UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

| CAMBER ENERGY, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

CAMBER ENERGY

15915 Katy Freeway, Suite 450

Houston, Texas 77094

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On April 26, 2023

_______________________________

Dear Stockholders:

Camber Energy, Inc. (“we”, “us” or the “Company”) cordially invites you to attend a special meeting of stockholders (the “Special Meeting”). The meeting will be held virtually on April 26, 2023, at 10:00 a.m. (Houston time), at 15915 Katy Freeway, Suite 450, Houston, Texas 77094.

Due to the public health impact of the novel coronavirus outbreak (COVID-19) and to support the health and well-being of our management and stockholders, NOTICE IS HEREBY GIVEN that the Special Meeting will be held in a virtual meeting format only. The virtual meeting may be accessed at https://agm.iproxydirect.com/cei. There is no in-person meeting for you to attend. Registration to attend the Special Meeting will begin at 9:45 a.m. (15 minutes before the Special Meeting begins), which can be accomplished using your control number and other information. Once your registration is complete, you can access the Special Meeting at https://agm.iproxydirect.com/cei and click on “Vote My Shares” to cast your vote on the proposals being considered at the Special Meeting. You will also be permitted to submit questions at the time of registration. After registration is complete and you have entered the Special Meeting virtually, the next screen will include a “Ask a Question” box where your questions may be submitted. You may ask questions that are confined to matters properly before the Special Meeting and of general Company concern. All answers to proper questions received at the meeting will be posted to the Investor Relations page of our website upon conclusion of the meeting. The meeting will begin promptly at 10:00 a.m. (Houston time). We encourage you to access the virtual meeting prior to the start time. Online access will open approximately at 9:45 a.m. (Houston time), and you should allow ample time to log in to the meeting and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. There will be technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page. Whether or not you plan to attend the Special Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Special Meeting.

At the meeting we will be considering and voting on the following matters:

1. To approve the filing of an amendment to the Company’s Articles of Incorporation to increase the number of our authorized shares of common stock from 20,000,000 to 500,000,000; and

2. To consider and vote upon a Proposal to authorize the Company’s Board of Directors (the “Board of Directors”), in its discretion, to adjourn the Special Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the Proposal listed above at the time of the Special Meeting.

Stockholders who owned our common stock, Series C Redeemable Convertible Preferred Stock (“Series C Preferred Stock”) or Series G Redeemable Convertible Preferred Stock (“Series G Preferred Stock”) at the close of business on February 28, 2023 (the “Record Date”), may attend and vote at the meeting, provided that holders of our Series C Preferred Stock and Series G Preferred Stock have the right to cast votes on all Proposals above, except any shareholder proposals, equal to the as-converted amount of such Series C Preferred Stock and Series G Preferred Stock, respectively (subject to the beneficial ownership limitations in the Certificate of Designations of Preferences, Powers, Rights and Limitations of Series C Redeemable Convertible Preferred Stock (the “Series C COD”) and the Certificate of Designations of Preferences, Powers, Rights and Limitations of Series G Redeemable Convertible Preferred Stock (the “Series G COD”), respectively). The holders of the Series C Preferred Stock and the Series G Preferred Stock have contractually agreed not to vote any shares except as requested by the Board of Directors. A stockholders list will be available at our offices at 15915 Katy Freeway, Suite 450, Houston, Texas 77094, for a period of ten days prior to the meeting. We hope that you will be able to virtually attend the meeting.

Pursuant to rules adopted by the SEC, the Company uses the Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders. All stockholders will have the ability to access the proxy materials (including the Proxy Statement or the form of proxy) via the Internet at https://www.iproxydirect.com/CEI or request a printed set of the proxy materials by contacting our main office at (281) 404-4387. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. The Notice contains a control number that you will need to vote your shares. Please keep the Notice for your reference through the meeting date. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its Special Meeting.

Whether or not you plan to attend the Special Meeting, please vote electronically via the Internet or by telephone, or, if you requested paper copies of the proxy materials, please complete, sign, date and return the accompanying proxy card in the enclosed postage-paid envelope. See “How do I cast my vote?” in the Proxy Statement for more details.

We look forward to seeing you at the meeting.

| | By order of the Board of Directors, | |

| | | |

| | /s/ James A. Doris | |

| | James A. Doris | |

| | Chief Executive Officer | |

| | | |

| Houston, Texas | | |

| March 10, 2023 | | |

TABLE OF CONTENTS

Appendix:

Appendix A - Form of Certificate of Amendment to Articles of Incorporation (see Proposal 1)

CAMBER ENERGY

15915 Katy Freeway, Suite 450

Houston, Texas 77094

________________________________

PROXY STATEMENT

_______________________________

GENERAL INFORMATION

Camber Energy, Inc. (“Camber,” “we,” “us”, “our” or the “Company”) has made these materials available to you on the Internet or, upon your request, has delivered printed versions of these materials to you by mail, in connection with the Company’s solicitation of proxies for use at a special meeting of stockholders (the “Special Meeting” or the “Meeting”) to be held virtually on April 26, 2023, at 10:00 a.m. (Houston time), at 15915 Katy Freeway, Suite 450, Houston, Texas 77094, and at any postponement(s) or adjournment(s) thereof. These materials were first sent or given to stockholders on or around March 10, 2023. You are invited to attend the Special Meeting and are requested to vote on the Proposals described in this Proxy Statement.

For the continued support of the health and well-being of our management and stockholders, NOTICE IS HEREBY GIVEN that the Special Meeting will be held in a virtual meeting format only. The virtual meeting may be accessed at https://agm.iproxydirect.com/cei. There is no in-person meeting for you to attend. Registration to attend the Special Meeting will begin at 9:45 a.m. (15 minutes before the Special Meeting begins), which can be accomplished using your control number and other information. Once your registration is complete, you can access the Special Meeting at https://agm.iproxydirect.com/cei and click on “Vote My Shares” to cast your vote on the proposals being considered at the Special Meeting. You will also be permitted to submit questions at the time of registration. After registration is complete and you have entered the Special Meeting virtually, the next screen will include a “Ask a Question” box where your questions may be submitted. You may ask questions that are confined to matters properly before the Special Meeting and of general Company concern. All answers to proper questions received at the meeting will be posted to the Investor Relations page of our website upon conclusion of the meeting. The meeting will begin promptly at 10:00 a.m. (Houston time). We encourage you to access the virtual meeting prior to the start time. Online access will open approximately at 9:45 a.m. (Houston time), and you should allow ample time to log in to the meeting and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance. There will be technicians ready to assist you with any technical difficulties you may have accessing the virtual meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page. Whether or not you plan to attend the Special Meeting, we urge you to vote and submit your proxy in advance of the meeting by one of the methods described in the proxy materials for the Special Meeting.

Information Contained In This Proxy Statement

The information in this Proxy Statement relates to the Proposals to be voted on at the Special Meeting. If you requested printed versions of these materials by mail, these materials also include the proxy card or vote instruction form for the Special Meeting.

Important Notice Regarding the Availability of Proxy Materials

Pursuant to rules adopted by the SEC, the Company uses the Internet as the primary means of furnishing proxy materials to stockholders. Accordingly, the Company is sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to the Company’s stockholders. All stockholders will have the ability to access the proxy materials via the Internet at https://www.iproxydirect.com/CEI or request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. The Notice contains a control number that you will need to vote your shares. Please keep the Notice for your reference through the meeting date. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of its Special Meeting.

DEFINITIONS

Unless the context requires otherwise, references to the “Company,” “we,” “us,” “our,” “Camber” and “Camber Energy, Inc.” refer specifically to Camber Energy, Inc. and its consolidated subsidiaries.

In addition, unless the context otherwise requires and for the purposes of this Proxy Statement only:

| · | “Code” means the Internal Revenue Code of 1986, as amended from time to time; |

| | |

| · | “Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| | |

| · | “SEC” or the “Commission” refers to the United States Securities and Exchange Commission; and |

| | |

| · | “Securities Act” refers to the Securities Act of 1933, as amended. |

INFORMATION CONCERNING SOLICITATION AND VOTING

Our Board of Directors (the “Board of Directors”) is soliciting proxies for the Special Meeting of stockholders and at any adjournments or postponements of the meeting. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the meeting. Please read it carefully.

The Company will pay the costs of soliciting proxies from stockholders. Our officers, directors and regular employees may solicit proxies on behalf of the Company without additional compensation, personally or by telephone. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses. The Company may also engage a third party to assist the Company in soliciting proxies for the special meeting and may pay the third-party base fees, reasonable out-of-pocket expenses.

REVERSE STOCK SPLIT

Effective on December 21, 2022, the Company, with the approval of the Company’s Board of Directors, pursuant to Section 78.207 of the Nevada Revised Statutes (“NRS”), affected a 1-for-50 reverse stock split of the Company’s (a) authorized shares of common stock (from 1,000,000,000 shares to 20,000,000 shares), and (b) issued and outstanding shares of common stock (the “Reverse Stock Split”). The effect of the Reverse Stock Split was to combine every 50 shares of outstanding common stock into one new share, with a proportionate 1-for-50 reduction in the Company’s authorized shares of common stock, but with no change in the par value per share of the common stock. No fractional shares were issued as a result of the Reverse Stock Split, and no cash or other consideration were paid. Instead, fractional shares resulting from the Reverse Stock Split were rounded up to the nearest whole share on a per shareholder basis. The result of the Reverse Stock Split was to reduce, as of the effective date of the Reverse Stock Split, the number of shares of common stock outstanding from approximately 887.7 million shares to approximately 17.8 million shares (prior to rounding).The Reverse Stock Split was effected pursuant to the filing of a Certificate of Change pursuant to NRS Section 78.209, with the Secretary of State of the State of Nevada.

The Reverse Stock Split was effected in order to regain compliance with the NYSE American continued listing standards set forth in Section 1003(f)(v) of the NYSE American Company Guide (“Company Guide”) due to the common stock selling at a low price for a substantial period of time. On January 3, 2023, following the effectiveness of the Reverse Stock Split, the Company received a notice letter from the NYSE American stating that the Company was back in compliance with the Company Guide.

The information and disclosures set forth in this Proxy Statement have been retroactively adjusted to reflect the Reverse Stock Split.

QUESTIONS AND ANSWERS

General Questions and Answers

| Q: | Who can vote at the meeting? |

| | |

| A: | The Board of Directors set February 28, 2023 as the record date for the meeting. You can attend and vote at the meeting if you were a holder of our common stock, Series C Preferred Stock or Series G Preferred Stock at the close of business on the record date, provided that holders of our Series C Preferred Stock and Series G Preferred Stock have the right to cast votes on all Proposals above, except any shareholder proposals, equal to the as-converted amount of such Series C Preferred Stock and Series G Preferred Stock, respectively, (subject to the beneficial ownership limitations in the Series C COD and Series G COD, respectively). On the record date, there were 20,000,000 shares of common stock issued and outstanding, 238 shares of Series C Preferred Stock issued and outstanding, and 5,272 shares of Series G Preferred Stock issued and outstanding. The votes associated with such Series C Preferred Stock and Series G Preferred Stock, given beneficial ownership limitations, total 2,219,753, collectively, resulting in an aggregate of 22,219,753 total voting shares at the meeting. |

| Q: | What Proposals will be voted on at the meeting? |

| | |

| A: | Two Proposals are scheduled to be voted upon at the meeting: |

| | · | To approve the filing of an amendment to the Company’s Articles of Incorporation, as amended (the “Articles of Incorporation”) to increase the number of our authorized shares of common stock from 20,000,000 to 500,000,000. |

| | | |

| | · | To consider and vote upon a Proposal to authorize our Board of Directors, in its discretion, to adjourn the Special Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the Proposal listed above at the time of the Special Meeting. |

| Q: | Why did I receive a one-page notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials? |

| | |

| A: | Pursuant to rules adopted by the SEC, we have elected to provide access to our proxy materials over the Internet. Accordingly, on or about March 10, 2023, we are sending the Notice to our stockholders of record and beneficial owners. All stockholders will have the ability, beginning on or about March 10, 2023, to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice ls. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis, provided, however, that only one proxy statement will be delivered to multiple stockholders sharing an address. |

| | |

| Q: | Can I vote my shares by filling out and returning the Notice? |

| | |

| A: | No. The Notice identifies the items to be voted on at the meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to vote via the Internet, by telephone or by requesting and returning a paper proxy card. You may also vote during the meeting by following the instructions available on the meeting website during the meeting. |

| | |

| Q: | How can I get electronic access to the proxy materials? |

| | |

| A: | The Notice will provide you with instructions regarding how to: |

| | · | View our proxy materials for the meeting on the Internet; and |

| | | |

| | · | Instruct us to send future proxy materials to you electronically by email. |

| | | |

| | · | Choosing to receive future proxy materials by email will save us the cost of printing and mailing documents to you and will reduce the impact of our Special Meeting on the environment. If you choose to receive future proxy materials by email, you will receive an email next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by email will remain in effect until you terminate it. |

| Q: | How do I cast my vote? |

| A: | Stockholders whose shares are registered in their own names may vote at the virtual meeting or by proxy. If you would like to vote at the virtual meeting, please follow the instructions that will be available on the online meeting platform during the meeting. Proxies may be submitted over the Internet, by telephone or by mail. |

| | · | Call 1-866-752-8683 to vote by telephone; |

| | | |

| | · | Go to https://www.iproxydirect.com/CEI to vote over the Internet; or |

| | | |

| | · | If you received a paper copy of your proxy materials, please MARK, SIGN, DATE AND RETURN your proxy card in the postage-paid envelope. If you are voting by telephone or the Internet, have the control number from your proxy card ready, and please do not mail your proxy card. |

Proxies submitted over the Internet or by telephone must be received by 11:59 p.m. Eastern Time, on Tuesday, April 25, 2023. Submitting a proxy authorizes the persons appointed as proxies to vote your shares at the Special Meeting in the manner that you have indicated. The persons named in the form of proxy (James A. Doris and Holly McCaw) have advised that they will vote all shares represented by proxy unless authority to so vote is withheld by the stockholder granting the proxy. If your proxy does not indicate your vote, the persons named in the proxy will vote your shares as recommended by the Board of Directors on all matters. If any other matters properly come before the meeting, your shares will be voted in accordance with the discretion of the persons named in the proxy.

If your shares are registered in the name of a broker, bank or other nominee (typically referred to as being held in “street name”), you will receive instructions from your broker, bank or other nominee that must be followed in order for your broker, bank or other nominee to vote your shares per your instructions. Many brokerage firms and banks have a process for their beneficial holders to provide instructions via the Internet, via fax or over the telephone. If Internet, fax or telephone voting is unavailable from your broker, bank or other nominee, please request a paper copy of the proxy and complete and return the voting instruction card in the addressed, postage paid envelope provided.

In the event you do not provide instructions on how to vote, your broker will not be able to vote your shares. Under the rules that govern brokers who are voting with respect to shares that are held in street name, brokers have the discretion to vote such shares on routine matters, but not on non-routine matters. Non-routine matters include the approval of the amendment to our Articles of Incorporation to increase our authorized common stock and the approval to adjourn the meeting. Your vote is especially important. If your shares are held by a broker, your broker cannot vote your shares for these non-routine matters unless you provide voting instructions. Therefore, please instruct your broker regarding how to vote your shares on these matters promptly. See “Vote Required” following each Proposal for further information.

If you hold shares through a bank, broker, or other nominee and wish to be able to vote in person at the Special Meeting, you must obtain a legal proxy from your bank, broker, or other nominee and present it to the inspector of election with your ballot at the meeting.

| Q: | Can I revoke or change my proxy? |

| | |

| A: | Yes. You may revoke or change a previously delivered proxy at any time before the meeting by delivering another proxy with a later date, by voting again via the Internet, fax or by telephone, or by delivering written notice of revocation of your proxy to our Secretary (the “Secretary”) at our principal executive offices before the beginning of the meeting. You may also revoke your proxy by attending the meeting and voting at the meeting, although attendance at the meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares through a broker, bank or other nominee, you must contact that nominee to revoke any prior voting instructions. You also may revoke any prior voting instructions by voting at the meeting if you obtain a legal proxy as described above. |

| | |

| Q: | How does the Board of Directors recommend I vote on the Proposals? |

| | |

| A: | The Board of Directors recommends you vote “FOR” the amendment to our Articles of Incorporation to increase our authorized common stock, and “FOR” the approval to adjourn the meeting to a later date, as described above. |

| | |

| Q: | Who will count the vote? |

| | |

| A: | The inspector of election will count the vote. |

| | |

| Q: | What is a “quorum?” |

| | |

| A: | A quorum is the number of shares that must be present to hold the meeting. The quorum requirement for the meeting is 33% of the outstanding voting shares as of the record date, present in person or represented by proxy. Your shares will be counted for purposes of determining if there is a quorum if you are present and vote in person at the meeting; or have voted on the Internet, by fax, by telephone or by properly submitting a proxy card or voting instruction card by mail. Abstentions and broker non-votes also count toward the quorum. “Broker non-votes” occur when brokers, banks or other nominees that hold shares on behalf of beneficial owners do not receive voting instructions from the beneficial owners prior to the meeting and do not have discretionary voting authority to vote those shares. |

| | |

| Q: | What vote is required to approve each item? |

| | |

| A: | The following table sets forth the voting requirement with respect to each of the Proposals: |

| Proposal 1 - Approval of the filing of an amendment to the Company’s Articles of Incorporation to increase the number of our authorized shares of common stock from 20,000,000 to 500,000,000. | | To be approved by stockholders, this Proposal must receive the affirmative “FOR” vote of the holders of a majority of the shares outstanding and entitled to vote. |

| | | |

| Proposal 2 - Approval to adjourn the Special Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the Proposal listed above at the time of the Special Meeting. | | To be approved by stockholders, this Proposal must receive the affirmative “FOR” vote of the holders of a majority of shares represented at the meeting, in person or by proxy, and entitled to vote. |

| Q: | What does it mean if I get more than one Notice? |

| | |

| A: | Your shares are probably registered in more than one account. Please provide voting instructions for all Notices, proxy and voting instruction cards you receive. |

| | |

| Q: | How many votes can I cast? |

| | |

| A: | Holders of our common stock receive one vote for each share of common stock which they hold as of the Record Date. Holders of our Series C Preferred Stock and Series G Preferred Stock have the right to cast votes on all Proposals above, except any shareholder proposals, equal to the as-converted amount of such Series C Preferred Stock and Series G Preferred Stock, respectively, (subject to the beneficial ownership limitations in the Series C COD and Series G COD, respectively). On the record date, there were 20,000,000 shares of common stock issued and outstanding, 238 shares of Series C Preferred Stock issued and outstanding, and 5,272 shares of Series G Preferred Stock issued and outstanding. The votes associated with such Series C Preferred Stock and Series G Preferred Stock, given beneficial ownership limitations, total 2,219,753, collectively, resulting in an aggregate of 22,219,753 total voting shares at the meeting. |

| | |

| Q: | Where can I find the voting results of the meeting? |

| | |

| A: | The preliminary voting results will be announced at the meeting. The final results will be published in a current report on Form 8-K to be filed by us with the SEC within four business days of the meeting. |

PROPOSAL 1

THE AMENDMENT TO THE COMPANY’S ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF OUR

AUTHORIZED SHARES OF COMMON STOCK FROM 20,000,000 TO 500,000,000

General

Our Articles of Incorporation currently authorize the issuance of up to 20,000,000 shares of common stock. As of the date of the proxy statement, 20,000,000 shares of common stock were issued and outstanding, and no shares of common stock were available for future issuance. In order to ensure sufficient shares of common stock will be available for issuance by us, our Board of Directors has approved, and has recommended that our stockholders approve, an amendment to our Articles of Incorporation to increase our authorized shares of common stock from 20,000,000 shares to 500,000,000 shares (the “Increase In Authorized Shares”).

We desire to authorize additional shares of common stock to ensure that enough shares will be available (a) for issuance of shares of common stock upon conversion of currently outstanding Series C Preferred Stock, including, but not limited to, the shares issuable upon conversion of, including shares issuable for dividends, interest and conversion premiums thereon and (b) in the event the Board of Directors determines that it is necessary or appropriate to (i) raise additional capital through the sale of equity securities, (ii) provide equity incentives to employees and officers, (iii) complete various currently-contemplated or future acquisitions of other businesses or assets not currently owned by the Company (subject to any additional shareholder vote that may be required in connection with any such acquisition), (iv) establish strategic partnerships, or (v) satisfy other corporate purposes. The availability of additional shares of common stock is particularly important in the event that the Board of Directors needs to undertake any of the foregoing actions on an expedited basis and thus to avoid the time and expense of seeking stockholder approval in connection with the contemplated issuance of common stock.

The increase in authorized common stock will not have any immediate effect on the rights of existing stockholders. However, the Board of Directors will have the authority to issue authorized common stock without requiring future stockholder approval of such issuances, except as may be required by applicable law or the NYSE American, up to the increased amount of authorized shares of common stock (i.e., 500,000,000 shares). For example, the rules of the NYSE American require that we obtain stockholder approval prior to the issuance of shares of common stock in a private financing at a price less than the greater of the book value or market value of our common stock, where the total number of shares which may be issued pursuant to such transactions is 20% or more of the outstanding common stock prior to issuance.

To the extent that additional authorized shares of common stock are issued in the future, they may decrease the existing stockholders’ percentage equity ownership and, depending on the price at which they are issued, could be dilutive to the existing stockholders. It is currently anticipated that a portion of the additional 480,000,000 shares of authorized but unissued shares of common stock which will be made available through the Increase in Authorized Shares of common stock will be issued in connection with: (i) shares of common stock due to a former holder of Series C Preferred Stock regarding prior conversions of shares of Series C Preferred Stock, which common share entitlement is fixed at 730,241 shares of common stock; and (ii) the conversion of all or a portion of the 238 outstanding shares of Series C Preferred Stock, pursuant to the terms of the Series C COD. The 238 outstanding shares of Series C Preferred Stock are potentially convertible into approximately 4,310,234 shares of common stock, subject to a 9.99% beneficial ownership limitation and further adjustment as provided in the Series C COD, which estimate is based on low volume weighted average price of the Company’s common stock (the “Low VWAP”) being $1.7124 for the purpose of calculating the conversion premium due in connection with the conversion of the 238 outstanding shares of Series C Preferred Stock. If the Low VWAP falls below $1.7124 during the Measurement Period (as defined in the Series C COD), the 238 outstanding shares of Series C Preferred Stock would potentially be convertible into more than 4,310,234 shares of common stock, which would result in additional dilution to existing stockholders.

SEC rules require disclosure of the possible anti-takeover effects of an increased in authorized capital stock and other charter or bylaw provisions that could have an anti-takeover effect. The increased proportion of unissued authorized shares of common stock, compared to issued shares of common stock, could, under certain circumstances, have an anti-takeover effect (for example, by permitting issuances that would dilute the stock ownership of a person seeking to effect a change in the composition of our Board of Directors or contemplating a tender offer or other transaction for our combination with another company). However, the Amendment (defined below) is not being proposed in response to any effort of which we are aware to accumulate shares of our common stock or obtain control of our Company, nor is it part of a plan by management to recommend a series of similar amendments to our Board of Directors and stockholders.

The holders of common stock have no preemptive rights, and the Board of Directors has no plans to grant such rights with respect to any such shares.

The form of the proposed amendment to our Articles of Incorporation to effect the Increase in Authorized Shares will be in substantially the form as attached to this proxy statement as Appendix A (the “Amendment”). If our stockholders approve this Proposal, as soon as practicable after the Special Meeting the Company intends to file the Amendment with the Secretary of State of the State of Nevada. Upon approval and following such filing with the Secretary of State of the State of Nevada, the Amendment will become effective on the date indicated in the Amendment.

Stockholders should be aware that we currently have insufficient reserves of authorized but unissued shares of common stock remaining to satisfy the maximum number of shares of common stock issuable upon conversion (and conversion premiums thereon) of our Series C Preferred Stock. We calculate that the holders of Series C Preferred Stock are still due 4,310,234 shares of common stock upon conversion of the 238 currently outstanding shares of Series C Preferred Stock (when including conversion premiums thereon). This underlying shares of common stock estimate is based on Low VWAP being $1.7124 for the purpose of calculating the conversion premium due in connection with the conversion of the 238 outstanding shares of Series C Preferred Stock. If the Low VWAP falls below $1.7124 during the Measurement Period, the 238 outstanding shares of Series C Preferred Stock would potentially be convertible into more than 4,310,234 shares of common stock, which would result in additional dilution to existing stockholders and impose additional reserve requirements on the Company.

The Amendment will become effective on the date of effectiveness set forth in the Amendment when filed with the Secretary of State of the State of Nevada.

As of the date of this Proxy Statement, we do not have any definitive plans, agreements or understandings with respect to the additional authorized shares that will become available for issuance after the Amendment has been implemented, except for potentially in connection with previously announced transactions and for shares of common stock which may be issued upon conversion of the Series C Preferred Stock and the Series G Preferred Stock.

Shareholder-Related Litigation

The Company was the target of a “short” report issued by Kerrisdale Capital in early October, 2021, and as a result of such short report, on October 29, 2021, a Class Action Complaint (i.e. C.A.No.4:21-cv-03574) was filed against the Company, its CEO and CFO by Ronald E. Coggins, Individually and on Behalf of All Others Similarly Situated v. Camber Energy, Inc., et al.; in the U.S. District Court for the Southern District of Texas, Houston Division, pursuant to which the Plaintiffs are seeking to recover damages alleged to have been suffered by them as a result of the defendants’ violations of federal securities laws. The defendants deny the allegations contained in the Class Action Complaint and have engaged Baker Botts L.L.P. to defend the action.

On or about June 30, 2022, the Company was made aware of a Shareholder Derivative Complaint filed in the U.S. District Court for the Southern District of Texas, Houston Division (Case No. 4:22-cv-2167) against the Company, its current directors, and certain of its former directors (the “Houston Derivative Complaint” and, together with the Nevada Derivative Complaint, the “Derivative Complaints”). The allegations contained in the Houston Derivative Complaint involve state-law claims for breach of fiduciary duty and unjust enrichment and a federal securities claim under Section 14(a) of the Exchange Act. On January 20, 2023, the U.S. District Court held that certain claims brought by the plaintiff relating to director actions and statements made in proxy statements prior to June 30, 2019, were time barred, but did not dismiss certain claims brought by plaintiff relating to director actions and statements made in proxy statements after June 30, 2019. Pursuant to Article 6 of the Amended and Restated Bylaws, on February 15, 2023, the Company’s Board of Directors formed a Committee of the Board (the “Special Litigation Committee”) to investigate, analyze, and evaluate the remaining allegations in the Houston Derivative Complaint. The Special Litigation Committee’s investigation and evaluation remains ongoing. At this time, we are not able to predict the outcome of the Special Litigation Committee investigation or these claims.

On or about April 18, 2022, the Company was made aware of a Shareholder Derivative Complaint filed with the District Court in Clark County, Nevada (Case No. A-22-848486-B) against the Company and its directors, and on or about May 4, 2022 the Company was made aware of a second Shareholder Derivative Complaint filed with the District Court in Clark County, Nevada (Case No. A-22-852069-B) against the Company and its directors. On July 18, 2022, the shareholder plaintiff in Case No. A-22-848486-B voluntarily dismissed his lawsuit, and on December 12, 2022, the shareholder plaintiff in Case No. A-22-852069-B voluntarily dismissed his lawsuit.

No Appraisal Rights

Under Nevada law, our stockholders are not entitled to appraisal rights with respect to the increase to the number of authorized shares of common stock.

Vote Required

The approval of this Proposal requires the affirmative vote of the holders of a majority of our outstanding voting shares entitled to vote at the meeting . As a result, abstentions will have the same effect as shares voted against this proposal. Broker non-votes will have the same effect as shares voted against this proposal. For the approval of this Proposal, you may vote “FOR” or “AGAINST” or abstain from voting.

Board of Directors Recommendation

The Board of Directors recommends that you vote “FOR” the adoption of the Amendment to the Articles of Incorporation to increase the number of shares of authorized common stock.

PROPOSAL 2

ADJOURNMENT OF THE SPECIAL MEETING

Our stockholders may be asked to consider and act upon one or more adjournments of the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of the other Proposal set forth in this Proxy Statement.

If a quorum is not present at the Special Meeting, our stockholders may be asked to vote on the Proposal to adjourn the Special Meeting to solicit additional proxies. If a quorum is present at the Special Meeting, but there are not sufficient votes at the time of the Special Meeting to approve the other Proposal set forth in this Proxy Statement, our stockholders may also be asked to vote on the Proposal to approve the adjournment of the Special Meeting to permit further solicitation of proxies in favor of the other Proposal. However, a stockholder vote may be taken on the other Proposal in this Proxy Statement prior to any such adjournment if there are sufficient votes for approval on such Proposal.

If the adjournment Proposal is submitted for a vote at the Special Meeting, and if our stockholders vote to approve the adjournment Proposal, the meeting will be adjourned to enable the Board of Directors to solicit additional proxies in favor of the other Proposal. If the adjournment Proposal is approved, and the Special Meeting is adjourned, the Board of Directors will use the additional time to solicit additional proxies in favor of the other Proposal to be presented at the Special Meeting, including the solicitation of proxies from stockholders that have previously voted against the relevant Proposal.

The Board of Directors believes that, if the number of voting shares voting in favor of any of the Proposals presented at the Special Meeting is insufficient to approve a Proposal, it is in the best interests of our stockholders to enable the Board of Directors, for a limited period of time, to continue to seek to obtain a sufficient number of additional votes in favor of the Proposal. Any signed proxies received by us in which no voting instructions are provided on such matter will be voted in favor of an adjournment in these circumstances. The time and place of the adjourned meeting will be announced at the time the adjournment is taken. Any adjournment of the Special Meeting for the purpose of soliciting additional proxies will allow our stockholders who have already sent in their proxies to revoke them at any time prior to their use at the Special Meeting as adjourned or postponed.

Vote Required

The approval of the adjournment of the Special Meeting, if necessary or appropriate, to another place, date or time, if deemed necessary or appropriate, in the discretion of the Board of Directors, requires the vote of a majority of the shares represented at the meeting, in person or by proxy, and entitled to vote at the Special Meeting. As a result, abstentions will have the same practical effect as votes against this Proposal. Broker non-votes will have no effect on the outcome of this Proposal. For the approval of the adjournment, you may vote “FOR” or “AGAINST” or abstain from voting.

Board of Directors Recommendation

The Board of Directors recommends that you vote “FOR” the approval of the adjournment of the Special Meeting, if necessary or appropriate, to another place, date or time, if deemed necessary or appropriate, in the discretion of the Board of Directors.

OTHER INFORMATION

Principal Stockholders

The following table sets forth information as of March 10, 2023 regarding the beneficial ownership of our common stock, assuming the conversion of our Series C Preferred Stock, by:

| | · | each stockholder known by us to be the beneficial owner of more than five percent of our outstanding shares of common stock, |

| | | |

| | · | each director, |

| | | |

| | · | each executive officer, and |

| | | |

| | · | all directors and executive officers as a group. |

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting of securities, or to dispose or direct the disposition of securities or has the right to acquire such powers within 60 days. For purposes of calculating each person’s percentage ownership, common stock issuable pursuant to options, warrants or other securities exercisable within 60 days are included as outstanding and beneficially owned for that person or group, but are not deemed outstanding for the purposes of computing the percentage ownership of any other person. Except as disclosed in the footnotes to this table and subject to applicable community property laws, we believe that each beneficial owner identified in the table possesses sole voting and investment power over all common stock shown as beneficially owned by the beneficial owner.

Percentage ownership of our common stock in the table is based on 22,219,753 shares of common stock issued and outstanding as of March 10, 2023, assuming the conversion of all shares of Series C Preferred Stock issued and outstanding as of March 10, 2023, subject to a beneficial ownership limitation preventing conversion into our common stock if the holder would be deemed to beneficially own more than 9.99% of our common stock. This table is based on information supplied by officers, directors and selling stockholders and by Schedules 13D and Schedules 13G, if any, filed with the SEC. Unless otherwise indicated, the address of each of the individuals and entities named below is c/o Camber Energy, Inc., 15915 Katy Freeway, Suite 450, Houston, Texas 77094.

To our knowledge, except as indicated in the footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and investment power with respect to their common stock. Pursuant to Rule 13d-4 under the Exchange Act, the statements concerning voting and dispositive power concerning the common stock included in the footnotes to this table shall not be construed as admissions that such persons are the beneficial owners of such common stock.

| | | Number of Shares of Common Stock | | | Percent of Common Stock | |

| Stockholder | | | | | | |

| Executive Officers and Directors | | | | | | |

| James A. Doris | | | - | | | * | |

| Frank W. Barker, Jr. | | | - | | | * | |

| Robert K. Green | | | - | | | * | |

| Fred S. Zeidman | | | - | | | * | |

| James G. Miller | | | - | | | * | |

| All Executive Officers and Directors as a Group (Five Persons) | | | - | | | * | |

| Greater than 5% Stockholders | | | | | | |

| Antilles Family Office, LLC (1) | | | 2,219,753 | | | 9.99 | % |

* Indicates beneficial ownership of less than 1% of the outstanding common stock.

(1) 5330 Yacht Haven Grande, Suite 206, St. Thomas, U.S. Virgin Islands, 00802. As of March 10, 2023, Antilles Family Office, LLC (“Antilles”) holds 238 shares of Series C Preferred Stock, 5,272 shares of Series G Preferred Stock, which are currently not convertible into common stock, and 2,000,000 warrants; provided that, pursuant to the terms of the Series C COD and the Series G COD, the Company may not issue shares of common stock which, when aggregated with all other shares of common stock then deemed beneficially owned by Antilles, would result in the reporting person holding at any one time more than 9.99% of all common stock outstanding immediately after giving effect to such issuance. Additionally, Discover Growth Fund, LLC (“Discover”), which the Company believes is an affiliate of Antilles, holds 1,000,000 warrants. Following the Reverse Stock Split, (i) the 2,000,000 warrants held by Antilles have an exercise price of $100.00 per warrant for the first 1,000,000 warrants, and an exercise price of $200.00 per warrant for the remaining 1,000,000 warrants, and (ii) the 1,000,000 warrants held by Discover have an exercise price of $500.00 per warrant for the first 500,000 warrants, and an exercise price of $1,000.00 per warrant for the remaining 500,000 warrants. Accordingly, given the current trading price of the Company’s common stock, the aforementioned 9.99% beneficial ownership limitation and the fact that, given the Company’s believe that Discover is an affiliate of Antilles, Antilles may be deemed to beneficially own any shares of common stock held by Discover, the Company does not believe Antilles or Discover will exercise these warrants or convertible the loan balance therefore increasing its beneficial ownership in excess of 9.99%. The Company believes that John Burke has voting and dispositive control over the securities held by the shareholder. Antilles and Discover have contractually agreed not to vote any shares except as requested by the Board of Directors.

Dissenters’ Rights

Under Nevada law there are no dissenters’ rights available to our stockholders in connection with any of the Proposals.

Other Matters

The Board of Directors knows of no other business to be brought before the Special Meeting. If, however, any other business should properly come before the Special Meeting, the persons named in the accompanying proxy will vote the proxy in accordance with applicable law and as they may deem appropriate in their discretion, unless directed by the proxy to do otherwise.

Stockholder Proposals for 2023 Annual Meeting of Stockholders and 2023 Proxy Materials

Proposals of holders of our voting securities intended to be presented at our 2023 fiscal year Annual Meeting of stockholders and included in our proxy statement and form of proxy relating to such meeting pursuant to Rule 14a-8 of Regulation 14A must be received by us, addressed to our Secretary, at our principal executive offices at 15915 Katy Freeway, Suite 450 Houston, Texas 77094, not earlier than the close of business on April 19, 2023, and not later than the close of business on June 29, 2023, together with written notice of the stockholder’s intention to present a proposal for action at the fiscal 2023 Annual Meeting of stockholders, unless our annual meeting date occurs more than 30 days before or 30 days after September 27, 2023. In that case, we must receive proposals not earlier than the close of business on the 120th day prior to the date of the fiscal 2023 annual meeting and not later than the close of business on the later of the 90th day prior to the date of the annual meeting or, if the first public announcement of the date of the Annual Meeting is less than 100 days prior to the date of the meeting, the 10th day following the day on which we first make a public announcement of the date of the meeting. The notice must be personally delivered to the Company or sent by first class certified mail, return receipt requested, postage prepaid, and must include the name and address of the stockholder, the number of voting securities held by the stockholder of record, a statement that the stockholder holds such shares beneficially and the text of the proposal to be presented for vote at the meeting, a statement in support of the proposal, and must otherwise comply with Rule 14a-8 of Regulation 14A and the requirements of our Bylaws.

The proposal should state as clearly as possible the proposal and should be accompanied by a supporting statement. The proposal, including the accompanying supporting statement, may not exceed 500 words. Upon receipt of any such proposal, the Company will determine whether or not to include such proposal in the proxy statement and proxy in accordance with regulations governing the solicitation of proxies. The Company reserves the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable rules and requirements. As the rules of the SEC make clear, simply submitting a proposal does not guarantee that it will be included.

In addition to satisfying the foregoing requirements under our Bylaws, to comply with the SEC’s universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Board of Directors’ nominees must provide notice that sets forth the information required by SEC Rule 14a-19 no later than July 29, 2023 (unless we move the meeting up or delay it by more than 30 days from September 27, 2023, in which case notice must be provided by the later of (i) 60 days prior to the date of the fiscal 2023 annual meeting or (ii) the 10th day following the day on which public announcement of the date of the fiscal 2023 annual meeting is first made by the registrant).

Interest of Certain Persons in or Opposition to Matters to Be Acted Upon

| (a) | No officer or director of the Company has any substantial interest in the matters to be acted upon, other than his role as an officer or director of the Company. |

| | |

| (b) | No director of the Company has informed the Company that he intends to oppose the action taken by the Company set forth in this Proxy Statement. |

Additional Information

Our Annual Report to Stockholders on Form 10-K covering the fiscal year ended December 31, 2021, our Quarterly Reports on Form 10-Q and other information are available on our website (www.camber.energy) and may also be obtained by calling (281) 404-4387 or writing to the address below:

| | Camber Energy, Inc. | |

| 15915 Katy Freeway, Suite 450 | |

| | Houston, TX 77094 | |

| | Attn: Secretary | |

The persons designated to vote shares covered by our Board of Directors’ proxies intend to exercise their judgment in voting such shares on other matters that may properly come before the meeting. Management does not expect that any matters other than those referred to in this Proxy Statement will be presented for action at the meeting.

| | Sincerely, | |

| | | | |

| By: | /s/ James A. Doris | |

| | | James A. Doris | |

| | | Chief Executive Officer | |

| Houston, Texas | | | |

| March 10, 2023 | | | |

APPENDIX A

[PROXY CARD]

CAMBER ENERGY, INC.

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

SPECIAL MEETING OF STOCKHOLDERS – APRIL 26, 2023 AT 10:00 A.M.

LOCAL TIME

CONTROL ID:

REQUEST ID:

The undersigned stockholder of CAMBER ENERGY, INC., a Nevada corporation (the “Company”), hereby acknowledges receipt of the Notice of Special Meeting of Stockholders and Proxy Statement of the Company, each dated on or around March 10, 2023, and hereby appoints James A. Doris and Holly McCaw proxies and attorneys-in-fact, each with full power of substitution, on behalf and in the name of the undersigned, to represent the undersigned at the Special Meeting of Stockholders of the Company, to be held on April 26, 2023, at 10:00 a.m. (Houston time) online only at https://agm.issuerdirect.com/cei, and at any adjournment or adjournments thereof, and to vote all shares of the Company that the undersigned would be entitled to vote if then and there personally present, on the matters set forth on the reverse side, and all such other business as may properly come before the meeting. You hereby revoke all proxies previously given.

(CONTINUED AND TO BE SIGNED ON REVERSE SIDE.)

VOTING INSTRUCTIONS

If you vote by phone, fax or internet, please DO NOT mail your proxy card.

| MAIL: | Please mark, sign, date, and return this Proxy Card promptly using the enclosed envelope. |

| FAX: | Complete the reverse portion of this Proxy Card and Fax to 202-521-3464. |

| INTERNET: | https://www.iproxydirect.com/CEI |

| PHONE: | 1-866-752-VOTE(8683) |

| SPECIAL MEETING OF THE STOCKHOLDERS OF CAMBER ENERGY, INC. | PLEASE COMPLETE, DATE, SIGN AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE: ☒ |

| PROXY SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS |

| PROPOSAL 1 | | → | FOR | | AGAINST | | ABSTAIN | | | |

| To approve an amendment to the Company’s Articles of Incorporation to increase the number of our authorized shares of common stock from 20,000,000 to 500,000,000. | | ☐ | | ☐ | | ☐ | | | |

| | | | | | | | | | |

| PROPOSAL 2 | | → | FOR | | AGAINST | | ABSTAIN | | | |

| To consider and vote upon a Proposal to authorize our Board of Directors, in its discretion, to adjourn the Special Meeting to another place, or a later date or dates, if necessary or appropriate, to solicit additional proxies in favor of the Proposal listed above at the time of the Special Meeting. | | ☐ | | ☐ | | ☐ | | | |

| | | | | MARK “X” HERE IF YOU PLAN TO ATTEND THE MEETING: ☐ |

| This Proxy, when properly executed will be voted as provided above, or if no contrary direction is indicated, it will be voted “For” each of Proposals 1 and 2, and for all such other business as may properly come before the meeting in the sole determination of the Proxies. | | | | MARK HERE FOR ADDRESS CHANGE ☐ New Address (if applicable): ____________________________ ____________________________ ____________________________ IMPORTANT: Please sign exactly as your name or names appear on this Proxy. When shares are held jointly, each holder should sign. When signing as executor, administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate name by duly authorized officer, giving full title as such. If signer is a partnership, please sign in partnership name by authorized person. Dated: ________________________, 2023 |

| (Print Name of Stockholder and/or Joint Tenant) |

| (Signature of Stockholder) |

| (Second Signature if held jointly) |

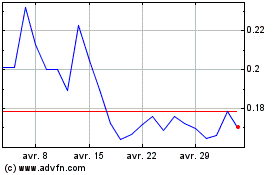

Camber Energy (AMEX:CEI)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Camber Energy (AMEX:CEI)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024