00015550742021FYfalseP3DP1YP3Y00015550742021-01-012021-12-3100015550742021-06-30iso4217:USD00015550742022-03-25xbrli:shares00015550742021-12-3100015550742020-12-31iso4217:USDxbrli:shares00015550742020-01-012020-12-310001555074us-gaap:EquitySecuritiesMember2021-01-012021-12-310001555074us-gaap:EquitySecuritiesMember2020-01-012020-12-310001555074us-gaap:CommonStockMember2019-12-310001555074us-gaap:AdditionalPaidInCapitalMember2019-12-310001555074us-gaap:RetainedEarningsMember2019-12-310001555074us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001555074us-gaap:TreasuryStockMember2019-12-3100015550742019-12-310001555074us-gaap:CommonStockMember2020-01-012020-12-310001555074us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001555074us-gaap:TreasuryStockMember2020-01-012020-12-310001555074us-gaap:RetainedEarningsMember2020-01-012020-12-310001555074us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001555074us-gaap:CommonStockMember2020-12-310001555074us-gaap:AdditionalPaidInCapitalMember2020-12-310001555074us-gaap:RetainedEarningsMember2020-12-310001555074us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001555074us-gaap:TreasuryStockMember2020-12-310001555074us-gaap:CommonStockMember2021-01-012021-12-310001555074us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001555074us-gaap:TreasuryStockMember2021-01-012021-12-310001555074us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001555074us-gaap:RetainedEarningsMember2021-01-012021-12-310001555074us-gaap:CommonStockMember2021-12-310001555074us-gaap:AdditionalPaidInCapitalMember2021-12-310001555074us-gaap:RetainedEarningsMember2021-12-310001555074us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001555074us-gaap:TreasuryStockMember2021-12-310001555074us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001555074us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2020-12-3100015550742014-03-3100015550742014-01-012014-03-31xbrli:pure0001555074us-gaap:SeriesAPreferredStockMember2020-02-030001555074aamc:AltisourceAssetManagementCorporationv.LuxorCapitalGroupLPMember2020-01-272020-01-270001555074aamc:AltisourceAssetManagementCorporationv.LuxorCapitalGroupLPMembersrt:MinimumMember2020-01-272020-01-270001555074aamc:AltisourceAssetManagementCorporationv.LuxorCapitalGroupLPMembersrt:MaximumMember2020-01-272020-01-270001555074srt:MinimumMemberaamc:LuxorCapitalPartnersGroupLuxorMember2020-02-032020-02-0300015550742020-02-030001555074aamc:LuxorCapitalPartnersGroupLuxorMember2020-02-032020-02-030001555074aamc:PutnamEquitySpectrumFundandPutnamCapitalSpectrumFundPutnamMemberus-gaap:SeriesAPreferredStockMemberaamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMember2021-02-172021-02-170001555074aamc:PutnamEquitySpectrumFundandPutnamCapitalSpectrumFundPutnamMemberaamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMemberus-gaap:CommonStockMember2021-02-170001555074aamc:PutnamEquitySpectrumFundandPutnamCapitalSpectrumFundPutnamMemberaamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMember2021-02-172021-02-1700015550742021-02-172021-02-170001555074us-gaap:AdditionalPaidInCapitalMember2021-02-172021-02-170001555074aamc:SettlementAgreementWithWellingtonMember2021-08-272021-08-270001555074us-gaap:SeriesAPreferredStockMemberaamc:SettlementAgreementWithWellingtonMember2021-08-272021-08-270001555074us-gaap:SeriesAPreferredStockMemberaamc:SettlementAgreementWithWellingtonMember2021-08-270001555074us-gaap:SubsequentEventMember2022-01-06aamc:investor0001555074us-gaap:SubsequentEventMemberus-gaap:SeriesAPreferredStockMemberaamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMember2022-01-062022-01-060001555074us-gaap:SubsequentEventMemberus-gaap:SeriesAPreferredStockMember2022-01-062022-01-060001555074us-gaap:SubsequentEventMemberus-gaap:SeriesAPreferredStockMember2022-01-060001555074aamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMembersrt:ScenarioForecastMember2022-01-012022-03-3100015550742016-05-2600015550742016-12-29aamc:series_of_preferred_stock0001555074us-gaap:RedeemablePreferredStockMember2021-12-310001555074us-gaap:RedeemablePreferredStockMember2020-12-310001555074us-gaap:PreferredStockMember2021-12-310001555074us-gaap:PreferredStockMember2020-12-310001555074us-gaap:AccountingStandardsUpdate201602Member2019-01-010001555074us-gaap:RetainedEarningsMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-01-01aamc:lease0001555074srt:MinimumMember2021-12-310001555074srt:MaximumMember2021-12-310001555074srt:MinimumMember2021-01-012021-12-310001555074srt:MaximumMember2021-01-012021-12-310001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:TerminationAgreementMember2020-08-130001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:TerminationAgreementMember2020-08-170001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:TerminationAgreementMember2020-12-310001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:RiverBusinessSolutionsPrivateLimitedMemberaamc:TerminationAgreementMember2020-12-310001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:TerminationAgreementMember2020-08-172020-08-170001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:TerminationAgreementMemberus-gaap:CommonStockMember2020-12-312020-12-310001555074aamc:FrontYardResidentialCorporationMembersrt:AffiliatedEntityMemberaamc:TerminationAgreementMemberus-gaap:CommonStockMember2020-12-310001555074us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:AssetManagement1Member2021-01-012021-12-310001555074us-gaap:SegmentDiscontinuedOperationsMemberus-gaap:AssetManagement1Member2020-01-012020-12-310001555074aamc:TerminationFeeMemberus-gaap:SegmentDiscontinuedOperationsMember2021-01-012021-12-310001555074aamc:TerminationFeeMemberus-gaap:SegmentDiscontinuedOperationsMember2020-01-012020-12-310001555074us-gaap:SegmentDiscontinuedOperationsMemberaamc:ExpenseReimbursementsMember2021-01-012021-12-310001555074us-gaap:SegmentDiscontinuedOperationsMemberaamc:ExpenseReimbursementsMember2020-01-012020-12-310001555074us-gaap:SegmentDiscontinuedOperationsMember2021-01-012021-12-310001555074us-gaap:SegmentDiscontinuedOperationsMember2020-01-012020-12-310001555074us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMember2020-12-310001555074us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMemberus-gaap:FairValueInputsLevel1Member2020-12-310001555074us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMemberus-gaap:CommonStockMember2020-12-310001555074us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Memberus-gaap:CommonStockMember2020-12-310001555074aamc:FrontYardResidentialCorporationMemberus-gaap:CommonStockMember2020-12-310001555074aamc:FrontYardResidentialCorporationMemberus-gaap:CommonStockMember2021-01-112021-01-110001555074us-gaap:CommonStockMember2021-01-012021-12-310001555074us-gaap:CommonStockMember2020-01-012020-12-310001555074us-gaap:CommonStockMember2020-12-310001555074us-gaap:EquitySecuritiesMember2020-12-310001555074us-gaap:CommonStockMember2021-12-310001555074us-gaap:EquitySecuritiesMember2021-12-310001555074srt:AffiliatedEntityMemberaamc:FrontYardResidentialCorporationMemberaamc:AmendedAssetManagementAgreementMember2019-05-072019-05-0700015550742021-07-182021-07-1800015550742021-07-212021-07-210001555074us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001555074srt:ManagementMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001555074srt:ManagementMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001555074srt:ManagementMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:RestrictedStockMember2021-01-012021-12-31aamc:installment0001555074srt:ManagementMemberus-gaap:RestrictedStockMember2020-01-012020-12-310001555074us-gaap:RestrictedStockMember2021-01-012021-12-310001555074us-gaap:RestrictedStockMember2020-01-012020-12-310001555074us-gaap:RestrictedStockMember2021-12-310001555074us-gaap:RestrictedStockMember2020-12-310001555074srt:DirectorMemberus-gaap:RestrictedStockMember2021-01-012021-12-310001555074srt:DirectorMemberus-gaap:RestrictedStockMember2020-01-012020-12-310001555074us-gaap:RestrictedStockMember2019-12-310001555074us-gaap:RestrictedStockMember2019-01-012019-12-310001555074aamc:USVirginIslandsMember2021-01-012021-12-310001555074aamc:USVirginIslandsMember2020-01-012020-12-310001555074aamc:OtherjurisdictionMember2021-01-012021-12-310001555074aamc:OtherjurisdictionMember2020-01-012020-12-310001555074us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001555074us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001555074us-gaap:RestrictedStockMember2021-01-012021-12-310001555074us-gaap:RestrictedStockMember2020-01-012020-12-310001555074us-gaap:PreferredStockMember2021-01-012021-12-310001555074us-gaap:PreferredStockMember2020-01-012020-12-310001555074us-gaap:SubsequentEventMember2022-03-312022-03-310001555074us-gaap:SubsequentEventMember2022-03-310001555074us-gaap:SubsequentEventMemberaamc:PutnamEquitySpectrumFundandPutnamCapitalSpectrumFundPutnamMemberaamc:LuxorCapitalGroupLPetal.v.AltisourceAssetManagementCorporationMember2022-02-172022-02-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

COMMISSION FILE NUMBER: 001-36063

Altisource Asset Management Corporation

(Exact name of registrant as specified in its charter)

| | | | | |

| U.S. Virgin Islands | 66-0783125 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

5100 Tamarind Reef

Christiansted, U.S. Virgin Islands 00820

(Address of principal executive office)

(704) 275-9113

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Exchange on which Registered |

| Common stock, par value $0.01 per share | AAMC | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large Accelerated Filer | ☐ | | Accelerated Filer | ☐ |

| Non-Accelerated Filer | ☒ | | Smaller Reporting Company | ☒ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

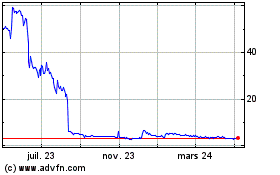

The aggregate market value of common stock held by non-affiliates of the registrant was $17.0 million, based on the closing share price as reported on the New York Stock Exchange on June 30, 2021 and the assumption that all Directors and executive officers of the registrant and their families and beneficial holders of 10% of the registrant's common stock are affiliates. This determination of affiliate status is not necessarily a conclusive determination for any other purpose.

As of March 25, 2022, 2,061,411 shares of our common stock were outstanding (excluding 1,355,130 shares held as treasury stock).

Portions of the Registrant's definitive proxy statement relating to its 2022 annual meeting of shareholders (the "2022 Proxy Statement") are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated. The Registrant intends to file the 2022 Proxy Statement with the U.S. Securities and Exchange Commission not later than 120 days after the end of the fiscal year to which this report relates.

Altisource Asset Management Corporation

December 31, 2021

Table of Contents

References in this report to “we,” “our,” “us,” “AAMC,” or the “Company” refer to Altisource Asset Management Corporation and its consolidated subsidiaries, unless otherwise indicated. References in this report to “Front Yard” refer to Front Yard Residential Corporation and its consolidated subsidiaries, unless otherwise indicated.

Special note on forward-looking statements

Our disclosure and analysis in this Annual Report on Form 10-K contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

The forward-looking statements contained in this report reflect our current views about future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause our actual results to differ significantly from those expressed in any forward-looking statement. Factors that may materially affect such forward-looking statements include, but are not limited to:

•Our ability to develop and implement new businesses or, to the extent such businesses are developed, our ability to make them successful or sustain the performance of any such businesses;

•Developments in the litigation regarding our redemption obligations under the Certificate of Designations of our Series A Convertible Preferred Stock (the “Series A Shares”), including our ability to obtain declaratory relief confirming that we were not obligated to redeem any of the Series A Shares on the March 15, 2020 redemption date if we do not have funds legally available to redeem all, but not less than all, of the Series A Shares requested to be redeemed on that redemption date;

•Our search for a permanent Chief Executive Officer;

•General economic and market conditions;

•The failure of our information technology systems, a breach thereto, and our ability to integrate and improve those systems at a pace fast enough to keep up with competitors and security threats; and

•The potential for the COVID-19 pandemic to adversely affect our business, financial position, operations, business prospects, customers, employees and third-party service providers.

While forward-looking statements reflect our good faith beliefs, assumptions and expectations, they are not guarantees of future performance. Such forward-looking statements speak only as of their respective dates, and we assume no obligation to update them to reflect changes in underlying assumptions or factors, new information or otherwise. For a further discussion of these and other factors that could cause our future results to differ materially from any forward-looking statements contained herein, please refer to the section “Item 1A. Risk Factors.”

Part I

Item 1. Business

Our New Business

Altisource Asset Management Corporation (“we,” “our,” “us,” “AAMC,” or the “Company”) was incorporated in the United States Virgin Islands (“USVI”) on March 15, 2012 (our “inception”), and we commenced operations in December 2012. Our primary business was to provide asset management and certain corporate governance services to institutional investors. In October 2013, we applied for and were granted registration by the Securities and Exchange Commission (the “SEC”) as a registered investment adviser under Section 203(c) of the Investment Advisers Act of 1940. We historically operated in a single segment focused on providing asset management and certain corporate governance services to investment vehicles. Our primary client was Front Yard Residential Corporation (“Front Yard”), a public real estate investment trust (“REIT”) focused on acquiring and managing quality, affordable single-family rental (“SFR”) properties throughout the United States.

On August 13, 2020, we entered into a Termination and Transition Agreement (the “Termination Agreement”) with Front Yard and Front Yard Residential L.P. (“FYR LP”) to terminate the Amended and Restated Asset Management Agreement, dated as of May 7, 2019 (the “Amended AMA”), by and among Front Yard, FYR LP and AAMC, and to provide for a transition plan to facilitate the internalization of Front Yard’s asset management function (the “Transition Plan”). The Termination Agreement was effective on December 31, 2020, the date that the parties mutually agreed that the Transition Plan had been satisfactorily completed (the “Termination Date”) and, the Amended AMA was terminated in its entirety.

As disclosed in our public filings, the Company’s prior business operations ceased in the first week of 2021. During 2021, the Company engaged in a comprehensive search to acquire an operating company with the proceeds received from the sale of its operations in accordance with the Termination Agreement. A range of industries were included in the search, including, but not limited to, real estate lending, cryptocurrency, block-chain technology and insurance operations. Outside professional firms, including among others, Cowen and Company, LLC, an investment bank, and Norton Rose Fulbright LLP, a global law practice, were engaged to provide due diligence, legal and valuation expertise to assist in our search.

Ultimately, in March 2022, AAMC determined to move forward with the newly created Alternative Lending Group (ALG) and grow organically and to pursue an opportunity related to Crypto ATMs.

With a capital commitment of $40 million to grow the operations of ALG, the Company intends to perform the following:

•Build out a niche origination platform as well as a loan acquisition team;

•Fund the originated or acquired alternative loans from a combination of Company equity and future lines of credit;

•Sell the originated and acquired alternative loans through forward commitment and repurchase contracts;

•Leverage senior management’s expertise in this space; and

•Utilize AAMC’s existing operations in India to drive controls and cost efficiencies.

The type of product we expect to originate or acquire are alternative loans that offer opportunities for rapid growth and allow us to tap into underserved markets. We intend to stay agile on the loan product mix, but we are currently focused on markets not addressed by banks, agency aggregators and most traditional lenders, including but not limited to:

•Transitional Loans: bridge loans on single family and commercial real estate;

•Ground-up Construction Loans: assisting developers in projects with the primary focus on workforce housing;

•Investor Loans: Non-agency loans on investment rental properties that are debt service coverage ratio type loans;

•Special Purpose Credit Programs: loans to extend special purpose credit to applicants who meet certain eligibility requirements such as credit assistance programs; and

•“Gig Economy” Loans: Loans to professionals, self-employed borrowers, start-up business owners lacking income documentation to qualify for Agency purchase.

In the near future, we expect our main business segment to be ALG, whose primary sources of income will be derived from mortgage banking activities generated through the origination and acquisition of loans, and their subsequent sale or securitization as well as net interest income from loans while held on the balance sheet.

In addition to ALG operations, AAMC will also invest capital into a Crypto ATM business through its Right of First Refusal Agreement with the cryptocurrency company, ForumPay, with the intent to deploy crypto enabled ATMs worldwide. The

Crypto ATMs using ForumPay's software will generally allow users to purchase multiple cryptocurrencies such as Bitcoin, Ethereum and Litecoin, using fiat currency, sell the same cryptocurrencies and eventually remit payments globally either in cryptocurrency or the local fiat currency. The Company will earn revenue by charging fees for utilizing the ATMs for exchange between cryptocurrency and local fiat currency.

The Right of First Refusal Agreement includes the following provisions:

•Co-marketing efforts between AAMC and ForumPay;

•ForumPay to provide advanced technology that includes:

◦Cash purchases of cryptocurrencies;

◦Cryptocurrency conversions to cash (in local currency);

◦Capacity to fund remittances to third parties (in crypto or local currencies); and

•AAMC will be responsible for ATM hardware, installation, maintenance, operation and insurance.

We will initially invest $2.0 million and plan to invest more as the opportunity warrants.

Environmental, Social and Governance

As AAMC is initiating new operations, its management team will assess its strategic and operational approach to environmental, social, and governance (“ESG”) matters in 2022 and execute on specific ESG initiatives, accordingly. AAMC’s corporate goal of investing in underserved markets is integrated with, and linked to, our approach to ESG matters at AAMC.

Human Capital Resources

As of December 31, 2021, AAMC employed 24 full-time employees, with plans to increase our headcount through the creation of alternative loan origination and acquisition teams. At this time, our employees are primarily based in the United States Virgin Islands and India. The retention of our employees and the ability to attract new employees are core to the sustainability and long-term success of AAMC and we will invest in programs that attract, retain, develop, and care for our people. Cultural priorities and values are closely intertwined with our overarching business strategy and we believe these priorities support AAMC’s ability to fulfill our mission and contribute to our ongoing focus on having a strong, healthy culture and a capable and satisfied workforce.

Diversity, Equity, Inclusion, and Belonging

The Company believes in developing an atmosphere that fosters diversity, equity, inclusion, and belonging (“DEIB”). This mandate starts from the top with our Board of Directors all being persons of color. Our DEIB work is focused on 1) developing and executing programs and processes that increase the representation of female and racially diverse employees at all levels within the organization; and 2) investing in programs, training, and mentorship that contribute to an inclusive and equitable work environment for all our employees. Through our origination activities, we believe that we will have the opportunity to provide liquidity and capital through our assessment of underserved markets.

Competition

We will be subject to intense competition in acquiring, originating, and selling loans, the potential for initiating securitization transactions, and in other aspects of our business. Dependent upon the loan product niche as we expand, our potential competitors may include in varying degrees, commercial banks, mortgage REITs, regional and community banks, other specialty finance companies, financial institutions, as well as investment funds and other investors in real estate-related assets. In addition, other companies may be formed that will compete with us. Some of our competitors may have higher risk tolerances or different risk assessments, which could allow them to consider a wider variety of investments and establish more favorable relationships than we can. Some of our competitors have greater resources than us and we may not be able to compete successfully with them.

Federal and State Regulatory and Legislative Developments

Our new business will be affected by conditions in the housing, business-purpose, multifamily, and real estate markets and the broader financial markets, as well as by the financial condition and resources of other participants in these markets. These

markets and many of the participants in these markets are subject to, or regulated under, various federal and state laws and regulations. In some cases, the government or government-sponsored entities, such as Fannie Mae and Freddie Mac, directly participate in these markets. In particular, because issues relating to residential real estate and housing finance can be areas of political focus, federal, state and local governments may be more likely to take actions that affect residential real estate, the markets for financing residential real estate, and the participants in residential real estate-related industries than they would with respect to other industries. As a result of the government’s statutory and regulatory oversight of the markets we participate in and the government’s direct and indirect participation in these markets, federal and state governmental actions, policies, and directives can have an adverse effect on these markets and on our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future, which effects may be material. For additional discussion regarding federal and state legislative and regulatory developments, see the risk factor below under the heading “Federal and state legislative and regulatory developments and the actions of governmental authorities and entities may adversely affect our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future" in Part I, Item 1A of this Annual Report on Form 10-K.

Information Available on Our Website

Our website can be found at www.altisourceamc.com. We make available, free of charge through the investor information section of our website, access to our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the U.S. Securities Exchange Act of 1934, as well as proxy statements, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the U.S. Securities and Exchange Commission (“SEC”). We also make available, free of charge, access to the charters for our Audit Committee, Compensation Committee, and Governance and Nominating Committee, our Corporate Governance Standards, Policy Regarding Majority Voting, and our Code of Ethics governing our directors, officers, and employees. Within the time period required by the SEC and the New York Stock Exchange, we will post on our website any amendment to the Code of Ethics and any waiver applicable to any executive officer, director, or senior officer (as defined in the Code). In addition, our website includes information concerning purchases and sales of our equity securities by our executive officers and directors, as well as disclosure relating to certain non-GAAP financial measures (as defined in the SEC’s Regulation G) that we may make public orally, telephonically, by webcast, by broadcast, or by similar means from time to time. The information on our website is not part of this Annual Report on Form 10-K.

Our Investor Relations Department can be contacted at 5100 Tamarind Reef, Christiansted, USVI, 00820, Attn: Investor Relations, telephone 704-275-9113 or email ir@altisourceamc.com.

Certifications

Our Interim Chief Executive Officer and Chief Financial Officer have executed certifications dated March 31, 2022, as required by Sections 302 and 906 of the Sarbanes-Oxley Act of 2002, and we have included those certifications as exhibits to this Annual Report on Form 10-K.

Sarbanes-Oxley Act of 2002

The Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”) imposes a wide variety of regulatory requirements on publicly-held companies and their insiders. Many of these requirements affect us. For example:

•Pursuant to Rule 13a-14 under the Exchange Act, our Interim Chief Executive Officer and Chief Financial Officer must certify the accuracy of the financial statements contained in our periodic reports;

•Pursuant to Item 307 of Regulation S-K, our periodic reports must disclose our conclusions about the effectiveness of our disclosure controls and procedures;

•Pursuant to Rule 13a-15 of the Exchange Act, our management must prepare a report regarding its assessment of our internal control over financial reporting; and

•Pursuant to Item 308 of Regulation S-K and Rule 13a-15 of the Exchange Act, our periodic reports must disclose whether there were significant changes in our internal controls or in other factors that could significantly affect these controls subsequent to the date of their evaluation, including any corrective actions with regard to material weaknesses.

The Sarbanes-Oxley Act requires us to review our current policies and procedures to determine whether we comply with the Sarbanes-Oxley Act and the regulations promulgated thereunder. We will continue to monitor our compliance with all

regulations that are adopted under the Sarbanes-Oxley Act and will take actions necessary to ensure that we are in compliance therewith.

Item 1A. Risk Factors

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. Many of these risks relate to our new businesses and will be increasingly critical as we invest additional funds in these businesses and acquire additional mortgage loans. If any of the following risks actually occur, our business, operating results and financial condition could be materially adversely affected.

We face a variety of risks that are substantial and inherent in our businesses. The following is a summary of some of the more important factors that could affect our businesses:

Market

•General economic developments and trends and the performance of the housing, real estate, mortgage finance, and broader financial markets may adversely affect our business and the value of, and returns on, real estate-related and other assets we own or may acquire and could also negatively impact our business and financial results.

•Federal and state legislative and regulatory developments and the actions of governmental authorities and entities may adversely affect our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future.

•Unpredictability of the credit markets may restrict our access to capital and may make it difficult or impossible for us to obtain any required additional financing.

•The future development and growth of our crypto ATM business is subject to a variety of factors that are difficult to predict and evaluate. If the crypto business opportunities do not grow as we expect, our business, operating results, and financial condition could be adversely affected.

•Our businesses, financial condition, liquidity and results of operations have been and may in the future be adversely affected by the COVID-19 pandemic.

Operational

•We may not be successful in entering into new businesses and markets, which could adversely affect our business, results of operations and financial condition.

•Our use of leverage may expose us to substantial risks.

•Operational risks, including those associated with our business model, may disrupt our businesses, result in losses or limit our growth.

•We depend on key personnel to manage our business, and the loss of any key person’s services, combined with our inability to identify and retain a suitable replacement for such person, could materially adversely affect us. Additionally, the cost to retain our key personnel could put pressure on our operating margins.

•Our inability to manage future growth effectively could have an adverse impact on our business, results of operations and financial condition.

•If we fail to develop, enhance and implement strategies to adapt to changing conditions in the real estate and capital markets, our business, results of operations and financial condition may be materially and adversely affected.

Investing

•The nature of the assets we hold and the investments we make expose us to credit risk that could negatively impact the value of those assets and investments, our earnings, dividends, cash flows, and access to liquidity, or otherwise negatively affect our business.

•We may have concentrated credit risk in certain geographical regions and may be disproportionately affected by an economic or housing downturn, natural disaster, terrorist event, climate change, or any other adverse event specific to those regions.

•The timing of credit losses can harm our economic returns.

•Our efforts to manage credit risks may fail.

•Multifamily and business purpose mortgage loan borrowers that have been negatively impacted by the pandemic may not make payments of principal and interest relating to their mortgage loans on a timely basis, or at all, which could negatively impact our business.

•Changes in prepayment rates of mortgage loans could reduce our earnings, dividends, cash flows, and access to liquidity.

•Interest rate fluctuations can have various negative effects on us and could lead to reduced earnings and increased volatility in our earnings.

•Our growth may be limited if assets are not available or not available at attractive prices.

•We may change our investment strategy or financing plans, which may result in riskier investments and diminished returns.

•The performance of the assets we own will vary and may not meet our earnings or cash flow expectations. In addition, the cash flows and earnings from, and market values of loans, we own may be volatile.

•The inability to access financial leverage through warehouse and repurchase facilities, credit facilities, or other forms of debt financing may inhibit our ability to execute our business plan, which could have a material adverse effect on our financial results, financial condition, and business.

•Entering into hedging activities may subject us to increased regulation.

•Our results could be adversely affected by counterparty credit risk.

Internal

•We remain in outstanding litigation with one of the holders of our Series A Convertible Preferred Stock (“Series A Shares”) related to their purported notices under the Certificate of Designations of the Series A Shares (the “Certificate”) to redeem an aggregate of $144.2 million liquidation preference of our Series A Shares in March 2020. If we are required to pay damages or redeem a portion of their Series A Shares, it could materially and adversely affect our ongoing business and liquidity.

•We are subject to the risks of securities laws liability and related civil litigation.

•An unidentified material weakness in our internal control over financial reporting could, if not remediated, result in material misstatements in our financial statements.

•We may become subject to the requirements of the Investment Company Act, which would limit our business operations and require us to spend significant resources to comply with such act.

•Failure to retain the tax benefits provided by the USVI would adversely affect our financial performance.

•Our USVI operations may become subject to United States federal income taxation.

•Our cash balances are held at a number of financial institutions that expose us to their credit risk.

•Our failure to meet the continued listing requirements of the NYSE American could result in a delisting or a halt in the trading of our common stock.

•The market price and trading volume of our common stock may be volatile and may be affected by market conditions beyond our control.

RISKS RELATED TO OUR MARKET GENERALLY

General economic developments and trends and the performance of the housing, real estate, mortgage finance, and broader financial markets may adversely affect our business and the value of, and returns on, real estate-related and other assets we own or may acquire and could also negatively impact our business and financial results.

Our level of business activity and the profitability of our business, as well as the values of, and the cash flows from, the assets we own, are affected by developments in the U.S. economy and the broader global economy. As a result, negative economic developments are likely to negatively impact our business and financial results. There are a number of factors that could contribute to negative economic developments, including, but not limited to, U.S. fiscal and monetary policy changes, including Federal Reserve policy shifts and changes in benchmark interest rates, changing U.S. consumer spending patterns, negative developments in the housing, single-family rental (SFR), multifamily, and real estate markets, rising unemployment, rising government debt levels, changing expectations for, or the occurrence of, inflation and deflation, or adverse global political and economic events, such as the outbreak of pandemic, epidemic disease, or warfare (including the recent outbreak of hostilities between Russia and Ukraine).

Rising inflation and elevated U.S. budget deficits and overall debt levels, including as a result of federal pandemic relief and stimulus legislation and/or economic or market and supply chain conditions, can put upward pressure on interest rates and could be among the factors that could lead to higher interest rates in the future. Higher interest rates could adversely affect our overall business, income, including by reducing the fair value of many of our assets. This may affect our earnings results, reduce our ability to securitize, re-securitize, or sell our assets, or reduce our liquidity. Higher interest rates could also reduce the ability of borrowers to make interest payments or to refinance their loans.

Real estate values, and the ability to generate returns by owning or taking credit risk on loans secured by real estate, are important to our business.

Federal and state legislative and regulatory developments and the actions of governmental authorities and entities may adversely affect our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future.

As noted above, our business is affected by conditions in the housing, business purpose, multifamily, and real estate markets and the broader financial markets, as well as by the financial condition and resources of other participants in these markets. These markets and many of the participants in these markets are subject to, or regulated under, various federal and state laws and regulations. In some cases, the government or government-sponsored entities, such as Fannie Mae and Freddie Mac, directly participate in these markets. In particular, because issues relating to residential housing and real estate finance can be areas of political focus, federal, state and local governments may be more likely to take actions that affect residential housing, the markets for financing residential housing, and the participants in residential housing-related industries than they would with respect to other industries. As a result of the government’s statutory and regulatory oversight of the markets we participate in and the government’s direct and indirect participation in these markets, federal and state governmental actions, policies, and directives can have an adverse effect on these markets and on our business and the value of, and the returns on, mortgages, mortgage-related securities, and other assets we own or may acquire in the future, which effects may be material.

Ultimately, we cannot assure you of the impact that governmental actions may have on our business or the financial markets and, in fact, they may adversely affect us, possibly materially. We cannot predict whether or when such actions may occur or what unintended or unanticipated impacts, if any, such actions could have on our business and financial results. Even after governmental actions have been taken and we believe we understand the impacts of those actions, prevailing interpretations may shift, or we may not be able to effectively respond to them so as to avoid a negative impact on our business or financial results.

Unpredictability of the credit markets may restrict our access to capital and may make it difficult or impossible for us to obtain any required additional financing.

We intend to borrow money from lenders to fund our origination and purchase of mortgage loans. The domestic and international credit markets can be unpredictable. In the event that we need additional capital for our business, we may have a difficult time obtaining it and/or the terms upon which we can obtain it may be unfavorable, which would have an adverse impact on our financial performance.

The future development and growth of our crypto ATM business is subject to a variety of factors that are difficult to predict and evaluate. If the crypto business opportunities do not grow as we expect, our business, operating results, and financial condition could be adversely affected.

Crypto assets built on blockchain technology were only introduced in 2008 and remain in the early stages of development. In addition, different crypto assets are designed for different purposes. Bitcoin, for instance, was designed to serve as a peer-to-peer electronic cash system, while Ethereum was designed to be a smart contract and decentralized application platform. Many other crypto networks, ranging from cloud computing to tokenized securities networks, have only recently been established. The further growth and development of any crypto assets and their underlying networks and other cryptographic and algorithmic protocols governing the creation, transfer, and usage of crypto assets represent a new and evolving paradigm that is subject to a variety of factors that are difficult to evaluate

We will need to be vigilant to protect against various operational risks and technical issues that could potentially result in disabled functionalities, exposure of certain users’ personal information, theft of users’ assets, and other negative consequences, and which would require resolution with the attention and efforts of their global miner, user, and development communities. If any such risks or other risks materialize, and in particular if they are not resolved, the development and growth of crypto may be significantly affected and, as a result, our business, operating results, and financial condition could be adversely affected.

Cryptocurrency is subject to an extensive and highly evolving regulatory landscape and any adverse changes to, or our failure to comply with, any laws and regulations could adversely affect our ability to develop our Crypto ATM business.

The complexity and evolving nature of our business and the significant uncertainty surrounding the regulation of the cryptoeconomy require us to exercise our judgment as to whether certain laws, rules, and regulations apply to us, and it is possible that governmental bodies and regulators may disagree with our conclusions. To the extent we have not complied with such laws, rules, and regulations, we could be subject to significant fines, revocation of licenses, limitations on our products and services, reputational harm, and other regulatory consequences, each of which may be significant and could adversely affect our business, operating results, and financial condition.

Our businesses, financial condition, liquidity and results of operations have been and may in the future be adversely affected by the COVID-19 pandemic.

The COVID-19 pandemic created economic and financial disruptions that have in the past adversely affected and may in the future adversely affect our business, financial condition, liquidity and results of operations. The extent to which the COVID-19 pandemic will negatively affect our businesses, financial condition, liquidity and results of operations will depend on future developments, including the emergence of new variants of COVID-19 and the effectiveness of vaccines and treatments over the long term and against new variants, which are highly uncertain and cannot be predicted.

While financial markets have rebounded from the significant declines that occurred early in the pandemic and global economic conditions generally improved in 2021, certain of the circumstances that arose or became more pronounced after the onset of the COVID-19 pandemic persisted in 2021, including (i) relatively weak consumer confidence; (ii) low levels of the federal funds rate and yields on U.S. Treasury securities which, at times, were near zero; (iii) higher cyber security, information security and operational risks; and (iv) interruptions in the supply chain that have adversely affected many businesses and have contributed to higher rates of inflation.

Depending on the duration and severity of the pandemic going forward, as well as the effects of the pandemic on consumer confidence, the conditions noted above could continue for an extended period and other adverse developments may occur or reoccur, including defaults by consumers on loans and changes in consumer spending or borrowing patterns. Our ability to enter into new business, acquire new business, and grow new business has been materially impacted by COVID-19 and related governmental measures imposed to contain the virus, such as the closure of stores, restrictions on travel, quarantines or stay-at-home orders. If the disruptions caused by the pandemic continue, our ability to succeed at these new businesses could suffer materially.

Travel restrictions, the closure of non-essential businesses or shelter-in-place/stay-at-home orders may make it more difficult and costly for our business. This extended period of remote working by our employees may introduce operational risks, including technology availability and heightened cybersecurity risk. Remote working environments may be less secure and more susceptible to hacking attacks, including phishing and social engineering attempts that seek to exploit the COVID-19 pandemic. In addition, our data security, data privacy, investor reporting and business continuity processes could be impacted by a third party’s inability to perform due to COVID-19 or by failures of, or attacks on, their information systems and technology. Our accounting and financial reporting systems, processes, and controls could be impacted as a result of these risks.

Governmental authorities worldwide have taken increased measures to stabilize the markets and support economic growth. The continued success of these measures is unknown and they may not be sufficient to address future market dislocations or avert severe and prolonged reductions in economic activity.

RISKS RELATED TO OUR OPERATIONS

We may not be successful in entering into new businesses and markets, which could adversely affect our business, results of operations and financial condition.

Our new strategy focuses on the purchase and origination of mortgage loans. Given our focus across the real estate industry, these initiatives could increase our costs and expose us to new market risks and legal and regulatory requirements. These loans have different economic structures than our previous businesses and will require different strategies and policies and procedures. These activities also may impose additional compliance burdens on us, subject us to enhanced regulatory scrutiny and expose us to greater reputation and litigation risk.

The success of our growth strategy will depend on, among other things:

•Our ability to correctly originate and purchase mortgage loans that appeal to end investors;

•The diversion of management’s time and attention into the growth of such new businesses;

•Management’s ability to spend time developing and integrating the new business and the success of the integration effort;

•Our ability to identify and manage risks in new lines of businesses;

•Our ability to obtain requisite approvals and licenses from the relevant governmental authorities and to comply with applicable laws and regulations without incurring undue costs and delays; and

•Our ability to successfully negotiate and enter into beneficial arrangements with our counterparties.

We are also entering into a new Crypto ATM business. We may not be successful in this new business and even if we do succeed in creating revenues in these businesses, they may not be profitable.

In some instances, we may determine that growth in a specific area is best achieved through the acquisition of an existing business or a smaller scale lift out of an origination team to enhance our platform. Our ability to consummate an acquisition will depend on our ability to identify and value potential acquisition opportunities accurately and successfully compete for these businesses against companies that may have greater financial resources. Even if we are able to identify and successfully negotiate and complete an acquisition, these transactions can be complex and we may encounter unexpected difficulties or incur unexpected costs.

In addition, if a new business or venture developed internally or by acquisition is unsuccessful, we may decide to wind down, liquidate and/or discontinue it. Such actions could negatively impact our relationships with our counterparties in those businesses, could subject us to litigation or regulatory inquiries and can expose us to additional expenses, including impairment charges.

Our use of leverage may expose us to substantial risks.

We intend to use indebtedness as a means to finance our future business operations, which will expose us to the risks associated with using leverage. We are dependent on financial institutions extending credit to us on reasonable terms to finance our new business. There is no guarantee that such institutions will extend credit to us or that we will be able to refinance any new obligations when they mature. As borrowings under any future credit facility or any other indebtedness mature, we may be required to either refinance them by entering into a new facility or issuing additional debt, which could result in higher borrowing costs, or issuing additional equity, which would dilute existing stockholders. We could also repay them by using cash on hand, cash provided by our continuing operations or cash from the sale of our assets, which could reduce dividends to our stockholders. We could have difficulty entering into new facilities or issuing debt or equity securities in the future on attractive terms, or at all.

Operational risks, including those associated with our business model, may disrupt our businesses, result in losses or limit our growth.

We rely heavily on our financial, accounting, information and other data processing systems. We may face various security threats, including cyber security threats to and attacks on our information technology infrastructure that are intended to gain access to our proprietary information, destroy data or disable, degrade or sabotage our systems. These security threats could originate from a wide variety of sources, including unknown third parties outside the company.

There may be an increase in the frequency and sophistication of the cyber and security threats we face, with attacks ranging from those common to businesses generally to those that are more advanced and persistent, which may target us because, as an alternative lender, we hold an amount of confidential and sensitive information about our borrowers, our portfolio companies and potential investments. As a result, we may face a heightened risk of a security breach, online extortion attempt, or disruption with respect to this information resulting from an attack by computer hackers, foreign governments, cyber extortionists or cyber terrorists. If successful, these types of attacks on our network or other systems could have a material adverse effect on our business and results of operations, due to, among other things, the loss of investor or proprietary data, interruptions or delays in our business and damage to our reputation. Our suppliers, contractors, investors, and other third parties with whom we do business also experience cyber threats and attacks that are similar in frequency and sophistication. In many cases, we have to rely on the controls and safeguards put in place by our suppliers, contractors, investors and other third parties to defend against, respond to, and report these attacks.

We depend on key personnel to manage our business, and the loss of any key person’s services, combined with our inability to identify and retain a suitable replacement for such person, could materially adversely affect us. Additionally, the cost to retain our key personnel could put pressure on our operating margins.

Our success is largely dependent on the skills, experience, and performance of our key personnel. The business acumen, expertise, and business relationships of our key personnel are critical elements in developing our new businesses. Financial services professionals are in high demand, and we face significant competition for qualified employees. The loss of services of any of our key personnel for any reason, combined with our inability to identify and retain a suitable replacement for such person, could have a material adverse effect on our business, results of operations, and financial condition. Moreover, to retain key personnel, we may be required to increase compensation to such individuals, resulting in additional expense.

Our inability to manage future growth effectively could have an adverse impact on our business, results of operations and financial condition.

Our ability to grow will depend on our management’s ability to originate and/or acquire investor real estate loans. In order to do this, we will need to identify, hire, train, supervise and manage new employees. Any failure to effectively manage our future growth, including a failure to successfully expand our loan origination activities could have a material and adverse effect on our business, results of operations and financial condition.

If we fail to develop, enhance and implement strategies to adapt to changing conditions in the real estate and capital markets, our business, results of operations and financial condition may be materially and adversely affected.

The manner in which we compete and the loans for which we compete are affected by changing conditions, which can take the form of trends or sudden changes in our industry, regulatory environment, changes in the role of government-sponsored entities, changes in the role of credit rating agencies or their rating criteria or process or the United States economy more generally. If we do not effectively respond to these changes, or if our strategies to respond to these changes are not successful, our business, results of operations and financial condition may be materially and adversely affected.

RISKS RELATED TO OUR INVESTING STRATEGY

The nature of the assets we hold and the expected investments we make could potentially expose us to credit risk that could negatively impact the value of those assets and investments, our earnings, dividends, cash flows, and access to liquidity, or otherwise negatively affect our business.

Overview of credit risk

We assume credit risk primarily through the ownership of business purpose and multifamily real estate loans. Credit losses on these types of real estate loans can occur for many reasons, including: fraud; poor underwriting; poor servicing practices; weak economic conditions; increases in payments required to be made by borrowers; declines in the value of real estate; declining rents and/or elevated delinquencies associated with single- and multifamily rental housing; the outbreak of highly infectious or contagious diseases; natural disasters, the effects of climate change (including flooding, drought, wildfires, and severe weather) and other natural events; uninsured property loss; over-leveraging of the borrower; costs of remediation of environmental conditions, such as indoor mold; changes in zoning or building codes and the related costs of compliance; acts of war or terrorism; changes in legal protections for lenders and other changes in law or regulation; and personal events affecting borrowers, such as reduction in income, job loss, divorce, or health problems. In addition, the amount and timing of credit losses could be affected by loan modifications, delays in the liquidation process, documentation errors, and other action by servicers. Weakness in the U.S. economy or the housing market could cause our credit losses to increase beyond levels that we currently anticipate.

Credit losses on business purpose and multifamily real estate loans can occur for many of the reasons noted above. Moreover, these types of real estate loans may not be fully amortizing and, therefore, the borrower’s ability to repay the principal when due may depend upon the ability of the borrower to refinance or sell the property at maturity. Business purpose and multifamily real estate loans and real estate loans collateralizing business purpose and multifamily securities are particularly sensitive to conditions in the rental housing market and to demand for residential rental properties.

For loans we own directly, we will most likely be in a position to incur credit losses - should they occur - only after losses are borne by the owner of the property (e.g., by a reduction in the owner’s equity stake in the property). We may take actions available to us in an attempt to protect our position and mitigate the amount of credit losses, but these actions may not prove to be successful and could result in our increasing the amount of credit losses we ultimately incur on a loan.

Additionally, loans to small, privately owned businesses such as borrowers from our business purpose loan origination platforms involve a high degree of business and financial risk. Often, there is little or no publicly available information about these businesses. Accordingly, we must rely on our own due diligence to obtain information in connection with our investment decisions. A borrower’s ability to repay its loan may be adversely impacted by numerous factors, including a downturn in its industry or other negative local or more general economic conditions. Deterioration in a borrower’s financial condition and prospects may be accompanied by deterioration in the collateral for the loan. These factors may have an impact on loans involving such businesses, and can result in substantial losses, which in turn could have a material and adverse effect on our business, results of operations and financial condition.

We may have concentrated credit risk in certain geographical regions and may be disproportionately affected by an economic or housing downturn, natural disaster, terrorist event, climate change, or any other adverse event specific to those regions.

A decline in the economy or difficulties in certain real estate markets, such as a high level of foreclosures in a particular area, are likely to cause a decline in the value of multifamily properties in that market. This, in turn, will increase the risk of delinquency, default, and foreclosure on real estate loans we may hold with properties in those regions. This may then adversely affect our credit loss experience and other aspects of our business, including our ability to securitize (or otherwise sell) real estate loans and securities.

The occurrence of a natural disaster (such as an earthquake, tornado, hurricane, flood, landslide, or wildfire), or the effects of climate change (including flooding, drought, and severe weather), may cause decreases in the value of real estate (including sudden or abrupt changes) and would likely reduce the value of the properties collateralizing real estate loans we own. For example, in recent years, hurricanes have caused widespread flooding in Florida and Texas and wildfires and mudslides in northern and southern California have destroyed or damaged thousands of homes. Since certain natural disasters may not typically be covered by the standard hazard insurance policies maintained by borrowers, the borrowers may have to pay for repairs due to the disasters. Borrowers may not repair their property or may stop paying their mortgage loans under those circumstances, especially if the property is damaged. This would likely cause foreclosures to increase and lead to higher credit losses on our loans.

The timing of credit losses can harm our economic returns.

The timing of credit losses can be a material factor in our economic returns from real estate loans, investments, and securities. If unanticipated losses occur within the first few years after a loan is originated, those losses could have a greater negative impact on our investment returns than unanticipated losses on more seasoned loans. The timing of credit losses could be affected by the creditworthiness of the borrower, the borrower’s willingness and ability to continue to make payments, and new legislation, legal actions, or programs that allow for the modification of loans or rental obligations, or ability for borrowers or tenants to get relief through forbearance, bankruptcy or other avenues.

Our efforts to manage credit risks may fail.

We will attempt to manage risks of credit losses by continually evaluating our investments for impairment indicators and establishing reserves under GAAP for credit and other risks based upon our assessment of these risks. We cannot establish credit reserves for tax accounting purposes. The amount of reserves that we establish may prove to be insufficient, which would negatively impact our financial results and would result in decreased earnings. In addition, cash and other capital we hold to help us manage credit and other risks and liquidity issues may prove to be insufficient. If these increased credit losses are greater than we anticipated and we need to increase our credit reserves, our GAAP earnings might be reduced. Increased credit losses may also adversely affect our cash flows, ability to invest, asset fair values, access to short-term borrowings, and ability to finance assets.

Changes in consumer behavior, bankruptcy laws, tax laws, regulation of the mortgage industry, and other laws may exacerbate loan or investment losses. In most cases, the value of the underlying property will be the sole effective source of funds for any recoveries. Other changes or actions by judges or legislators regarding mortgage loans and contracts, including the voiding of certain portions of these agreements, may reduce our earnings, impair our ability to mitigate losses, or increase the probability and severity of losses. Any expansion of our loss mitigation efforts could increase our operating costs and the expanded loss mitigation efforts may not reduce our future credit losses.

Multifamily and business purpose mortgage loan borrowers that have been negatively impacted by the pandemic may not make payments of principal and interest relating to their mortgage loans on a timely basis, or at all, which could negatively impact our business.

Multifamily and business purpose loans we are to own could be subject to similar risks as those described above and could likely be impaired, potentially materially to the extent multifamily and business purpose loan borrowers have been negatively impacted by the pandemic and do not timely remit payments of principal and interest relating to their mortgage loans. In addition, if tenants who rent their residence from a multifamily or business purpose loan borrower are unable to make rental payments, are unwilling to make rental payments, or a waiver of the requirement to make rental payments on a timely basis, or at all, is available under the terms of any applicable forbearance or waiver agreement or program (which rental payment forbearance or waiver program may be available as a result of a government-sponsored or -imposed program or under any such agreement or program a landlord may otherwise offer to tenants), then the value of multifamily and business purpose loans we

own will likely be impaired, potentially materially. Moreover, to the extent the economic impact of any such pandemic impacts local, regional or national economic conditions, the value of multifamily and residential real estate that secures multifamily and business purpose loans is likely to decline, which would also likely negatively impact the value of mortgage loans we own, potentially materially.

Additionally, a significant amount of the business purpose loans that we own are short-term bridge loans that are secured by residential properties that are undergoing rehabilitation or construction and not occupied by tenants. Because these properties are generally not income producing (e.g., from rental revenue), in order to fund principal and interest payments, these borrowers may seek to renegotiate the terms of their mortgage loan, including by seeking payment forbearances, waivers, or maturity extensions as a result of being negatively impacted by the pandemic. Moreover, planned construction or rehabilitation of these properties may not be able to proceed on a timely basis or at all due to operating disruptions or government mandated moratoriums on construction, development or redevelopment. All of the foregoing factors would also likely negatively impact the value of mortgage loans we own, potentially materially.

Changes in prepayment rates of mortgage loans could reduce our earnings, dividends, cash flows, and access to liquidity.

The economic returns we earn from most of the real estate loans we own are affected by the rate of prepayment of the mortgage loans. Prepayments are difficult to accurately predict and adverse changes in the rate of prepayment could reduce our cash flows, earnings, and dividends. Adverse changes in cash flows would likely reduce the fair values of many of our assets, which could reduce our ability to borrow against our assets and may cause market valuation adjustments for GAAP purposes, which could reduce our reported earnings. While we will estimate prepayment rates to determine the effective yield of our assets and valuations, these estimates are not precise and prepayment rates do not necessarily change in a predictable manner as a function of interest rate changes. Prepayment rates can change rapidly. As a result, changes can cause volatility in our financial results, affect our ability to securitize assets, affect our ability to fund acquisitions, and have other negative impacts on our ability to generate earnings.

Some of the business purpose loans we originate or hold may allow the borrower to make prepayments without incurring a prepayment penalty and some may include provisions allowing the borrower to extend the term of the loan beyond the originally scheduled maturity. Because the decision to prepay or extend a business purpose loan is controlled by the borrower, we may not accurately anticipate the timing of these events, which could affect the earnings and cash flows we anticipate and could impact our ability to finance these assets.

Interest rate fluctuations can have various negative effects on us and could lead to reduced earnings and increased volatility in our earnings.

Changes in interest rates, the interrelationships between various interest rates, and interest rate volatility could have negative effects on our earnings, the fair value of our assets and liabilities, loan prepayment rates, and our access to liquidity. Changes in interest rates can also harm the credit performance of our assets. We may seek to hedge some but not all interest rate risks. Our hedging may not work effectively and we may change our hedging strategies or the degree or type of interest rate risk we assume.

Some of the loans we may own or acquire may have adjustable-rate coupons (i.e., they may earn interest at a rate that adjusts periodically based on an interest rate index). The cash flows we receive from these assets may vary as a function of interest rates, as may the reported earnings generated by these loans. We also may acquire loans and securities for future sale, as assets we are accumulating for securitization, or as a longer-term investment. We may fund assets with a combination of equity, fixed rate debt and adjustable rate debt. To the extent we use adjustable rate debt to fund assets that have a fixed interest rate (or use fixed rate debt to fund assets that have an adjustable interest rate), an interest rate mismatch could exist and we could, for example, earn less (and fair values could decline) if interest rates rise, at least for a time. We may or may not seek to mitigate interest rate mismatches for these assets with hedges such as interest rate agreements and other derivatives and, to the extent we do use hedging techniques, they may not be successful.

Higher interest rates generally will reduce the fair value of many of our assets. This may affect our earnings results, reduce our ability to sell our assets, or reduce our liquidity. Higher interest rates could reduce the ability of borrowers to make interest payments or to refinance their loans. Higher interest rates could reduce property values and increased credit losses could result. Higher interest rates could reduce mortgage originations, thus reducing our opportunities to acquire new assets.

It can be difficult to predict the impact on interest rates of unexpected and uncertain global political and economic events, such as the outbreak of pandemic or epidemic disease, warfare (including the recent outbreak of hostilities between Russia and Ukraine), economic and international trade conflicts or sanctions, the change in the U.S. presidential administration and

political makeup of the Congress, or changes in the credit rating of the U.S. government; however, increased uncertainty or changes in the economic outlook for, or rating of, the creditworthiness of the U.S. government may have adverse impacts on, among other things, the U.S. economy, financial markets, the cost of borrowing, the financial strength of counterparties we transact business with, and the value of assets we hold. Any such adverse impacts could negatively impact the availability to us of short-term debt financing, our cost of short-term debt financing, our business, and our financial results.

Our growth may be limited if assets are not available or not available at attractive prices.

To reinvest the proceeds from principal repayments we receive on our existing loans and deploy capital we raise, we may seek to originate, invest in, or acquire new assets. If the availability of new assets is limited, we may not be able to originate, invest in, or acquire assets that will generate attractive returns. Generally, asset supply can be reduced if originations of a particular product are reduced or if there are fewer sales in the secondary market of seasoned product from existing portfolios. In particular, assets we believe have a favorable risk/reward ratio may not be available for purchase (or origination by our business purpose loan origination platform).

We originate business purpose loans, but we may not be willing to provide the level of loan proceeds to the borrower or interest rate that borrowers find acceptable or that matches our competitors, which would likely reduce the volume of these types of loans that we originate.

We may change our investment strategy or financing plans, which may result in riskier investments and diminished returns.

We may change our investment strategy or financing plans at any time, which could result in our making investments that are different from, and possibly riskier than, the investments we are currently planning to make. A change in our investment strategy or financing plans may increase our exposure to interest rate and default risk and real estate market fluctuations. Decisions to employ additional leverage could increase the risk inherent in our investment strategy. Furthermore, a change in our investment strategy could result in our making investments in new asset categories or in different proportions among asset categories than management’s current strategy. Alternatively, we could determine to change our investment strategy or financing plans to be more risk averse, resulting in potentially lower returns, which could also have an adverse effect on our financial returns.

The performance of the assets we own will vary and may not meet our earnings or cash flow expectations. In addition, the cash flows and earnings from, and market values of loans, we own may be volatile.

We seek to manage certain of the risks associated with acquiring, originating, holding, selling, and managing real estate loans. No amount of risk management or mitigation, however, can change the variable nature of the cash flows of, fair values of, and financial results generated by these loans. Changes in the credit performance of, or the prepayments on, these real estate loans, and changes in interest rates impact the cash flows on these loans, and the impact could be significant for our loans with concentrated risks. Changes in cash flows lead to changes in our return on investment and also to potential variability in and level of reported income. The revenue recognized on some of our assets is based on an estimate of the yield over the remaining life of the asset. Thus, changes in our estimates of expected cash flow from an asset will result in changes in our reported earnings on that asset in the current reporting period. We may be forced to recognize adverse changes in expected future cash flows as a current expense, further adding to earnings volatility.

The inability to access financial leverage through warehouse and repurchase facilities, credit facilities, or other forms of debt financing may inhibit our ability to execute our business plan, which could have a material adverse effect on our financial results, financial condition, and business.

Our ability to fund our business depends on our securing warehouse, repurchase, or other forms of debt financing (or leverage) on acceptable terms. For example, pending the sale of a pool of mortgage loans we intend to generally fund those mortgage loans through borrowings from warehouse, repurchase, and credit facilities, and other forms of short-term financing.

We cannot assure you that we will be successful in establishing sufficient sources of short-term debt when needed. In addition, because of its short-term nature, lenders may decline to renew our short-term debt upon maturity or expiration, and it may be difficult for us to obtain continued short-term financing. To the extent our business calls for us to access financing and counterparties are unable or unwilling to lend to us, then our business and financial results will be adversely affected. It is also possible that lenders who provide us with financing could experience changes in their ability to advance funds to us,

independent of our performance or the performance of our loans, in which case funds we had planned to be able to access may not be available to us.

Entering into hedging activities may subject us to increased regulation.

Under the Dodd-Frank Act, there is increased regulation of companies that enter into interest rate hedging agreements and other hedging instruments and derivatives. This increased regulation could result in us being required to register and be regulated as a commodity pool operator or a commodity trading advisor. If we are not able to maintain an exemption from these regulations, it could have a negative impact on our business or financial results. Moreover, rules requiring central clearing of certain interest rate swap and other transactions, as well as rules relating to margin and capital requirements for swap transactions and regulated participants in the swap markets, as well as other swap market regulatory reforms, may increase the cost or decrease the availability to us of hedging transactions.

Our results could be adversely affected by counterparty credit risk.