ASFV Committee Reveals Troubling Statements Made by Entrenched AIM Board Uncovered Through Discovery in Delaware Action

24 Octobre 2022 - 2:30PM

Jonathan Jorgl, an AIM ImmunoTech Inc. (NYSE American: AIM) (“AIM”)

stockholder, together with his nominees, Robert L. Chioini and

Michael Rice (collectively, the “AIM Stockholder Full Value

Committee” or the “ASFV Committee”), today announced that several

alarming statements from the incumbent directors were uncovered

through the discovery process in the pending Delaware Action in

which the parties are awaiting a ruling. The ASFV Committee

remains confident that Mr. Jorgl’s nomination was valid. Until

the court rules, the stockholders should not be distracted by

cherry-picked, incomplete, and misleading information disseminated

by the incumbent board.

“We believe the entrenched AIM Board’s

statements about stockholders, expectation for excessive

compensation, and tactics to deny any stockholder nomination are

truly reprehensible,” stated the ASFV Committee. “The Board’s

actions, before the ASFV nomination and since, clearly demonstrate

that they are breaching their fiduciary duties to the Company and

its stockholders. We believe it is clear that this entrenched Board

is not putting the interests of the Company and its stockholders

first in making decisions and evaluating opportunities.”

What actually was learned through discovery,

among many other troubling findings not becoming of a board of

directors, was that:

The Incumbent Board Does Not Care that

Stockholders Are Incurring Massive Losses

- All the directors testified during

their depositions that they did not pay much attention to AIM’s

tumbling stock price and that they took no responsibility for its

decline, going as far as blaming “the war in Ukraine,” Vladimir

Putin, the COVID-19 pandemic, and “stock manipulation” schemes by

unknown actors.

- William Mitchell – the Chairman of

AIM’s Board – also testified that “the only thing that concerns”

him about the plummeting stock price if the price got low enough to

trigger the delisting of AIM’s stock.

- The Board systematically ignores

stockholder inquiries, methodically blocks stockholder email

addresses, fails to hold investor calls for multi-month stretches

at a time, and rarely tracks or discusses AIM’s stock.

- William Mitchell admitted he “does

not hear any report about what the stockholders think” and “refuses

to talk with stockholders directly.”

- Thomas Equels went so far as to

call certain stockholders “troll[s],” accused others of not being

“legitimate stockholders,” and confirmed that he has outsourced all

investor relations to outside consultants that either block or

filter out the negative commentary, so the incumbent directors

never have to hear of it.

- Rather than confront disgruntled

stockholders, the incumbent Board has tried to bully them into

submission through frivolous lawsuits, defamatory press releases,

and threatening legal letters as part of a long-standing practice

to silence stockholders whom the Board believes are capable of

starting a proxy contest.

Rather than Expand the Board to Better

AIM and Restore Stockholder Value, the Incumbent Board Has Instead

Elected to Use AIM’s Cash to Fund Increases in Their

Compensation

- The incumbent board members

admitted facts demonstrating that they are in over their heads,

such as: (i) the fact that Thomas Equels (a lawyer by training) has

had to learn how to run AIM “on the job” given that he has no prior

experience working in pharmaceutical companies, running a public

company, or overseeing clinical trials; (ii) the fact that William

Mitchell is an academic with no other experience sitting on the

board of a public company; and (iii) the fact that Stewart

Appelrouth (an accountant by training) has no prior experience

working for a pharmaceutical company or sitting on the board of a

public company.

- The only apparent reason Thomas

Equels appointed Stewart Appelrouth to the board is that Appelrouth

is a long-time friend and colleague of Equels who had assisted

Equels and his wife on their personal income tax returns and served

as a testifying expert in cases handled by Equels and his wife when

they were in private practice.

- Peter Rodino – the executive who

Thomas Equels principally relies to run the company – is

overstretched given that he is currently attempting to fulfill four

separate roles at AIM, including serving as AIM’s Chief Operating

Officer (even though he has no prior experience in that role),

General Counsel (even though he had not practiced law for 16 years

prior to taking this role), Executive Director of Governmental

Relations (another role he has never held), and Corporate Secretary

(another role he has never held).

- Notwithstanding the foregoing, the

incumbent Board members have never once considered expanding the

Board or hiring executives with relevant experience to help run

AIM.

- Instead, since taking control of

the Board in 2016, the incumbent board members have focused on

increasing their compensation packages, with Equels’s package

increasing by millions of dollars during this time. One AIM

stockholder testified that when he confronted Equels about this

bloated compensation package, Equels said that he needs to be

compensated millions of dollars per year because he had grown

accustomed to making that compensation when he was a trial

lawyer.

The Incumbent Board Members Rejected Mr.

Jorgl’s Nomination Letter so They Could Entrench Themselves and

Keep Enriching Themselves Off of the Backs of AIM

Stockholders

- William Mitchell testified during

his deposition that he knew he was going to reject Mr. Jorgl’s

nomination letter as soon as it came in (and before any

investigation into its validity) and that he just needed any

pretext – no matter how flimsy or attenuated – to reject it.

- Within just hours after receiving

Mr. Jorgl’s nomination letter, the incumbent board’s lawyers and

consultants were instructed to “scrub” the nomination letter to

find some reason to deny it.

- The so-called “investigation” that

the Board conducted was results-oriented and conducted for the sole

reason of rejecting the nominations – it consisted entirely of

“Google searches” by Thomas Equels and Peter Rodino.

- Thomas Equels admitted that his

inquiry into Mr. Jorgl’s nomination letter did not reveal “direct

evidence” that supported their basis for rejecting the nominations,

i.e., that there were undisclosed arrangements or understandings

between the ASFV Committee and other AIM stockholders that the

Board believed were “involved” in this nomination.

- William Mitchell and Peter Rodino

admitted that AIM’s conclusion that these individuals were all

working together was based on nothing but a “hypothesis” and

“speculation” that very well “could be wrong.”

- William Mitchell admitted that, had

Mr. Jorgl disclosed those (nonexistent) arrangements or

understandings, Mitchell still would have rejected Mr. Jorgl’s

nomination letter – confirming he was always going to reject the

nominations, regardless of their validity.

- The members of the ASFV Committee

each stated through uncontroverted sworn testimony that they had no

undisclosed arrangements or understandings of any kind, including

with the four AIM stockholders the Board (erroneously) believed

were involved in Mr. Jorgl’s nomination efforts.

- And each of the four AIM

stockholders similarly stated through uncontroverted sworn

testimony that they were not involved with Mr. Jorgl’s nomination

efforts, much less had “arrangements or understandings” with the

ASFV Committee about those nominations. In other words, the

incumbent Board’s pretext for denying Mr. Jorgl’s nomination letter

has been debunked.

The ASFV Committee continued:

What has become

evident is that the incumbent directors have enriched themselves at

the expense of stockholders and patients. They are now panicking

that they may lose their board seats (and excessive compensation)

in a fair election and are desperately trying to spin any narrative

to take the focus off their bad behavior to avoid their expected

proxy loss. The preliminary injunction hearing in Delaware was held

on October 5th, and the parties are currently awaiting a ruling.

The ASFV Committee remains confident that Mr. Jorgl’s nomination

was valid. Pending a decision by the court, the stockholders should

not be distracted by the false narrative and misleading information

disseminated by the incumbent board.

It is time for accountability and much

needed change at AIM – the ASFV Committee urges all stockholders to

vote on the GOLD proxy

card today to elect ONLY Robert L. Chioini and Michael

Rice.

It is important that you mark the boxes

for Robert L. Chioini and Michael Rice ONLY and

leave the boxes for the incumbent AIM directors

unmarked.

Contact:

Alliance Advisors, LLC200 Broadacres Drive, 3rd

FloorBloomfield, New Jersey

07003(877) 728-5012aim@allianceadvisors.com

Important Information and Participants in the

Solicitation

The ASFV Committee has filed a definitive proxy statement and

associated GOLD proxy card with the

Securities and Exchange Commission (“SEC”) to be used to solicit

votes for the election of its slate of highly-qualified director

nominees at the Annual Meeting. Details regarding the ASFV

Committee’s nominees are included in the proxy statement.

THE ASFV COMMITTEE STRONGLY ADVISES ALL STOCKHOLDERS OF AIM TO

READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME

AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

Information regarding the identity of participants in the ASFV

Committee’s solicitation, and their direct or indirect interests,

by security holdings or otherwise, is set forth in the ASFV

Committee’s proxy statement. Stockholders can obtain a copy of the

proxy statement, and any amendments or supplements thereto and

other documents filed by the ASFV Committee with the SEC for no

charge at the SEC’s website at www.sec.gov. Copies will also be

available at no charge at the following website:

https://viewproxy.com/aim/. Investors can also contact Alliance

Advisors at the telephone number or email address set for the

above.

As of the date hereof, Mr. Jorgl is the record and beneficial

owner of 1,000 shares of common stock, par value $0.001 per share,

of AIM (the “common stock”). As of the date hereof, no other

Participant is the record or beneficial owner of any shares of

common stock.

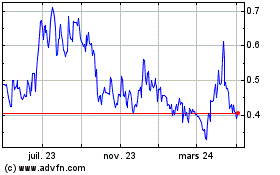

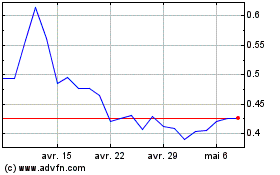

AIM ImmunoTech (AMEX:AIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

AIM ImmunoTech (AMEX:AIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024