Walgreens Profit Squeezed by Weak Prescription Volumes -- 2nd Update

08 Janvier 2020 - 6:46PM

Dow Jones News

By Sharon Terlep and Allison Prang

Walgreens Boots Alliance Inc.'s quarterly earnings dropped 25%

amid increased competition from online and discount retailers and

shrinking profits in prescription drugs.

The pharmacy chain's fiscal first-quarter profit fell to $845

million, even as overall revenue rose and the company worked to cut

costs. Retail pharmacy sales increased 1.6% in the U.S., well below

expectations, and executives said prescription volumes were weaker

than planned.

Chief Executive Stefano Pessina said a turnaround will take time

and stuck by financial targets for the full fiscal year. "It has

been a slow start to the financial year with a competitive U.S.

pharmacy environment and soft trading conditions in the U.K.," Mr.

Pessina said on a conference call Wednesday.

The company's shares fell 6% in morning trading to $55.86. Last

year, shares were the worst performing member of the Dow Jones

Industrial Average, falling 13.7%. The index gained 22% in

2019.

Walgreens, which also owns the Boots drugstore chain in Europe,

is getting squeezed in U.S. negotiations with pharmacy-benefit

managers, which serve insurers and other clients by choosing which

medicines to cover and pushing for lower prices from drugmakers and

sellers.

Prices that pharmacies pay for generic drugs have been falling,

but insurers' reimbursement rates are declining more. At the same

time, competition from Amazon.com Inc. and other retailers has hurt

the company's retail business.

For the first time, Walgreen executives seemed to acknowledge

fallout from the acquisition of health insurer Aetna by rival CVS

Health Corp. CVS, which already had its own prescription-benefit

manager, now owns one of the nation's largest insurers at a time

when those relationships are becoming ever more critical.

"We're doing less well with them," said co-Chief Operating

Officer Alex Gourlay, referring to Aetna. "For the obvious

reasons."

Walgreens has said it doesn't need to own an insurer or PBM to

thrive, and on Wednesday the company said it had a number of

successful partnerships with other companies that will bolster its

profit in coming years.

The company didn't address reports from late last year that it

was in talks with private-equity firm KKR & Co. over a

potential buyout. Those talks stalled and no deal appears imminent,

people familiar with the matter have said.

Total sales rose less than 2% in the quarter ended Nov. 30,

hitting $34.3 billion. Adjusted earnings of $1.37 a share missed

the consensus estimate from analysts polled by FactSet.

Walgreens said comparable retail sales in the U.S. -- or those

at stores that have been open for at least a year at minimum --

declined 0.5% in the first quarter because of less of an emphasis

on tobacco. Walgreens raised the minimum age required for customers

to buy tobacco products in its stores to 21 as of Sept. 1.

Executives said they were on track with a restructuring effort

that they have predicted will generate annual savings of $1.8

billion by 2022.

Walgreens said in October it was shutting down the in-store

health clinics in the U.S. that it runs. The company, however, is

keeping the ones run by local health systems.

Write to Sharon Terlep at sharon.terlep@wsj.com and Allison

Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 08, 2020 12:31 ET (17:31 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

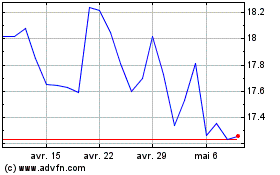

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Walgreens Boots Alliance (NASDAQ:WBA)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024