Statement of Changes in Beneficial Ownership (4)

31 Mars 2023 - 1:03AM

Edgar (US Regulatory)

FORM 4

☐

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Gen IV Investment Opportunities, LLC |

2. Issuer Name and Ticker or Trading Symbol

BATTALION OIL CORP

[

BATL

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

1700 BROADWAY, 35TH FLOOR |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/28/2023 |

|

(Street)

NEW YORK, NY 10019 |

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

|

(City)

(State)

(Zip)

|

Rule 10b5-1(c) Transaction Indication

☐

Check this box to indicate that a transaction was made pursuant to a contract, instruction or written plan that is intended to

satisfy the affirmative defense conditions of Rule 10b5-1(c). See Instruction 10.

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Series A Redeemable Convertible Preferred Stock | (3) | 3/28/2023 | | A | | 5138 (1) | | (4) | (5)(6) | Common Stock | (4) | (2) | 5138 | D | |

| Explanation of Responses: |

| (1) | This Form 4 is jointly filed by Gen IV Investment Opportunities, LLC ("Gen IV"), a Delaware limited liability company, LSP Generation IV, LLC ("LSP Gen IV"), a Delaware limited liability company, and LSP Investment Advisors, LLC ("LSP Advisors"), a Delaware limited liability company. LSP Gen IV, as the managing member of Gen IV, has the power to direct the affairs of Gen IV, including voting and disposing of the shares. LSP Advisors, as the investment manager of Gen IV, also has the power to direct the voting and disposition of the shares held by Gen IV. For Section 16 purposes, LSP Gen IV and LSP Advisors disclaim beneficial ownership over the shares reported herein, except to the extent of their pecuniary interest therein. |

| (2) | Pursuant to a Purchase Agreement dated as of March 28, 2023 (the "Series A Purchase Agreement"), on March 28, 2023 (the "Issuance Date"), Gen IV acquired from the Issuer 5,138 shares of Series A Redeemable Convertible Preferred Stock of the Issuer, par value $0.0001 per share ("Series A Preferred Shares") convertible into shares of Common Stock for an aggregate purchase price of approximately $5.0 million. |

| (3) | Pursuant to the Certificate of Designations contemplated by the Series A Purchase Agreement (the "Series A Certificate of Designations"), the conversion price of the Series A Preferred Shares is $9.03 per share and is subject to adjustment for stock splits, combinations, certain distributions or similar events in accordance with the terms of the Series A Certificate of Designations. |

| (4) | Subject to the terms and conditions of the Series A Certificate of Designations, all or any portion of the Series A Preferred Shares may be converted by Gen IV at any time into Common Stock at the Conversion Ratio. The "Conversion Ratio", for each Series A Preferred Share is the quotient of (i) the then-applicable liquidation preference (as determined in accordance with the Series A Certificate of Designations) and (ii) the then-applicable conversion price. |

| (5) | The Series A Preferred Shares have no expiration date. If based on the Issuer's financial statements for any fiscal quarter and a reserve report as of the same date, as of such date: (x) the PDP PV-20 value (as determined in accordance with the Series A Certificate of Designations) divided by (y) the number of outstanding shares of Common Stock, calculated on a fully diluted basis is equal to or exceeds 130% of the Conversion Price, then the Issuer may, from time to time until such time that the foregoing conditions are no longer satisfied or a Material Adverse Effect (as defined in the Series A Purchase Agreement) has occurred since the date of the most financial statements that met the foregoing conditions, cause the conversion of all or any portion of the Series A Preferred Shares into Common Stock using the then-applicable Conversion Ratio. |

| (6) | The Series A Preferred Shares are also subject to redemption by the Issuer at any time following the Issuance Date in accordance with the terms of the Series A Certificate of Designations. In the event of a change of control transaction, the Series A Preferred Shares are subject to redemption or conversion in accordance with the terms of the Series A Certificate of Designations. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Gen IV Investment Opportunities, LLC

1700 BROADWAY

35TH FLOOR

NEW YORK, NY 10019 |

| X |

|

|

LSP Generation IV, LLC

1700 BROADWAY

35TH FLOOR

NEW YORK, NY 10019 |

| X |

|

|

LSP Investment Advisors, LLC

1700 BROADWAY

35TH FLOOR

NEW YORK, NY 10019 |

| X |

|

|

Signatures

|

| Gen IV Investment Opportunities, LLC By: /s/ Jeff Wade Name: Jeff Wade

Title: Chief Compliance Officer | | 3/30/2023 |

| **Signature of Reporting Person | Date |

| LSP Generation IV, LLC By: /s/ Jeff Wade Name: Jeff Wade Title: Chief Compliance Officer | | 3/30/2023 |

| **Signature of Reporting Person | Date |

| LSP Investment Advisors, LLC By: /s/ Jeff Wade Name: Jeff Wade Title: Chief Compliance Officer and Associate General Counsel | | 3/30/2023 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

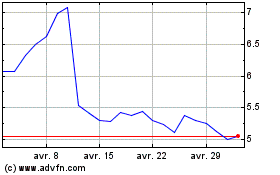

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Battalion Oil (AMEX:BATL)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024