What Investors Can Learn From the Best Poker Players -- Journal Report

04 Novembre 2019 - 4:32AM

Dow Jones News

By Nick Ravo

Some of the biggest investors on Wall Street are known to be ace

poker players. Are there things we small fish can learn from Texas

Hold 'em that will make us better investors?

Researchers on the subject say the answer is yes.

Kevin J.S. Zollman, an associate professor of philosophy at

Carnegie Mellon University who studies game theory, notes an oddity

of behavioral finance called the disposition effect, in which

investors tend to sell assets that have increased in value but hold

on to those that have decreased. Why? Investors dislike losing more

than they like winning.

This same behavior manifests itself in poker, Dr. Zollman says,

when players, to their detriment, more often walk away when they've

won money than when they are losing, or when they take too many

quick small gains and unrelentingly try to recoup losses. Small

investors, he says, often defeat themselves by doing the same

things.

A similar behavior is referred to as hedonic framing, which is

thinking about one's money -- gains and losses in particular -- in

ways that maximize pleasure and minimize pain. In poker, this is

seen in players who fold often and quickly, and who play lots of

relatively low-risk, low-stakes hands, says best-selling author and

corporate-decision strategist Annie Duke. They might often win, she

says. But when they lose, they lose just a little bit more than

they win, and it adds up.

Likewise, traders, Ms. Duke says, can worry too much about how

often they have winning trades and not enough about how much profit

they are making overall. Ms. Duke was a Ph.D. candidate in

cognitive psychology at the University of Pennsylvania before

joining the professional poker circuit.

Overconfident investors

Luck, Ms. Duke says, plays a big role in both poker and

investing. Poker, she says, is a better proxy for investing than

chess, bridge or backgammon, because of the similar balance of

known and unknown information. To deal with uncertainty, she says,

traders and poker players must develop resilience and learn not to

be guided too much by "results-based behavior." Put another way,

they must learn that it is possible to do everything right and have

a bad outcome; and it is possible to do everything wrong -- maybe

by throwing a dart at a list of stocks -- and win big.

Dr. Zollman notes that a related cognitive bias, the

Dunning-Kruger Effect -- which is, essentially, extreme

overconfidence -- also tends to exist in small-time investors but

less so in high-level poker players. "You have to straddle this

line," says Dr. Zollman. "You don't want to react too strongly to

each individual hand, which would be like reacting too

strongly...to each trade."

Less esoteric criteria come into play as well when judging the

abilities of investors and poker pros. For example, experts say

that an ability to "read" people is found in both groups. To wit,

good poker players can sense a bluff; good investors know when an

investment pitch is mostly hyperbole.

Also, the player or trader with more knowledge -- enhanced by a

good memory and computational ability -- will usually win. Some

"day traders, " in other words, are at a distinct disadvantage to

pros with high-speed algorithms.

'Gambler's Ruin'

Other mathematical analogies found in poker and investing, Dr.

Zollman says, include the "gambler's ruin" problem, which, to

simplify, means that over-betting can cause a card player to run

out of chips. If that sounds obvious, there are obvious solutions

as well, at least in investing. "The gambler's ruin problem is why

people diversify portfolios," Dr. Zollman says.

A common trait in successful investors and poker players is an

ability to accept regrets. How often has a small trader muttered at

a cocktail party: I should have bought Microsoft in 1986 or ditched

Enron in 2001 or gone all-in on the S&P 500 ETF in March

2009.

It is no different in poker, where players sometimes miss an

opportunity by folding too soon. But, as Ms. Duke observes, the

only way to avoid those kinds of regrets is to play every hand

until the end.

"You would lose your money incredibly quickly," she adds.

Maybe the best investment lesson of all that can be learned by

playing poker is that it is hard to be a big, consistent winner in

either endeavor.

Mr. Ravo is a writer in Seattle. He can be reached at

reports@wsj.com.

(END) Dow Jones Newswires

November 03, 2019 22:17 ET (03:17 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

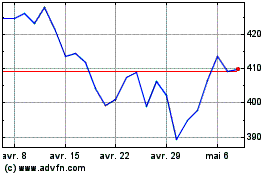

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

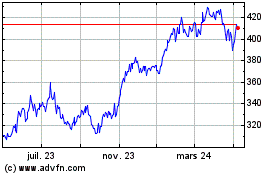

Microsoft (NASDAQ:MSFT)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024