UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to 167;240.14a-12

|

| AVALON HOLDINGS CORPORATION |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

| |

(1)

|

Title of each class of securities to which transaction applies:

|

| |

(2)

|

Aggregate number of securities to which transaction applies:

|

| |

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

(4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| |

(1)

|

Amount Previously Paid:

|

| |

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

AVALON HOLDINGS

CORPORATION

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

Notice of Annual Meeting

of Shareholders

April 28, 2022

and

Proxy Statement

|

Avalon Holdings Corporation • One American Way • Warren, Ohio 44484-5555

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD APRIL 28, 2022

To the Shareholders of Avalon Holdings Corporation:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of Avalon Holdings Corporation will be held at The Grand Resort, located at 9519 East Market Street, Warren, Ohio, on Thursday, April 28, 2022 at 10:00 A.M., local time, for the following purposes:

| |

1.

|

To elect six Directors, two of whom will be Class A Directors elected by the holders of Class A Common Stock, and four of whom will be Class B Directors elected by the holders of Class B Common Stock, such Directors to hold office until the next Annual Meeting of Shareholders and until their successors are elected and qualified;

|

| |

2.

|

To conduct an advisory vote on executive compensation;

|

| |

3.

|

To transact such other business as may properly come before the meeting and any adjournment thereof;

|

all in accordance with the accompanying Proxy Statement.

The Board of Directors has fixed the close of business on Friday, March 4, 2022, as the record date for the determination of the shareholders entitled to notice of and to vote at such meeting or any adjournment thereof. Only those shareholders of record at the close of business on such date will be entitled to vote at the meeting or any adjournment thereof.

Your prompt action in voting your proxy will be greatly appreciated. Whether or not you plan to attend the annual meeting, we urge you to cast your vote. You can vote via the internet, by telephone or by returning the proxy card. If you are voting by returning the proxy card, an envelope is provided for your use which requires no postage if mailed in the United States. If you have more than one shareholder account, you are receiving a proxy for each account. Please vote all proxies you receive.

Additionally, the Notice of Meeting, Proxy Statement and our Annual Report to Shareholders for the fiscal year ended December 31, 2021 are available on the internet at http://www.proxyvote.com.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Bryan P. Saksa

Bryan P. Saksa

Secretary

Warren, Ohio

March 11, 2022

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

April 28, 2022

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of Avalon Holdings Corporation (the “Company”) of proxies in the form enclosed herewith to be voted at the Annual Meeting of Shareholders to be held at The Grand Resort, located at 9519 East Market Street, Warren, Ohio, on Thursday, April 28, 2022, at 10:00 A.M., local time, and at any adjournment thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Shareholders. This Proxy Statement is being sent to each holder of the issued and outstanding shares of Class A Common Stock, $.01 par value, (“Class A Common Stock”) and Class B Common Stock, $.01 par value, (“Class B Common Stock,” and together with the Class A Common Stock, the “Common Stock”) of the Company entitled to vote at the meeting in order to furnish information relating to the business to be transacted at the meeting. The Company’s Annual Report to Shareholders for the fiscal year ended December 31, 2021, including financial statements, is being mailed to shareholders, together with this Proxy Statement and the accompanying form of proxy, beginning on or about March 14, 2022. Additionally, the Notice of Meeting, Proxy Statement and our Annual Report to Shareholders for the fiscal year ended December 31, 2021 are available on the internet at http://www.proxyvote.com.

Any shareholder giving a proxy will have the right to revoke it at any time prior to the voting thereof by giving written notice to the Secretary of the Company, by voting in person at the Annual Meeting, or by execution of a subsequent proxy provided that such action is taken in sufficient time to permit the necessary examination and tabulation of the subsequent proxy or revocation before the vote is taken. Shares of Common Stock represented by the proxies in the form enclosed, properly executed, will be voted in the manner designated, or if no applicable instructions are indicated, in favor of the Directors named therein and in favor of the Board recommendations. The persons named in the enclosed form of proxy are authorized to vote, in their discretion, upon such other business as may properly come before the meeting and any adjournment thereof. Only those shares represented at the Annual Meeting in person or by proxy shall be counted for purposes of determining the number of votes required for any proposals upon which shareholders of the Company shall be called upon to vote. If shareholders do not give their brokers instructions as to how to vote shares held in street name, the brokers have discretionary authority to vote those shares on “routine” matters, but not on “non-routine” proposals, such as the election of directors and the advisory vote regarding executive compensation. As a result, if you hold your shares in street name and do not provide voting instructions to your broker, your shares will not be voted on any proposal on which your broker does not have discretionary authority to vote. This is sometimes called a “broker non-vote.” Shares held by brokers who do not have discretionary authority to vote on a particular matter and who have not received voting instructions from their customers will be counted as present for the purposes of determining whether there is a quorum at the annual meeting, but will not be counted or deemed to be present in person or by proxy for the purposes of determining whether our shareholders have approved that matter. Abstentions and “broker non-votes” shall not be counted as votes for or against any matter upon which shareholders of the Company shall be called upon to vote. The Articles of Incorporation of the Company do not permit cumulative voting in the election of Directors.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The Board of Directors has fixed the close of business on March 4, 2022, as the record date for the determination of shareholders entitled to notice of and to vote at the Annual Meeting. Only shareholders of record at the close of business on that date will be entitled to vote at the meeting or any adjournment thereof. At the Annual Meeting, the holders of Class A Common Stock will be entitled, as a class, to elect two Directors (“Class A Directors”) and the holders of Class B Common Stock will be entitled, as a class, to elect four Directors (“Class B Directors,” and together with the Class A Directors, the “Directors”).

Except for the election of Directors and as otherwise required by the provisions of the Company’s Articles of Incorporation or by law, holders of the Class A Common Stock and Class B Common Stock will vote or consent as a single class on all matters with each share of Class A Common Stock having one vote per share and each share of Class B Common Stock having ten votes per share. In the event that the outstanding shares of Class B Common Stock constitute less than 50% of the total voting power of the issued and outstanding shares of Class A Common Stock and Class B Common Stock, the holders of the Class A Common Stock (one vote per share) and Class B Common Stock (ten votes per share) will vote as a single class for the election of Directors. At the close of business on March 4, 2022, the Company had 3,287,647 shares of Class A Common Stock outstanding entitling the holders thereof to 3,287,647 votes in the aggregate and 611,784 shares of Class B Common Stock outstanding entitling the holders thereof to 6,117,840 votes in the aggregate.

Each share of Class B Common Stock is convertible at any time, at the option of the shareholder, into one share of Class A Common Stock. Shares of Class B Common Stock are also automatically converted into shares of Class A Common Stock on the transfer of such shares to any person other than the Company, another holder of Class B Common Stock or a “Permitted Transferee” as defined in the Company’s Articles of Incorporation. The Class A Common Stock is not convertible.

The following table sets forth information with respect to beneficial ownership of the Class A Common Stock and Class B Common Stock by each person known to the Company to be the beneficial owner of more than five percent of either class of Common Stock. This information is as of March 4, 2022, unless noted that it is based upon Schedules 13-D or 13-G filed with the Securities and Exchange Commission (the “Commission”).

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent

|

|

|

Percent of

|

|

| |

|

Class A Common Stock

|

|

|

Class B Common Stock

|

|

|

of all

|

|

|

Total

|

|

|

Name

|

|

Number of

Shares

|

|

|

Percent of

Class

|

|

|

Number

of Shares

|

|

|

Percent of

Class

|

|

|

Common

Stock

|

|

|

Voting

Power

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald E. Klingle (1)(2)

|

|

|

170,417 |

|

|

|

5.2 |

% |

|

|

611,133 |

|

|

|

99.9 |

% |

|

|

20.0 |

% |

|

|

66.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Anil Choudary Nalluri

|

|

|

808,069 |

|

|

|

24.6 |

% |

|

|

- |

|

|

|

- |

|

|

|

20.7 |

% |

|

|

8.6 |

% |

|

5500 Market Street, Suite 128

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Youngstown, OH 44512

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Includes 14,296 shares of Class B Common Stock and 397 shares of Class A Common Stock owned by Mr. Klingle’s spouse, the beneficial ownership of which is disclaimed. Mr. Klingle has sole voting power and sole investment power over 170,020 shares of Class A Common Stock and 596,837 shares of Class B Common Stock.

|

|

(2)

|

Ronald E. Klingle is an employee, executive officer and director of the Company. The address for Mr. Klingle is c/o Avalon Holdings Corporation, One American Way, Warren, Ohio 44484-5555.

|

|

(3)

|

Based upon the latest available information contained in Schedule 13D/A filed with the Commission on March 5, 2020. Mr. Nalluri has sole voting power and sole dispositive power over all of the shares listed.

|

PROPOSAL #1

ELECTION OF DIRECTORS

It is intended that the proxies will be voted for the election of the six nominees named below to hold office as Directors until the next succeeding annual shareholders’ meeting and until their respective successors are duly elected and qualified. Specifically, the holders of Class A Common Stock are entitled, as a class, to elect two Class A Directors and the holders of Class B Common Stock are entitled, as a class, to elect four Class B Directors. It is the intention of the persons named in the enclosed forms of proxy to vote such proxies as specified and if no specification is made, to vote such proxies for the election as Directors of the nominees for Class A Directors and Class B Directors listed below. All such nominees have consented to serve if elected. While management has no reason to believe that any of the nominees will not be available to serve as a Director, if for any reason any of them should become unavailable, the proxies will be voted for such substitute nominees as may be designated by the Board of Directors. The two nominees for Class A Directors receiving the greatest number of votes from the holders of shares of Class A Common Stock eligible to be cast at the meeting will be elected Class A Directors; and, the four nominees for Class B Directors receiving the greatest number of votes from the holders of shares of Class B Common Stock eligible to be cast at the meeting will be elected Class B Directors. Set forth below is certain information about the nominees for Class A Directors and Class B Directors:

|

Name

|

|

Age

|

|

Director Since

|

|

Title

|

|

Term

|

|

Nominees for Class A Directors:

|

|

|

|

|

|

|

|

|

|

Kurtis D. Gramley

|

|

59 |

|

2007 |

|

Director

|

|

1 year

|

|

Stephen L. Gordon

|

|

80 |

|

1998 |

|

Director

|

|

1 year

|

| |

|

|

|

|

|

|

|

|

|

Nominees for Class B Directors:

|

|

|

|

|

|

|

|

|

|

Ronald E. Klingle

|

|

74 |

|

1998 |

|

Chairman of the Board, Chief Executive Officer and Director

|

|

1 year

|

|

Bryan P. Saksa

|

|

45 |

|

2015 |

|

Chief Financial Officer, Treasurer and Secretary

|

|

1 year

|

|

Timothy C. Coxson

|

|

71 |

|

2020 |

|

Director

|

|

1 year

|

|

Christine M. Bell

|

|

53 |

|

2021 |

|

President, Avalon Golf and Country Club

|

|

1 year

|

Set forth below is information concerning each nominee for election as a director, including such nominee’s principal occupation.

Kurtis D. Gramley has been a director of the Company since April 2007. He has been Chairman of the Board of Directors and Chief Executive Officer of Edgewood Surgical Hospital located in Transfer, Pennsylvania since 2004. From 2002 to present, Mr. Gramley has served as President and Chief Executive Officer of Kapital Development, LLC which is the founding entity of Edgewood Surgical Hospital. Mr. Gramley has been involved in the development and management of healthcare related facilities and the medical profession since 1992. He was President of Shenango Inn Enterprises, Inc. and David Mead Inn Enterprises, Inc. from 1992 to 2000. Mr. Gramley received his Bachelor of Science degree in Accounting and Finance from the University of Virginia in 1985 and has been a Certified Public Accountant since 1986 and previously worked for PriceWaterhouseCoopers, a national public accounting firm. Mr. Gramley will serve as the financial expert on the audit committee.

Director Qualifications:

Leadership and financial experience – Mr. Gramley is Chairman of the Board of Directors and Chief Executive Officer of Edgewood Surgical Hospital and a Certified Public Accountant. The Board benefits from Mr. Gramley’s executive leadership and management experience as a CEO. The Board also benefits from his work experience and education in accounting, finance and auditing.

Stephen L. Gordon has been a director of the Company since June 1998. He was a Deputy Attorney General for the State of New Jersey and subsequently held a number of positions in the New York State Department of Environmental Conservation. He has been a partner in the law firm of Beveridge & Diamond, P.C. since 1982. Mr. Gordon received his Bachelor of Arts degree from Rutgers University and his Doctor of Jurisprudence degree from the University of Pennsylvania.

Director Qualifications:

Leadership and industry experience – Mr. Gordon has practiced Environmental Law since 1970. He advises clients on energy and land use law, hazardous and non-hazardous waste issues, water and groundwater issues, air emissions issues, as well as, issues dealing with the construction and operation of electric generation and electric transmission facilities. Mr. Gordon brings to the Board extensive experience in the waste industry which helps provide our Company with sales and marketing strategy, identifying opportunities in the waste business and risk management.

Ronald E. Klingle has been a director and Chairman of the Board of the Company since June 1998. He was Chief Executive Officer from June 1998 until December 2002. He reassumed and held the position of Chief Executive Officer from March 15, 2004 until February 28, 2010 and reassumed the position again on February 16, 2011. Mr. Klingle has over 40 years of environmental experience and received his Bachelor of Engineering degree in Chemical Engineering from Youngstown State University. Mr. Klingle is the spouse of Frances R. Klingle who is the Chief Administrative Officer of the Company.

Director Qualifications:

Leadership and industry experience – Mr. Klingle is the Chairman and Chief Executive Officer of the Company. He holds over 50% of the voting power of the Company, directly aligning his interests with those of our shareholders. He was co-founder of American Waste Services, Inc., the Company’s predecessor, which was involved in owning and operating landfills, waste transportation and environmental consulting and engineering. He has extensive executive leadership and management experience and continues to lead the development and execution of our businesses.

Bryan P. Saksa was appointed Chief Financial Officer and Treasurer of the Company in December 2014. He has been a director of the Company since April 2015 and was appointed Secretary in November 2015. Mr. Saksa previously held financial accounting and reporting positions at Myers Industries, Inc. and TransDigm Group, Inc. Mr. Saksa received his Bachelor of Business Administration degree in Accounting from Cleveland State University and has been a Certified Public Accountant since 2001 and previously worked for Grant Thornton LLP, a national accounting firm.

Director Qualifications:

Leadership and financial experience – Mr. Saksa, the Company’s Chief Financial Officer, has expertise in corporate finance, financial reporting, accounting and auditing, having served in various roles for over 20 years and has extensive management experience. He is a Certified Public Accountant and has held various positions in accounting and finance throughout his career.

Timothy C. Coxson has been a director of the Company since November 2020. Mr. Coxson is a Financial Consultant. Mr. Coxson was previously a director of the Company from April 2007 to April 2015. He was also Chief Financial Officer and Treasurer of Avalon from June 1998 until August 2004 and from March 2006 until November 2014. From September 2004 to March 2006 and from December 2014 to October 2015, he was Director of Corporate Services of Avalon.

Director Qualifications:

Leadership and financial experience - Mr. Coxson has over 25 years of experience in accounting and external reporting while working for publicly owned companies. Mr. Coxson, has expertise in corporate finance, financial reporting and accounting and has extensive executive management experience. He has held various executive positions in accounting throughout his career. The Board also benefits from Mr. Coxson’s knowledge and familiarity of the waste and golf business. He received a Bachelor of Business Administration degree in Accounting from The Ohio State University.

Christine M. Bell has been a director of the Company since April 2021. Ms. Bell was appointed President of Avalon Golf and Country Club in August 2013 and The Grand Resort in August 2014. She joined the Avalon management team in June of 2007 and is responsible for overall operations at The Grand Resort and all country club locations. Christine began her career in the hospitality industry employed by the Meyer Jabara Hotel Group from 1991 to 2007 where she served in a variety of management positions, including Director of Sales and Catering for the Holiday Inn Metroplex in Youngstown, Ohio and the Sheraton Inn in Canton, Ohio. Christine earned a Bachelor of Science degree in Commercial Recreation and Tourism with a Business Management Minor from Kent State University.

Director Qualifications:

Leadership and industry experience – Ms. Bell has over 25 years of progressive management experience in the hospitality and hotel industry with a concentration in the food and beverage segment and corporate/social banquet sales for a 16,000 square foot convention center in addition to hotel and corporate event management. Ms. Bell plays a major role in the growth and success of Avalon Golf and Country Club and The Grand Resort.

Board Leadership Structure

The Company does not have a policy on whether the roles of Chairman of the Board and Chief Executive Officer should be separate. The Board believes that it should be free to make a choice from time to time in any manner that is in the best interests of the Company and its shareholders.

Director Independence

Avalon Holdings Corporation is a controlled company because over 50% of the voting power of the Company is held by Mr. Klingle. As such, the Company does not require the majority of its directors to be independent. The Board of Directors has determined that the three members of the Audit Committee, Mr. Gramley, Mr. Gordon and Mr. Coxson, are independent as defined by the Securities and Exchange Commission and NYSE Amex.

STOCK OWNERSHIP OF MANAGEMENT

The following table sets forth information as of December 31, 2021, with respect to beneficial ownership of the Class A Common Stock and Class B Common Stock by: (i) the Company’s directors, including nominees, and certain named officers of the Company, and (ii) all executive officers and directors, including nominees, as a group. See “Voting Securities and Principal Holders Thereof.”

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percent

|

|

|

Percent of

|

|

| |

|

Class A Common Stock

|

|

|

Class B Common Stock

|

|

|

of all

|

|

|

Total

|

|

|

Name

|

|

Number

of Shares

|

|

|

Percent of

Class

|

|

|

Number

of Shares

|

|

|

Percent of

Class

|

|

|

Common

Stock

|

|

|

Voting

Power

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald E. Klingle (1)(3)(5)

|

|

|

170,417 |

|

|

|

5.2 |

% |

|

|

611,133 |

|

|

|

99.9 |

% |

|

|

20.0 |

% |

|

|

66.8 |

% |

|

Bryan P. Saksa (1)(5)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Christine M. Bell (1)(5)

|

|

|

- |

|

|

|

- |

|

|

|

100 |

|

|

|

* |

|

|

|

* |

|

|

|

* |

|

|

Kurtis D. Gramley (5)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Timothy C. Coxson (5)

|

|

|

399 |

|

|

|

* |

|

|

|

- |

|

|

|

- |

|

|

|

* |

|

|

|

* |

|

|

Stephen L. Gordon (5)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Frances R. Klingle (2)

|

|

|

397 |

|

|

|

* |

|

|

|

14,296 |

|

|

|

2.3 |

% |

|

|

0.4 |

% |

|

|

1.5 |

% |

|

Clifford P. Davis (4)

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

All executive officers, directors and nominees for directors as a group (9 persons) (6)

|

|

|

170,816 |

|

|

|

5.2 |

% |

|

|

611,233 |

|

|

|

99.9 |

% |

|

|

20.1 |

% |

|

|

66.8 |

% |

*Less than one percent.

| (1) |

Each is an employee, executive officer and director of the Company. |

| |

|

| (2) |

Mrs. Klingle is an employee and executive officer of the Company. |

| |

|

| (3) |

Includes 14,296 shares of Class B Common Stock and 397 shares of Class A Common Stock owned by Mr. Klingle’s spouse, the beneficial ownership of which is disclaimed. Mr. Klingle has sole voting power and sole investment power over 170,020 shares of Class A Common Stock and 596,837 shares of Class B Common Stock. |

| |

|

| (4) |

Mr. Davis is an employee and executive officer of the Company. |

| |

|

| (5) |

Each of these individuals is a nominee for Director. |

| |

|

| (6) |

In determining the number of shares held by executive officers and directors as a group, shares beneficially owned by more than one executive officer or director have been counted only once. |

MEETINGS AND COMMITTEES OF THE BOARD

The Board of Directors has established four standing committees to assist in the discharge of its responsibilities. These are the Executive, Audit, Option Plan and Compensation Committees. The Board as a whole nominates directors for election. During 2021, the Board of Directors held four meetings.

Each incumbent Director acted pursuant to all written consents without formal meeting and attended at least 75% of the total number of meetings of the Board of Directors and the committees of the Board on which the respective Directors served during 2021. All of the Board members attended the prior year’s annual meeting.

The Executive Committee, subject to the restrictions of the Ohio General Corporation Law, may exercise the authority of the Board of Directors in the management of the business and affairs of the Company during intervals between meetings of the Board. During 2021, the Executive Committee held no meetings. The Executive Committee consists of three members, as follows: Messrs. Klingle (Chairman), Gramley and Coxson.

The Audit Committee is responsible for recommending the firm of independent accountants to be engaged to audit the Company’s financial statements, reviewing the scope and results of the audit with the independent accountants, reviewing with management and the independent accountants the Company’s interim and year-end operating results, considering the adequacy of the internal accounting controls and procedures of the Company and reviewing the non-audit services to be performed by the independent accountants. During 2021, the Audit Committee held four meetings. The Audit Committee consists of three members, as follows: Messrs. Gramley (Chairman), Coxson and Gordon.

The Board of Directors has determined that each member of the Audit Committee is independent as defined by the Securities and Exchange Commission and NYSE Amex. The Board of Directors has identified Mr. Gramley as the Audit Committee financial expert. The Company has adopted a formal written Audit Committee Charter. The Audit Committee reviews and reassesses the adequacy of the formal written charter on an annual basis.

The Compensation Committee is responsible for reviewing and establishing the compensation arrangements for employees of the Company, including the salaries and bonuses of top management. During 2021, the Compensation Committee held three meetings. The Compensation Committee consists of three members, as follows: Messrs. Saksa (Chairman), Klingle and Gordon. Avalon Holdings Corporation is a controlled company because over 50% of the voting power of the Company is held by Mr. Klingle. As such, the members of the Company’s Compensation Committee are not all independent.

The Option Plan Committee determines grants of options to purchase shares under the Company’s 2019 Long-Term Incentive Plan based on recommendations made by the Company’s Compensation Committee. During 2021, the Option Plan Committee held no meetings. The Option Plan Committee consists of three members, as follows: Messrs. Gordon (Chairman), Gramley and Coxson.

DIRECTOR NOMINATING PROCESS

Avalon Holdings Corporation is a controlled company because over 50% of the voting power of the Company is held by Mr. Klingle. As such, the Company does not have a Nominating Committee. Because Mr. Klingle holds a majority of the voting power, nominations for Directors are generally based on his recommendations. In general, the Company’s Board will nominate existing Directors for re-election unless the Board has a concern about the Director’s ability to perform his or her duties. In the event of a vacancy on the Board, potential candidates are evaluated based upon their experience, skills, integrity and background concerning the types of businesses in which the Company operates and how the nominee would complement the existing Board’s skills and experience.

The Board of Directors has no formal procedures to be followed in submitting recommendations of candidates for Director. However, nominations for Director may be made by our shareholders, provided such nominations comply with certain timing and information requirements set forth in our bylaws. Nominations should be made via written request to the attention of the Company’s Secretary, One American Way, Warren, Ohio 44484.

AUDIT COMMITTEE REPORT

The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of the accounting firm that is engaged as the Company’s independent registered public accounting firm. The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. In fulfilling its responsibilities, the Audit Committee has reviewed and discussed the audited financial statements contained in the 2021 Annual Report on SEC Form 10-K with Company’s management and independent registered public accounting firm. Management is responsible for the financial statements and the reporting process, including the system of internal controls. The Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformity of those audited financial statements with accounting principals generally accepted in the United States of America.

In the performance of the Audit Committee’s oversight function, we have reviewed and discussed with management the Company’s audited financial statements for the year ended December 31, 2021 and management’s assessment of the effectiveness of the Company’s internal control over financial reporting. The Audit Committee discussed with the Company’s independent registered public accounting firm, the matters required to be discussed by Public Company Accounting Oversight Board Audit Standard No. 16, Communications with Audit Committees, and such other matters as we have deemed to be appropriate. In addition, the Audit Committee has received and discussed the written disclosures and the letter from the independent registered public accounting firm required by Public Company Oversight Board Rule 3526 (Independence Discussions with Audit Committees) regarding its independence.

In reliance on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors (and the Board approved) that the audited financial statements be included in the Company’s Annual Report on SEC Form 10-K for the year ended December 31, 2021, for filing with the Securities and Exchange Commission.

AUDIT COMMITTEE

Kurtis D. Gramley (Chairman)

Stephen L. Gordon

Timothy C. Coxson

Executive Compensation

Avalon is a controlled company as defined by the NYSE Amex company guide because over 50% of the voting power is held by Mr. Klingle. During 2021, Mr. Klingle was the Chairman of the Board and Chief Executive Officer and Mr. Saksa was Chief Financial Officer. Both Mr. Klingle and Mr. Saksa were members of the Compensation Committee. As such, the members of the Company’s Compensation Committee are not all independent. Although the Company’s executive compensation program is established by the Compensation Committee, the Compensation Committee and the Board of Directors, as a whole, discuss the reasonableness of the amounts of compensation received by the Chief Executive Officer and the other executive officers. The Compensation Committee does not have a charter.

The Company maintains a cash compensation program which is designed to motivate, retain and attract management and is comprised of base salary and discretionary bonuses. The purpose of the base salary is to create a secure base of cash compensation for executives that is competitive with the market. Executive salaries do not follow a preset schedule or formula. For the most part, increases in compensation of the Chief Executive Officer and other executive officers are dependent upon discretionary bonuses approved by the Board of Directors.

The Compensation Committee discusses and reviews base salaries and discretionary bonuses for all of the executive officers, including Mr. Klingle, the Chief Executive Officer, based upon an evaluation of each individual’s performance, any change in responsibilities and their potential to contribute to the success of the Company. No specific weights have been assigned to those factors. Mr. Kenneth McMahon, Chief Executive Officer of American Waste Management Services, Inc. (“AWMS”), received a discretionary bonus, based upon eight percent of the income before taxes of the waste management and brokerage company.

With regard to individual performance of executive officers, other than the Chief Executive Officer, the Compensation Committee relies to a large extent on the Chairman of the Board and Chief Executive Officer’s evaluation of each individual executive officer’s performance.

In November 2021, the Board of Directors voted not to make a discretionary contribution to the Company’s 401(k) Profit sharing Plan for the year ended December 31, 2021.

Section 162(m) of the Internal Revenue Code addresses the nondeductibility for federal income tax purposes of certain compensation in excess of $1 million paid to an employee during the taxable year. As it is highly unlikely that any executive officer or other employee of the Company will be awarded compensation in excess of $1 million in the foreseeable future, the Compensation Committee has not established a policy with respect to the nondeductibility of such employee compensation.

The Compensation Committee believes that the Chief Executive Officer, as well as, the other executive officers of the Company, are dedicated to achieving significant improvements in the Company’s long-term financial performance and that the compensation policies, plans and programs implemented by the Company contribute to achieving those results.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Compensation of Executive Officers

The following information sets forth the compensation of the Company’s Principal Executive Officer during 2021 and the Company’s two most highly compensated executive officers, other than the Chief Executive Officer, who were serving as executive officers as of December 31, 2021; in each case for services rendered in all capacities to the Company and/or its subsidiaries during the fiscal year ended December 31, 2021.

|

SUMMARY COMPENSATION TABLE (1)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

All Other

|

|

|

|

|

|

|

Name and Principal Position

|

|

Year

|

|

Salary

|

|

|

Bonus

|

|

|

Compensation (2)

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald E. Klingle

|

|

2021

|

|

$ |

210,000 |

|

|

$ |

130,000 |

|

|

$ |

- |

|

|

$ |

340,000 |

|

|

Chairman of the Board and

|

|

2020

|

|

$ |

210,000 |

|

|

$ |

30,000 |

|

|

$ |

7,889 |

|

|

$ |

247,889 |

|

|

Chief Executive Officer

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth J. McMahon

|

|

2021

|

|

$ |

130,000 |

|

|

$ |

343,780 |

|

|

$ |

- |

|

|

$ |

473,780 |

|

|

Chief Executive Officer, American

|

|

2020

|

|

$ |

130,000 |

|

|

$ |

322,105 |

|

|

$ |

- |

|

|

$ |

452,105 |

|

|

Waste Management Services, Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bryan P. Saksa

|

|

2021

|

|

$ |

160,000 |

|

|

$ |

130,000 |

|

|

$ |

- |

|

|

$ |

290,000 |

|

|

Chief Financial Officer, Treasurer and

|

|

2020

|

|

$ |

160,000 |

|

|

$ |

30,000 |

|

|

$ |

- |

|

|

$ |

190,000 |

|

|

Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1)

|

Includes salary and/or bonuses deferred pursuant to Section 401(k) of the Internal Revenue Code.

|

| |

(2)

|

Amount represents Mr. Klingle’s personal use for an automobile.

|

Outstanding Equity Awards at Fiscal Year-End

The following table represents the outstanding equity awards for each named officer at December 31, 2021:

|

Option Awards

|

Stock Awards

|

|

Name

|

Number of securities underlying unexercised options (2)

(#)

exercisable

|

Number of securities underlying unexercised options (1)

(#) unexercisable

|

Equity

Incentive plan awards:

Number of securities underlying unexercisable unearned

options

(#)

|

Option

exercise

price

($)

|

Option

Expiration

Date

|

Number

of shares

or units

that have

not

vested

(#)

|

Market

value

of

shares

or units

that

have

not

vested

($)

|

Equity

incentive

plan

awards:

Number

of

unearned

shares,

units or

other

rights that

have not

vested

(#)

|

Equity

incentive

plan

awards:

Market or

payout

value of

unearned

shares,

units or

other

rights that

have not

vested

($)

|

|

Bryan P.

Saksa

|

— |

54,000 |

— |

$1.83 |

03/15/26

|

— |

— |

— |

— |

| |

(1)

|

See Note 13 to our consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2021 filed with the SEC for information regarding the stock options granted under the 2019 Long-Term Incentive Plan and the 2009 Long-term Incentive Plan.

|

| |

(2)

|

The stock options, vest ratably over a five year period and have a contractual term of ten years from the date of grant. At the end of each contractual vesting period, the share price of the Avalon common stock, traded on a public stock exchange (NYSE Amex), must reach a predetermined price within three years following such contractual vesting period before the stock options are exercisable (See table below). If the Avalon common stock price does not reach the predetermined price, the stock options will either be cancelled or the period will be extended at the discretion of the Board of Directors.

|

The table below represents the period and predetermined stock price needed for vesting:

| |

Begins Vesting

|

Ends Vesting

|

|

Predetermined

Vesting Price

|

|

| |

|

|

|

|

|

|

|

Block 1

|

12 mo. after Grant Dates

|

48 mo. after Grant Dates

|

|

$ |

3.43 |

|

|

Block 2

|

24 mo. after Grant Dates

|

60 mo. after Grant Dates

|

|

$ |

4.69 |

|

|

Block 3

|

36 mo. after Grant Dates

|

72 mo. after Grant Dates

|

|

$ |

6.43 |

|

|

Block 4

|

48 mo. after Grant Dates

|

84 mo. after Grant Dates

|

|

$ |

8.81 |

|

|

Block 5

|

60 mo. after Grant Dates

|

96 mo. after Grant Dates

|

|

$ |

12.07 |

|

OPTION EXERCISES AND STOCK VESTED IN FISCAL 2021

During fiscal 2021, no stock options were exercised by the named executive officers under either the Company’s 2019 or 2009 Long-Term Incentive Plans.

PROPOSAL #2

ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in July 2010, requires that we provide our shareholders with the opportunity to vote to approve the compensation of our named executive officers as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC.

This advisory vote, commonly referred to as a “say-on-pay” advisory vote, is not binding on the Company, our Board of Directors or our Compensation Committee. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our named executive officers, as disclosed in this proxy statement in accordance with the compensation disclosure rules of the SEC. To the extent there is any significant vote against our named executive officers’ compensation as disclosed in this proxy statement, our Compensation Committee and Board of Directors will consider our shareholders’ concerns and evaluate whether any actions are necessary to address those concerns.

The affirmative vote of a majority of the votes cast in person or by proxy at the annual meeting is required to approve, on an advisory basis, the compensation of our named executive officers as disclosed in this proxy statement.

Accordingly, we ask our shareholders to vote on the following resolution at our 2022 annual meeting of shareholders:

RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the Named Executive Officers, as disclosed in the Company’s Proxy Statement for the 2022 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission including the Summary Compensation Table and other related tables and disclosures.

The Board of Directors unanimously recommends a vote FOR the approval, on an advisory basis, of the compensation of our named executive officers disclosed in this proxy statement.

Compensation of Directors

Each of the Company’s directors who is not an officer or employee of the Company is entitled to receive a retainer fee of $20,000 per year for Board of Directors membership and a fee of $1,000 for attendance at each Board of Directors meeting ($500 for a committee meeting held on a separate day). Officers and employees who serve as directors are not compensated for their services as directors. In accordance with the Company’s 2019 Long-Term Incentive Plan and the 2009 Long-Term Incentive Plan, non-employee directors are entitled to receive grants of options to purchase shares of Class A Common Stock as determined by the Board of Directors. All directors are reimbursed for expenses incurred in attending Board of Directors meetings and committee meetings.

|

DIRECTOR COMPENSATION

|

|

|

Name

|

|

Fees earned or paid in cash

|

|

|

Stock

awards

|

|

|

Option

awards (1)

|

|

|

Non-equity incentive plan compensation

|

|

|

Nonqualified deferred compensation earnings

|

|

|

All other compensation

|

|

|

Total

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kurtis D. Gramley

|

|

$ |

24,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

24,000 |

|

|

Stephen L. Gordon

|

|

$ |

24,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

24,000 |

|

|

Timothy C. Coxson

|

|

$ |

24,000 |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

24,000 |

|

The Company’s non-employee directors did not have any stock option awards at December 31, 2021.

|

EQUITY PLANS INFORMATION

|

|

|

Plan Category

|

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

|

|

Weighted-average exercise price of outstanding options, warrants and rights

|

|

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (1)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plan approved by securitiy holders

|

|

|

54,000 |

|

|

$ |

1.83 |

|

|

|

1,150,000 |

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The SEC requires disclosure of any transactions with related parties in which the amount exceeds $120,000. As defined by the SEC, the term related parties include any director, executive officer, nominee for director or any immediate family member of the director or executive officer, which includes child, stepchild, parent, stepparent, spouse, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law.

AWMS Holdings LLC

In August 2013, Avalon created a new Ohio limited liability company, AWMS Holdings, LLC, to act as a holding company to form and own a series of wholly owned subsidiaries that will own and operate salt water injection wells and facilities (together the “facilities”). AWMS Holdings, LLC, offers investment opportunities to accredited investors by selling membership units of AWMS Holdings, LLC through private placement offerings. The monies received from these offerings, along with internally contributed capital, are used to construct the facilities necessary for the operation of salt water injection wells. AWMS Water Solutions, LLC, a wholly owned subsidiary of Avalon, manages all the salt water injection well operations, including the marketing and sales function and all decisions regarding the well operations for a percentage of the gross revenues. As a result of the private placement offering, Avalon is not the majority owner of AWMS Holdings, LLC; however, due to the managerial control of AWMS Water Solutions, LLC the financial statements of AWMS Holdings, LLC and subsidiaries are included in Avalon’s consolidated financial statements.

Mr. Gramley and Mr. Gordon who are each a current director and nominee for director of the Company and are considered related parties, have purchased membership units in AWMS Holdings, LLC totaling $450,000 and $200,000, respectively.

Avalon Med Spa, LLC

In March 2021, Avalon created a new Ohio limited liability company, Avalon Med Spa, LLC. Avalon Med Spa, LLC provides elective appearance improving nonsurgical aesthetic services under the supervision of a licensed physician. Avalon Med Spa, LLC, offers investment opportunities to accredited investors by selling membership units through private placement offerings. The monies received from these offerings, along with internally contributed capital, are used to purchase medical spa equipment and construct the facilities necessary for operation. Avalon operates and manages all decisions regarding the medical spa operations for a percentage of the gross revenues. Avalon is the majority owner of Avalon Med Spa, LLC owning 50.1% of the company. The financial statements of Avalon Med Spa, LLC are included in Avalon’s consolidated financial statements.

Mr. Gramley, a related party as a current director and nominee for director of the Company, invested $71,242 in Avalon Med Spa, LLC. Mr. Gramley’s investment represents less than 10% of the total investment in Avalon Med Spa, LLC.

INDEPENDENT PUBLIC ACCOUNTANTS

The appointment of an independent public registered public accounting firm is approved annually by the Board of Directors based on the recommendation of the Audit Committee. Grant Thornton Thornton LLP (“Grant Thornton”) has served as the independent public accountant of the Company since 2019. Representatives of Grant Thornton will be present at the Annual Meeting of Shareholders and will be given an opportunity to make a statement if they desire to do so and will respond to appropriate questions from shareholders.

The aggregate fees billed to the Company for the years ended December 31, 2021 and 2020 by Grant Thornton are as follows:

| |

|

2021

|

|

|

2020

|

|

|

Audit fees

|

|

$ |

131,351 |

|

|

$ |

127,587 |

|

|

Audit-related fees

|

|

|

10,700 |

|

|

|

9,833 |

|

|

Tax fees

|

|

|

- |

|

|

|

- |

|

|

All other fees

|

|

|

- |

|

|

|

- |

|

The amount shown for “Audit fees” consists of fees relating to the audit of the Company’s financial statements and quarterly reviews of the unaudited interim financial statements. In 2021 and 2020, the amount shown for “audit-related fees” relate to the audit of the Company’s 401(k) profit sharing plan.

PRE-APPROVAL POLICY REGARDING INDEPENDENT AUDITORS

It is the Audit Committee’s policy to pre-approve all audit and non-audit services performed by the Company’s independent registered public accounting firm. All services provided by the Company’s independent registered public accounting firm were pre-approved by the Audit Committee in 2021.

COMPLIANCE WITH SECTION 16(a) OF THE SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors, its executive officers and persons holding more than 10 percent of a class of the Company’s equity securities, to file with the Commission, the NYSE Amex and the Company, initial reports of ownership and reports of changes in ownership of Common Stock and other equity securities of the Company. These officers, directors and greater than 10 percent shareholders are required by the Commission’s regulations to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on review of any such reports furnished to the Company, no such Section 16(a) reports were delinquent in 2021.

HEDGING POLICY

The Company has not adopted any practices or policies regarding the ability of employees (including officers) or directors of the Company, or any of their designees, to purchase financial instruments (including prepaid variable forward contracts, equity swaps, collars, and exchange funds), or otherwise engage in transactions, that hedge or offset, or are designed to hedge or offset, any decrease in the market value of Common Stock of the Company held by any such person, or Common Stock subject to options granted by the Company to any such person, other than the Company’s insider trading policy, which is intended to prohibit both transactions in Company securities while in possession of material non-public information and short selling of Company securities.

ANNUAL REPORT TO SHAREHOLDERS

The Company has enclosed its Annual Report to Shareholders for the Company and its subsidiaries for the year ended December 31, 2021, including financial statements reflecting the financial position and results of operations of the Company and its subsidiaries for that year. The Annual Report is not deemed to have been filed with the Commission and such report is not incorporated in this Proxy Statement nor is it part of this proxy solicitation.

SHAREHOLDER PROPOSALS

Any shareholder proposals which are intended to be presented at the 2023 Annual Meeting of Shareholders must be received by the Secretary of the Company at our principal executive offices no later than November 18, 2022. Such proposals must meet the requirements of the Commission to be eligible for inclusion in the Company’s 2023 Proxy Materials.

SHAREHOLDER COMMUNICATION TO THE BOARD

The Board provides a process for shareholders to send communications to the Board or to any Director individually. Shareholders may send written communications to the Board or to any Director c/o Avalon Holdings Corporation, One American Way, Warren, Ohio 44484, Attention: Secretary. All communications will be compiled by the Secretary and submitted to the Board or the individual Directors on a periodic basis.

FORM 10-K REPORT

The Company filed its Annual Report on Form 10-K for the year ended December 31, 2021, with the Commission on March 10, 2022. A copy of the Form 10-K report, including any financial statements and schedules, and a list describing any exhibits not contained therein, may be obtained without charge by any shareholder. The exhibits are available upon payment of nominal charges which approximate the Company’s cost of reproduction of the exhibits. Written requests for copies of the Form 10-K report or exhibits should be directed to the Secretary, Avalon Holdings Corporation, One American Way, Warren, Ohio 44484-5555.

OTHER MATTERS

The Board of Directors does not know of any matters or business to be presented for action at the meeting other than as set forth above. The enclosed proxy does, however, confer discretionary authority upon the persons named therein, or their substitutes, to take action with respect to any other matter that may properly be brought before the meeting or any adjournment thereof.

SOLICITATION OF PROXIES

The enclosed form of proxy is solicited by the Board of Directors and the proxies named therein have been designated by the Board of Directors. Shares represented by the proxy, when properly executed, will be voted at the meeting and, where a choice has been specified, such shares will be voted in accordance with such specification. If no specification is indicated, the proxies will be voted for the election of the nominees named herein as directors, in favor of the Board recommendations and on other matters presented for a vote in accordance with the judgment of the persons acting under the proxies. The cost of preparing, printing, assembling and mailing will be paid by the Company. In addition to the solicitation of proxies by mail, officers, directors, or other employees of the Company, as yet undesignated, and without additional remuneration, may solicit proxies personally or by other appropriate means, if deemed advisable. The Company will request brokers, banks and other nominees to send proxy material to, and if voting by mail obtain proxies from, the beneficial owners of Common Stock held of record by them and it will reimburse such persons for their expenses in so doing.

Your prompt action in voting your proxy will be greatly appreciated. It is hoped that you will attend the meeting. Whether or not you plan to attend the annual meeting, we urge you to cast your vote. You can vote via the internet, by telephone or by returning the proxy card. If you are voting by returning the proxy card, a self-addressed envelope, which requires no additional postage if mailed in the United States, is enclosed. If you have more than one shareholder account, you are receiving a proxy for each account. Please vote all proxies you receive.

BY ORDER OF THE BOARD OF DIRECTORS

/s/ Bryan P. Saksa

Bryan P. Saksa

Secretary

Warren, Ohio

March 11, 2022

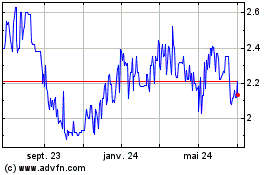

Avalon Holdngs (AMEX:AWX)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

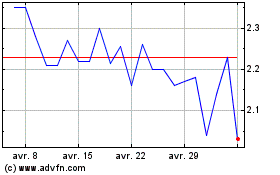

Avalon Holdngs (AMEX:AWX)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024