As filed with the Securities and Exchange Commission on January 7, 2022

Securities Act File No. 333-259267

Investment Company Act File No. 811-02151

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, DC 20549

Form N-2

(Check

Appropriate Box or Boxes)

|

|

|

|

|

☒

|

|

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

☐

|

|

Pre-Effective Amendment No.

|

|

|

|

|

☒

|

|

Post-Effective Amendment No. 1

|

and/or

|

|

|

|

|

☒

|

|

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940

|

|

|

|

|

☒

|

|

Amendment No. 29

|

BANCROFT FUND LTD.

(Exact

name of Registrant as specified in Charter)

One Corporate Center, Rye, New York 10580-1422

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code: (800) 422-3554

Jane D. O’Keeffe

Bancroft Fund Ltd.

One

Corporate Center

Rye, New York 10580-1422

(914) 921-5100

(Name and Address of Agent for Service)

Copies to:

|

|

|

|

|

Peter Goldstein, Esq.

|

|

Thomas A. DeCapo, Esq.

Kenneth E. Burdon, Esq.

|

|

Bancroft Fund Ltd.

|

|

Skadden, Arps, Slate, Meagher & Flom LLP

|

|

One Corporate Center

|

|

500 Boylston Street

|

|

Rye, New York 10580-1422

|

|

Boston, Massachusetts 02116

|

|

(914) 921-5100

|

|

(617) 573-4800

|

Approximate Date of Commencement of Proposed Public Offering: From time to time after the effective date of this Registration Statement.

|

☐

|

Check box if the only securities being registered on this Form are being offered pursuant to dividend or

interest reinvestment plans.

|

|

☑

|

Check box if any securities being registered on this Form will be offered on a delayed or continuous basis in

reliance on Rule 415 under the Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan.

|

|

☑

|

Check box if this Form is a registration statement pursuant to General Instruction A.2 or a post-effective

amendment thereto.

|

|

☐

|

Check box if this Form is a registration statement pursuant to General Instruction B or a post-effective

amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act.

|

|

☐

|

Check box if this Form is a post-effective amendment to a registration statement filed pursuant to General

Instruction B to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act.

|

It

is proposed that this filing will become effective (check appropriate box):

|

☐

|

when declared effective pursuant to section 8(c) of the Securities Act

|

If appropriate, check the following box:

|

☐

|

This [post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement].

|

|

☐

|

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, and

|

|

|

the Securities Act registration statement number of the earlier effective registration statement for the same

offering is: ______.

|

|

☐

|

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the

Securities Act

|

|

|

registration statement number of the earlier effective registration statement for the same offering is: ______.

|

|

☒

|

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the

Securities Act

|

|

|

registration statement number of the earlier effective registration statement for the same offering is:

333-259267.

|

Check each box that appropriately characterizes the Registrant:

|

☑

|

Registered Closed-End Fund

(closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

|

|

☐

|

Business Development Company (closed-end company that intends or has

elected to be regulated as a business development company under the Investment Company Act.

|

|

☐

|

Interval Fund (Registered Closed-End Fund or a Business Development

Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

|

|

☑

|

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

|

☐

|

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

|

|

☐

|

Emerging Growth Company (as defined by Rule 12b-2 under the Securities

and Exchange Act of 1934).

|

|

☐

|

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

|

☐

|

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing).

|

EXPLANATORY NOTE

This Post-Effective Amendment No. 1 to the Registration Statement on Form N-2 (File Nos. 333-259267 and 811-02151) of Bancroft Fund Ltd. (the

“Registration Statement”) is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the purpose of filing exhibits to the Registration Statement. Accordingly, this

Post-Effective Amendment No. 1 consists only of a facing page, this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This Post-Effective Amendment No. 1 does not

modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities Act, this Post-Effective Amendment No. 1 shall become effective immediately upon filing with the Securities and Exchange Commission. The contents of

the Registration Statement are hereby incorporated by reference.

PART C

OTHER INFORMATION

|

Item 25.

|

Financial Statements and Exhibits

|

Part A

The

audited financial statements included in the annual report to the Fund’s shareholders for the fiscal year ended October

31, 2021 (the “2021 Annual Report”), together with the report of PricewaterhouseCoopers LLP thereon, are incorporated by reference to the 2021 Annual Report in Part A.

The report of Tait, Weller & Baker LLP included in

the annual report to the Fund’s shareholders for the fiscal year ended October 31, 2017 (the “2017 Annual Report”), is incorporated by reference to the 2017 Annual Report in Part A.

The Financial Highlights included in the annual report

to the Fund’s shareholders for the fiscal year ended October 31, 2015 (the “2015 Annual Report”), are incorporated by reference to the 2015 Annual Report in Part A.

Part B

None

(ii) Amendment

to Amended and Restated Agreement and Declaration of Trust of Registrant (2)

(iii) Statement

of Preferences for 5.375% Series A Cumulative Preferred Shares (3)

(iv) Statement of Preferences for

Cumulative Preferred Shares *

|

|

(d)

|

(i) Form of Subscription Certificate for Common Shares *

|

(ii) Form of Subscription Certificate for [ ]% Series

Cumulative Preferred Shares *

(iii) Form

of Subscription Certificate Shares for Common Shares and [

]% Series Cumulative Preferred Shares *

(iv) Form

of Indenture (4)

(v) Form T-1 Statement of Eligibility of Trustee with respect to the Form

of Indenture *

|

|

(h)

|

(i) Form of Underwriting Agreement *

|

(ii) Form of Dealer Manager Agreement *

(ii) Appendix A, dated November

20, 2015, to Amended and Restated Master Custodian Agreement (2)

(ii) Addendum to Transfer Agency and Registrar Services

Agreement (3)

(iii) Form of Rights Agent Agreement *

(iv) Form of Information Agent Agreement *

(ii) Consent of Independent Registered

Public Accounting Firm (8)

(ii) Form

of Prospectus Supplement Relating to Common Shares (4)

(iii) Form

of Prospectus Supplement Relating to Preferred Shares (4)

(iv) Form

of Prospectus Supplement Relating to Notes (4)

(v) Form

of Prospectus Supplement Relating to Subscription Rights to Purchase Common Shares (4)

(vi) Form

of Prospectus Supplement Relating to Subscription Rights to Purchase Preferred Shares (4)

(vii) Form

of Prospectus Supplement Relating to Subscription Rights to Purchase Common and Preferred Shares (4)

|

(1)

|

Incorporated by reference to the Registrant’s Semi-Annual Report for Management Companies on Form NSAR, as

filed with the Commission on June 30, 2006.

|

|

(2)

|

Incorporated by reference to the Registrant’s Registration Statement on Form N-2, File Nos. 333-211322 and 811-02151, as filed with the Commission on May 12, 2016.

|

|

(3)

|

Incorporated by reference to the Post-Effective Amendment No. 1 to the Registrant’s Registration

Statement on Form N-2, File No. 333-21322 and 811-02151, as filed with the Commission on August 8, 2016.

|

|

(4)

|

Incorporated by reference to the Registrant’s Registration Statement on Form N-2, File No. 333-259267, as

filed with the Commission on September 2, 2021.

|

|

(5)

|

Incorporated by reference to the Registrant’s Semi-Annual Report on Form

N-CSR for the reporting period ended April 31, 2021, as filed with the Commission on July 6, 2021.

|

|

(6)

|

Incorporated by reference to Exhibit (g) of The Gabelli Utilities Fund’s Registration Statement on

Form N-1A, File Nos. 333-81209 and 811-09397, as filed with the Commission on May 1, 2002.

|

|

(7)

|

Incorporated by reference to the Registrant’s Registration Statement on Form N-2, File Nos. 333-109243 and 811-0215 as filed with the Commission on September 29, 2003.

|

|

(8)

|

Incorporated by reference to the Pre-Effective Amendment No. 1 to the Registrant’s Registration Statement

on Form N-2, File No. 333-259267 and 811-02151, as filed with the Commission on December 14, 2021.

|

|

*

|

To be filed by Amendment.

|

|

Item 26.

|

Marketing Arrangements

|

The information contained under the heading “Plan of Distribution” in the Prospectus is incorporated by reference, and any

information concerning any underwriters will be contained in the accompanying Prospectus Supplement, if any.

|

Item 27.

|

Other Expenses of Issuance and Distribution

|

The following table sets forth the estimated expenses to be incurred in connection with the offering described in this Registration Statement:

|

|

|

|

|

SEC registration fees

|

|

$ 10,910

|

|

NYSE American listing fee

|

|

$ 17,329

|

|

Rating Agency fees

|

|

$ 50,000

|

|

Printing/engraving expenses

|

|

$ 150,000

|

|

Auditing fees and expenses

|

|

$ 47,500

|

|

Legal fees and expenses

|

|

$ 315,000

|

|

Miscellaneous

|

|

$ 113,261

|

|

|

|

|

|

Total

|

|

$ 704,000

|

|

Item 28.

|

Persons Controlled by or Under Common Control with Registrant

|

None.

Item 29. Number of Holders of

Securities as of November 30, 2021

|

|

|

|

|

Title of Class

|

|

Number of

Record Holders

|

|

Common Shares of Beneficial Interest

|

|

505

|

|

5.375% Series A Cumulative Preferred Shares

|

|

1

|

The Registrant’s Agreement and Declaration of Trust provides as follows:

Section 2.8 Personal Liability of Shareholders. Neither the Trust nor the Trustees, nor any officer, employee, or agent of the Trust shall have any

power to bind personally any Shareholder or to call upon any Shareholder for the payment of any sum of money or assessment whatsoever other than such as the Shareholder may at any time personally agree to pay by way of subscription for any Shares or

otherwise. The Shareholders shall be entitled, to the fullest extent permitted by applicable law, to the same limitation of personal liability as is extended under the Delaware General Corporation Law to stockholders of private corporations for

profit. Every note, bond, contract or other undertaking issued by or on behalf of the Trust or the Trustees relating to the Trust shall include a recitation limiting the obligation represented thereby to the Trust and the assets belonging thereto

(but the omission of such a recitation shall not operate to bind any Shareholder or Trustee of the Trust or otherwise limit any benefits set forth in the Delaware Act that may be applicable to such Persons).

Section 8.1 Limitation of Liability. A Trustee or officer of the Trust, when acting in such capacity, shall not be personally liable to any person

for any act, omission or obligation of the Trust or any Trustee or officer of the Trust; provided, however, that nothing contained herein or in the Delaware Act shall protect any Trustee or officer against any liability to the Trust or to

Shareholders to which he would otherwise be subject by reason of willful misfeasance, bad faith, gross negligence or reckless disregard of the duties involved in the conduct of his office with the Trust.

Section 8.2 Indemnification of Covered Persons. Every Covered Person shall be indemnified by the Trust to the fullest extent permitted by the

Delaware Act, the Bylaws and other applicable law.

Section 8.3 Indemnification of Shareholders. In case any Shareholder or former Shareholder

of the Trust shall be held to be personally liable solely by reason of his being or having been a Shareholder of the Trust or any Class and not because of his acts or omissions or for some other reason, the Shareholder or former Shareholder (or

his heirs, executors, administrators or other legal representatives, or, in the case of a corporation or other entity, its corporate or general successor) shall be entitled, out of the assets of the Trust, to be held harmless from and indemnified

against all loss and expense arising from such liability in accordance with the Bylaws and applicable law. The Trust shall upon request by the Shareholder, assume the defense of any such claim made against the Shareholder for any act or obligation

of the Trust.

Article VI of the Registrant’s Amended and Restated By-Laws provides as follows:

Section 6.1 Mandatory Indemnification.

(a) The Fund shall indemnify the Trustees and officers of the Fund (each such person being an

“indemnitee”) against any liabilities and expenses, including amounts paid in satisfaction of judgments, in compromise or as fines and penalties, and reasonable counsel fees reasonably incurred by such indemnitee in connection with the

defense or disposition of any action, suit or other proceeding, whether civil or criminal, before any court or administrative or investigative body in which he may be or may have been involved as a party or otherwise (other than, except as

authorized by the Trustees, as the plaintiff or complainant) or with which he may be or may have been threatened, while acting in any capacity set forth above in this Section 6.1 by reason of his having acted in any such capacity, except with

respect to any matter as to which he shall not have acted in good faith in the reasonable belief that his action was in the best interest of the Fund or, in the case of any criminal proceeding, as to which he shall have had reasonable cause to

believe that the conduct was unlawful, provided, however, that no indemnitee shall be indemnified hereunder against any liability to any person or any expense of such indemnitee arising by reason of (1) willful misfeasance, (2) bad faith,

(3) gross negligence, or (4) reckless disregard of the duties involved in the conduct of his position (the conduct referred to in such clauses (1) through (4) being sometimes referred to herein as “disabling conduct”).

Notwithstanding the foregoing, with respect to any action, suit or other proceeding voluntarily prosecuted by any indemnitee as plaintiff, indemnification shall be mandatory only if the prosecution of such action, suit or other proceeding by such

indemnitee was authorized by a majority of the Trustees.

(b) Notwithstanding the foregoing, no indemnification shall be made hereunder unless there has

been a determination (i) by a final decision on the merits by a court or other body of competent jurisdiction before whom the issue of entitlement to indemnification hereunder was brought that such indemnitee is entitled to indemnification

hereunder or, (ii) in the absence of such a decision, by (1) a majority vote of a quorum of those Independent Trustees who are not parties to the proceeding (“Disinterested Non-Party

Trustees”), that the indemnitee is entitled to indemnification hereunder, or (2) if such quorum is not obtainable or even if obtainable, if such majority so directs, independent legal counsel in a written opinion conclude that the

indemnitee should be entitled to indemnification hereunder. All determinations to make advance payments in connection with the expense of defending any proceeding shall be authorized and made in accordance with the immediately succeeding paragraph

(c) below.

(c) The Fund shall make advance payments in connection with the expenses of defending any action with respect to which indemnification

might be sought hereunder if the Fund receives a written affirmation by the indemnitee of the indemnitee’s good faith belief that the standards of conduct necessary for indemnification have been met and a written undertaking to reimburse the

Fund unless it is subsequently determined that he is entitled to such indemnification and if a majority of the Trustees determine that the applicable standards of conduct necessary for indemnification appear to have been met. In addition, at least

one of the following conditions must be met: (i) the indemnitee shall provide adequate security for his undertaking, (ii) the Fund shall be insured against losses arising by reason of any lawful advances, or (iii) a majority of a

quorum of the Disinterested Non-Party Trustees, or if a majority vote of such quorum so direct, independent legal counsel in a written opinion, shall conclude, based on a review of readily available facts (as

opposed to a full trial-type inquiry), that there is substantial reason to believe that the indemnitee ultimately will be found entitled to indemnification.

(d) The rights accruing to any indemnitee under these provisions shall not exclude any other right to which he may be lawfully entitled.

(e) Notwithstanding the foregoing, subject to any limitations provided by the 1940 Act, the Declaration and these

By-Laws, the Fund shall have the power and authority to indemnify persons providing services to the Fund to the full extent provided by law as if the Fund were a corporation organized under the Delaware

General Corporation Law provided that such indemnification (or contractual provision therefor) has been approved by a majority of the Trustees.

Section 6.2 No Duty of Investigation; Notice in Fund Instruments, etc. No purchaser, lender, transfer agent or other person dealing with the

Trustees or with any officer, employee or agent of the Fund shall be bound to make any inquiry concerning the validity of any transaction purporting to be made by the Trustees or by said officer, employee or agent or be liable for the application of

money or property paid, loaned, or delivered to or on the order of the Trustees or of said officer, employee or agent. Every obligation, contract, undertaking, instrument, certificate, Share, other security of the Trust, and every other act or thing

whatsoever executed in connection with the Fund shall be conclusively taken to have been executed or done by the executors thereof only in their capacity as Trustees under these By-Laws or in their capacity as

officers, employees or agents of the Trust. The Trustees may maintain insurance for the protection of the Fund Property, its shareholders, Trustees, officers, employees and agents in such amount as the Trustees shall deem adequate to cover possible

liability, and such other insurance as the Trustees in their sole judgment shall deem advisable or is required by the 1940 Act.

Section 6.3

Reliance on Experts, etc. Each Trustee and officer or employee of the Fund shall, in the performance of its duties, be fully and completely justified and protected with regard to any act or any failure to act resulting from reliance in good

faith upon the books of account or other records of the Trust, upon an opinion of counsel, or upon reports made to the Fund by any of the Fund’s officers or employees or by any advisor, administrator, manager, distributor, selected dealer,

accountant, appraiser or other expert or consultant selected with reasonable care by the Trustees, officers or employees of the Fund, regardless of whether such counsel or other person may also be a Trustee.

Section 6.4 Amendment, Repeal or Modification. Any amendment, repeal, or modification of, or adoption

of any provision inconsistent with, this Article VI (or any provision hereof) shall not adversely affect any right to indemnification or advancement of expenses granted to any person pursuant hereto with respect to any act or omission of such person

occurring prior to the time of such amendment, repeal, modification, or adoption (regardless of whether the proceeding relating to such acts or omissions is commenced before or after the time of such amendment, repeal, modification, or adoption).

Any amendment or modification of, or adoption of any provision inconsistent with, this Article VI (or any provision hereof), that has the effect of positively affecting any right to indemnification or advancement of expenses granted to any person

pursuant hereto, shall not apply retroactively to any person who was not serving as a Trustee or officer of the Fund at the time of such amendment, modification or adoption. The provisions of this Article VI do not deprive any person who was a

Covered Person at the time of the adoption of these By-Laws of any benefit provided under the Fund’s Amended and Restated By-Laws, effective as of April 10,

2006, with respect to the time period prior to the adoption of these By-Laws.

Section 9 of

the Registrant’s Investment Advisory Agreement provides as follows:

9. Indemnity

(a) The Fund hereby agrees to indemnify the Adviser and each of the Adviser’s Trustees, officers, employees, and agents (including any individual who

serves at the Adviser’s request as director, officer, partner, trustee or the like of another corporation) and controlling persons (each such person being an “indemnitee”) against any liabilities and expenses, including amounts paid

in satisfaction of judgments, in compromise or as fines and penalties, and counsel fees (all as provided in accordance with applicable corporate law) reasonably incurred by such indemnitee in connection with the defense or disposition of any action,

suit or other proceeding, whether civil or criminal, before any court or administrative or investigative body in which he may be or may have been involved as a party or otherwise or with which he may be or may have been threatened, while acting in

any capacity set forth above in this paragraph or thereafter by reason of his having acted in any such capacity, except with respect to any matter as to which he shall have been adjudicated not to have acted in good faith in the reasonable belief

that his action was in the best interest of the Fund and furthermore, in the case of any criminal proceeding, so long as he had no reasonable cause to believe that the conduct was unlawful, provided, however, that (1) no indemnitee shall be

indemnified hereunder against any liability to the Fund or its shareholders or expense of such indemnitee arising by reason of (i) willful misfeasance, (ii) bad faith, (iii) gross negligence, (iv) reckless disregard of the duties

involved in the conduct of his position (the conduct referred to in such clauses (i) through (v) being sometimes referred to herein as “disabling conduct”), (2) as to any matter disposed of by settlement or a compromise

payment by such indemnitee, pursuant to a consent decree or otherwise, no indemnification either for said payment or for any other expenses shall be provided unless there has been a determination that such settlement or compromise is in the best

interests of the Fund and that such indemnitee appears to have acted in good faith in the reasonable belief that his action was in the best interest of the Fund and did not involve disabling conduct by such indemnitee and (3) with respect to

any action, suit or other proceeding voluntarily prosecuted by any indemnitee as plaintiff, indemnification shall be mandatory only if the prosecution of such action, suit or other proceeding by such indemnitee was authorized by a majority of the

full Board of the Fund. Notwithstanding the foregoing the Fund shall not be obligated to provide any such indemnification to the extent such provision would waive any right which the Fund cannot lawfully waive.

(b) The Fund shall make advance payments in connection with the expenses of defending any action with respect to which indemnification might be sought

hereunder if the Fund receives a written affirmation of the indemnitee’s good faith belief that the standard of conduct necessary for indemnification has been met and a written undertaking to reimburse the Fund unless it is subsequently

determined that he is entitled to such indemnification and if the Trustees of the Fund determine that the facts then known to them would not preclude indemnification. In addition, at least one of the following conditions must be met: (A) the

indemnitee shall provide a security for his undertaking, (B) the Fund shall be insured against losses arising by reason of any lawful advances, or (C) a majority of a quorum of Trustees of the Fund who are neither “interested

persons” of the Fund nor parties to the proceeding (“Disinterested Non-Party Trustees”) or an independent legal counsel in a written opinion, shall determine, based on a review of readily

available facts (as opposed to a full trial-type inquiry), that there is reason to believe that the indemnitee ultimately will be found entitled to indemnification.

(c) All determinations with respect to indemnification hereunder shall be made (1) by a final decision on the merits by a court or other body before whom

the proceeding was brought that such indemnitee is not liable by reason of disabling conduct or, (2) in the absence of such a decision, by (i) a majority vote of a quorum of the Disinterested

Non-party Trustees of the Fund, or (ii) if such a quorum is not obtainable or even, if obtainable, if a majority vote of such quorum so directs, independent legal counsel in a written opinion.

(d) The rights accruing to any indemnitee under these provisions shall not exclude any other right to which he may be lawfully entitled.

(e) Any indemnity payment to the Adviser pursuant to this Section 9 shall be subject to the expense limitation set forth in the penultimate paragraph of

Section 7 for the two year time period referred to therein.

Other

Underwriter indemnification provisions to be filed by amendment.

Additionally, the Registrant and the other funds in the Gabelli/GAMCO Fund Complex jointly maintain, at their own expense, E&O/D&O

insurance policies for the benefit of its directors/trustees, officers and certain affiliated persons. The Registrant pays a pro rata portion of the premium on such insurance policies.

Insofar as indemnification for liability arising under the Securities Act of 1933 may be permitted to directors, officers and controlling

persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities

Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the

successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

|

Item 31.

|

Business and Other Connections of Investment Adviser

|

The Investment Adviser, a limited liability company organized under the laws of the State of New York, acts as investment adviser to the

Registrant. The Registrant is fulfilling the requirement of this Item 31 to provide a list of the officers and directors of the Investment Adviser, together with information as to any other business, profession, vocation or employment of a

substantial nature engaged in by the Investment Adviser or those officers and directors during the past two years, by incorporating by reference the information contained in the Form ADV of the Investment Adviser filed with the Securities and

Exchange Commission pursuant to the Investment Advisers Act of 1940 (Securities and Exchange Commission File No. 801-37706).

|

Item 32.

|

Location of Accounts and Records

|

The accounts and records of the Registrant are maintained in part at the office of the Investment Adviser at One Corporate Center, Rye, New

York 10580-1422, in part at the offices of the Fund’s custodian, State Street Bank and Trust Company, at One Lincoln Street, Boston, Massachusetts 02111, and in part at the offices of the Fund’s shareholder services and transfer agent,

American Stock Transfer & Trust Company, LLC, at 6201 15th Avenue, Brooklyn, NY 11219.

|

Item 33.

|

Management Services

|

Not applicable.

|

|

3.

|

Registrant undertakes:

|

|

|

a.

|

to file, during a period in which offers or sales are being made, a post-effective amendment to this

Registration Statement:

|

|

|

(1)

|

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

|

(2)

|

to reflect in the prospectus any facts or events after the effective date of the registration statement (or the

most recent post- effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of

securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with

the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the

effective registration statement.

|

|

|

(3)

|

to include any material information with respect to the plan of distribution not previously disclosed in the

Registration Statement or any material change to such information in the Registration Statement.

|

Provided, however,

that paragraphs a(1), a(2), and a(3) of this section do not apply to the extent the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or

furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference into the registration statement, or is

contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

b.

|

that for the purpose of determining any liability under the Securities Act, each post-effective amendment shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

|

|

|

c.

|

to remove from registration by means of a post-effective amendment any of the securities being registered which

remain unsold at the termination of the offering;

|

|

|

d.

|

that, for the purpose of determining liability under the Securities Act to any purchaser:

|

|

|

(1)

|

if the Registrant is subject to Rule 430B:

|

|

|

(A)

|

Each prospectus filed by the Registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the

registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

(B)

|

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule

430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that

prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration

statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective

date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

|

|

|

(2)

|

if the Registrant is subject to Rule 430C: each prospectus filed pursuant to Rule 424(b) under the Securities

Act as part of a registration statement relating to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration

statement as of the date it is first used after effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated

by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the

registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first use.

|

|

|

e.

|

that for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in

the initial distribution of securities:

|

The undersigned Registrant undertakes that in a primary offering of securities

of the undersigned Registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following

communications, the undersigned Registrant will be a seller to the purchaser and will be considered to offer or sell such securities to the purchaser:

|

|

(1)

|

any preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be

filed pursuant to Rule 424 under the Securities Act;

|

|

|

(2)

|

free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used

or referred to by the undersigned Registrant;

|

|

|

(3)

|

the portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act

relating to the offering containing material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

|

|

|

(4)

|

any other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

|

|

|

5.

|

The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the

Securities Act of 1933, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 that is incorporated by reference into the registration statement shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

6.

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to

directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public

policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling

person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its

counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed by the final

adjudication of such issue.

|

|

|

7.

|

Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery,

within two business days of receipt of a written or oral request, any prospectus or Statement of Additional Information.

|

|

|

8.

|

Registrant undertakes to only offer rights to purchase common and preferred shares together after a

post-effective amendment to the Registration Statement relating to such rights has been declared effective.

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933 and the Investment Company Act of 1940, the Registrant has duly caused this

registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Rye, and State of New York, on the 7th day of January, 2022.

|

|

|

|

|

Bancroft Fund Ltd.

|

|

|

|

|

By:

|

|

/s/ Jane D. O’Keeffe

|

|

|

|

Jane D. O’Keeffe

President

|

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed

below by the following persons in the capacities indicated and on the 7th day of January, 2022.

|

|

|

|

|

NAME

|

|

TITLE

|

|

|

|

|

/s/ Jane D. O’Keeffe

Jane D. O’Keeffe

|

|

President and Trustee

(Principal Executive

Officer)

|

|

|

|

|

/s/ John C. Ball

John C. Ball

|

|

Treasurer

(Principal Financial and Accounting

Officer)

|

|

|

|

|

*

Mario J. Gabelli

|

|

Trustee

|

|

|

|

|

*

Kinchen C. Bizzell

|

|

Trustee

|

|

|

|

|

*

Elizabeth C. Bogan

|

|

Trustee

|

|

|

|

|

*

James P. Conn

|

|

Trustee

|

|

|

|

|

*

Frank J. Fahrenkopf, Jr.

|

|

Trustee

|

|

|

|

|

*

Daniel D. Harding

|

|

Trustee

|

|

|

|

|

*

Michael J. Melarkey

|

|

Trustee

|

|

|

|

|

*

Agnes Mullady

|

|

Trustee

|

|

|

|

|

*

Kuni Nakamura

|

|

Trustee

|

|

|

|

|

*

Nicholas W. Platt

|

|

Trustee

|

|

|

|

|

|

*

Anthonie C. van Ekris

|

|

Trustee

|

|

|

|

|

/s/ John C. Ball

John C. Ball

|

|

Attorney-in-Fact

|

|

*

|

Pursuant to a Power of Attorney

|

EXHIBIT INDEX

|

|

|

|

|

EXHIBIT

NUMBER

|

|

DESCRIPTION OF EXHIBIT

|

|

|

|

|

Ex. (n)(i)

|

|

Consent of Independent Registered Public Accounting Firm

|

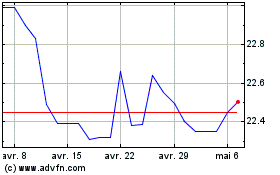

Bancroft (AMEX:BCV-A)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Bancroft (AMEX:BCV-A)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024