■ Organic sales growth of 15.7% in first-half 2020:

- €1,476 million in sales

- Up 15.8% as reported

■ As expected, a mixed sales performance, with faster

momentum in molecular biology solutions contrasting with a slowdown

in microbiology, immunoassays and industrial applications

■ Robust growth in contributive operating income before

non-recurring items, to €253 million, or 17.1% of sales

Alexandre Mérieux, Chairman and Chief Executive Officer, said:

“In today’s unprecedented health crisis, bioMérieux’s positioning

as a specialist in infectious disease diagnostics takes on all of

its meaning and allowed to rapidly provide high-performance

solutions for diagnosing COVID-19. Despite the pandemic’s negative

impact on certain product lines and taking into account health and

economic conditions, bioMérieux is expected to deliver a remarkable

performance this year. However, this performance is not projectable

beyond 2020.”

Regulatory News:

The Board of Directors of bioMérieux (Paris:BIM), a world leader

in the field of in vitro diagnostics, met on September 1st under

the chairmanship of Alexandre Mérieux and approved the consolidated

financial statements for the six months ended June 30, 2020. The

statements had been reviewed by the Statutory Auditors.

Consolidated data

In € millions

2020

2019

% change

as reported

Sales

1,476

1,275

+15.8%

Contributive operating income before

non‑recurring items(1)

% sales

253

17.1%

198

15.5%

+27.8%

Operating income(2)

232

189

+22.7%

Net attributable income

173

141

+23.0%

Earnings per share (in €)

€1.46

€1.19

(1) Contributive operating income before non-recurring items

corresponds to operating income before non-recurring items relating

to the BioFire acquisition and integration and before accounting

entries relating to the BioFire purchase price allocation.

(2) Operating income is the sum of contributive operating income

before non-recurring items, BioFire acquisition fees and purchase

price amortization expense and “material, extraordinary and

non-recurring items” recognized in “Other non-recurring income and

expenses from operations, net”.

SALES

NB: Unless otherwise stated, sales

growth is expressed at constant exchange rates and scope of

consolidation (like-for-like).

Consolidated sales amounted to €1,476 million in the first half

of 2020, up 15.7% like-for-like from €1,275 million in the

year-earlier period. Reported growth stood at 15.8% for the period.

There was little or no impact from exchange rate movements, as the

decline in emerging market currencies against the euro canceled out

the increase in the US dollar.

Analysis of sales

In € millions

SALES - SIX MONTHS ENDED JUNE 30,

2019

1,275

Currency effect

+2

+0.2%

Changes in scope of consolidation(1)

-1

-0.1%

Organic growth (at constant exchange rates

and scope of consolidation)

+200

+15.7%

SALES - SIX MONTHS ENDED JUNE 30,

2020

1,476

+15.8%

NB: A definition of the currency effect and of changes in the

scope of consolidation is provided at the end of this press

release. (1) Disposal of businesses in Australia and acquisition of

Invisible Sentinel on February 7, 2019.

ANALYSIS OF SALES BY APPLICATION

Sales by Application

In € millions

Q2 2020

Q2 2019(3)

% change as reported

% changeat constant

exchange rates

and scope

of consolidation

Six

months

ended

June 30, 2020

Six

months

ended

June 30,

2019(3)

% change as reported

% changeat constant

exchange rates

and scope

of consolidation

Clinical Applications

601.6

529.8

+13.5%

+14.1%

1,257.4

1,056.7

+19.0%

+18.7%

Molecular biology

264.1

154.1

+71.3%

+70.8%

557.3

326.3

+70.8%

+68.7%

Microbiology

208.7

247.1

-15.5%

-14.2%

460.4

484.5

-5.0%

-4.2%

Immunoassays

96.2

119.9

-19.8%

-18.2%

195.0

229.2

-14.9%

-14.2%

Other lines(1)

32.5

8.6

x 2.8

x 2.7

44.7

16.7

x 1.7

x 1.6

Industrial Applications(2)

105.8

113.7

-6.9%

-5.2%

218.8

218.3

+0.2%

+1.1%

TOTAL CONSOLIDATED SALES

707.4

643.5

+9.9%

+10.7%

1,476.2

1,275.1

+15.8%

+15.7%

(1) Including Applied Maths, BioFire Defense, and

R&D-related revenue arising on clinical applications. (2)

Including R&D-related revenue arising on industrial

applications. (3) Including the transfer of certain veterinary

operations from industrial to clinical applications.

■ Clinical application sales, which accounted for

approximately 85% of bioMérieux’s consolidated total, rose by 14%

year-on-year to €602 million in the second quarter of 2020, and by

nearly 19% to €1,257 million over the first half.

- In molecular biology, the BIOFIRE® FILMARRAY® product

line reported remarkable growth in the second quarter, led by sales

of the new version of the respiratory panel with SARS-CoV-2.

Including BioFire Defense sales recognized in “Other lines”,

molecular biology sales rose by around 80% over the period. The

BIOFIRE® installed base continued to expand, to more than 14,000

units at June 30, 2020, versus 10,400 at December 31, 2019. The

extraction and ARGENE® lines also made a significant contribution

to molecular biology sales growth, reflecting their complementarity

with the syndromic approach.

- The microbiology business was impacted by the slowdown

in reagent sales across all product lines due to the decline in

hospital visits, while equipment sales rose steeply during the

quarter.

- Sales of the immunoassay line also slowed in the wake of

lockdown measures and the decline in hospital use.

■ Industrial application sales, which represent around

15% of the consolidated total, decreased by 5% year-on-year to €106

million in the second quarter. While business with customers in the

pharmaceutical industry continued to trend upwards, the agri-foods

market contracted over the period, dragged down by the impact of

the health crisis.

ANALYSIS OF SALES BY REGION

Sales by Region

In € millions

Q2 2020

Q2 2019

% change as reported

% changeat constant

exchange rates

and scope

of consolidation

Six

months

ended

June 30, 2020

Six

months

ended

June 30, 2019

% change as reported

% changeat constant

exchange rates

and scope of

consolidation

Americas

364.7

285.7

+27.7%

+28.0%

762.4

581.8

+31.0%

+30.2%

North America

325.7

246.5

+32.2%

+29.8%

684.0

507.9

+34.7%

+31.4%

Latin America

38.9

39.2

-0.7%

+17.2%

78.4

73.9

+6.1%

+21.5%

Europe(1)

225.0

231.5

-2.8%

-1.7%

472.7

454.7

+4.0%

+4.4%

Asia Pacific

117.7

126.3

-6.8%

-5.6%

241.1

238.5

+1.1%

+2.0%

TOTAL SALES

707.4

643.5

+9.9%

+10.7%

1,476.2

1,275.1

+15.8%

+15.7%

(1) Including the Middle East and Africa.

■ Sales in the Americas (52% of the consolidated total)

rose by 28% year-on-year to €365 million in the second quarter and

by 30% to €762 million in the first half.

- In North America (46% of the consolidated total),

quarterly growth was primarily led by strong demand for the

BIOFIRE® FILMARRAY® molecular biology product line.

- In Latin America, every country except Brazil and

Colombia reported robust growth in second-quarter sales, supported

by the deployment of molecular biology solutions.

■ Sales in the Europe – Middle East – Africa region (32%

of the consolidated total) came to €225 million for the second

quarter, down 1.7% year-on-year. Sales for the first six months

were up 4% from the previous year, at €473 million.

- In Europe (27% of the consolidated total), solid growth

in the United Kingdom and Scandinavia failed to offset the slowdown

in the Benelux countries, Poland and Switzerland.

- The situation remained contrasted in the Russia – Middle

East – Africa region, where vibrant growth in Russia, Egypt and

the Middle East in the second quarter was somewhat offset by a

transient decline of sales in Africa.

■ In the Asia-Pacific region (16% of the consolidated

total), sales came to €118 million in the second quarter,

representing a year-on-year decline of around 6%. The robust sales

performance in Japan and Australia was more than offset by the

slowdown in China, where lower exposure to the molecular biology

lines meant that they were unable to make up for the slowdown in

sales of the other lines.

CONSOLIDATED INCOME STATEMENT

■ Gross profit

Gross profit for the first six months of the year came to €816

million or 55.3% of sales, down slightly from 55.7% in the

prior-year period. The erosion in gross margin primarily reflected

the adverse currency effect and the impact of phantom stock option

plans (PSOPs) in the United States. Excluding these two factors,

gross margin was unchanged for the period, despite the higher

proportion of instruments sales in the first-half mix.

■ Contributive operating income before non-recurring

items

Contributive operating income before non-recurring items came to

€253 million for first-half 2020, a year‑on‑year gain of 28%.

Contributive operating income before non-recurring items as a

percentage of sales was 17.1% as reported. An expense of €42

million was booked in the first half in respect of the PSOP bonus

plans in the United States that are indexed to the bioMérieux share

price, compared to an expense of €26 million in first-half 2019.

bioMérieux also recognized a €4 million expense on the settlement

of its obligations under a defined benefit pension plan for

bioMérieux Inc. employees in the United States. The currency

effects reduced reported contributive operating income before

non-recurring items by €7 million.

- Selling, general and administrative expenses amounted to

€382 million, or 25.9% of sales, compared with 27.8% in first‑half

2019. The improvement was primarily attributable to the decline in

selling expenses (conventions and business travels) as a result of

lockdown measures.

- R&D expenses came to €203 million, or 13.8% of

sales, compared with €179 million and 14% in first‑half 2019. The

increase in outlays reflected both the programs undertaken to

develop new SARS‑CoV‑2 diagnostics and the ongoing commitment to

driving innovation across every product line.

- Other operating income stood at around €22 million for

the period, unchanged year-on-year.

■ Operating income

Depreciation and amortization charged against assets revalued at

BioFire’s date of acquisition amounted to €9 million in first-half

2020, unchanged from first-half 2019. In June 2020, the Board of

Directors also decided exceptionally to reduce the dividend by €22

million and to allocate these funds to supporting initiatives in

the public interest. Of these funds, €12 million has already been

recognized in other non‑recurring expenses from operations in

first-half 2020.

As a result, consolidated operating income came to €232

million in the first half, representing a 23% increase on the €189

million reported for the first two quarters of 2019.

■ Net income of consolidated companies

Net financial expense amounted to €12 million over the

period, down slightly from €14 million in first-half 2019.

The Group's effective tax rate for the first half of 2020

stood at 21.7%, versus 20.8% in first-half 2019, which benefited

from the preferential tax rate applied to intellectual property

under the new Foreign‑Derived Intangible Income (FDII) deduction in

the United States.

Net attributable income amounted to €173 million for the

first half of 2020, up 23% from €141 million one year earlier.

CASH MANAGEMENT AND FINANCE

■ Free cash flow

EBITDA1 came to €345 million in first-half 2020, or 23.4%

of sales, up 22% from the €283 million reported for the same period

one year earlier. The increase reflects growth in contributive

operating income before non-recurring items and net additions to

depreciation and amortization of operating items and operating

provisions.

Income tax paid represented €60 million, an increase from

the €51 million paid in first-half 2019, in line with activity.

Working capital requirement rose by €22 million in the

first six months of 2020, primarily as a result of the following

factors:

- inventories rose by €55 million during the period, mainly due

to slower sales of the microbiology and immunoassay lines;

- trade receivables decreased slightly, thanks to the growth in

business in the United States;

- trade payables declined by €10 million, in line with the

reduction in average days sales outstanding;

- other working capital requirement items improved by €37

million, led by the increase in accrued taxes and payroll

liabilities (particularly the provision on the PSOP bonus plans

indexed to the bioMérieux share price).

Capital expenditure outlays represented around 8.6% of

sales or €127 million in first-half 2020, versus €123 million in

first-half 2019.

In light of the above, free cash flow came in at €144

million in first-half 2020, compared to €55 million one year

earlier.

■ Change in net debt

Purchases of non-current financial assets, net of

disposals, amounted to €9 million, versus €72 million in first-half

2019. bioMérieux also bought back its own shares in an amount of

around €2 million.

A dividend of €22 million will be paid in the second half

of the year instead of in the first half as was the case in

2019.

As a result, consolidated net debt came to €192 million

at June 30, 2020, versus €317 million at December 31, 2019.

FULL-YEAR OUTLOOK

In light of the uncertainties linked to the current health

crisis, bioMérieux has deemed it preferable not to issue any new

annual guidance as of the date of release of its interim results.

Nevertheless, based on the robust first-half performance and the

nature of bioMérieux’s business, the favorable impact on financial

results is expected to continue in the second half.

GOVERNANCE

The Board of Directors has decided to rename its Human

Resources, Appointments and Remuneration Committee to Human

Resources and CSR Committee. Thus, the Committee, in addition

to its historical missions, will be in charge of ensuring that the

Company takes CSR topics into account, and their integration into

its strategy.

___________________________

1 EBITDA corresponds to the aggregate of contributive operating

income before non-recurring items, and operating depreciation and

amortization.

SIGNIFICANT EVENTS OF THE FIRST HALF

■ Launch of COVID-19 diagnostic tests

During the first half, bioMérieux received:

- an Emergency Use Authorization (EUA) from the US Food and Drug

Administration for the BIOFIRE® COVID-19 test;

- an Emergency Use Authorization (EUA) from the US Food and Drug

Administration for the ARGENE® SARS-COV-2 R-GENE® test;

- an Emergency Use Authorization (EUA) from the US Food and Drug

Administration for the BIOFIRE® Respiratory 2.1 Panel (RP2.1);

- CE marking for the VIDAS® anti-SARS-CoV-2 IgG and VIDAS®

anti-SARS-CoV-2 IgM serology tests

■ bioMérieux issued a €200 million Euro PP bond

On June 29, 2020, bioMérieux announced that it had issued a €200

million Euro PP new debt with a top‑tier European institutional

investor. The private placement comprised two tranches: one 7-year

€145 million tranche and one 10-year €55 million tranche, bearing

an aggregated annual coupon of 1.61%.

SUBSEQUENT EVENTS

■ CE marking for the BIOFIRE® Respiratory 2.1 plus Panel with

SARS-CoV-2 On July 15, 2020, bioMérieux announced that the

BIOFIRE® Respiratory 2.1 plus Panel (RP2.1plus) had obtained CE

marking. RP2.1plus simultaneously tests for 23 pathogens (19

viruses, including SARS‑CoV‑2, and 4 bacteria) responsible for the

most frequent respiratory tract infections.

■ Launch of BIOFIRE® MYCOPLASMA test for mycoplasma detection

in biopharmaceutical products On July 16, 2020, bioMérieux

announced the launch of BIOFIRE® MYCOPLASMA, an innovative test for

mycoplasma detection in pharmaceutical products used for

biotherapeutics (antibodies, hormones, cell and gene therapies,

etc.). Based on the BIOFIRE® technology used for several years in

the field of clinical diagnostics, BIOFIRE® MYCOPLASMA allows

pharmaceutical industry customers to carefully monitor the risk of

contamination at each step in their manufacturing processes.

■ FDA issues Emergency Use Authorization for VIDAS®

anti‑SARS-CoV-2 IgG and VIDAS® anti‑SARS-CoV-2 IgM serology

tests On August 7, 2020, bioMérieux announced that it had

received an Emergency Use Authorization (EUA) from the US Food and

Drug Administration for the VIDAS® anti-SARS-CoV-2 IgG and VIDAS®

anti‑SARS‑CoV-2 IgM serology tests. These tests detect antibodies

in people exposed to the SARS‑CoV‑2 virus that causes COVID-19.

INVESTOR PRESENTATION

bioMérieux will hold an investor presentation on Wednesday,

September 2, 2020 at 2:30 pm CEST (GMT+1). The presentation will be

given in English and will be accessible via conference call or

webcast.

Conference call:

France

Europe

United States

+33 (0)1 76 77 22 57

+44 (0)330 336 9411

+1 (323) 794-2423

Access code: 5153696

Webcast:

https://globalmeet.webcasts.com/starthere.jsp?ei=1359165&tp_key=6c99c81d9f

INVESTOR CALENDAR

Third-quarter 2020 sales

October 22, 2020

Notes and definitions

The above forward-looking statements are based, entirely or

partially, on assessments or judgments that may change or be

modified, due to uncertainties and risks related to the Company’s

economic, financial, regulatory and competitive environment,

notably those described in the 2019 Universal Registration

Document. Accordingly, the Company cannot give any assurance nor

make any representation as to whether the objectives will be met.

The Company does not undertake to update or otherwise revise any

forecasts or objectives presented herein, except in compliance with

the disclosure obligations applicable to companies whose shares are

listed on a stock exchange.

Currency effect: this is

established by converting actual numbers at the average rates of

year y-1. In practice, those rates are either average rates

communicated by the ECB, or hedged rates if hedging instruments

have been set up.

Changes in scope of consolidation:

these are determined:

- for acquisitions in the period, by

deducting from sales for the period the amount of sales generated

during the period by acquired entities as from the date they

entered the consolidated reporting scope; - for acquisitions in the

previous period, by deducting from sales for the period the amount

of sales generated in the months in the previous period during

which the acquired entities were not consolidated; - for disposals

in the period, by adding to sales for the period the amount of

sales generated by entities sold during the previous period in the

months of the current period during which these entities were no

longer consolidated; - for disposals in the previous period, by

adding to sales for the period the amount of sales generated during

the previous period by the entities sold.

ABOUT BIOMÉRIEUX

Pioneering Diagnostics

A world leader in the field of in vitro diagnostics for over 55

years, bioMérieux is present in 44 countries and serves more than

160 countries with the support of a large network of distributors.

In 2019, revenues reached €2.7 billion, with over 90% of sales

outside of France.

bioMérieux provides diagnostic solutions (systems, reagents,

software and services) which determine the source of disease and

contamination to improve patient health and ensure consumer safety.

Its products are mainly used for diagnosing infectious diseases.

They are also used for detecting microorganisms in agri-food,

pharmaceutical and cosmetic products.

bioMérieux is listed on the Euronext Paris

stock market.

Symbol: BIM – ISIN Code: FR0013280286

Reuters: BIOX.PA/Bloomberg: BIM.FP

www.biomerieux.com

APPENDIX 1: QUARTERLY SALES BY

REGION AND APPLICATION

Sales by Application in € millions and %

Change in Sales by Application

First quarter

Second quarter

First half

2020

2019

2020

2019

2020

2019

Clinical Applications

655.8

526.9

601.6

529.8

1257.4

1056.7

Microbiology

251.6

237.4

208.7

247.1

460.4

484.5

Immunoassays

98.8

109.3

96.2

119.9

195.0

229.2

Molecular biology

293.2

172.1

264.1

154.1

557.3

326.3

Other lines(1)

12.2

8.1

32.5

8.6

44.7

16.7

Industrial Applications(2)

113.0

104.6

105.8

113.7

218.8

218.3

TOTAL SALES

768.8

631.6

707.4

643.5

1,476.2

1,275.1

(1) Including Applied Maths, BioFire Defense,

and R&D-related revenue arising on clinical applications. (2)

Including R&D-related revenue arising on industrial

applications.

First quarter

Second quarter

First half

As reported

Like-for-like(3)

As reported

Like-for-like

As reported

Like-for-like

Clinical Applications

+24.7%

+23.3%

+13.5%

+14.1%

+19.0%

+18.7%

Microbiology

+6.7%

+6.3%

-15.5%

-14.2%

-5.0%

-4.2%

Immunoassays

-9.4%

-9.9%

-19.8%

-18.2%

-14.9%

-14.2%

Molecular biology

+69.7%

+66.9%

+71.3%

+70.8%

+70.8%

+68.7%

Other lines(1)

+50.6%

+43.8%

x 2.8

x 2.7

x 1.7

x 1.6

Industrial Applications(2)

+6.0%

+7.9%

-6.9%

-5.2%

+0.2%

+1.1%

TOTAL SALES

+21.5%

+20.8%

+9.9%

+10%

+15.8%

+15.7%

(1) Including Applied Maths, BioFire Defense,

and R&D-related revenue arising on clinical applications. (2)

Including R&D-related revenue arising on industrial

applications. (3) At constant exchange rates and scope of

consolidation.

Sales by Region in € millions and % Change

in Sales by Region

First quarter

Second quarter

First half

2020

2019

2020

2019

2020

2019

Americas

397.7

296.1

364.7

285.7

762.4

581.8

North America

358.2

261.4

325.7

246.5

684.0

507.9

Latin America

39.5

34.7

38.9

39.2

78.4

73.9

Europe(1)

247.7

223.3

225.0

231.5

472.7

454.7

Asia Pacific

123.4

112.2

117.7

126.3

241.1

238.5

TOTAL CONSOLIDATED SALES

768.8

631.6

707.4

643.5

1,476.2

1,275.1

(1) Including the Middle East and Africa.

First quarter

Second quarter

First half

As reported

Like-for-like(2)

As reported

Like-for-like

As reported

Like-for-like

Americas

+34.0%

+32.2%

+27.7%

+28.0%

+31.0%

+30.2%

North America

+36.7%

+33.0%

+32.2%

+29.8%

+34.7%

+31.4%

Latin America

+13.7%

+26.7%

-0.7%

+17.2%

+6.1%

+21.5%

Europe(1)

+10.8%

+10.7%

-2.8%

-1.7%

+4.0%

+4.4%

Asia Pacific

+10.0%

+10.5%

-6.8%

-5.6%

+1.1%

+2.0%

TOTAL SALES

+21.5%

+20.8%

+9.9%

+10.7%

+15.8%

+15.7%

(1) Including the Middle East and Africa. (2)

At constant exchange rates and scope of consolidation.

APPENDIX 2: SUMMARY CONSOLIDATED

FINANCIAL STATEMENTS AT JUNE 30, 2020

CONSOLIDATED INCOME STATEMENT

In millions of euros

30/06/2020

30/06/2019

NET SALES

1,476.2

1,275.1

Cost of sales

-659.8

-565.1

GROSS PROFIT

816.4

709.9

OTHER OPERATING INCOME

21.9

21.2

Selling and marketing expenses

-282.3

-271.7

General and administrative expenses

-99.9

-82.5

Research and development expenses

-203.0

-178.9

TOTAL OPERATING EXPENSES

-585.2

-533.0

CONTRIBUTIVE OPERATING INCOME

253.1

198.1

BioFire acquisition's fees and depreciation costs (1)

-9.0

-8.9

OPERATING INCOME BEFORE NON-RECURRING ITEMS

244.1

189.3

Other non-recurring income (expenses)

-12.0

0.0

OPERATING INCOME

232.1

189.2

Cost of net financial debt

-8.5

-10.7

Other financial items

-3.9

-3.5

Income tax

-47.7

-36.4

Investments in associates

-0.3

0.0

NET INCOME OF CONSOLIDATED COMPANIES

171.7

138.7

Attributable to the minority interests

-1.2

-1.8

ATTRIBUTABLE TO THE PARENT COMPANY

172.9

140.6

Basic net income per share

1.46

€

1.19

€ Diluted net income per share

1.46

€

1.18

€

(1) Non-recurring items relating to the acquisition and

integration of BioFire, and accounting entries relating to its

purchase price allocation.

CONSOLIDATED BALANCE SHEET

ASSETS (in millions of euros)

30/06/2020

31/12/2019

30/06/2019

restated(1)

Intangible assets

491.0

508.4

530.2

Goodwill

651.0

652.5

649.7

Property, plant and equipment

916.7

894.7

807.4

Right of use

124.3

130.5

134.3

Financial assets

51.1

41.9

71.8

Investments in associates

0.0

0.2

0.2

Other non-current assets

14.8

16.1

15.3

Deferred tax assets

98.8

99.0

89.2

NON-CURRENT ASSETS

2,347.8

2,343.5

2,298.3

Inventories and work in progress

541.9

494.7

481.1

Accounts receivable

535.3

552.1

494.8

Other operating receivables

76.7

61.1

89.0

Tax receivable

25.4

42.3

27.2

Non-operating receivables

12.4

13.3

12.1

Cash and cash equivalents

589.5

275.0

247.7

CURRENT ASSETS

1,781.1

1,438.5

1,351.9

ASSETS HELD FOR SALE

0.0

0.0

0.0

TOTAL ASSETS

4,128.9

3,781.9

3,650.2

LIABILITIES AND SHAREHOLDERS' EQUITY

(in millions of euros)

30/06/2020

31/12/2019

30/06/2019

restated(1)

Share capital

12.0

12.0

12.0

Additional paid-in capital & Reserves

2,178.3

1,919.1

1,912.1

Net income for the year

172.9

272.8

140.6

SHAREHOLERS' EQUITY

2,363.2

2,203.9

2,064.7

MINORITY INTERESTS

44.5

50.7

51.9

TOTAL EQUITY

2,407.7

2,254.6

2,116.5

Net financial debt - long-term

338.1

153.7

520.2

Deferred tax liabilities

137.5

141.2

141.1

Provisions

49.1

62.3

48.9

NON-CURRENT LIABILITIES

524.8

357.2

710.2

Net financial debt - short-term

443.2

438.6

149.3

Provisions

45.6

47.0

42.3

Accounts payable

201.2

211.9

189.5

Other operating liabilities

412.2

381.1

376.7

Tax liabilities

25.6

32.3

22.4

Non-operating liabilities

68.7

59.3

43.1

CURRENT LIABILITIES

1,196.5

1,170.1

823.4

LIABILITIES RELATED TO ASSETS HELD FOR SALE

0.0

0.0

0.0

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY

4,128.9

3,781.9

3,650.2

(1) Comparative data at June 30, 2019 have been restated to

reflect the impact at that date of the changes in the value of the

Hybiome assets and liabilities recognized at December 31, 2018.

CONSOLIDATED CASH FLOW STATEMENT

In millions euros

30/06/2020

31/12/2019

30/06/2019

Net income of consolidated companies

171.7

269.7

138.7

- Investments in associates

0.3

0.0

0.0

- Cost of net financial debt

8.5

20.6

10.6

- Other financial items

3.9

2.5

3.5

- Current income tax expense

47.7

77.8

36.3

- Operating depreciation and provisions on assets

91.6

189.5

85.0

- Non-recurring items and BioFire acquisition's fees and

depreciation costs

21.0

17.8

8.9

EBITDA (before non-recurring items)

344.7

577.9

283.0

Other non current operating gains/losses(w/o exceptionnal

depreciations, assets losses and capital gains/losses)

-11.7

-0.1

0.1

Other financial items(w/o accruals & disposal of financial

assets)

-3.9

-2.0

-3.5

Operating provisions for risks and contingencies

0.8

-6.8

-11.9

Change in fair value of financial instruments

0.2

-1.4

-0.9

Share-based payments

4.4

9.4

5.0

Elimination of other gains and losses without any impact on cash

or operations

-10.2

-0.9

-11.2

Change in inventories

-55.5

-71.0

-59.3

Change in accounts receivable

6.1

-57.3

1.4

Change in accounts payable

-10.1

32.9

8.5

Change in other operating working capital

37.2

26.0

12.2

Change in operating working capital (1)

-22.3

-69.4

-37.2

Other non operating working capital

15.6

2.1

1.7

Change in non-current assets

1.3

0.4

1.0

Other cashflows from operation

-5.4

-66.9

-34.5

Income tax paid

-59.9

-81.6

-51.4

Cost of net financial debt

-8.5

-20.6

-10.6

Net cash flow from operations

260.7

407.9

175.3

Purchase of property, plant and equipment

-127.4

-272.5

-123.3

Proceeds on fixed asset disposals

11.8

17.1

5.4

Purchase of financial assets / Disposals of financial assets

-0.6

-2.4

-2.3

FREE CASH FLOW (2)

144.5

150.1

55.1

Purchase / Disposals related to minority

interests

-4.7

48.5

20.0

Impact of changes in the scope of consolidation

-4.0

-72.8

-68.4

Net cash flow from (used in) investment activities

-124.9

-282.1

-168.6

Increase in capital

0.0

0.1

0.0

Purchases and proceeds of treasury stocks

-1.9

0.0

0.5

Dividends to shareholders

0.0

-41.3

-41.3

Flow from new loans #REF!

0.0

0.0

Flow from loans reimbursment #REF!

-69.2

-10.7

Variation of interests without taking or loss of control

0.0

-23.5

-23.7

Net cash flow from (used in) financing activities

174.6

-133.9

-75.2

Net change in cash and cash equivalents

310.4

-8.1

-68.4

Net cash and cash

equivalents at the beginning of the year

264.0

278.2

278.2

Impact of currency changes on net cash and cash

equivalents

-7.7

-6.1

-3.0

Net cash and cash equivalents at the end of the year

566.7

264.0

206.9

(1) Including additions to and reversals of current provisions.

(2) Available cash flow is defined as cash flow from operating

activities plus cash flow from investing activities, excluding net

cash and cash equivalents from acquisitions and disposals of

subsidiaries.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200901006113/en/

Investor Relations bioMérieux Sylvain

Morgeau/Franck Admant Tel.: +33 (0)4 78 87 20 00

investor.relations@biomerieux.com

Media Relations bioMérieux Aurore Sergeant Tel.:

+33 (0)4 78 87 20 53 media@biomerieux.com

Image Sept Laurence Heilbronn Tel.: +33 (0)1 53 70 74 64

lheilbronn@image7.fr

Claire Doligez Tel.: +33 (0)1 53 70 74 48 cdoligez@image7.fr

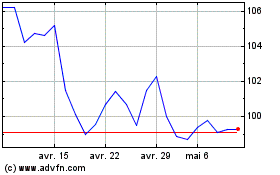

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Biomerieux (EU:BIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024