Additional Proxy Soliciting Materials (definitive) (defa14a)

04 Octobre 2022 - 3:08PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | | |

Filed by the Registrant x |

|

Filed by a Party other than the Registrant ☐ |

|

Check the appropriate box: |

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

x | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

|

AMPIO PHARMACEUTICALS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

| |

☐ | Fee paid previously with preliminary materials. |

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Ampio Pharmaceuticals Announces NYSE American Has Commenced Delisting Proceedings

ENGLEWOOD, Colo., October 4, 2022 — Ampio Pharmaceuticals, Inc. (NYSE American: AMPE) (the “Company”) received written notification from NYSE American LLC (“NYSE American” or the “Exchange”) stating that the staff of NYSE Regulation has determined to commence proceedings to delist the Company’s common stock from the Exchange. Trading in the Company’s common stock was suspended.

NYSE Regulation staff determined that the Company is no longer suitable for listing pursuant to Section 1033(f)(v) of the NYSE American Company Guide due to the abnormally low trading price of the Company’s common stock. The Exchange’s application to the Securities and Exchange Commission to delist the Company’s common stock is pending, subject to the completion of the Exchange’s applicable procedures, including any appeal by the Company of NYSE Regulation’s decision.

The Company has a right to an appeal of this determination by the Exchange, provided that the Company files a written request for such review within seven calendar days after receiving the notice. The Company’s Board of Directors is currently considering whether to appeal the Exchange’s determination to commence delisting proceedings.

Prior to receipt of the letter from NYSE American, the Company began actively taking steps to regain compliance with the listing standards of the NYSE American. Specifically, the Company’s Board of Directors unanimously approved and recommended that the Company’s stockholders approve an amendment to the Company’s certificate of incorporation to effect a reverse stock split of the Company’s common stock at a ratio of not less than 5-to-1 and not greater than 15-to-1, with the exact ratio to be determined by the Board in its discretion

before October 13, 2023 (the “Reverse Stock Split”). The Company has called a Special Meeting of Stockholders for October 13, 2022 to consider the Reverse Stock Split. Consummation of the Reverse Stock Split may increase the price of the Company’s shares of common stock and, as a result, would likely enable the Company to maintain a higher market price for its common stock, although there can be no assurance that the Company’s stockholders will approve the Reverse Stock Split. There can be no assurance that the Company will appeal the Exchange’s determination or the outcome of any such appeal. There can be no assurance that the Exchange will reconsider their decision to delist in light of such appeal.

In the meantime, the Company’s common stock will trade on the OTC Pink under the symbol “AMPE.” The Company can provide no assurance that its common stock will continue to trade on this market, that brokers will continue to provide public quotes of the Company’s common stock on this market or otherwise make a market in the Company’s common stock or that the trading volume of the Company’s common stock will be sufficient to provide for an efficient trading market.

Caution Regarding Forward-Looking Statements

This press release includes certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements, other than statements of present or historical fact, included in this document regarding the proposed reverse stock split and strategic alternatives process are forward-looking statements. These forward-looking statements are subject to risks and uncertainties, including: Ampio’s stock is subject to delisting from the NYSE American under currently pending delisting proceeding; the Ampio stockholders may not approve the reverse stock split proposal; if a reverse stock split is completed, the market price of Ampio’s common stock may not demonstrate sustained price improvement to regain compliance with the NYSE American continued listing standards or Ampio may not be able to maintain listing on the NYSE American for any other reason; the challenges in identifying one or more attractive, strategic businesses to transform Ampio through one or more strategic transactions and the risk that no strategic transaction will be considered by the Ampio board to be in the best interests of its stockholders; the strategic alternatives process will consume our cash resources and reduce cash available to be used in a strategic transaction or cash available for the post-closing business; the strategic alternatives process and any strategic transaction may involve

unexpected costs, liabilities or delays; the expense and risk associated with any strategic transaction, including the risk that the expected benefits of the transaction may not be realized in the time frames expected or at all; and Ampio’s stock price has suffered and may continue to suffer as a result of uncertainty surrounding the strategic alternatives process and any resulting strategic transaction.

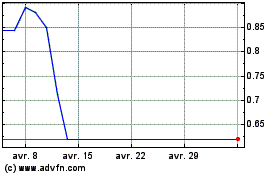

Ampio Pharmaceuticals (AMEX:AMPE)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Ampio Pharmaceuticals (AMEX:AMPE)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024