Yen Weakens Amid Risk Appetite

12 Juillet 2018 - 8:33AM

RTTF2

The Japanese yen slipped against its major opponents in the

early European session on Thursday, as European shares rose on

expectations that the U.S. threats to expand tariff hikes is bluff

and bluster and trade agreements will ultimately be reached.

Bloomberg reported late Wednesday that China and the U.S are

showing some willingness to resume high-level trade talks, which

could resolve the trade spat between the world's biggest

economies.

Traders await consumer price inflation figures later in the day.

This follows a day after strong producer inflation report boosted

hopes for two more hikes by the Fed this year.

Oil steadied after going into free fall on Wednesday amid trade

tensions and supply concerns, as Libya resumed production and Saudi

Arabia reported a big jump in output for June.

The yen dropped to near a 2-month low of 148.66 against the

pound, more than 5-month low of 112.46 against the greenback,

4-month low of 112.97 against the franc and more than a 2-month low

of 131.39 against the euro, from its early highs of 147.79, 111.92,

112.35 and 130.67, respectively. The yen is likely to find support

around 152.00 against the pound, 133.00 against the euro and 114.00

against both the greenback and the franc.

The yen declined to 85.24 against the loonie, its lowest since

June 6. On the downside, 87.00 is likely seen as the next support

level for the yen.

The yen fell to 2-day lows of 76.11 against the kiwi and 83.05

against the aussie, off its previous highs of 75.55 and 82.39,

respectively. The next possible support for the yen is seen around

78.00 against the kiwi and 84.00 against the aussie.

Looking ahead, Canada new housing price index for May, U.S.

weekly jobless claims for the week ended July 7, consumer prices

and monthly budget statement for June are scheduled for release in

the New York session.

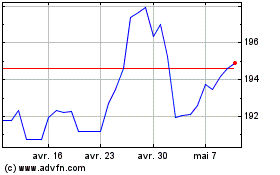

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Mar 2024 à Avr 2024

Sterling vs Yen (FX:GBPJPY)

Graphique Historique de la Devise

De Avr 2023 à Avr 2024