UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

(Amendment No. )

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| |

|

| ☐ |

Confidential, for Use of the Commission Only (as Permitted

by Rule 14a-6(e)(2)) |

| |

|

| ☐ |

Definitive Proxy Statement |

| |

|

| ☒ |

Definitive Additional Materials |

| |

|

| ☐ |

Soliciting Material under § 240.14a-12 |

AIM

ImmunoTech Inc.

(Name

of Registrant as Specified in its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with

preliminary materials |

| |

|

| ☐ |

Fee computed on table in

exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

AIM

ImmunoTech Board Issues Letter to Shareholders

Corrects

the Record Regarding Activist Group’s False and Misleading Statements

Highlights

Evidence of Group’s Scheme to Have Jorgl Serve as the “Face of the Activist” to Help Them “Get Control”

Without Paying a Premium to All Shareholders

Group

Concealed that Its Campaign Was Orchestrated by One Convicted Felon and Financed by Another Criminal – Until Forced to Do So in

Context of Litigation

Urges

Shareholders to Continue to Support Company’s Positive Momentum Towards Value Creation by Voting on the WHITE Proxy Card

to Re-Elect AIM’s Current Directors

OCALA,

Fla., October 26, 2022 — The Board of Directors (“Board”) of AIM ImmunoTech Inc. (NYSE: American AIM) (“AIM”

or the “Company”) today issued a letter to shareholders to correct the record around recent false and misleading statements

made by Jonathan Jorgl and other members of an activist group, who have attempted to nominate two director candidates for election as

directors at the Company’s 2022 Annual Meeting of Shareholders and are seeking to take control of the Board.

The

full text of the letter follows:

October

26, 2022

Dear

fellow shareholders:

We

are writing to you today to set the record straight following the web of false and misleading statements made recently by a group of

individuals that is trying to take control of the Board of Directors (the “Board”) of AIM ImmunoTech (the “Activist

Group”). Key facts that the Activist Group is concealing include:

| |

1. |

The

fact that its campaign to gain control of AIM has been orchestrated by an individual – Franz Tudor – who has been

convicted of insider trading and is being funded by another individual – Michael Xirinachs – who recently pled guilty

to wire fraud. |

| |

2. |

After

Tudor determined to seek control via a proxy contest and selected the director nominees, he and his nominees searched for someone

to buy AIM stock and serve as the “face” of the effort because the Activist Group wanted to hide the involvement

of criminals (i.e., Tudor and Xirinachs). |

| |

3. |

The

Activist Group intends to potentially acquire AIM, merge it with another company or sell all or part of the Company. |

Given

that these facts only came out in the context of expedited litigation in which the Activist Group tried to prevent and evade discovery,

shareholders should ask themselves what else this group may be hiding.

As

you may know, our 2022 Annual Meeting of Shareholders (the “Annual Meeting”) is scheduled to be held on November 3, 2022.

Jonathan Jorgl, the “face” of the Activist Group, who personally owns only 1,000 shares of AIM and purchased them in late

June 2022, has attempted to nominate two director candidates – Robert Chioini and Michael Rice – for election to the Board

at the Annual Meeting. If these two individuals were elected, they would control the Board and the Company.

Shareholders

have the right to nominate director candidates for election to the Board, but are required to comply with AIM’s bylaws. Like many

companies, AIM has bylaw provisions in place to ensure that shareholders nominating director candidates present sufficient information

for the Board to assess the nominations and to allow other investors to make informed decisions when they vote. In this case, the

Activist Group did not provide this required information and, alarmingly, appears to have concealed myriad facts about its actions, funding,

associates and intentions.

After

careful deliberation, the Board unanimously determined that these nominations did not comply with AIM’s bylaws and were invalid.

Jorgl is attempting to fight this determination in a case currently pending before the Delaware Court of Chancery. On October 5, 2022,

the Delaware Court held a hearing on Jorgl’s request for a preliminary injunction. The Court has not yet ruled, but the

Company anticipates that the Court will be issuing its decision in advance of the Annual Meeting. Unless the result of the Delaware litigation

is that the nominations are valid, all proxies submitted by the Activist Group at the Annual Meeting will be disregarded.

The

Activist Group has cherry-picked and distorted information from the litigation discovery and has attempted to create a smokescreen to

hide its true intentions. The Company believes the Activist Group is spreading misinformation about the Company, its directors and its

progress, including through numerous misleading StockTwits posts by Tudor under his handle “beaufordb” (which he conceded

during a deposition belongs to him). It is important that shareholders understand the truth and are not misled by those who do not share

their interests.

Fortunately

for all shareholders, a great deal of information has come to light as a result of the Activist Group’s lawsuit against the Company.

These facts reveal the true picture:

| |

● |

A

convicted criminal, Franz Tudor, initiated the Activist Group campaign and selected the nominees, |

| |

● |

The

campaign is being funded by another criminal, Michael Xirinachs, who recently pled guilty to wire fraud, |

| |

● |

Jorgl

is merely serving as the “face” of the group to conceal the significant roles of the criminals, and |

| |

● |

The

Activist Group has plans to take control of the Company’s Board for purposes at odds with the best interests of all

shareholders. |

Please

consider the following:

The

Activist Group’s Campaign Was Orchestrated by Undisclosed Individuals – Including Two Convicted Criminals – Who Have

Been Trying to Take Control of AIM for Years

| |

● |

From

the start, Jorgl failed to disclose that he was making his nominations on behalf of and in concert with other individuals, including

Tudor, Ted Kellner, Todd Deutsch and Walter Lautz – who had been conspiring for years to influence control of AIM and profit

through stock manipulation efforts. |

| |

|

|

| |

● |

Tudor

is a convicted insider trader who has been improperly interfering with AIM’s business relations and seeking to disrupt AIM

for approximately two years – ever since AIM declined his bid in 2020 to be hired as an international business development

consultant to the Company. His harassment of AIM and attempts to interfere with its business relations became so extreme that AIM

successfully obtained an injunction against Tudor in Marion County, Florida in August 2021. |

| |

|

|

| |

● |

As

early as December 2021, Tudor and Lautz were working to find an activist front man to remove AIM President, CEO and director Thomas

Equels and the other members of the Board from AIM, as shown in their private communications: |

| |

○ |

“[T]his

board needs to be ousted” |

| |

○ |

“[W]e

need to find a way to get Tom [Equels] ousted” |

| |

● |

Prior

to Jorgl submitting his nominations, Tudor worked with Lautz to present a proposal to AIM to nominate Chioini (later one of Jorgl’s

nominees) and Daniel Ring as candidates for the Board. After that invalid proposal and its purported nominations were properly rejected,

Tudor emailed AIM’s outside IR firm and said “you now get gloves off.” |

Jorgl

is Merely the “Face” of the Activist Group’s Campaign – Which is Financially Supported by Michael Xirinachs,

Who Owns No AIM Stock and Recently Pled Guilty to Wire Fraud

| |

● |

In

his nomination notice, Jorgl did not include the true arrangements and motivations behind the nominations. Discovery in the Delaware

litigation brought to light numerous items that were omitted. |

| |

|

|

| |

● |

In

early June 2022, Tudor sent an email to Deutsch stating that Tudor had two candidates “to run and get control of the BOD,”

and further informing Deutsch that “I have a shareholder who is will[ing] [sic] to have their name as the lead” but that

he had not yet been able to find someone to finance the effort. |

| |

|

|

| |

● |

In

June of 2022, Lautz texted Tudor indicating that Lautz could no longer be “the face” of the activist undertaking. |

| |

○ |

Lautz

followed up several days later asking Tudor “were you able to find someone to be the face of the activist?” |

| |

● |

Days

later, the Activist Group learned that Jorgl, who owned no AIM stock, was willing to be the “face” of its endeavor. Chioini

texted Rice: |

| |

○ |

“[w]e

really need to get [Jorgl] b[u]y the shares today every day matters.” |

| |

○ |

“Try

to get him to do it in the next 40 minutes. It’s probably very important. And I’ll jump on the phone with them and talk

to the guy if he wants.” |

| |

○ |

“I

[am] burning a Cuban limited edition Hoyo de Monterrey [cigar] sitting on my dock in the 87 [degree] heat under the sun. The same

thing we’re going to do when we celebrate winning board seats taking control of the company.” |

| |

● |

Finally,

discovery revealed that Michael Xirinachs – whose involvement Jorgl did not initially disclose – was actively involved

with the activist effort for months. Xirinachs recently pled guilty to criminal charges of wire fraud relating to fraudulent securities

trading and promotion and material misrepresentations to investors and misuse of funds. According to the Activist Group’s

definitive proxy statement, Xirinachs was sentenced by a federal court on June 13, 2022 to three years of probation and ordered to

pay hundreds of thousands of dollars in restitution. |

| |

○ |

Email

communications produced in discovery show that Xirinachs began discussing AIM with the Activist Group as early as April 29, 2022,

less than two months before his sentencing for wire fraud in connection with penny stock manipulation. Xirinachs subsequently

agreed to fund the effort to take over AIM. |

| |

○ |

Xirinachs

was deeply involved in the scheme nearly two months before the Activist Group identified Jorgl to serve as the “face”

of the efforts. |

| |

○ |

Initially,

the Activist Group tried to construct a fiction that an entity called River Rock Advisors was funding the nomination efforts and

stated in a press release that River Rock would be participating in the solicitation. But discovery revealed that River Rock

had no funds and that Xirinachs is secretly funding some or all of the group’s efforts, leading to the Activist Group having

to finally disclose Xirinachs’ role in its proxy statement. |

The

Activist Group Has Nefarious Intentions

Perhaps

most damning for the Activist Group’s campaign is that discovery has revealed it is hiding its true intentions for the Company.

The

Company received additional evidence in the litigation that the Activist Group includes other undisclosed AIM shareholders with significant

ownership in likely violation of the federal securities laws. This evidence included handwritten notes belonging to Ted Kellner that,

in reference to 2022 conversations with Todd Deutsch and others, estimate that their undisclosed group had significant aggregate beneficial

ownership over AIM shares:

| |

● |

“Thought

collectively we had 20 percent” |

| |

● |

“What

do we own? 15 to 18 percent. Franz Tudor? Who wrote this [memo on AIM]? Franz” |

With

this context, it is no surprise that despite owning just 1,000 shares acquired for $870, Jorgl and the members of the Activist Group

that have been disclosed have said they will spend nearly 1,000 times that (approximately $850,000) on its campaign to take control of

the Board.

As

to what the Activist Group might do if it is successful, Xirinachs stated in a July 2022 email to Chioini:

| |

● |

“The

way I hope this all plays out is we get control of AIM … we continue to look for opportunities to either acquire, (to spin

off at a later time), license technology, or possibly merge with.” |

| |

● |

Xirinachs

twice refers to Jorgl’s nominees as “our slate.” |

The

AIM Board Has Successfully Executed on a Multi-Year Turnaround Plan and the Company Has Significant Momentum

The

incumbent AIM Board has overseen the Company’s successful efforts to overcome multiple obstacles, keep the lights on when there

was no money, improve its financial condition and set the Company on a path towards long-term shareholder value creation.

| |

● |

In

2015, AIM was in crisis: cash was extremely low, the NYSE threatened to delist AIM’s stock because it was trading under $0.20

per share, and auditors questioned AIM’s going-concern status. The Company’s supply of its primary drug, Ampligen, was

perilously low and there were no clinical trials in the works. |

| |

|

|

| |

● |

Then,

in 2016, the current members of the Board put in place a plan to contain expenses, including through reworking and in numerous instances

deferring executive and director compensation, and to increase cash reserves to manufacture Ampligen. The turnaround plan has been

successful. Ampligen is now in adequate supply, AIM is conducting several clinical trials and results to date are promising, establishing

the drug’s potential in multiple applications. |

| |

|

|

| |

● |

We

have achieved multiple potentially game-changing clinical and regulatory milestones this year, and expect this positive momentum

to continue throughout the rest of 2022 and into next year. These include the following: |

| |

○ |

Extremely

positive data from a single-center named patient program was published in March 2022. The manuscript titled, “Rintatolimod

(Ampligen®) enhances numbers of peripheral B cells and is associated with longer survival in patients with locally advanced and

metastasized pancreatic cancer pre-treated with FOLFIRINOX: a single-center named patient program,” was published in the peer-reviewed

journal, Cancers Special Issue: Combination and Innovative Therapies for Pancreatic Cancer. |

| |

|

|

| |

○ |

Presented

positive data in an abstract at the American Association for Cancer Research (AACR) Annual Meeting 2022 which shows significant survival

advantage when Ampligen is combined with Keytruda in advanced recurrent ovarian cancer. |

| |

|

|

| |

○ |

We

received notification from the U.S. Food and Drug Administration (“FDA”) that the FDA’s Clinical Hold on AIM’s

investigational new drug (“IND”) application for a Phase 2 study of Ampligen as a therapy for locally advanced pancreatic

cancer (“AMP-270”) had been lifted and the Company may proceed with the study. |

| |

○ |

On

July 28, 2022, we reported positive preliminary pilot study data from our ongoing Expanded Access Program (“AMP-511”)

evaluating Ampligen in patients with chronic fatigue symptoms following COVID infections (a form of “Long COVID”). |

| |

|

|

| |

○ |

Subsequent

to the positive results in AMP-511, on October 12, 2022, we reported that the FDA had authorized AIM to proceed with a Phase 2 study

evaluating Ampligen as a therapeutic for patients with post-COVID conditions (“AMP-518”). |

| |

● |

Your

Board has the right experience, skill sets and deep knowledge of the Company and its drug candidates to continue overseeing the successful

execution of our strategy to deliver therapies for patients and value for our shareholders. |

| |

○ |

Stewart

L. Appelrouth is a certified public accountant with over 40 years of accounting and audit experience. He serves as head of the

Board’s audit committee and brings important leadership, industry, financial and regulatory expertise, including having served

as a FINRA Arbitrator. |

| |

|

|

| |

○ |

Thomas

K. Equels, M.S., J.D., Executive Vice Chairman, Chief Executive Officer and President, has decades of experience as a practicing

attorney specializing in complex business litigation. He also has extensive experience in clinical trial design and development,

creating intellectual property concepts, and in financing drug development – as well as industry legal experience. |

| |

|

|

| |

○ |

Dr.

William M. Mitchell, Chairman, has extensive medical industry experience, including as a Professor of Pathology at Vanderbilt

University School of Medicine, a board-certified physician and a former member of the Board of Directors of Chronix Biomedical, a

company involved in next generation DNA sequencing for medical diagnostics. Dr. Mitchell is the inventor of record on numerous U.S.

and international patents and is experienced in regulatory affairs through filings with the FDA. |

***

We

appreciate your support and investment in the Company. As described above, the Activist Group’s actions have created much noise

and distraction around this year’s Annual Meeting. We urge you to listen to the facts and recognize that the Activist Group’s

best interests are not aligned with yours.

Please

ignore any proxy materials you receive from the Activist Group and vote on the Company’s WHITE proxy card for your current highly

qualified directors to protect your investment.

Sincerely,

The

AIM ImmunoTech Board of Directors

WE URGE YOU TO COMPLETE, DATE, AND SIGN THE ENCLOSED

WHITE PROXY CARD AND MAIL IT PROMPTLY IN THE POSTAGE-PAID ENVELOPE PROVIDED, OR VOTE BY TELEPHONE OR THE INTERNET AS INSTRUCTED

ON THE WHITE PROXY CARD, WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING.

THE BOARD RECOMMENDS A VOTE “FOR ALL”

OF OUR BOARD’S NOMINEES

(STEWART L. APPELROUTH, THOMAS K. EQUELS AND WILLIAM

M. MITCHELL)

ON PROPOSAL 1 USING THE ENCLOSED WHITE PROXY

CARD.

If

you have any questions or need assistance voting, please contact the Company’s proxy solicitor Morrow Sodali LLC (“Morrow

Sodali”) using the below information.

509

Madison Avenue

Suite

1206

New

York, NY 10022

Banks

and Brokers Call: (203) 658-9400

Shareholders

Call Toll Free: (800) 662-5200

E-mail:

AIM@investor.morrowsodali.com

About

AIM ImmunoTech Inc.

AIM

ImmunoTech Inc. is an immuno-pharma company focused on the research and development of therapeutics to treat multiple types of cancers,

immune disorders, and viral diseases, including COVID-19. The Company’s lead product, Ampligen® (rintatolimod) is an immuno-modulator

with broad spectrum activity being developed for globally important cancers, viral diseases and disorders of the immune system.

Ampligen

is currently being used as a monotherapy to treat pancreatic cancer patients in an Early Access Program (EAP) approved by the Inspectorate

of Healthcare in the Netherlands at Erasmus Medical Center and AIM plans to initiate a Phase 2 clinical study in 2022. The Company also

has multiple ongoing clinical trials to evaluate Ampligen as a combinational therapy for the treatment of a variety of solid tumor types

both underway and planned at major cancer research centers. Additionally, Ampligen is approved in Argentina for the treatment of severe

chronic fatigue syndrome (CFS) and is currently being evaluated in many aspects of SARS-CoV-2/COVID-19 myalgic encephalomyelitis/chronic

fatigue syndrome (ME/CFS) and Post COVID Conditions.

For

more information, please visit aimimmuno.com and connect with the Company on Twitter, LinkedIn, and Facebook.

Forward-Looking

Statements

This

press release contains certain forward-looking statements that involve risks, uncertainties and assumptions that are difficult to predict.

Words and expressions reflecting optimism, satisfaction or disappointment with current prospects, as well as words such as “believes,”

“hopes,” “intends,” “estimates,” “expects,” “projects,” “plans,”

“anticipates” and variations thereof, or the use of future tense, identify forward-looking statements, but their absence

does not mean that a statement is not forward-looking. The Company’s forward-looking statements are not guarantees of performance,

and actual results could vary materially from those contained in or expressed by such statements due to risks, uncertainties and other

factors. The Company urges investors to consider specifically the various risk factors identified in its most recent Form 10-K, and any

risk factors or cautionary statements included in any subsequent Form 10-Q or Form 8-K, filed with the Securities and Exchange Commission.

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release.

Except as required by law, the Company does not undertake any responsibility to update any forward-looking statements to take into account

events or circumstances that occur after the date of this press release.

Investor

Contacts:

JTC

Team, LLC

Jenene

Thomas

833-475-8247

AIM@jtcir.com

OR

Morrow

Sodali

AIM@investor.MorrowSodali.com

Media

Contact:

Longacre

Square Partners

Dan

Zacchei / Joe Germani

dzacchei@longacresquare.com

/ jgermani@longacresquare.com

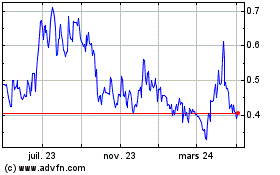

AIM ImmunoTech (AMEX:AIM)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

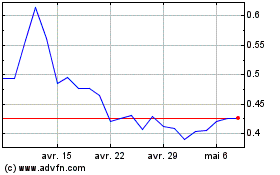

AIM ImmunoTech (AMEX:AIM)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024