Current Report Filing (8-k)

29 Septembre 2022 - 10:16PM

Edgar (US Regulatory)

0001309082false00013090822022-09-272022-09-27iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 27, 2022

Camber Energy, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 000-29219 | | 20-2660243 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

15915 Katy Freeway, Suite 450 Houston, Texas | | 77094 |

(Address of principal executive offices) | | (Zip Code) |

(Registrant’s telephone number, including area code): (281) 404-4387

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common Stock | | CEI | | NYSE American |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.07 Submission of Matters to a Vote of Security Holders.

On September 27, 2022, Camber Energy, Inc. (“we”, “us” or the “Company”) held its combined 2021 and 2022 Annual Meeting of Stockholders (the “Meeting”). At the Meeting, an aggregate of 330,350,920 shares of voting stock, or approximately 60.5% of our 545,750,593 total outstanding voting shares as of August 12, 2022, the record date for the Meeting (the “Record Date”), were present virtually at or were voted at the Meeting, constituting a quorum. The following proposals were voted on at the Meeting (as described in greater detail in the Definitive Proxy Statement on Schedule 14A, filed with the Securities and Exchange Commission on August 17, 2022, and the supplement thereto, filed with the Securities and Exchange Commission on September 2, 2022 (together, the “Proxy”), with the results of such voting as set forth below. Capitalized terms have the meanings given to such terms in the Proxy and this Form 8-K should be read in connection with the Proxy.

Proposal 1 | | | For | | Withhold | | Broker Non-Votes | |

Election of Directors: | | | | | | | |

James A. Doris | | 265,840,984 | | 12,924,664 | | 51,585,272 | |

Fred S. Zeidman | | 262,711,066 | | 16,054,582 | | 51,585,272 | |

James G. Miller | | 263,837,754 | | 14,927,894 | | 51,585,272 | |

Robert K. Green | | 263,863,681 | | 14,901,967 | | 51,585,272 | |

Proposal 2 | | | For | | Against | | Abstain* | |

Ratification of the appointment of Turner, Stone & Company, L.L.P. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2022. | | 316,753,242 | | 11,787,836 | | 1,809,842 | |

Proposal 3 | | | For | | Against | | Abstain | Broker Non-Votes |

To approve, by a non-binding vote, the compensation of the Company’s named executive officers | | 266,339,685 | | 18,058,070 | | 2,127,426 | 43,825,739 |

* There were no Broker Non-Votes on this proposal.

As a result of the above voting, each of the four (4) director nominees were duly appointed to the Board of Directors by a plurality of the votes cast (there was no solicitation in opposition to management’s nominees as listed in the proxy statement), each to serve a term of one year and until their respective successors have been elected and qualified, or until their earlier resignation or removal; proposals 2 and 3, which each required the affirmative vote of a majority of the shares present in person or represented by proxy at the Meeting and entitled to vote, were validly approved by the Company’s stockholders (notwithstanding the fact that proposal 3 is non-binding).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CAMBER ENERGY, INC. | |

| | |

| Date: September 29, 2022 | By: | /s/ James A. Doris | |

| Name: | James A. Doris | |

| Title: | Chief Executive Officer | |

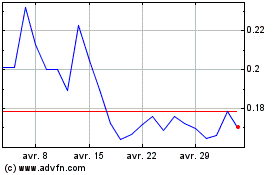

Camber Energy (AMEX:CEI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Camber Energy (AMEX:CEI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024