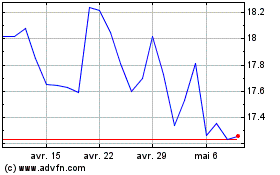

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024