Current Report Filing (8-k)

18 Mars 2022 - 8:06PM

Edgar (US Regulatory)

0001555074false00015550742022-03-162022-03-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 18, 2022 (March 16, 2022)

ALTISOURCE ASSET MANAGEMENT CORPORATION

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| U.S. Virgin Islands | | 001-36063 | | 66-0783125 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive offices including zip code)

(704) 275-9113

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | AAMC | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter):

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 16, 2022, Jason Kopcak entered into an employment agreement with Altisource Asset Management Company (the “Company”) as President and Chief Operating Officer. Mr. Kopcak's employment will begin on May 15, 2022 or such earlier date as the Company and Mr. Kopcak agree (the "Start Date").

Prior to joining the Company, Mr. Kopcak, 50, was employed with Morgan Stanley beginning in September, 2018, as an Executive Director of the residential mortgage team within Global Capital Markets. He was involved in all facets of the mortgage and alternative lending business from trading, warehousing, securitization to investment banking. Prior to his employment at Morgan Stanley, Mr. Kopcak worked at Nomura, a global financial services group, from May, 2012 until September, 2018 in a similar capacity. Mr. Kopcak has more than twenty-five years of experience in the mortgage business.

In connection with his appointment, the Company and Mr. Kopcak entered into an employment agreement (the “Employment Agreement”) setting forth the terms of Mr. Kopcak’s employment. The Employment Agreement provides for an annual base salary of $575,000, an annual bonus of $575,000, and participation in employee benefit programs of the Company on the same terms as other similarly situation employees. In addition, Mr. Kopcak will receive a $250,000 signing bonus (subject to 100%, 66.67% or 33.33% recoupment if Mr. Kopcak terminates his employment without Good Reason (as defined in the Employment Agreement) or the Company terminates Mr. Kopcak for Cause (as defined in the Employment Agreement) during the first, second or third years of employment, respectively). For the avoidance of doubt, the amounts the Employee is required to repay pursuant to the preceding sentence are the entire amount of the Signing Bonus paid by the Company, or (66.67%) or (33.33%) of such amount less any taxes paid by the Employee. Mr. Kopcak will receive a one-time equity award grant of 22,500 restricted shares of Company common stock, which will vest in three equal installments on the first three anniversaries of the Start Date. In the event Mr. Kopcak's employment is terminated by the Company without Cause or he resigns for Good Reason he would be entitled to, among other things, a separation payment in the amount of one-half of his annual base salary, one-half of his target annual bonus and accelerated vesting of his restricted shares.

The Employment Agreement contains customary covenants on non-competition (for 12 months if termination is for Cause or without Good Reason), non-solicitation of employees (for 12 months) and non-solicitation of customers (for 12 months) by Mr. Kopcak and requires that all disputes be determined by binding arbitration.

The foregoing description of the Employment Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment Agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure

On March 21, 2022, at 8:00 a.m. (ET), the Company will hold a conference call to discuss the firm’s new strategic direction. A copy of the presentation for the conference call is attached as Exhibit 99.1 to this Report on Form 8-K.

Exhibit 99.1 is being furnished pursuant to Item 7.01 of Form 8-K and the information included therein shall not be deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act") or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of Group Inc. under the U.S. Securities Act of 1933, as amended, or the Exchange Act.

Item 8.01 Other Events.

On March 18, 2022, the Company issued a press release announcing the firm's new strategic direction. A copy of the press release is attached as Exhibit 99.2 to this Report on Form 8-K and incorporated into this Item 8.01 by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | Jason Kopcak Employment Contract dated March 16, 2022. |

| | |

| | |

| | Presentation of AAMC dated March 18, 2022 for conference call on March 21, 2022. |

| | |

| | |

| | Press Release of Altisource Asset Management Corporation, dated March 18, 2022. |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| | |

| | |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | Altisource Asset Management Corporation |

| March 18, 2022 | By: | /s/ Kevin Sullivan |

| | Kevin Sullivan General Counsel |

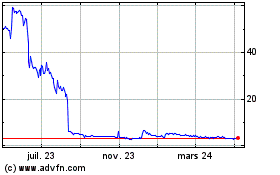

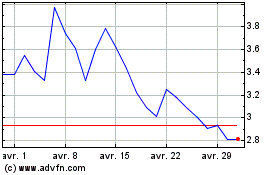

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Altisource Asset Managem... (AMEX:AAMC)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024