By Sarah Nassauer and Suzanne Kapner

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 16, 2018).

Walmart Inc. is gearing up for a strong holiday season with a

robust U.S. economy spurring consumer spending and the retail giant

finding its footing in a shifting landscape.

Executives at the world's biggest retailer by revenue said they

are heading into the busy shopping period with lean inventories in

stores and more products online to compete with Amazon.com Inc. for

younger and wealthier shoppers.

On Thursday, Walmart reported sales at U.S. stores open at least

a year rose 3.4% in the latest quarter, including a 43% jump in

e-commerce sales. Walmart executives said same-store results, which

exclude volatile gasoline sales, will show growth of at least 3%

for the full fiscal year ending in January.

Other major U.S. chains are reporting mixed results, a sign that

not all retailers are benefiting from the strong job market and

rising wages. The Commerce Department said Thursday that American

consumers picked up their spending in October after two consecutive

months of declining retail sales.

Shares of Walmart and other retailers declined on Thursday as

investors worried that profits aren't keeping pace with sales gains

because companies are investing in workers' wages and lowering

prices to compete with Amazon. Despite its sales growth, Walmart's

profit margins narrowed in the latest quarter.

"Profitless growth is now the best case" for most retailers this

year, Simeon Gutman, an analyst at Morgan Stanley, said in a note

to clients.

Among traditional retailers, there is a divide between those

that are adapting to the rise of online shopping and those still

struggling to attract customers. Sears Holdings Corp. filed for

bankruptcy protection last month capping years of declining sales

and store closures.

On Wednesday, Macy's Inc. reported higher profit and a 3.1% jump

in same-store sales, saying that initiatives to spruce up its

department stores and allow shoppers to buy online and pick up in

stores were paying off.

However, rival J.C. Penney Co. on Thursday reported lower sales

and a $151 million quarterly loss. Penney's chief executive, Jill

Soltau, who joined the department store last month, said it needs

to do a better job clearing excess inventory and understanding what

its customers want.

Nordstrom Inc., which caters to higher-end customers, said

same-store sales rose 2.3% but the gains were driven by its

off-price Nordstrom Rack chain. The increase at its full-price

department stores was just 0.4%

Nordstrom's net income fell to $67 million from $114 million a

year earlier, hurt by a charge to repay credit-card holders with

delinquent accounts who were improperly charged higher interest

rates beginning in 2010.

At Walmart, total quarterly revenue was $124.9 billion, an

increase of 1.4% as lower international sales and currency

translations slowed the overall gains.

Walmart shed control of its operations in Brazil and is merging

its U.K. operations with a rival to focus on its domestic business

and e-commerce operations.

Profit attributable to Walmart was down 2.2% from the

year-earlier quarter at $1.71 billion, or 58 cents a share.

Walmart's gross margins fell slightly as the company lowered

prices and absorbed higher transportation costs and as e-commerce

made up a larger percentage of sales, Walmart finance chief Brett

Biggs said. The company's online segment currently operates at a

loss.

Walmart's stock slipped 2% to $99.54 on Thursday. The shares had

been trading near their record high of $109.98, and yet are little

changed from where they started the year.

In the U.S., Walmart said sales growth was driven by

market-share gains in groceries, household goods and other

categories.

Executives highlighted demand for fresh food and apparel,

including Walmart's house brands, as well as toys as the company

expanded its selection after the collapse of Toys "R" Us Inc. It is

selling 30% more toys in stores and 40% more toys online this fall

versus last year.

Walmart expects its e-commerce operations to record a slightly

greater operating loss next year.

CEO Doug McMillon said it aims to get closer to profitability by

selling more items that are higher-margin, if infrequent,

purchases, in addition to common household goods. "The process

takes time, and we're making progress," he said.

While most of its U.S. sales come from groceries, Walmart has

added trendy fashion to its online assortment. In the past year, it

has struck a deal to sell apparel from Lord & Taylor through

Walmart.com and acquired online lingerie seller Bare Necessities

and plus-size clothing brand Eloquii. Walmart previously acquired

men's fashion site Bonobos and women's clothing seller

ModCloth.

The nation's largest retailer is reviewing every item expected

to be subject to tariff-related increases in the coming months,

discussing with suppliers ways to reduce costs, executives said.

"The teams are hard at it," and merchandising executives are

traveling overseas to study the issue, said Walmart's U.S. chief,

Greg Foran, on a call with reporters.

In the U.S., Walmart aims to use its position as the country's

largest grocery seller to outpace Amazon. The company has expanded

a program that lets grocery shoppers order online and pick up at

2,100 of its U.S. stores. Walmart will also add grocery delivery

services to about 800 of its stores by the end of the year, using

third-party services such as Postmates Inc. and Deliv Inc.

Walmart's efforts in online grocery pickup are driving the

expansion, eMarketer analyst Andrew Lipsman said. But, he added,

"As fast as Walmart's e-commerce business is growing, it still

pales in comparison to juggernaut Amazon."

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Suzanne

Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

November 16, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

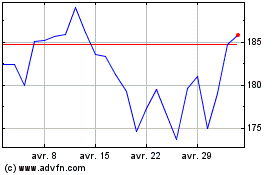

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

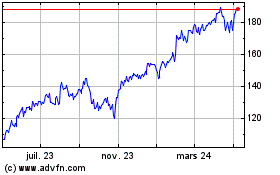

Amazon.com (NASDAQ:AMZN)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024